Bitcoin ETFs post historic $1.33B weekly outflow; Ethereum follows with $611M

![]()

Bitcoin began losing gains as US futures prepared to open as markets geared up to deal with a host of potential downside volatility catalysts.

The recent Bitcoin drop intensifies market fear, potentially leading to further declines and impacting the broader crypto ecosystem.

The post Bitcoin slides below $88K, triggering $135M in crypto long liquidations in the past hour appeared first on Crypto Briefing.

The calls of a potential Bitcoin supercycle in 2026 intensified over the past week after former Binance CEO Changpeng ‘CZ’ Zhao — yet another prominent voice in crypto — laid out his predictions for the new year. However, a popular analyst on the social media platform X has released an opposing view, predicting a deep bottom for the BTC price this year.

In a January 25th post on the X platform, prominent crypto trader Ali Martinez said, in a sarcastic tone, that “the super cycle is super cycling.” In what seemed like a response to the buzz around CZ’s Bitcoin supercycle projection, the market pundit tempered the expectations with a $31,000 price bottom call for the premier cryptocurrency in 2026.

This bearish prediction is based on the appearance of price fractals on the BTC chart. For context, fractals are repeating patterns in price charts that can help map and project potential price movements for a particular cryptocurrency (Bitcoin, in this scenario).

As observed in the chart above, the price of BTC is currently following a similar movement pattern as in 2022. The premier cryptocurrency, after initially setting a then all-time high around $67,000 in early 2021, witnessed a nearly 55% correction to just above the $30,000 level by mid-July.

While the price of Bitcoin recovered and went back to set a record high of above $69,000 by the end of 2021, the market leader spent the majority of the following year in a downward trend. Exacerbated by the various bearish events of 2022, BTC ended the year at a low of around $15,500.

Martinez believes that the Bitcoin price is undergoing a similar movement pattern, having experienced an over 32% decline before climbing to the current all-time high of $126,080. The market pundit postulates that the premier cryptocurrency is currently witnessing the extended decline that saw its price reach $15,500 in 2022.

However, it is worth mentioning that the target this time around lies at $31,800, nearly 65% drop from the current price point. Hence, if the historical patterns highlighted by Martinez are to go by, there seems to be a higher likelihood of the Bitcoin price embarking on an extended downward trend rather than a supercycle.

As of this writing, the price of BTC stands at around $88,528, reflecting an over 1% decline in the past 24 hours.

Small shops and some bigger chains in Las Vegas are now taking Bitcoin for everyday buys. People scan a QR code, pay from a phone, and the merchant gets paid. According to local reports, owners are trying this out to cut the cost of credit card processing and to attract customers who prefer crypto.

Reports say the move is largely about fees. Credit card processing often takes away 2.5–3.5% of a sale. For many small operators, that is painful. Payment tools that accept Bitcoin — often routed over the Lightning Network or through services that can convert crypto to cash — have lowered that burden for merchants.

According to FOX5, more businesses across Las Vegas are now accepting Bitcoin payments, from chains like Steak ’n Shake to small shops and medical practices. Merchants said Bitcoin helps attract new customers and cut costs, while Square has enabled about 4 million U.S. merchants…

— Wu Blockchain (@WuBlockchain) January 24, 2026

Square’s program, which lets millions of US merchants enable Bitcoin checkout with no processing fee through 2026, helped speed up adoption in the area.

Business owners are reporting real use, not just experiments. Juice stands and cafes have processed payments. Some larger outlets are listed on public payment maps so customers can find them.

This has meant more foot traffic from people who travel with crypto or who prefer to keep their cards for other uses. Reports note both new customers and savings on fees as clear benefits.

Lightning Network Speeds Up PaymentsThe Lightning Network is being used to make payments faster and cheaper at the cash register. It moves small Bitcoin payments quickly without the long wait a base-layer transfer can cause.

Merchants scan a code or show one on a screen. The payment is then sent from the buyer’s wallet and settled almost instantly. This technical fix has made in-person Bitcoin payments workable for the first time at many spots.

How Owners See ItOwners are balancing savings against new risks. Some keep crypto for a short time, then sell it for cash. Others leave part of their receipts in Bitcoin. Chargebacks, a problem with cards, are reduced when crypto is used.

A few places say small boosts in sales followed their switch to crypto, yet long-term patterns are still being watched. Reports have disclosed these mixed outcomes as part of a slow but clear shift.

Customers Find New Ways To PayShoppers are adapting. Tourists who carry crypto find these spots useful. Locals who are curious try the method at least once. Payment apps and merchant directories make the process easier for everyone.

For those who like simple steps, scanning a QR code and approving a payment on a phone works fine. For others it is a novelty that might stick.

Featured image from Unsplash, chart from TradingView

![]()

The Tallinn protocol upgrade marks Tezos' 20th major update since launching in 2018, and was implemented without a network fork.

A growing number of chart watchers are pointing to a long stretch of sideways trading for XRP and saying this setup has come before big rallies. According to a widely followed analyst known as CryptoBull, the current price action echoes earlier runs in the token’s history.

