Crypto market stabilizes as US Dollar Index tumbles ahead of FOMC decision

Gold climbed to a fresh all-time high, crossing $5,100 an ounce on Monday, extending its record-breaking run as investors seek shelter amid rising geopolitical tensions and global fiscal risks.

Spot gold prices gained 2.4%, trading at $5,102 an ounce, before paring gains to $5,086.

The surge comes days after President Donald Trump warned Canada that the U.S. would impose a 100% tariff on goods sold in the U.S. if the country strikes a trade deal with China. “If Canada makes a deal with China, it will immediately be hit with a 100% Tariff against all Canadian goods and products coming into the U.S.A.,” Trump wrote in a Truth Social post.

However, Ethereum is moving in the opposite direction, trading at $2,877.15 with a 24-hour trading volume of $24.69 billion. The token now sits 36% below its $4,953.73 peak.

The “Gold versus ETH: Which hits $5K first?” market on Myriad has reached a resolution, with gold hitting the $5k mark first. The precious metal jumped 7.28% on the week and was recently priced at $4,938 before Monday’s breakout.

While gold is typically compared to Bitcoin, predictors on Myriad favored ETH for months, betting on its volatile upward mobility, but they’ve become less confident as crypto markets slide. The prediction market opened in October 2025.

Western ETF holdings have climbed by about 500 tonnes since the start of 2025. Goldman Sachs lifted its December 2026 gold price forecast to $5,400 an ounce, up from $4,900, arguing that hedges against global macro and policy risks have become “sticky.”

Central bank purchases remain robust as Goldman estimates central-bank purchases are averaging around 60 tonnes a month, far above the pre-2022 average of 17 tonnes.

“While this rally in gold has not, and will not, be linear, we believe the trends driving this rebasing higher in gold prices are not exhausted,” Natasha Kaneva, head of Global Commodities Strategy at J.P. Morgan, stated. “The long-term trend of official reserve and investor diversification into gold has further to run.”

Ethereum saw $630 million in outflows last week, reflecting bearish sentiment as investors withdraw funds. A whale that had been dormant for nine years transferred 50,000 ETH, worth $145 million, to a Gemini wallet, a move often associated with liquidation intent.

According to @EmberCN monitoring, a dormant 9-year ETH whale address activated in the last 12 hours, transferring 50,000 ETH (worth $145 million) to Gemini exchange. The address withdrew 135,000 ETH ($12.17 million) from Bitfinex 9 years ago when ETH was priced ~$90, representing… pic.twitter.com/akGYWcKoVC

— Wu Blockchain (@WuBlockchain) January 26, 2026

The precious metal’s surge comes as flashpoints from Greenland and Venezuela to the Middle East reflect higher geopolitical risk. Trump’s tariff threat follows tensions that mounted after Canadian Prime Minister Mark Carney delivered an address at the World Economic Forum in Davos that was widely seen as a rebuke of the Trump administration’s policies.

Earlier this month, Carney announced that Canada and China reached a preliminary deal to remove trade barriers. Under the tentative agreement, Beijing cut tariffs on some Canadian agricultural products, while Ottawa increased quotas for imports of Chinese electric vehicles.

Canadian Prime Minister Mark Carney said on Sunday that Ottawa has no plans to pursue a free trade deal with China, noting that the recent agreement only reduces tariffs on select sectors. Carney’s remarks came a day after President Trump threatened a 100% tariff on Canadian goods.

The gold-crypto divergence indicates a broader risk recalibration. Following a record-breaking 2025, gold entered 2026 with momentum intact as geopolitical tensions, falling real interest rates, and efforts by investors and central banks to diversify away from the dollar reinforce its safe-haven role.

ETH failed to reclaim its “digital gold” narrative during peak macro stress. Analysts note that if ETH maintains support around the $2,500 level, it could reach an all-time high of $6,000 by 2026, but that thesis requires risk appetite to return. In August 2025, Trump raised the tariff on Canadian goods to 35%. A 100% tariff threat marks a major escalation.

Markets are pricing in two interest-rate cuts by the Federal Reserve later this year. Traders await this week’s FOMC meeting, where the central bank is widely expected to hold rates steady.

The post Gold Smashes $5,100 Record as Trump Tariff Threat Looms; ETH Slides Under $2,900 appeared first on Cryptonews.

