European banks form consortium to launch Euro-pegged stablecoin

Bank of Italy Governor Fabio Panetta told the country’s banking association on Wednesday that commercial banks must convert their money into digital tokens to remain competitive as stablecoins gain momentum, backed by what he described as strong support from the United States administration.

According to Reuters, the European Central Bank policymaker’s comments come as European officials debate how to preserve the continent’s monetary sovereignty while American policymakers accelerate efforts to establish dollar-backed digital assets as a global payment standard.

Addressing bankers in Milan, Panetta said traditional money would continue to anchor the financial system, but warned that both central bank and commercial bank money must become fully digital.

“I expect commercial bank money will also become mostly tokenised,” he stated, referring to the process of converting financial assets into digital tokens issued on distributed ledgers such as blockchain.

Panetta acknowledged that stablecoin use would grow substantially in line with Washington’s strategic priorities.

“They’ll definitely develop because there’s a big push by the U.S. administration,” he said, explaining that American officials view digital assets as tools to reinforce global dollar demand.

The governor emphasized uncertainty around stablecoins’ ultimate role but insisted they would not displace traditional money, which he called the financial system’s only stable anchor.

“It’s not clear what role they’ll have … but I expect the system will remain centred around central bank and commercial bank money, both of which will need to become digital,” Panetta added during his address to Italy’s banking leaders.

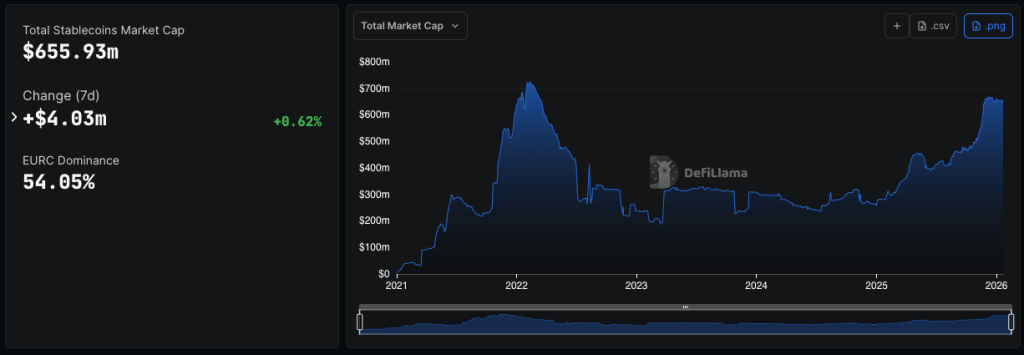

His warning arrives amid escalating European concerns about dollar-denominated stablecoins controlling 99.58% of the $300 billion global market while euro-backed alternatives remain marginal at just $680 million.

The ECB has repeatedly flagged systemic risks from rapid stablecoin growth, particularly as leading issuers now rank among the world’s largest U.S. Treasury holders, creating potential spillover effects into traditional markets during stress events.

The ECB seeks to launch a digital euro by 2029 to maintain the relevance of central bank money in an increasingly digital economy and to protect Europe’s monetary sovereignty.

Panetta noted recent geopolitical developments showed Europe’s risky dependence on American firms like Visa, Mastercard, and PayPal for over two-thirds of its payments.

The digital euro project has faced strong opposition from commercial banks, particularly in Germany, which fear competition from the ECB for deposits.

Panetta addressed this resistance directly, recounting discussions with banks in a large European country that opposed the project because they worried about losing 30% of the payments they handled digitally.

“When I discussed this with the banks of a large European country that opposed the digital euro because they worried they’d lose the 30% of payments they handled digitally, I told them: instead of worrying about the 30% think about who controls the 70% you’ve already lost,” Panetta said.

His remarks contrast sharply with a December open letter from 70 European economists who urged EU lawmakers to prioritize public digital currency over private stablecoins, warning that poor design choices could leave Europe dependent on foreign payment systems.