The signal is simple: long quiet periods sometimes lead to sharp moves when buying pressure returns. That does not mean a jump is guaranteed. Markets can stay quiet for a long time, and timing is uncertain.

Based on reports, XRP’s weekly structure shows a stretch of range trading after strong breakouts from earlier years. The comparison reaches back several cycles. In past examples, long ranges eventually gave way to impulsive runs that pushed the price far above prior highs.

The next impulse will take #XRP to $11 and the last wave to $70. The price pattern is copying the previous bullrun, only difference is time, which makes sense, as we need longer accumulation for higher prices. pic.twitter.com/WJxzYDVRKT

— CryptoBull (@CryptoBull2020) January 23, 2026

![]()

CryptoBull argues the present consolidation has lasted longer than previous ones, which, he says, could compress price action and build fuel for a larger expansion when momentum flips. The idea rests on history repeating itself in broad strokes, not in exact moves.

Some analysts see a sixfold move as plausible if the same pattern plays out. That kind of rise would put XRP near $11, a figure being discussed by multiple commentators. There is also talk of a further, final wave lifting the token much higher in a later stage — talk that reaches $70 in extreme scenarios.

A bottom test—where price revisits support to confirm strength before a new push—has appeared in a few past cycles and is being watched closely now.

The presence of such tests can either validate a base or warn that the range has more work to do. Timelines are vague, and a long accumulation period can stretch for years before any decisive breakout.

RLUSD Rumors Fuel Speculative CallsReports that BlackRock may use Ripple’s RLUSD stablecoin have added fuel to the fire. News like that has pushed sentiment upward and sparked fresh technical calls, with some forecasts ranging from $6 to $14 in near- to mid-term scenarios.

Other voices go far beyond, naming targets that would imply market caps so large they would be hard to reconcile with today’s market size.

These more extreme numbers should be treated with caution, because they assume near-perfect conditions and massive capital flows that may never arrive. Still, adoption whispers can tilt sentiment and speed up moves when buyers pile in.

Featured image from Unsplash, chart from TradingView

“Bitcoin is the digital gold” is one of the most popular narratives in the cryptocurrency industry, reiterating BTC’s growing status as a formidable store of value. However, while the premier cryptocurrency has floundered over the past months, gold and the metals market have largely witnessed explosive growth.

These contrasting performances have led to conversations about capital rotation between Bitcoin and gold, as the crowd expects one to always outperform the other at any given time. Recent data, however, suggests that the relationship between the BTC and gold price action is overrated.

In a January 24 post on the X platform, on-chain analyst with the pseudonym Darkfost weighed in on the discourse surrounding capital rotation between gold and Bitcoin. According to the market pundit, the idea that investor funds flow from gold to Bitcoin is somewhat overblown.

To highlight this overestimation, Darkfost shared a chart showing periods where BTC outperforms or underperforms depending on gold’s trend. This chart typically provides two signals: positive (BTC above the 180-day moving average [MA] and gold below the 180-day MA) and negative (BTC below the 180-day moving average and gold below the 180-day MA).

As observed in the chart above and stated by Darkfost, the relationship between Bitcoin and gold does not appear to be fully substantiated. The on-chain analyst revealed that there have been as many positive periods as the negative ones, suggesting that the flagship cryptocurrency moves independently of gold.

Darkfost wrote:

This suggests that BTC continues to evolve independently, without clear evidence of a sustained capital rotation from gold.

Furthermore, Darkfost noted that a positive signal does not necessarily mean that capital is flowing out of gold into Bitcoin. According to the on-chain analyst, it is simply not possible to determine whether there is a capital flow relationship between the world’s largest cryptocurrency and gold.

While Bitcoin started the new year on a pretty strong note, the bullish momentum has pretty much waned over the past two weeks. Meanwhile, the gold price has continued to flourish this year, recently reaching a new all-time high above $4,900 per ounce.

As of this writing, the price of BTC stands at around $89,230, reflecting no significant movement in the past 24 hours. According to data from CoinGecko, the flagship cryptocurrency is nearly 30% adrift its all-time high above the $126,000 level.

![]()

