Bitwise Chief: Bitcoin to Hit Fresh Records in 2026 and Break Four-Year Cycle

Major asset managers are forecasting that Bitcoin will shatter its traditional four-year cycle and reach new all-time highs in 2026, driven by massive institutional capital inflows and regulatory clarity.

Bitwise Chief Investment Officer Matt Hougan and Grayscale Research both project BTC will exceed its previous peak despite conventional wisdom suggesting 2026 should be a pullback year.

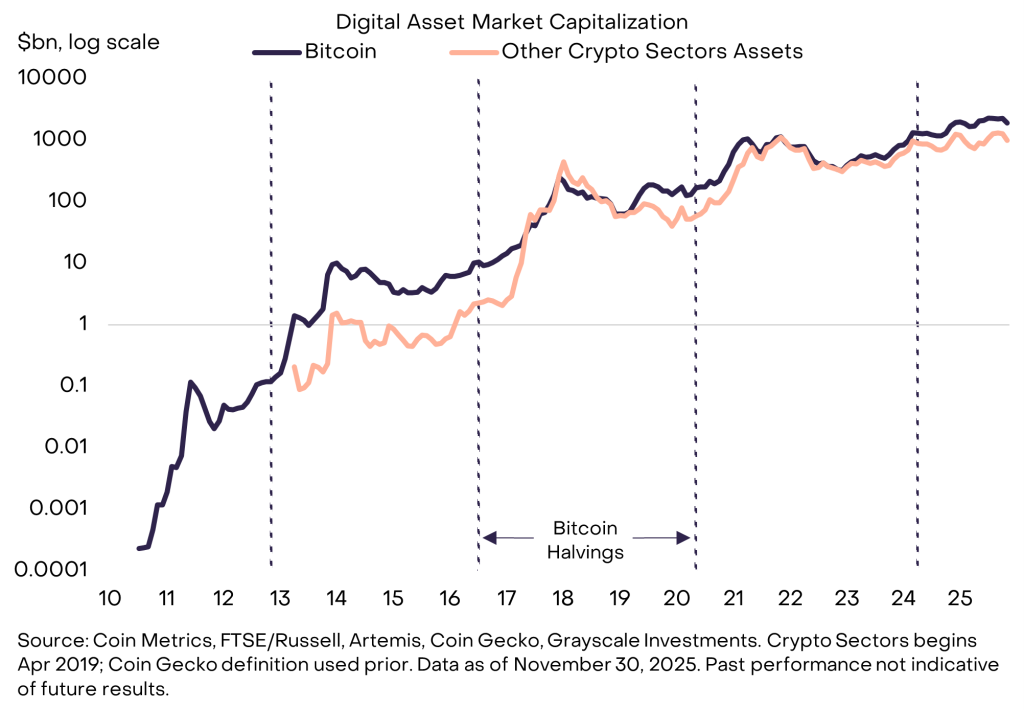

Bitcoin has historically followed a four-year cycle tied to halving events, with three significant up years followed by sharp corrections.

Since the most recent halving occurred in April 2024, more than 18 months ago, traditional cycle theory would predict 2026 as a down year.

However, Hougan argues that the forces driving previous cycles have weakened substantially, while new structural dynamics are taking hold.

“We believe the wave of institutional capital that began entering the space with the approval of spot bitcoin ETFs in 2024 will accelerate in 2026, as platforms like Morgan Stanley, Wells Fargo, and Merrill Lynch begin allocating,” Hougan wrote in Bitwise’s annual predictions report.

He expects Bitcoin to reach new all-time highs, relegating the four-year cycle to the dustbin of history.

Institutional Era Replaces Retail-Driven Volatility

Grayscale’s 2026 outlook echoes this transformation, projecting Bitcoin will set fresh records in the first half of next year as the market transitions into what it calls the institutional era.

The asset manager identifies two pillars supporting this view:

- Macro demand for alternative stores of value amid rising public debt

- Fiat currency risks, plus improving regulatory clarity that deepens blockchain integration with traditional finance.

The changing market structure has already altered Bitcoin’s price behavior. Previous bull markets saw gains exceeding 1,000% in a single year, while this cycle’s maximum year-over-year increase reached only 240% through March 2024.

Grayscale attributes this moderation to steadier institutional buying rather than retail momentum chasing, arguing the probability of deep, prolonged drawdowns has declined significantly.

Grayscale expects rising valuations in the crypto sector in 2026, and as a result, Bitcoin could exceed its previous high in the first half of the year.

Bitwise’s analysis also highlights how Bitcoin volatility has steadily decreased over the past decade, with BTC now less volatile than Nvidia throughout 2025.

Hougan predicts Bitcoin’s correlation with stocks will fall in 2026 as crypto-specific factors like regulatory progress and institutional adoption power the asset higher even if equities struggle.

Regulatory Clarity and Monetary Policy Alignment

Katherine Dowling, president of Bitcoin Standard Treasury Company, recently forecast that Bitcoin would reach $150,000 by the end of 2026, citing “the trifecta of a positive regulatory environment, quantitative easing, and institutional inflows.”

President Trump recently signed the GENIUS Act, establishing stablecoin regulatory framework, while the Office of the Comptroller of the Currency permitted national banks to offer crypto brokerage services.

Just this month, Bank of America now allows its financial advisers to recommend Bitcoin ETFs, potentially channeling portions of the bank’s $3.5 trillion in client assets into digital assets.

The Federal Reserve cut rates three times in 2025 and expects to continue easing next year.

Notably, Grayscale expects bipartisan crypto market structure legislation to become US law in 2026, which will solidify blockchain-based finance in capital markets.

Since US Bitcoin ETPs launched in January 2024, global crypto ETPs have attracted $87 billion in net inflows, yet less than 0.5% of US advised wealth is allocated to crypto.

On the technical level, according to a CryptoQuant analyst, on-chain data shows long-term holders distributing coins at one of the largest 30-day rates in the past 5 years, typically indicating late-cycle behavior.

However, CryptoQuant data also shows short-term holders are facing pressure, as Bitcoin has traded below their $104,000 cost basis since October 30, resulting in unrealized losses averaging 12.6%.

As reported by Cryptonews today, Bitcoin dropped nearly 4% to approximately $85,940 amid investor risk reduction ahead of crucial US economic data.

Despite near-term volatility, like other major players, Bitfinex maintains that the groundwork is being laid for BTC to regain all-time highs in 2026, supported by looser monetary policy and steady adoption by ETFs, corporates, and sovereign entities that are absorbing multiples of the yearly mined supply.

The post Bitwise Chief: Bitcoin to Hit Fresh Records in 2026 and Break Four-Year Cycle appeared first on Cryptonews.