— Cryptonews.com (@cryptonews) January 12, 2026

Seventy European economists warn that weak digital euro design could leave Europe reliant on US payment systems and dollar-backed stablecoins.#DigitalEuro #EU #Stablecoinhttps://t.co/FqcWLtAyEG

The academics, including Thomas Piketty and Paul De Grauwe, demanded that the digital euro serve as “the backbone of a sovereign, resilient European payment infrastructure,” with generous holding limits and broad accessibility.

Meanwhile, ten major European banks, including BNP Paribas, ING, and UniCredit, formed a consortium in December to launch a euro-backed stablecoin by mid-2026 through a Dutch entity called Qivalis.

The initiative directly addresses concerns about dollar dominance, with euro-denominated stablecoins accounting for less than 1% of the global market despite the eurozone’s economic scale.

Panetta’s tokenization call reflects growing recognition that traditional banks risk irrelevance if they do not adapt to blockchain-based payment systems.

The ECB confirmed last month it would begin allowing distributed ledger technology transactions to settle in central bank money in 2026, marking concrete progress toward integrating digital assets into Europe’s monetary infrastructure while political negotiations continue over the digital euro’s final regulatory framework.

The post Bank of Italy Chief Warns Banks Must Tokenize Money to Compete with Stablecoins appeared first on Cryptonews.

Markets convulsed after President Donald Trump threatened steep tariffs on eight European nations unless Denmark cedes Greenland, with rhetoric including hints the U.S. might seize the territory by force, triggering a global risk-off move on January 20.

Gold surged to record highs while Bitcoin plunged into the low-$90K range, with some intraday trades dipping as low as $87K.

The crypto market shed nearly $150 billion in market capitalization as leveraged positions unwound violently, exposing Bitcoin’s continued treatment as a speculative asset rather than the safe haven its proponents claim it to be.

Trump’s Saturday announcement targeted Germany, France, the UK, the Netherlands, Finland, Sweden, Norway, and Denmark with 10% tariffs starting February 1, escalating to 25% by June 1, unless a Greenland deal is reached.

ING economists warned that “additional tariffs of 25% would probably shave 0.2 percentage points off European GDP growth,” compounding recession fears already gripping the continent.

The tariff threat effectively reopened the trade war between the EU and the U.S., despite a temporary truce reached in late July, raising the stakes and bringing a far tougher approach.

European officials brought forward the option of activating the so-called anti-coercion instrument, the EU’s trade “bazooka“, allowing the bloc to impose tariffs and investment limits on offending nations.

French President Emmanuel Macron announced he would request the instrument’s activation, while Manfred Weber from the European Parliament’s largest party indicated the July deal was now “on ice.”

EU capitals is considering hitting U.S. with €93 billion worth of tariffs or restricting American companies from bloc’s market in response to President Donald Trump’s threats, per FT. pic.twitter.com/VuAefTw5yt

— Open Source Intel (@Osint613) January 18, 2026

European countries hold approximately $8 trillion in U.S. bonds and stocks, making Europe by far the largest U.S. lender and exposing the deep interdependence that could turn this standoff into a full-blown crisis.

Germany’s export-reliant economy faces particularly acute pressure, with ING economist Carsten Brzeski warning the new tariffs would be “absolute poison” for the fragile recovery underway.

German exports to the United States fell 9.4% from January to November compared with a year earlier, and the trade surplus dropped to its lowest level since 2021.

Meanwhile, gold’s parabolic rally pushed prices past $4,800 per ounce to all-time highs.

TD Securities’ Daniel Ghali told Bloomberg that “gold’s rally is about trust. For now, trust has bent, but hasn’t broken. If it breaks, momentum will persist for longer.“

Bitcoin’s collapse alongside traditional risk assets exposed the crypto’s failure to serve as a geopolitical hedge, despite years of positioning as “digital gold.”

CoinGlass liquidation data revealed $998.33 million in long positions wiped out over 24 hours, with Bitcoin accounting for $440.19 million as cascading margin calls accelerated during thin Asian trading hours.