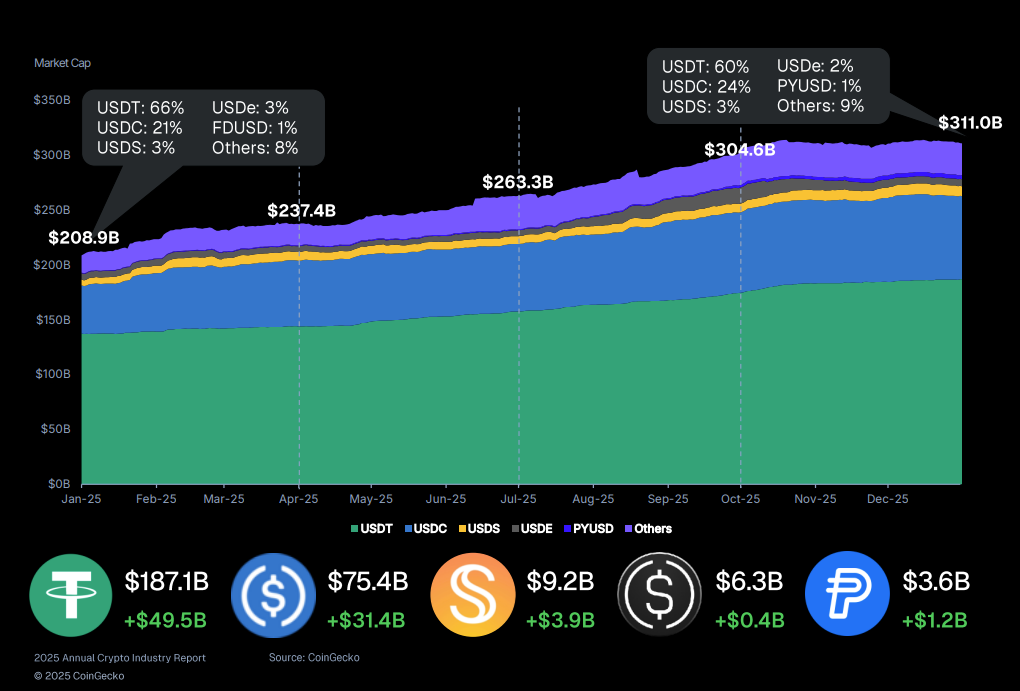

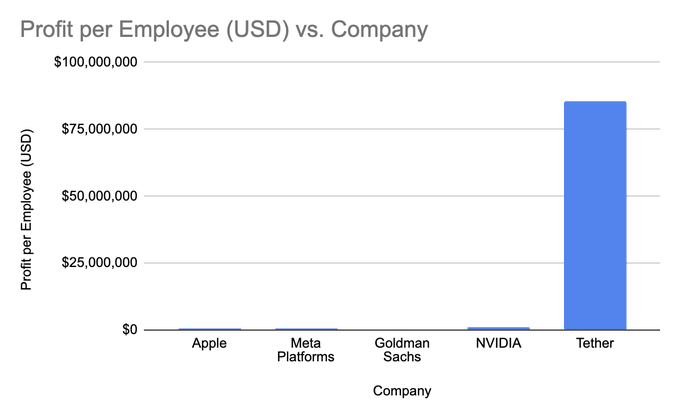

Tether emerged as the most profitable crypto entity in 2025, generating an estimated $5.2 billion in revenue as stablecoins overtook all other protocol categories in earnings.

According to the latest Coingecko annual crypto industry report, Tether alone accounted for 41.9% of all stablecoin-related revenue in 2025, outpacing competitors such as Circle, Hyperliquid, Pump.fun, Ethena, Axiom, Phantom, and PancakeSwap.

The results show that dollar-backed digital currencies have become the most durable revenue engine in crypto, even as market conditions fluctuated throughout the year.

Among more than 168 crypto protocols tracked in 2025, stablecoin issuers collectively generated the highest revenue, with Tether firmly at the center.

INSIGHT: Stablecoins generated $5.2B in revenue in 2025, accounting for 41.9% of total protocol revenue. pic.twitter.com/fjJrAn9k7B

— CoinGecko (@coingecko) January 25, 2026

Its $5.2 billion haul placed it well ahead of Circle and other major players, reinforcing USDT’s position as the industry’s primary settlement asset.

Within the top ten revenue-generating protocols, just four entities, led by Tether and Circle, produced 65.7% of total earnings, equivalent to roughly $8.3 billion.

The remaining six protocols in the top ten were all trading-focused platforms, highlighting a sharp divide between stable revenue streams and market-dependent income.

That contrast became clear as trading revenues swung widely with investor sentiment during the year.

Phantom, for example, recorded $95.2 million in revenue in January at the height of the Solana meme coin frenzy, only to see earnings fall to $8.6 million by December as speculative activity cooled.

The broader stablecoin market expanded rapidly, with total market capitalization rising by $6.3 billion in the fourth quarter alone to reach a record $311.0 billion.

That marked a 48.9% year-over-year increase, adding $102.1 billion as adoption accelerated across regions.

Tether maintained clear leadership with 60.1% of the total stablecoin market cap, or about $187.0 billion, followed by Circle’s USDC at 24.2%, equivalent to $72.4 billion.

Tether is now the world’s third-largest digital asset by market value at $186.8 billion, up roughly 50% from a year earlier.

While the top players strengthened their grip, shifts within the top five reflected changing risk appetites.

Ethena’s USDe experienced the sharpest reversal, with its market cap plunging 57.3%, or $6.5 billion, after a mid-October depeg on Binance undermined confidence in high-yield looping strategies.

Other stablecoins posted mixed but notable moves as capital rotated within the sector.

PayPal’s PYUSD surged 48.4%, adding $1.2 billion to reach $3.6 billion and briefly claiming the fifth spot before World Liberty Financial’s USD1 reclaimed it by nearly $1.

Additional high-growth tokens included Ripple’s RLUSD, which expanded 61.8% to add $488.2 million, and USDD, which climbed 76.9% with a $366.8 million increase.

