Bitcoin Price Prediction – $4.5B Realized Loss Is The Biggest Since 2022: Sub-$80K Next?

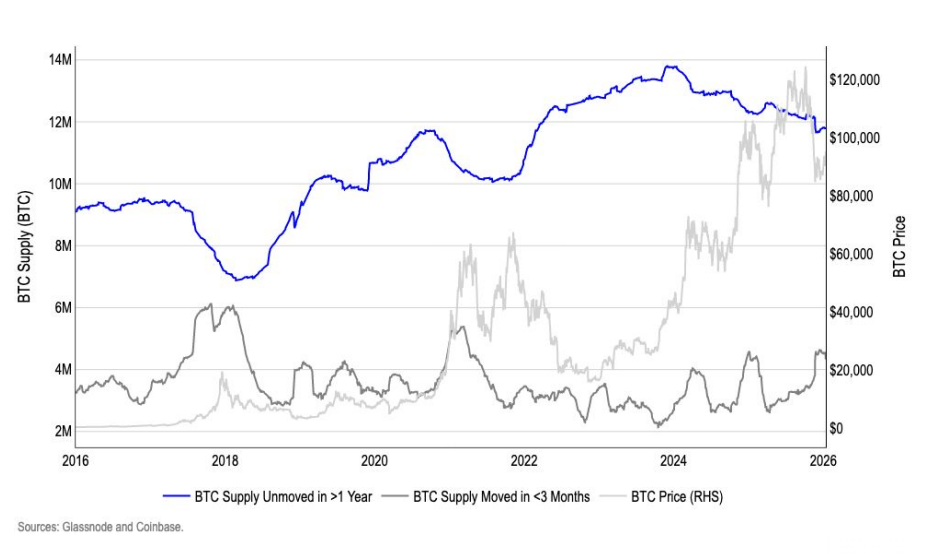

Bitcoin holders have experienced over $4.5 billion in realized losses following the cryptocurrency’s dramatic decline from above $120,000 to below $90,000, which marks the highest level of capitulation since the 2022 bear market.

The Bitcoin price prediction indicator shows that the price might be bracing for another drop below $80k because the last time this much realized losses occurred in Bitcoin, the price dropped more than 50% to $28,000 from $69k.

Bitcoin Capital Flight Sees ETFs Bleed $1.33B in Single Week

The exodus from Bitcoin continues through institutional channels, with U.S.-based Bitcoin ETFs recording $1.33 billion in net outflows over one week, the largest withdrawal since February 2025.

This substantial capital flight shows weakening institutional confidence in the cryptocurrency’s near-term prospects.