Galaxy Digital’s Alex Thorn noted that “Bitcoin isn’t quite doing the thing that it’s built to do, at least in real time,” while Bitunix analyst Dean Chen observed that “among crypto-native investors, it is increasingly framed as a geopolitical hedge and a non-sovereign store of value.”

“However, for the broader market, Bitcoin is still largely traded as a high-beta risk asset,” he concluded.

Derivatives markets paint an increasingly bearish picture for the months ahead.

Sean Dawson of Derive.xyz warned that “rising geopolitical tensions between the US and Europe—particularly around Greenland—raise the risk of a regime shift back into a higher-volatility environment, a dynamic not currently reflected in spot prices.”

Options data shows strong put open interest concentrated across the $75K-$85K strikes for the June 26 expiry, with Dawson noting that “from an options perspective, the outlook remains mildly bearish through mid-year. Traders are paying a premium for downside protection.“

Bloomberg Intelligence strategist Mike McGlone delivered an even more dire assessment, warning that Bitcoin’s inability to hold long-term averages in 2025 suggests the price could eventually drop as low as $10,000.

Duke University’s Campbell Harvey also claimed in academic research that Bitcoin “is hardly a safe-haven asset,” noting its correlation with gold has broken down completely.

Despite the bearish technical picture, not all analysts have turned pessimistic.

MEXC data showed that on January 16 alone, Bitcoin ETFs added 1,474 BTC, accounting for $1.48 billion in weekly inflows, while 36,800 BTC left exchanges.

These are signs of strong institutional demand and tightening supply that could limit downside.

In fact, as Cryptonews noted recently, the chance of Trump turning back on the tariff decision is high, with 86%, and that would greatly benefit Bitcoin after February 1.

— Cryptonews.com (@cryptonews) January 19, 2026

Historical tariff patterns show 86% chance that Trump reverses Europe tariffs before February 1, as Bitcoin's 24/7 markets prepare to signal policy shifts first.#Trump #Tariffs #Europe #Bitcoinhttps://t.co/eGxEedfe06

Speaking with Cryptonews, Bitfinex analysts also noted that “Bitcoin spot volumes remain normal, funding rates are close to neutral, and there has been no spike in exchange inflows that would signal reactive selling,” suggesting the selloff reflects macro-linked noise rather than a crypto-specific catalyst.

For now, whether Bitcoin’s current consolidation represents capitulation or merely the calm before a deeper storm remains the central question facing crypto markets as February approaches.

The post Greenland Gambit Sparks Crypto Chaos: Tariff Threats Send Bitcoin Sliding – Analysts Eye $75K appeared first on Cryptonews.

Harriet Rees from Starling Bank and Dr Rohit Dhawan from Lloyds Banking Group will spearhead AI adoption.

The post UK Appoints AI Champions to Boost Financial Services appeared first on TechRepublic.

This sweeping update introduces measures to identify and potentially exclude "high-risk" third countries and companies across 18 essential sectors.

The post EU’s New Cybersecurity Act Could Ban High-Risk Suppliers appeared first on TechRepublic.

Harriet Rees from Starling Bank and Dr Rohit Dhawan from Lloyds Banking Group will spearhead AI adoption.

The post UK Appoints AI Champions to Boost Financial Services appeared first on TechRepublic.

This sweeping update introduces measures to identify and potentially exclude "high-risk" third countries and companies across 18 essential sectors.

The post EU’s New Cybersecurity Act Could Ban High-Risk Suppliers appeared first on TechRepublic.

Under the new rules, measures for 5G cybersecurity would become mandatory.

The post EU Plans Phase Out of High Risk Telecom Suppliers, in Proposals Seen as Targeting China appeared first on SecurityWeek.

National Cyber Security Centre says these ideologically motivated attackers are moving beyond simple website disruptions.

The post NCSC Warns of Increased Russian Hacktivist Threat to UK Online Services appeared first on TechRepublic.

National Cyber Security Centre says these ideologically motivated attackers are moving beyond simple website disruptions.