Looking ahead, Bitwise CIO Matt Hougan recently suggested that Tether could become the world’s most profitable company if its trajectory continues.

“There’s a chance that many emerging market countries will convert from primarily using their own currencies to using USDT,” Hougan said, pointing to Tether’s near-total dominance outside Western markets.

Based on projected interest income, calculations indicate that custody of $3 trillion in assets could generate annual revenue exceeding the $120 billion earned by Saudi Aramco last year.

Tether CEO Paolo Ardoino previously told Cryptonews he remains confident USDT will retain its lead due to the company’s deep understanding of real-world usage.

Beyond stablecoins, Tether has expanded aggressively into traditional assets and investments.

— Cryptonews.com (@cryptonews) December 13, 2025

@Tether_to has launched an all-cash bid to acquire Italy’s @juventusfcen, an offer that was reportedly swiftly turned down.#Tether #Cryptohttps://t.co/4iTBXWjo5V

The company recently became the second-largest shareholder in Italian football club Juventus and has reportedly explored raising $20 billion for a 3% stake, a deal that would imply a valuation near $500 billion and place Tether among the world’s most valuable firms.

The post Tether Posts Largest Crypto Revenue in 2025: $5.2B From Stablecoin Dominance appeared first on Cryptonews.

Reports say the Ethereum Foundation has started a new team to prepare the network for possible quantum computer attacks. These machines could one day break the math behind wallets and signatures. The team’s work is moving from research into practical tests and experiments, which has drawn attention across the crypto community.

Based on reports, Thomas Coratger will lead the effort. The team includes cryptographers and engineers already testing new systems on devnets. Some work ties into a project called leanVM and a researcher named Emile, who focuses on building simple quantum-safe tools. The goal is to test new algorithms in real software while keeping current transactions running smoothly.

Today marks an inflection in the Ethereum Foundation’s long-term quantum strategy.

We’ve formed a new Post Quantum (PQ) team, led by the brilliant Thomas Coratger (@tcoratger). Joining him is Emile, one of the world-class talents behind leanVM. leanVM is the cryptographic…

— Justin Drake (@drakefjustin) January 23, 2026

A $1 million prize has been set for improvements to the Poseidon hash function. Another $1 million prize supports broader post-quantum research. In total, roughly $2 million are being offered to labs and independent developers to design and test quantum-resistant solutions. Reports say this funding is meant to speed up work and show what can realistically replace current signatures.

Multi-client devnets are already active. Developers are experimenting with new signature types to see what works and what fails. Biweekly sessions led by researchers like Antonio Sanso let teams share results and update code. A Post-Quantum Day is scheduled for March 2026 before ETHCC, with a larger event planned in October 2026 to show progress and plan next steps.

Quantum computers could, in theory, break the ECDSA and secp256k1 schemes used today. That risk is not immediate but serious enough that Ethereum is acting now. Reports note users should watch for official guidance, follow wallet updates, and avoid reusing addresses once upgrades roll out.

Community reaction has been mixed. Some online discussions praised the careful planning, while traders noticed a small dip in ETH price. Others questioned how upgrades would reach millions of wallets and what happens to old keys. The Foundation’s approach is to test solutions early so users and services are better protected when changes happen.

This step is part of Ethereum’s long-term plan for safety. Tests will continue, standards will be debated, and progress will be shared publicly. By acting now, Ethereum aims to reduce risk and make future transitions smoother for everyday users and the network as a whole.

Featured image from Unsplash, chart from TradingView

The Bitcoin price action has been muted over the past few days, trading within the $90,000 and $88,000 levels. Classically, consolidation periods often precede major moves either to the upside or downside of the market.

As such, questions on the next trajectory of the flagship cryptocurrency are being asked. A latest on-chain evaluation has offered a positive prognosis on the next direction for the Bitcoin price.

In a Quicktake post on CryptoQuant, on-chain analyst CoinNiel hypothesized that the Bitcoin price could be at the beginning of a bullish trend. The market quant based this prognosis on two metrics — the Accumulator Address Demand and the Liquidity Inventory Ratio (month).

The Accumulator Address Demand metric monitors the net buying pressure coming from addresses that buy Bitcoin consistently, and without any significant selling. This behavior (of buying and rarely selling) is typical of the large-scale Bitcoin holders, commonly known as the whales.

Notably, CoinNiel also pointed out that when major withdrawals from exchanges occur, they are rarely ever incited by retailers, but by whales. As such, when the Bitcoin whales withdraw their holdings from exchanges, their buying pressure translates into an increase in the Accumulator Address Demand.

From the chart above, the indicator has reached an all-time high level. According to the crypto pundit, this could be a sign that the whales are currently experiencing, on intense levels, the “fear of missing out.”

The second metric, the Liquidity Inventory Ratio (Month), also reinforces CoinNiel’s bullish outlook. This metric tracks and compares existing Bitcoin demand to the supply available on exchanges, showing whether demand can overwhelm available supply.

When this ratio rises sharply, it is usually a sign that demand is absorbing newly created supply. From the data shared by the analyst, the Liquidity Inventory Ratio has also reached an extreme value of 3.8.