Bitmines Ethereum holdings climbed to 4.2 million ETH as the firm accelerates staking and its push toward becoming a leading ETH validator.

The post Tom Lee’s Bitmine scoops 40,302 Ethereum as total staked exceeds 2 million ETH appeared first on Crypto Briefing.

Ethereum remains under pressure in a key support zone, teetering between a potential rebound and further decline. While bullish patterns like the cup-and-handle and ascending triangle are shaping up, confirmation is required before any decisive move.

Kamile Uray shared that Ethereum is currently trying to hold above the critical support zone between $2,775 and $2,623. This area has become a key battleground for bulls and bears, with buyers attempting to defend it to prevent further downside. If this support continues to hold, ETH could regain short-term stability and make another attempt to move higher.

On the upside, a sustained bounce from this zone could allow Ethereum to revisit the pink box resistance around the $3,445 level. A clean breakout above this resistance would activate bullish structures such as a cup-and-handle or an ascending triangle, signaling growing bullish momentum and opening the path toward the $3,894 level. However, this becomes possible if ETH manages to close above the $3,661 peak, confirming the formation of the first major high.

The $3,894 level carries technical significance, as it represents the 0.618 Fibonacci retracement of the most recent downward wave. A decisive close above this level would suggest continuation of the recovery. Failure to hold above it, however, could trigger renewed selling pressure and lead to another corrective move lower.

On the downside, if Ethereum loses the $2,623 support, a deeper decline toward the pink box zone between $2,274 and $2,104 would become likely. This area is notable for the potential formation of a bullish Libra pattern. Should reversal confirmation emerge from this zone, ETH could attempt another recovery phase, with the broader objective of retesting its previous highs.

Ethereum is currently following the trajectory outlined by Crypto Candy in a recent update on X. As predicted, the asset dipped into the lower support range between $2,600 and $2,700 and is now attempting to stage a recovery from the zone. Should this upward momentum persist, the immediate objective for bulls is a return to the $3,070 level.

However, for Ethereum to firmly re-enter bullish territory and shift the broader market structure, it must close decisively above the $3,070 threshold. This level serves as the primary gateway for any sustained recovery beyond the current relief rally. Until that breakout occurs, the prevailing market bias remains firmly bearish, as the failure to reclaim and hold above $3,070 suggests that the path of least resistance is still to the downside, with lower price points remaining the primary expectation for the short term.

BitMine Immersion Technologies, a New York–listed company chaired by Fundstrat’s Tom Lee, has quietly built one of the largest concentrated positions in Ethereum ever disclosed by a single entity.

In an update published on January 26, BitMine said it now holds 4,243,338 ether, giving the company control of roughly 3.52% of Ethereum’s total circulating supply.

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) January 26, 2026

BitMine provided its latest holdings update for January 26th, 2026:

$12.8 billion in total crypto + "moonshots":

– 4,243,338 ETH at $2,839 (@coinbase)

– 193 Bitcoin (BTC)

– $200 mllion stake in Beast Industries @MrBeast

– $19 million stake in Eightco Holdings (NASDAQ: $ORBS)…

At the time of disclosure, the position was valued at roughly $12 billion, making BitMine the largest Ethereum treasury in the world and the second-largest crypto treasury overall, behind Strategy Inc., formerly Strategy, which holds more than 700,000 bitcoin.