The post NCSC Warns of Increased Russian Hacktivist Threat to UK Online Services appeared first on TechRepublic.

President Donald Trump’s February 1 tariff deadline for eight European nations tied to Greenland has sparked a familiar trader fear: markets may shake out positions before suddenly reversing.

ChatGPT’s historical pattern analysis of comparable Trump tariff episodes suggests an 86% likelihood of some off-ramp (a pause, delay, exemption, or walkback) either before tariffs start or within roughly a week after.

This creates a high-stakes timing puzzle in which Bitcoin’s 24/7 price action may react to the outcome before traditional markets can.

The tariff announcement already wiped $875 million in crypto liquidations within 24 hours as Bitcoin slid 3% to $92,000, with 90% of forced closures hitting long positions across Hyperliquid, Bybit, and Binance.

Trump declared on Jan 17, 2026, 11:19 AM EST via Truth Social that Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland would face 10% tariffs starting February 1, escalating to 25% by June 1 “until a Deal is reached for the Complete and Total purchase of Greenland.“

— Cryptonews.com (@cryptonews) January 19, 2026

Trump's Europe tariff threats erase $875 million in crypto positions as Bitcoin falls 3% to $92,000 amid geopolitical market shock.#Trump #Europe #Tariffs #Bitcoinhttps://t.co/heRs8hxlkV

ChatGPT’s analysis of historical deadline-tariff episodes where Trump issued specific start dates for major trade actions reveals distinct reversal patterns.

When outcomes are grouped into reversal, softening, or no-easing categories, 86% of cases show some form of off-ramp materialized, either full cancellation, delays, exemptions, or partial walkbacks.

Breaking down the timeline further, there’s a 58% chance the off-ramp occurs before February 1 itself, combining a 29% probability of a full reversal before the start date with another 29% chance of softening measures such as delays or exemptions.

“The fact that this threat was on social media instead of distilled into an executive order and it has a delayed implementation means a lot of investors might just decide to wait things out before overreacting,” Brian Jacobsen, chief economic strategist at Annex Wealth Management, told Bloomberg.

The October 10 liquidation event preceding offers instructive parallels.

That episode saw brutal liquidations cascade through crypto markets during the pre-announcement phase as positioning built up, followed by sharp volatility swings between the announcement and implementation as traders attempted to front-run policy shifts.

After implementation, markets eventually stabilized once the actual tariff structure became clear, but not before major capital destruction during the uncertainty window.

While equities close overnight and on holidays, Bitcoin continues to print fear or relief in real time.

This 24/7 liquidity makes crypto markets the first responder to headline shifts, particularly during the key January 29–February 1 window, where any language pivot toward “pause,” “delay,” “talks,” “exemptions,” “framework,” or “deal” could ignite a violent relief rally with altcoins reacting even harder than Bitcoin.

In fact, speaking with Cryptonews, Farzam Ehsani, CEO of crypto exchange VALR, explains that growing fears of a U.S.-EU tariff standoff, combined with Trump’s aggressive trade rhetoric, pushed markets into renewed de-risking mode during thin weekend liquidity.

“Thin weekend liquidity and leverage fumes amplified the decline’s impact, turning the pullback into a flash drop of nearly $4,000 in less than two hours and a cascade of liquidated positions worth over $780 million,” Ehsani said.

“As capital rotated into established safe havens like gold, digital assets continued to trade as high-beta risk assets.“

The weakness extends beyond tariff fears into broader cryptocurrency-specific vulnerabilities.

While other risk assets, like the KOSPI, traded flat or higher amid US-EU trade-war concerns, cryptocurrencies continued to underperform, with only privacy coins standing out.

The final stretch before February 1 represents maximum drama for traders positioned either for a reversal or further downside.

If no off-ramp language emerges within the final 48-72 hours, markets may begin treating the threat as real, with Bitcoin pricing fear ahead of traditional assets.

European leaders are already unified in defiant opposition, which suggests a greater likelihood of a blink before the said date.