However, this extreme reading is only a reflection of what is happening on US exchanges. Hence, CoinNiel implied that, for the first time in years, US exchanges are recording exceptionally high demand relative to the coins available.

In theory, a 3.8 reading implies the imminence of a supply shock in the scenario where current conditions prevail. But, the analyst highlighted that it may not necessarily happen, as a 3.8 reading is more a sign of intensified whale demand than a surefire means to predict supply shocks.

The big picture, especially when these two metrics are looked at together, appears to be distinctly bullish. This is because available data points out that the whales are likely positioning for what could be a resumed bullish trajectory for the Bitcoin price.

As of this writing, Bitcoin is valued at $88,520, reflecting an over 1% decline in the past 24 hours.

Scroll co-founder Ye Chen’s X account was hijacked in a sophisticated phishing operation where attackers posed as platform employees to target crypto industry figures.

The compromised account, which commands substantial influence among crypto leaders, began distributing fraudulent messages claiming copyright violations and threatening account restrictions unless users clicked on malicious links within 48 hours.

The hackers transformed Chen’s profile to mimic X’s official branding, updating the bio to reference Twitter and nCino while warning followers about security breaches.

The attackers flooded the feed with reposts from X’s verified accounts to enhance perceived legitimacy, then launched their phishing campaign via direct messages.

The breach follows established tactics where hackers exploit trusted accounts to distribute malicious links disguised as urgent platform notifications.

Recipients received messages appearing to come from X’s rights management team, complete with fake compliance warnings and time-sensitive appeals processes designed to create panic and bypass security awareness.

Blockchain security researcher Wu Blockchain first identified the compromise and alerted the community to ignore any communications from the account.

The warning emphasized particular concern given Chen’s extensive network of high-profile cryptocurrency executives, developers, and investors who might trust messages from his verified account.

Scroll co-founder @shenhaichen's X account has been hacked and is currently sending phishing private messages impersonating X employees. This account has a large following among prominent figures in the crypto industry; the community and users are advised to be aware of the… pic.twitter.com/ctXk2G0bQm

— Wu Blockchain (@WuBlockchain) January 25, 2026

The attack represents the latest escalation in social media compromises targeting crypto industry leaders, in which hackers increasingly leverage delegated account access and expired domain registrations to bypass security measures, including two-factor authentication.

BNB Chain’s official account suffered a similar breach in October when hackers posted fake reward programs with phishing links after Binance co-founder CZ warned followers against clicking suspicious content.

The compromised account promoted fraudulent BSC token distributions, promising early payouts to users who voted on reward dates through malicious URLs designed to drain digital wallets.

Binance co-CEO Yi He’s WeChat account was also hijacked in December to promote meme coin schemes, with attackers conducting a coordinated pump-and-dump operation around the token MUBARA.

Two wallets created hours before the breach accumulated 21.16 million tokens before dumping holdings as retail traders flooded in, netting attackers approximately $55,000 while leaving later buyers exposed to price collapse.

— Cryptonews.com (@cryptonews) December 10, 2025

Changpeng Zhao @cz_binance warned that new co-CEO Yi He’s @heyibinance abandoned WeChat account was hacked and used to push a meme coin called MUBARA.#Binance #Memecoins https://t.co/sdyH325OMD

Among other notable accounts hacked were ZKsync and Matter Labs, which were compromised in May through what the team described as “delegated accounts” with limited posting privileges.

Hackers published false claims about an SEC investigation alongside fake airdrop promotions, triggering a 5% drop in the ZK token price despite a prior 38.5% weekly rally.

The prominent crypto media company, Watcher.Guru also confirmed its account breach in March after fake Ripple-SWIFT partnership claims spread across connected Telegram, Facebook, and Discord channels through automated content bots.

The team suspects the compromise originated from a suspicious link containing unusual query strings shared in their Telegram group weeks earlier.