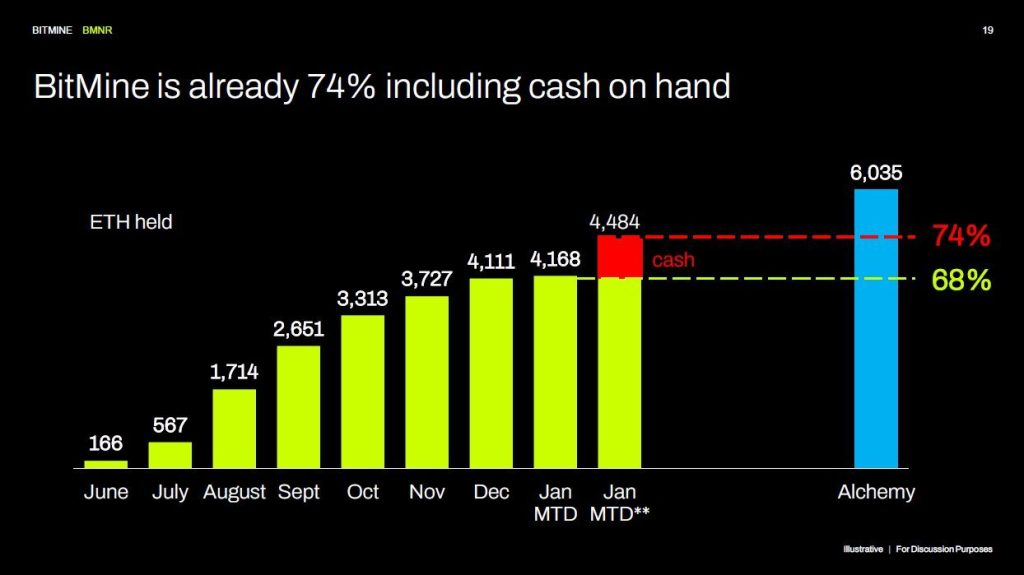

The disclosure shows how quickly BitMine’s balance sheet has expanded over the past six months.

Weekly purchase data shared by the company indicates steady accumulation since late October, 2025, with particularly large buying activity in December.

In the week ending January 26 alone, BitMine added just over 40,000 ETH, following purchases of more than 35,000 ETH the prior week and several six-figure ETH buys in December.

Last week the company bought the dip, purchasing $110M worth of Ethereum.

— Cryptonews.com (@cryptonews) January 21, 2026

BitMine @BitMNR now controls 3.48% of Ethereum’s total supply after adding $110M in $ETH during the dip, moving closer to its “Alchemy of 5%” goal.#Ethereum #BitMinehttps://t.co/W74cW2b8XH

The pace of accumulation has continued even as ether prices softened, with ETH down double digits over the past month amid broader market volatility.

Ethereum is currently trading at $2,940.44, showing a 2.0% increase over the past hour, which suggests short-term buying pressure returning to the market.

On a 24-hour basis, ETH is up a modest 0.4%, indicating relatively stable price action despite broader market fluctuations.

However, over the past seven days, Ethereum has declined by 8.4%, reaching as low as $2,787.

BitMine’s total crypto, cash, and equity holdings now stand at $12.8 billion, according to the company.

In addition to its Ethereum position, the firm holds 193 bitcoin, $682 million in cash, a $200 million stake in Beast Industries, and a smaller equity position in Eightco Holdings.

The company trades on the NYSE American under the ticker BMNR and was last priced around $28.50, down modestly on the day and slightly lower over the past week.

The Ethereum accumulation is central to BitMine’s stated long-term strategy, as it has publicly set a goal of acquiring 5% of Ethereum’s total supply, a target it refers to as the “alchemy of 5%.”

Based on current supply estimates, reaching that level would require roughly 6 million ETH.

At current market prices, closing that gap would require several billion dollars in additional capital.

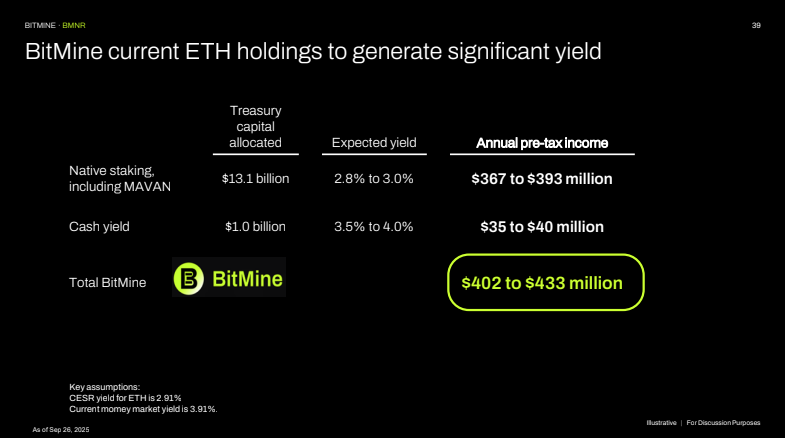

Beyond holding ether on its balance sheet, BitMine is also expanding its staking operations. As of January 25, the company had staked 2,009,267 ETH, worth about $5.7 billion, representing nearly half of its total holdings.