According to the BBC, UK Prime Minister Keir Starmer told Trump in a phone call that “applying tariffs on allies for pursuing the collective security of Nato allies is wrong,” while Swedish Prime Minister Ulf Kristersson stated, “We will not let ourselves be blackmailed.”

As Prime Minister, I will always act in the United Kingdom’s national interest. pic.twitter.com/ZkveFmD1R1

— Keir Starmer (@Keir_Starmer) January 19, 2026

French President Emmanuel Macron also called for activating the EU’s “trade bazooka,” an anti-coercion instrument designed to block US market access and impose sweeping restrictions on American goods.

Additionally, Germany’s Bundeswehr completed a reconnaissance mission in Greenland as part of NATO’s “Arctic Endurance” operation intended to strengthen the alliance’s footprint in the region.

Trump interpreted European military movements as hostile, writing that these countries “journeyed to Greenland, for purposes unknown” and placed “a level of risk in play that is not tenable or sustainable.“

Despite Bitcoin’s attempts to approach $100,000, monetary policy expectations offer little relief.

According to CME FedWatch tools, investors are pricing the first key rate cut only for June 2026, meaning tight financial conditions will persist.

“Clear signs of a reversal toward sustained growth are still lacking,” Ehsani said, adding that consolidation remains the baseline scenario for Bitcoin and most altcoins without new liquidity drivers.

For now, the trading playbook for the next 72 hours is binary.

Should the final two days before February 1 pass without conciliatory language from Washington, Bitcoin will likely lead the capitulation as markets price tariffs as credible rather than rhetorical.

Conversely, any headline indicating diplomatic retreat will trigger immediate repricing across crypto markets, with altcoins amplifying Bitcoin’s relief rally as leveraged positions scramble to reverse defensive positioning built during the selloff.

The post 86% Chance Trump Blinks on Tariffs, But Bitcoin Will Tell You First appeared first on Cryptonews.

The digital bank's free HMRC-recognised tax tool is unveiled ahead of Making Tax Digital changes.

The post Monzo Unleashes Tax Tool for UK Small Businesses appeared first on TechRepublic.

The digital bank's free HMRC-recognised tax tool is unveiled ahead of Making Tax Digital changes.

The post Monzo Unleashes Tax Tool for UK Small Businesses appeared first on TechRepublic.

Archaeologists recently found the wreck of an enormous medieval cargo ship lying on the seafloor off the Danish coast, and it reveals new details of medieval trade and life at sea.

Archaeologists discovered the shipwreck while surveying the seabed in preparation for a construction project for the city of Copenhagen, Denmark. It lay on its side, half-buried in the sand, 12 meters below the choppy surface of the Øresund, the straight that runs between Denmark and Sweden. By comparing the tree rings in the wreck’s wooden planks and timbers with rings from other, precisely dated tree samples, the archaeologists concluded that the ship had been built around 1410 CE.

Svaelget 2, as archaeologists dubbed the wreck (its original name is long since lost to history), was a type of merchant ship called a cog: a wide, flat-bottomed, high-sided ship with an open cargo hold and a square sail on a single mast. A bigger, heavier, more advanced version of the Viking knarrs of centuries past, the cog was the high-tech supertanker of its day. It was built to carry bulky commodities from ports in the Netherlands, north around the coast of Denmark, and then south through the Øresund to trading ports on the Baltic Sea—but this one didn’t quite make it.

© VollwertBIT

TikTok, and other major platforms popular with young people, are coming under increasing pressure to better identify and remove accounts.

The post TikTok to Roll Out Stronger Age Verification Across the EU appeared first on TechRepublic.

To help rectify the situation, the mayor has unveiled plans for free AI skills training and a new taskforce aimed at protecting jobs in the capital.

The post London Mayor Urges Stronger Regulation as AI Threatens Workforce appeared first on TechRepublic.

TikTok, and other major platforms popular with young people, are coming under increasing pressure to better identify and remove accounts.

The post TikTok to Roll Out Stronger Age Verification Across the EU appeared first on TechRepublic.