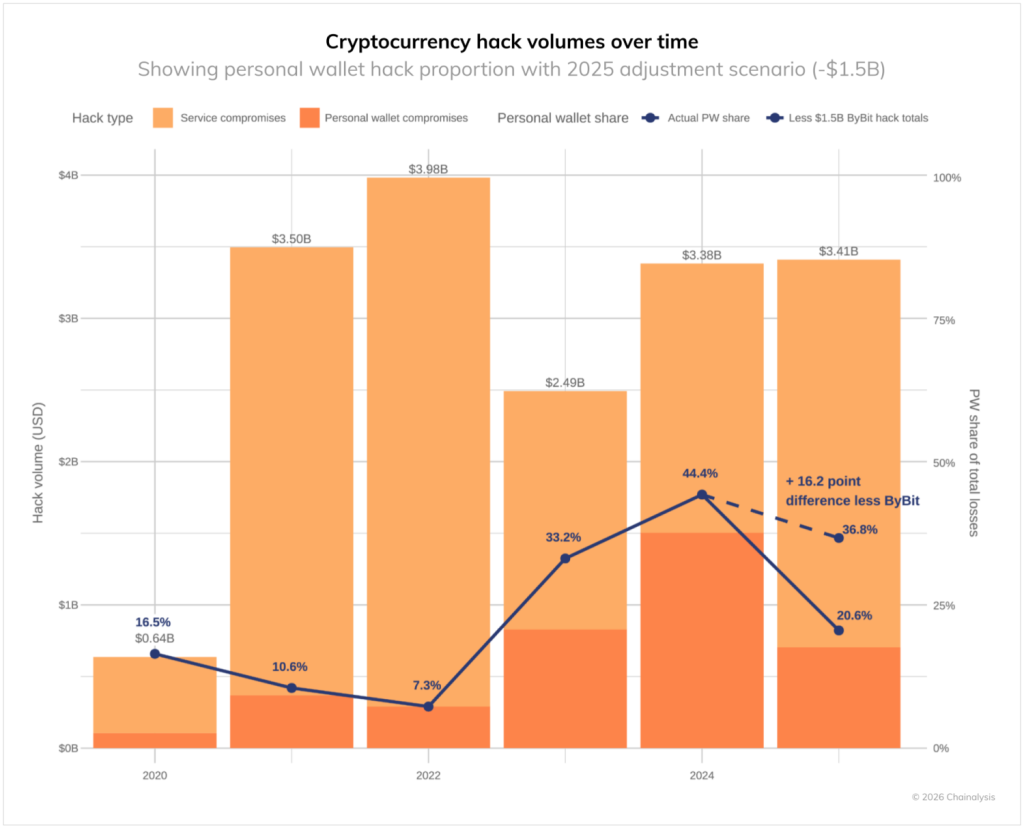

The crypto ecosystem witnessed over $3.4 billion stolen in 2025, according to Chainalysis’s 2026 Crypto Crime Report, with North Korean state-backed hackers accounting for a record $2.02 billion across fewer but increasingly sophisticated attacks.

The Democratic People’s Republic of Korea now represents 76% of all service compromises, bringing cumulative DPRK cryptocurrency theft to $6.75 billion since operations began.

Personal wallet compromises surged to 158,000 incidents affecting at least 80,000 unique victims, triple the 54,000 cases recorded in 2022.

Address poisoning scams drove December’s single-largest loss, when one victim transferred $50 million to a fraudulent wallet mimicking their intended destination, while private key leaks resulted in $27.3 million stolen from multi-signature wallets.

Most recently, Ubuntu developer Alan Pope warned that attackers are hijacking Snap Store publisher accounts by registering expired domains linked to legitimate developers, then pushing malicious updates to previously trusted packages.

The technique exploits automatic update systems and established trust signals, with at least 2 confirmed cases of wallet-stealing malware distributed through seemingly normal applications.

— Cryptonews.com (@cryptonews) January 21, 2026

Hackers are exploiting trusted Snap Store packages to steal cryptocurrency by hijacking existing publisher accounts.#Hack #Cryptohttps://t.co/YV5Yoiwb0F

Given these growing, multifaceted attack vectors, Better Business Bureau officials are warning consumers about phishing campaigns that lock X users out of their accounts and are subsequently used for cryptocurrency promotions.

Kentucky journalist Jennie Rees described receiving direct messages from apparent colleagues requesting contest votes, only to find her account posting fake Audi purchase claims tied to crypto earnings after clicking the malicious link.

The post Hackers Impersonate X Staff Using Compromised Scroll Founder Account appeared first on Cryptonews.

While Binance co-founder and former CEO Changpeng “CZ” Zhao made the headlines following his interview at the just-concluded World Economic Forum, where he called a Bitcoin supercycle in 2026, his crypto counterpart and Coinbase CEO, Brian Armstrong, has come forward with feedback from the global event held in Davos, Switzerland.

In a January 24 post on the social media platform X, Armstrong shared a few key “themes and takeaways” from the latest edition of WEF. After admitting that the conference offered a productive time of meeting people one-on-one, the Coinbase CEO revealed that the major focus was on pushing crypto adoption globally.

Starting his list of takeaways, Armstrong highlighted that everyone was talking about tokenization, which is beginning to expand to every asset class in the world. The crypto leader said to expect some major progress in the tokenization sector in 2026, especially as the Fortune 500 business leaders continuously lean in.

Secondly, the Coinbase CEO shared that crypto legislation and the CLARITY Act were another area of focus, as the government of the day looks to make the United States the crypto capital of the world. According to Armstrong, most of the bank CEOs he met at the WEF in the past week are actually pro-crypto.

Armstrong wrote on X:

One CEO of a top 10 global bank told me crypto is their number one priority, and they view it as existential.

Furthermore, the Coinbase CEO lauded the Trump administration as the most crypto-forward government in the world at the moment. Armstrong acknowledged their progress with the crypto market structure, stating that these clear rules are crucial for global competitiveness and will put money back in people’s pockets.

In what seemed like a cheeky tone, Armstrong mentioned that ESG (Environmental, Social, and Governance) and DEI (Diversity, Equity, and Inclusion) topics didn’t come up throughout the forum. According to the crypto founder, the week felt productive, as it centered around real, global progress — all thanks to BlackRock CEO and new WEF co-chair Larry Fink.