Using the composite Ethereum staking rate of roughly 2.81%, BitMine estimates that a fully deployed staking strategy could generate about $374 million in annual fees, or more than $1 million per day.

For now, the company relies on external staking providers, but it plans to launch its infrastructure, known as the Made in America Validator Network, or MAVAN, in early 2026.

— Cryptonews.com (@cryptonews) December 30, 2025

BitMine @BitMNR plans an early-2026 launch of its MAVAN validator network, aiming to turn a $12B Ether treasury into staking yield at scale.#BitMine #Staking https://t.co/YOlkeNouQu

Chairman Tom Lee has framed the Ethereum strategy as a long-term bet on institutional adoption of blockchain technology.

Speaking after last week’s World Economic Forum meeting in Davos, Lee said discussions among policymakers and business leaders increasingly point to the convergence of traditional finance, crypto, and artificial intelligence.

He pointed to Ethereum’s role in tokenization and financial infrastructure projects as evidence that Wall Street is already building on the network.

The post Tom Lee’s BitMine Corners 3.5% of Ethereum Supply as Treasury Tops With 4.24M ETH Buy appeared first on Cryptonews.

The crypto market is down today again. The cryptocurrency market capitalisation decreased by 0.8% over the past 24 hours, now standing at $3.05 trillion. At the time of writing, 93 of the top 100 coins recorded price drops. The total crypto trading volume stands at $139 billion.

We started the new week very much in the red. As of Monday morning (UTC), all top 10 coins per market capitalisation have posted price drops over the past 24 hours.

Bitcoin (BTC) fell by 0.7%, currently trading at $87,860. This is the smallest drop on the list,

Ethereum (ETH) decreased by 1.5%, changing hands at $2,892.

The highest fall among the top 10 is Solana (SOL)’s 3.3% to the price of $122.

It’s followed by Dogecoin (DOGE)’s drop of 1.6%, now trading at $0.1213.

At the same time, Tron (TRX) fell the least: 0.4% to $0.2953.

Moreover, of the top 100 coins per market cap, 93 have seen their price drop today.

MYX Finance (MYX) fell the most. It’s down 14%, now trading at $5.86.

Monero (XMR) follows, with a decrease of 5.4%, currently standing at $466.

Of the green coins, River (RIVER) stands at the top, having jumped by 43% to the price of $84.7.

The next on the list is Algorand (ALGO), which saw an increase of 2.3% to $0.1189.

The rest are up 1.3% and less per coin.

Macro uncertainty triggered over $550 million in crypto liquidations as BTC and ETH came under pressure.

QCP analysis notes that crypto assets traded in a narrow range over the weekend before coming under pressure in early Asian hours, triggering over $550 million in leveraged long liquidations. BTC briefly tested $86K before finding support, while Ethereum fell to the $2,785 area.…

— Wu Blockchain (@WuBlockchain) January 26, 2026

Meanwhile, the UK’s Financial Conduct Authority (FCA) moved into the final stage of consultations on a set of proposed crypto regulations. The FCA said it is seeking feedback on 10 proposed rules, describing this as the “final step” in the consultation process.

“These proposals continue our progress towards an open, sustainable and competitive crypto market that people can trust,” the regulator said.

— Ryan (King) Solomon (@IOV_OWL) January 23, 2026

BREAKING: The UK Just Moved to Fully Integrate Crypto Firms Into the FCA Rulebook pic.twitter.com/mGBJ61hLLB

Gadi Chait, Investment Manager at Xapo Bank, commented that recent weakness in Bitcoin follows a brief recovery last week, “set against a backdrop of macroeconomic developments that have influenced risk assets broadly.”

A convergence of factors drives volatility across markets. These include heightened geopolitical tensions and ongoing conflicts. Renewed focus on US strategic positioning toward Greenland and Donald Trump’s address at Davos “added to an already unsettled global environment.”

Regulatory uncertainty, especially in the US, and macroeconomic pressures add to this. “Central bank policy divergence, including expectations around further tightening by the Bank of Japan and the continued reduction of liquidity by the US Federal Reserve, continues to shape market behaviour.”

Chait says that, “amid this uncertainty, traditional commodities have rallied, while Bitcoin has underperformed. The reasons for this divergence are not yet clear, though such sequencing across asset classes is not without precedent.”