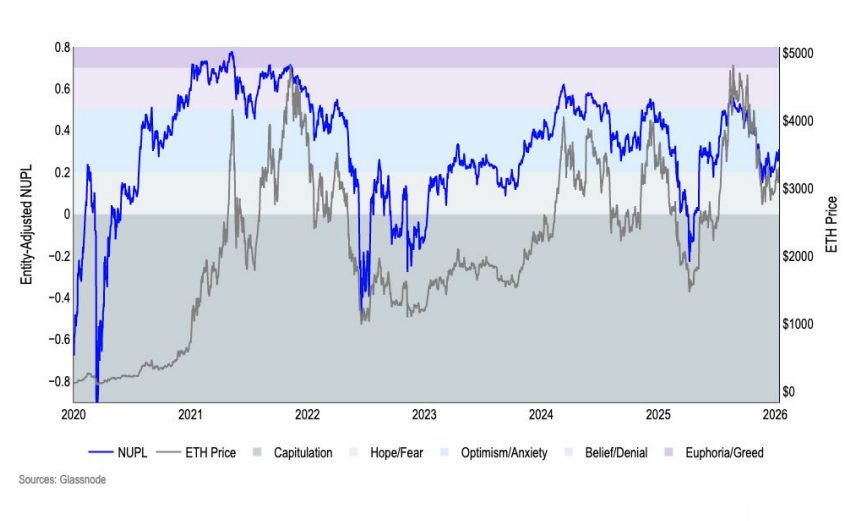

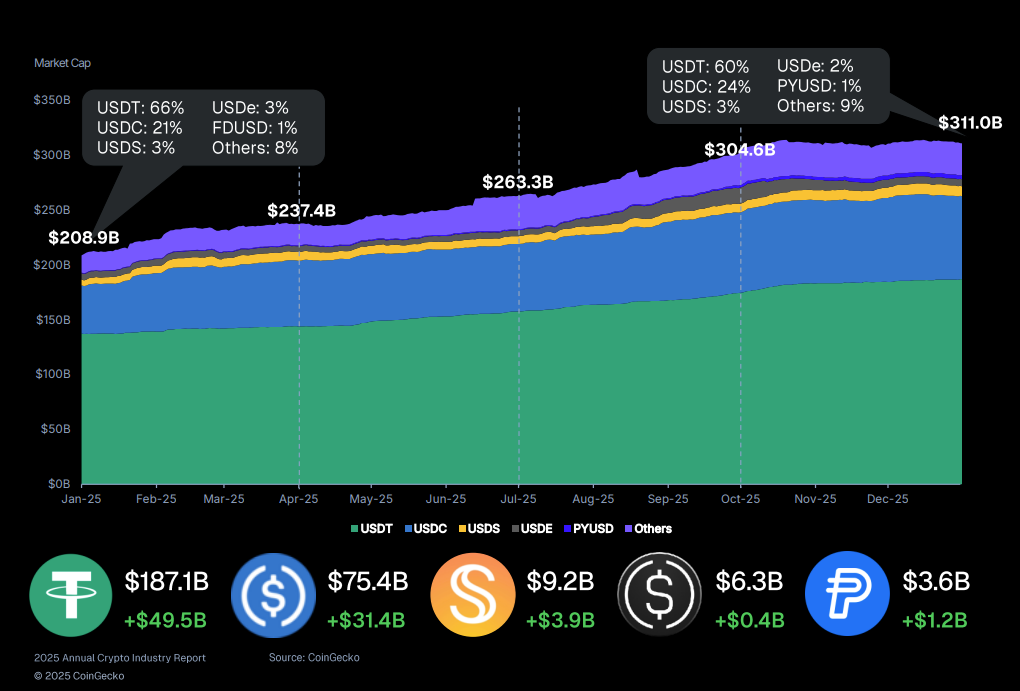

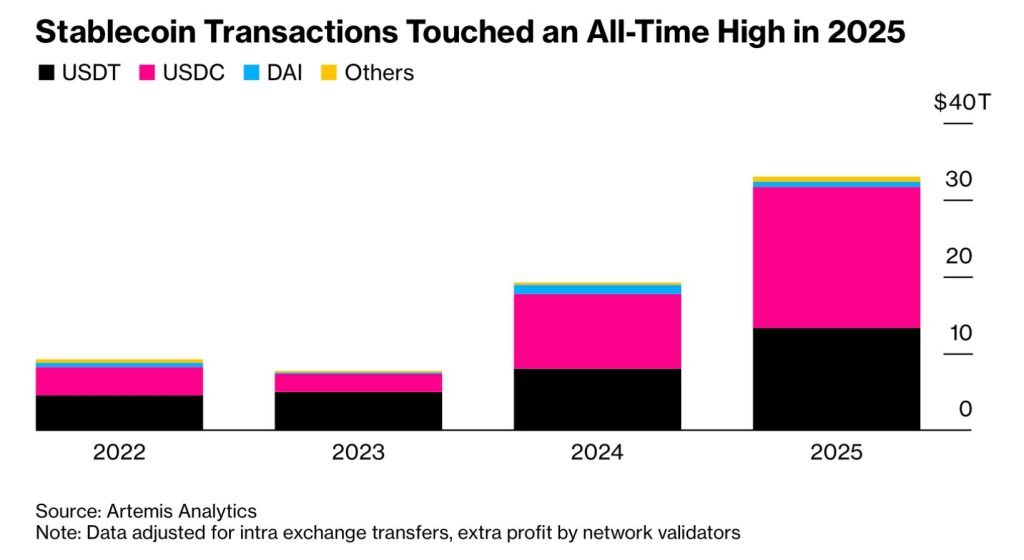

Adding to the bearish sentiment, stablecoin market capitalization has contracted significantly.

According to CryptoQuant researcher Darkfost, the Ethereum-based stablecoin total market cap declined by $7 billion in just seven days, dropping from $162 billion to $155 billion.

Darkfost characterized this development as “a very negative signal,” explaining that investors are completely exiting the crypto market as it continues correcting, while precious metals surge and equity markets maintain strong upward trends.

This migration of liquidity explains the persistent weakness across cryptocurrency markets.

The analyst drew parallels to 2021, noting that similar stablecoin market cap declines confirmed Bitcoin’s entry into bear market territory, though the Terra Luna collapse amplified that downturn.

Darkfost emphasized that current conditions must improve rapidly, or Bitcoin risks confirming a bearish trajectory with a breakdown well below $80,000.

Bitcoin Price Prediction: $80K Support Acts As Make-or-Break Zone

The weekly BTC/USDT chart shows Bitcoin consolidating after a sharp rejection from the $100,000–$103,000 supply zone, which is clearly identified as a bearish invalidation area.

Price currently trades in the mid-to-high $80,000 range, positioned just beneath the 9-week Simple Moving Average, which has transformed into short-term dynamic resistance following the recent breakdown.

Repeated failures to reclaim the $100,000 level confirm that sellers remain aggressive at elevated prices, establishing that zone as a formidable ceiling for any sustained recovery attempts.

The $80,000 level represents critical psychological and structural support. Bitcoin has demonstrated positive reactions near this zone, indicating buyers are defending it vigorously.

As long as Bitcoin maintains weekly closes above $80,000, the broader market structure remains corrective rather than definitively bearish.

Technical momentum indicators suggest caution in the near term.

The Relative Strength Index hovers around the low-40s and has printed multiple bearish divergences during the previous rally, signaling deteriorating momentum and validating the ongoing consolidation phase.

The chart suggests Bitcoin occupies a range-bound corrective phase, with $80,000 serving as the crucial line in the sand.

Holding above this level preserves the possibility of base-building and potential recovery toward $90,000–$95,000 initially.

A decisive weekly close above $100,000 would invalidate the bearish structure and signal trend continuation.

Conversely, losing $80,000 support would likely accelerate downside momentum toward the $70,000 region before establishing a more meaningful bottom.

Bitcoin Hyper Raises $31M As The Leading Crypto Presale

If Bitcoin successfully breaches the $100,000 psychological barrier, established BTC-beta projects like Bitcoin Hyper stand to benefit substantially.

Bitcoin Hyper ($HYPER) is developing the first functional Layer 2 solution for Bitcoin, leveraging Solana-based technology to provide speed and scalability while maintaining Bitcoin’s security framework.

The project has raised over $31million to facilitate Bitcoin-native decentralized applications, offering BTC holders opportunities to deploy assets productively through purpose-built on-chain tools.

Interested investors can participate in the presale by visiting the official Bitcoin Hyper website and connecting their wallet (such as Best Wallet).

The token is currently available for $0.013645 each and could be purchased via USDT or SOL swaps, or directly through a bank card.

Visit the Official Bitcoin Hyper Website HereThe post Bitcoin Price Prediction – $4.5B Realized Loss Is The Biggest Since 2022: Sub-$80K Next? appeared first on Cryptonews.