The Coinbase leader touted crypto and AI (artificial intelligence) as the most talked-about technologies in today’s world. Highlighting their compatibility, Armstrong stated that AI agents will eventually default to using stablecoins for payments, as they cannot be KYC’d like human beings.

Finally, Armstrong revealed that the Coinbase, Circle, and Bermuda partnership to build a fully on-chain economy was announced at WEF Davos 2026. “Excited to make progress on this and create a compelling case study for other nations to follow,” the crypto CEO concluded.

As of this writing, the global cryptocurrency market has a total capitalization of $3.086 trillion, with Bitcoin retaining its spot as the world’s largest cryptocurrency.

![]()

Nifty Gateway, the marketplace that once helped bring NFT drops to a wider audience, will stop running its marketplace on February 23, 2026. The company put the site into a withdrawal-only mode the same day it made the announcement, and users were told they must move any remaining funds and NFTs off the platform before that date.

According to the company, withdrawal tools are available now. Reports note users can pull USD or ETH balances through a linked Gemini Exchange account or send funds to their bank via Stripe.

Emails with step-by-step instructions will be sent to account holders, and a shutdown notice already appears on the Nifty Gateway homepage. The aim, as described by the owner, is to let people retrieve what they own before the platform goes dark.

Today, we are announcing that the Nifty Gateway platform will be closing on February 23, 2026. Starting today, Nifty Gateway is in withdrawal-only mode.

Nifty Gateway was launched in 2020 with the vision of revolutionizing digital art. Since launching, Nifty supported dozens of…

— Nifty Gateway Studio (@niftygateway) January 24, 2026

![]()

Based on reports from Gemini, the closure is meant to let the parent firm concentrate on building one bigger app for customers. The move highlights how interest and trading activity in many NFT markets have cooled from the highs seen in earlier years.

Some collectors and artists are left scrambling to rehome items they once sold or stored on Nifty Gateway.

End Of An Early PlayerNifty Gateway helped make buying NFTs easier for people who preferred credit cards and familiar checkout flows. It launched as a high-profile marketplace and hosted major drops from well-known creators.

The platform supported hundreds of millions in sales at its peak and played a clear part in bringing NFT art into mainstream headlines. Its exit marks the end of an important chapter for that wave of marketplaces.

Owners should check their inboxes for the official instructions, confirm where their tokens are stored, and move assets before the deadline. If NFTs are stored in custodial wallets on the site, they will need to be transferred out.

USD and ETH balances should be withdrawn or moved into a connected Gemini account if that option suits the owner. Waiting past the closure date will reduce options.

A Quiet Turning PointFor many collectors, this will feel like another sign that the early boom years have passed. For creators, the change raises questions about where drops and secondary sales will happen next.

Gemini says it will keep supporting NFTs through its other products, including the Gemini Wallet, but the specific ways that creators and buyers reconnect with those audiences will depend on new tools and services that arrive in the next months.

Featured image from Unsplash, chart from TradingView

![]()

The fourth-quarter crypto pullback hit ARK ETFs, with Coinbase emerging as the biggest drag on performance.

XRP is trading near $1.89–$1.91 as January draws to a close, holding a well-defined triple-bottom support around $1.88 after slipping below the $2.00 mark earlier this week. The pullback has coincided with ETF outflows and a sharp drop in trading volume, but price action suggests stabilization rather than renewed selling pressure.

With volatility compressing and buyers repeatedly defending the same demand zone, XRP is approaching a technical decision point that could define its next directional move.

Short-term pressure has been driven largely by institutional flows. According to data reported by CryptoQuant, U.S. spot XRP ETFs recorded their first weekly net outflows, totaling approximately $40.6 million toward the end of January. Trading volume has also declined sharply, with some estimates showing a 50%+ drop in 24-hour activity, signaling trader hesitation rather than aggressive selling.

That said, the flow data points to rotation and profit-taking, not abandonment. XRP remains one of the few large-cap tokens with clear regulatory positioning in the US, and earlier ETF inflows north of $1 billion underscore that institutional interest hasn’t disappeared. The current reset appears more about leverage clearing than confidence breaking.

Fundamentally, Ripple’s long-term thesis remains unchanged. XRP continues to underpin on-demand liquidity (ODL) across Ripple’s global payments network, offering faster and cheaper settlement compared to legacy systems.

More than 300 financial institutions remain connected to RippleNet, and ongoing regulatory clarity following 2025 rulings continues to distinguish XRP from many peers.

While no major partnership headlines have emerged this week, the absence of negative ecosystem news reinforces the view that the current weakness is market-driven, not fundamental.

From a technical perspective, XRP price prediction remains cautiously neutral near term. On the 2-hour chart, price is stabilizing inside a descending channel, capped by a falling trendline near $1.95. XRP is trading below the 50-EMA and 100-EMA, while the 200-EMA near $1.99 continues to act as firm resistance.

Support is clearly defined between $1.88 and $1.85, where repeated long lower wicks suggest responsive buying. RSI has recovered into the mid-40s after oversold readings, indicating easing downside pressure. Volatility has contracted, forming a descending wedge, a structure that often resolves higher if support holds.