“It remains possible that Bitcoin’s response emerges later, particularly as volatility subsides. For long-term participants, however, short- to medium-term price fluctuations remain a familiar feature rather than a signal of impaired fundamentals,” Chait concluded.

Moreover, Petr Kozyakov, Co-Founder and CEO at Mercuryo, argued that as a speculative asset, BTC has come under sustained selling pressure, and altcoins have followed suit.

“While the fortunes of the digital asset space will always be viewed through a lens fixated on token prices, the bigger picture is one of continued stablecoin adoption and the steady development of payment infrastructure,” he says.

He continues: “The evolution of the digital token space is being driven by merger and acquisition activity, alongside the inherent efficiencies of blockchain-based technology and its ability to operate around the clock, at speed and at lower cost.”

“This reality is increasingly unavoidable for financial institutions still reliant on technology that dates back to the 1960s. Away from daily price movements, a quiet revolution is most definitely afoot,” Kozyakov concluded.

At the time of writing on Monday morning, BTC was changing hands at $87,860. While the coin begun the day at the intraday high of $88,800, it relatively swiftly dropped to the low of $86,126. It has recovered somewhat since.

Over the past seven days, BTC decreased by 5.1%, trading in the $86,319–$93,252 range. It’s now 30% away from its all-time high of $126,080.

Failing to hold the current level risks additional pullbacks towards the $85,000 level, followed by $84,300 and $83,800.

At the same time, Ethereum was trading at $2,892. Earlier in the day, it traded at the intraday high level of $2,941. However, it then plunged to the intraday low of $2,787. It managed to shift course and move higher following this drop.

In a week, ETH fell 9.2%, moving between $2,801 and $3,222. Moreover, it decreased 41% from its ATH of $4,946.

Currently, the price risks a fall toward $2,670 and $2,520 in the near term.

Additionally, according to Bloomberg Intelligence Senior Commodity Strategist Mike McGlone, it is more likely that ETH will revisit the $2,000 level than push upwards and above $4,000.

ETH has been stuck in the $2,000–$4,000 range since 2023. However, it is leaning toward the lower end of this range.

Ether appears to be heading toward the lower end of its $2,000-$4,000 range since 2023. I see greater risks of it staying below $2,000 than above $4,000, especially when stock market volatility rebounds. pic.twitter.com/1IAMV10Jwe

— Mike McGlone (@mikemcglone11) January 25, 2026

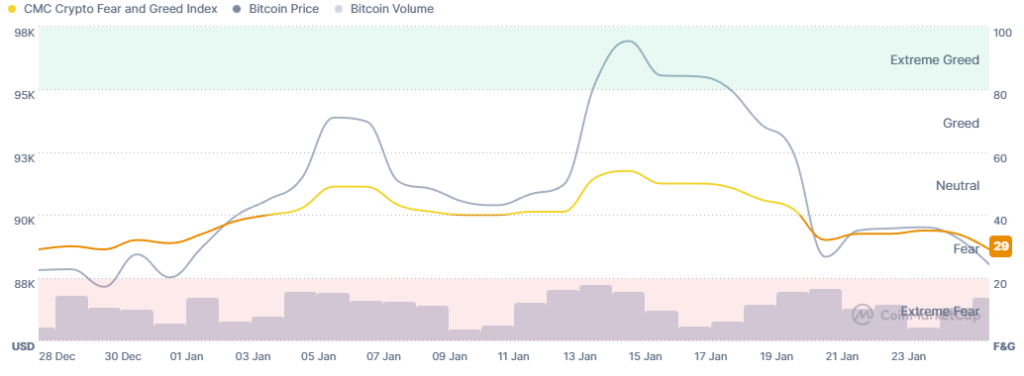

Meanwhile, the crypto market sentiment exited the neutral zone a week ago, and it has continued falling lower within the fear zone since.

The crypto fear and greed index decreased further over the weekend, currently standing at 29, compared to 34 seen over the weekend.

Unsurprisingly, given the market conditions, the sentiment reflects the overall worry and caution. It is now possible that the metric will drop further.

The US BTC spot exchange-traded funds (ETFs) posted another day of outflows on Friday, totalling $103.57 million. This is the fifth consecutive day of negative flows.

The total net inflow has pulled back yet again and now stands at $56.49 billion.

