Solana Price Prediction: Analysts See $180 Breakout as Spot ETF Inflows Reach $674M

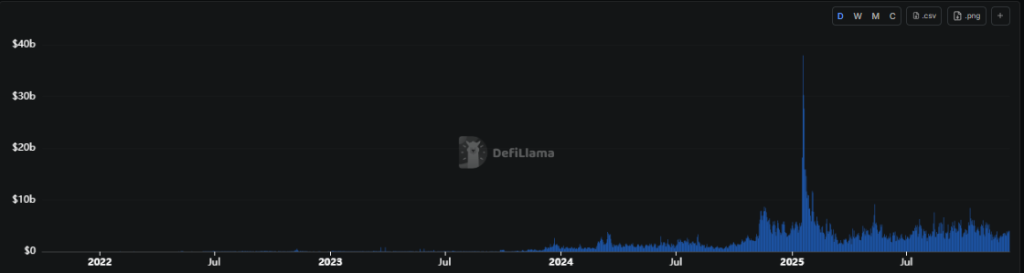

Solana spot ETFs, which debuted in late November 2025, have recorded net inflows for seven consecutive trading days, accumulating $674 million in total.

Analysts suggest this institutional buying pressure could propel the Solana price prediction toward a $180 breakout.

Bitwise Dominates Solana ETF Inflow Rankings Ahead of $180 Breakout

Data from Sosovalue reveals Bitwise commands the lead with $608.81 million in inflows, while Grayscale and Fidelity follow with $97.74 million and $54.8 million, respectively.

— DustyBC Crypto (@TheDustyBC) December 14, 2025

Last week, $SOL spot ETFs recorded 7 straight days of net inflows. pic.twitter.com/oSVTls5SzV

Despite a 2% price decline over the past week, analysts say the growing institutional appetite for Solana is a necessary catalyst to finally breach the 2-month $180 resistance barrier.

Beyond institutional interest through ETFs, Solana has been earning credibility from Wall Street in its campaign to become the blockchain infrastructure for capital markets.

At the recently concluded Solana Breakpoint conference, Marc Antonio, Head of DeFi at asset manager Galaxy Digital, declared that Solana represents the only blockchain capable of processing tokenized securities at the scale that Wall Street executives like Larry Fink have long championed.

Antonio emphasized, “We want Solana to be so dominant and we want Solana to have such good prices that when you compare the price of Nasdaq-listed Forward Industries on Solana versus Nasdaq, you want to buy on Solana. That’s the end state.”

Solana Price Prediction: Technical Setup Shows Accumulation Before $180 Breakout

Solana is consolidating below a long-term descending trendline following an extended corrective period, with price currently maintaining within a clearly defined accumulation zone spanning $120–$135.

This area has repeatedly absorbed selling pressure, indicating sellers are exhausting their control, though the market hasn’t yet demonstrated a decisive reversal.

The failure to recapture the $180 level maintains the broader structure as technically bearish, with that zone now functioning as the primary upside obstacle.

Momentum remains subdued, but the RSI is stabilizing in the low-40s and has begun printing mild bullish signals after a prolonged bearish stretch, suggesting downside momentum is diminishing.

If SOL can break above the descending trendline and reclaim $180, the chart opens pathways for a stronger recovery toward the $210 region, which aligns with the next major resistance level.

Pepenode Raises $2.3M To Position for Meme Coin Explosion

If SOL finally breaks through $180 resistance and converts the $200 psychological level into support, meme coins like Pepenode (PEPENODE) could experience 10-50x post-TGE rallies.

Pepenode is a new crypto project that’s already raised over $2.3 million despite challenging market conditions.

It’s a game where you can “mine” coins without needing expensive computer equipment.

You play the game in your web browser, set up virtual mining nodes, and upgrade your facilities to earn more tokens.

The project is replicating the success strategies of PEPE and popular Solana memecoins that saw dozens of projects rally over 100x during the 2024 summer season.

Now that more people are starting to purchase Pepenode’s mining rigs, the token price is expected to rise rapidly.

To join the presale before the price increases, visit the official Pepenode website and connect a crypto wallet like Best Wallet.

You can buy tokens now for $0.001192 each and pay with crypto coins like ETH, BNB, or USDT.

Visit the Official Pepenode Website HereThe post Solana Price Prediction: Analysts See $180 Breakout as Spot ETF Inflows Reach $674M appeared first on Cryptonews.