A successful break above $1.95 would expose $2.03–$2.06, signaling structural repair. Conversely, a decisive loss of $1.85 would open downside toward $1.80 and $1.77.

XRP Trade setup: Accumulate near $1.88–$1.85, target $2.03–$2.06, invalidation below $1.80.

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.9 million, with tokens priced at just $0.013635 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the PresaleThe post XRP Price Prediction: $1.88 Triple-Bottom Support as ETF Money Pulls Back – What’s Next? appeared first on Cryptonews.

South Korean crypto exchanges recorded a 62% surge in stablecoin trading volumes as the won fell to multi-year lows against the dollar, prompting platforms to intensify marketing campaigns around dollar-pegged tokens.

According to The Korea Times, trading volume in Tether (USDT) across the nation’s five major won-based exchanges climbed to 378.2 billion won ($261 million) when the exchange rate exceeded 1,480 won per dollar last Wednesday, citing CryptoQuant data.

The spike follows mounting currency pressures that pushed the won through nine consecutive days of declines against the dollar, marking its longest losing streak since 2008, Bloomberg reported.

Major exchanges, including Korbit, Coinone, Upbit, and Bithumb, launched aggressive promotional campaigns centered on stablecoins, including USDC and USDe, waiving trading fees and distributing rewards to boost volumes during what industry officials described as a downturn in broader crypto markets.

According to The Chosun Daily, South Korea’s major commercial banks slashed dollar deposit interest rates to near zero in response to government pressure to defend the exchange rate.

Shinhan Bank cut its annual rate from 1.5% to 0.1% starting January 30, while Hana Bank reduced rates from 2% to 0.05% for its Travelog Foreign Currency Account.

The coordinated move followed the authorities’ summoning of bank executives and their request that they “refrain from excessive marketing that encourages foreign currency deposits such as dollars.”

Banks responded by introducing incentives for won conversion, with Shinhan offering a 90% preferential rate for customers converting dollar deposits back to won, plus an additional 0.1 percentage point rate boost for those subscribing to won-term deposits afterward.

Dollar deposit balances at the five major banks fell 3.8% from month-end to 63.25 billion dollars as of January 22, marking the first decline after three consecutive months of surges.

Corporate deposits, which account for 80% of all dollar holdings, dropped sharply from 52.42 billion dollars at year-end to 49.83 billion dollars, suggesting that the authorities’ recommendation to sell dollars spot, combined with perceptions that the exchange rate had peaked, was driving the decline.

Individual dollar deposits grew at a significantly slower pace, rising just 109.64 million dollars, compared with the previous month’s 1.09 billion dollar surge.

President Lee Jae-myung delivered a rare verbal intervention on the exchange rate during a January 21 press conference, stating authorities predicted the rate would drop to around 1,400 won within one to two months.

The won-dollar rate immediately fell from 1,481.4 won to 1,467.7 won following his remarks, closing at 1,471.3 won.

Market observers noted the unprecedented nature of a sitting president specifying both an exchange rate target and timeline, with Lee’s statement carrying significantly more weight than U.S. Treasury Secretary Scott Bessent’s earlier comment that the won’s recent decline was “inconsistent with Korea’s strong fundamentals.”

Meanwhile, demand for dollar exchange slowed as average daily won-to-dollar conversions reached 16.54 million dollars from January 1-22, while dollar-to-won conversions surged to 5.2 million dollars daily, significantly exceeding last year’s 3.78 million dollar average and indicating increased profit-taking.

In fact, according to CNBC, South Korea’s fourth-quarter GDP growth slowed to 1.5% year over year, missing economists’ forecasts of 1.9%, as construction investment shrank 3.9% and exports pulled back 2.1% from the previous quarter.

The won has lost nearly 2% against the greenback this year, making it one of Asia’s worst-performing currencies, while South Korean retail investors bought approximately 2.4 billion dollars of U.S. equities on a net basis through mid-January, up roughly 60% from the same period last year.

The broader economic slowdown comes as Seoul advances major crypto policy reforms despite regulatory gridlock over stablecoin governance.

Earlier this month, South Korea ended its nine-year corporate crypto trading ban, permitting listed companies to invest up to 5% of equity capital in top-20 cryptocurrencies, while lawmakers passed amendments to the Capital Markets Act and Electronic Securities Act establishing legal frameworks for tokenized securities trading beginning January 2027.

— Cryptonews.com (@cryptonews) January 12, 2026

South Korea has launched guidelines, allowing listed companies and professional investors to invest up to 5% of their equity capital crypto.#SouthKorea #CorporateCryptoInvestment #CryptoInvestmenthttps://t.co/d55u3TDsBF

Korea Exchange Chairman Jeong Eun-bo pledged to launch spot Bitcoin ETFs and extend trading hours to 24/7 as part of efforts to eliminate the “Korea discount,” though comprehensive digital asset legislation remains stalled amid disputes between the Financial Services Commission and the Bank of Korea over stablecoin issuance rules.

The post Stablecoin Trading Surges 62% in Korea as Dollar Strengthens Against Won appeared first on Cryptonews.