Of the twelve ETFs, two recorded outflows, and none saw inflows. BlackRock let go of $101.62 million, and Fidelity followed with $1.95 million in outflows.

Moreover, the US ETH ETFs posted outflows as well on 22 January, with $41.74 million – a similar level as the day earlier. With this fourth consecutive red day, the total net inflow now stands at $12.3 billion.

Of the nine funds, two ETH ETFs posted outflows, and two saw inflows. BlackRock recorded $44.49 million in outflows, followed by Grayscale’s $10.8 million.

At the same time, Grayscale Mini Trust took in 9.16 million, followed by Fidelity’s $4.4 million in inflows.

Meanwhile, Japan’s Financial Services Agency is reportedly planning to add cryptocurrencies to the list of assets eligible for spot ETF products.

Japan would likely approve its first set of spot crypto ETFs as early as 2028, ending the agency’s ban on spot crypto ETFs.

— Cryptonews.com (@cryptonews) January 26, 2026

Japan’s Nomura Holdings and SBI Holdings are developing the first crypto ETF products, awaiting approval for listing on the Tokyo Stock Exchange. #JapanCryptoETF #NomuraHoldings #SBIHoldingshttps://t.co/zT14u2QbqK

The crypto market has seen yet another drop over the past day. Meanwhile, the US stock market closed the week with a mixed picture. That said, it also posted a second consecutive red week. By the closing time on Friday, 23 January, the S&P 500 was up 0.033%, the Nasdaq-100 increased by 0.34%, and the Dow Jones Industrial Average fell by 0.58%. Due to high volatility, investors are shifting their money into safe-haven assets, particularly gold.

For now, the drops may continue in the near- to mid-term, pushed by macroeconomic developments. Occasional smaller and brief jumps are expected, intersecting the current trend.

The post Why Is Crypto Down Today? – January 26, 2026 appeared first on Cryptonews.

BlackRock’s Rick Rieder may replace Jerome Powell as Fed Chair. He’s a huge Bitcoin bull. Here’s why crypto holders should pay attention.

Ethereum whale deposits 50,000 ETH into Gemini after 9 years, signaling strategic profit-taking amid market weakness.

The post Ethereum OG whale wakes up after nine years, deposits 50K ETH into Gemini appeared first on Crypto Briefing.

Ethereum co-founder Vitalik Buterin has publicly walked back a position he held for nearly a decade, showing Ethereum’s renewed stance about self-sovereignty, verification, and the future role of cryptography.

In a recent post on X, Buterin said he no longer agrees with a 2017 statement in which he dismissed the idea of users fully validating blockchains themselves as a “weird mountain man fantasy,” arguing that both technology and real-world experience have reshaped his view.

The idea of average users personally validating the entire history of the system is a weird mountain man fantasy. There, I said it.

— vitalik.eth (@VitalikButerin) June 9, 2017

The comment revisits a long-running debate in blockchain design that dates back to Ethereum’s early years.

In 2017, Buterin sparred publicly with blockchain theorist Ian Grigg over whether blockchains should store full state, such as account balances and smart contract data, directly on-chain.

Grigg argued that chains only needed to record transaction ordering, with state reconstructed locally and discarded.

Buterin was a vehement opponent of such a design at the time, citing that such a design would require users to constantly rerun the whole transaction history or utilize third-party RPC services to get the current state.

At the time, Buterin claimed that Ethereum was better compromised with the design where state roots are pegged to block headers.

Using Merkle proofs and an honest majority assumption for proof-of-work or proof-of-stake, users would be able to check a certain value without going through a single intermediary.

— Cryptonews.com (@cryptonews) February 19, 2024

Vitalik Buterin: Verkle Trees Implementation to Benefit Ethereum Stakers and Network Nodes

Ethereum co-founder @VitalikButerin has highlighted the advantages of implementing Verkle Trees within Ethereum’s staking protocol.#CryptoNews #newshttps://t.co/Ep7l0NaPr9

Making the entire chain completely self-validating, he said, was in theory attractive but computationally impractical to ordinary users, unless the network grossly constrained its capacity.

The difference, as explained by Buterin, is the maturation of zero-knowledge cryptography, specifically zk-SNARKs.

These cryptographic evidences enable a user to prove that a group of calculations has been done right without re-running all the processes or showing the data behind the scenes.

To him, it is like finding an inexpensive, one-size-fits-all solution after years of trade-off disputes. He claimed that with zk-SNARKs, Ethereum could obtain the security of full verification without necessarily subjecting users to prohibitive costs.

I no longer agree with this previous tweet of mine – since 2017, I have become a much more willing connoisseur of mountains. It's worth explaining why.https://t.co/SRvRtuFKQu

— vitalik.eth (@VitalikButerin) January 26, 2026

First, the original context. That tweet was in a debate with Ian Grigg, who argued that blockchains…

Buterin said this advance allows Ethereum to revisit trade-offs that were once accepted reluctantly, especially around scalability, decentralization, and verification. He also acknowledged that his earlier thinking relied too heavily on idealized assumptions.

In practice, he noted, networks experience outages, latency spikes, service shutdowns, and regulatory or social pressure that can push intermediaries to censor applications or users. In those moments, reliance on third parties or developer intervention can become a single point of failure.

That perspective underpins his renewed support for what he described metaphorically as the “mountain man’s cabin,” a fallback option that allows users to directly interact with the chain when everything else breaks.

There has been a growing focus on Zk-SNARKs in the roadmap of Ethereum, especially in the form of zero-knowledge rollups.

These layer-2 networks reduce fees significantly by offloading thousands of transactions and making a single cryptographic proof to Ethereum.

Even projects like zkSync, StarkNet, Scroll, and others are already based on these methods, but with various trade-offs in the size of the proof, transparency, and the cost of calculation.

Mid-2025 community proposals stated that off-chain personal data and using cryptographic proofs might be a solution to align Ethereum with European rules on data protection.

— Cryptonews.com (@cryptonews) June 9, 2025

Ethereum community member Eugenio Reggianini has proposed a technical framework to align Ethereum with EU GDPR rules.#eth #eu #ethereumhttps://t.co/zDmQpFh647

ZK-SNARKs were mentioned as a method of enabling validators to verify that data is correct without access to it, minimizing on-chain access.

On the protocol layer, Buterin has additionally admitted that there are certain remnants of legacy design that now pose a bottleneck to Ethereum’s ambitions to go zero-knowledge.

In late 2025, he proposed removing the modular exponentiation precompile, a feature he originally introduced, after it proved to be a major bottleneck for generating zk proofs.

The post Ethereum Founder Vitalik Buterin Reverses Stance: Why ZK-SNARKs Are Now Ethereum’s ‘Magic Pill’ appeared first on Cryptonews.

Ethereum is more likely to revisit the $2,000 level than stage a decisive move back above $4,000, according to Bloomberg Intelligence Senior Commodity Strategist Mike McGlone.

Key Takeaways:

In a recent post on X, McGlone pointed to persistent range-bound trading and rising macro risks weighing on the asset.

He said Ether has remained trapped in a $2,000–$4,000 range since 2023, but momentum appears to be shifting toward the lower end.

McGlone argued that the risks of Ethereum staying below $2,000 are greater than the chances of a sustained breakout above $4,000, especially if volatility in global equity markets rebounds.

His accompanying chart highlights repeated failures near the upper boundary of the range, alongside multiple tests of support closer to $2,000.

McGlone’s view contrasts with a more optimistic narrative circulating among crypto-focused analysts.

BullifyX, a widely followed market commentator, recently compared Ethereum’s long-term price structure to that of gold.

According to BullifyX, Ethereum is undergoing an extended accumulation phase characterized by gradual higher lows and compressed price action, a pattern that historically preceded strong rallies in traditional safe-haven assets.

Every time I look at the #Ethereum chart, it mirrors #GOLD a little too perfectly.

— BullifyX (@Bullify_X) January 25, 2026

Long accumulation. Relentless structure. Explosive moves after patience is rewarded.

That’s not weakness that’s strength building quietly.

Once you see it, you can’t unsee it.$ETH isn’t… pic.twitter.com/G9ndiXsQVO

The analyst described Ethereum’s current behavior as a period of quiet positioning rather than fading demand, suggesting that prolonged consolidation could ultimately lay the groundwork for a sharp upside move once conditions shift.

Meanwhile, Ethereum co-founder Vitalik Buterin has framed 2026 as more than a technical milestone.

In a recent post, he said the community is entering a phase focused on restoring personal autonomy and improving user experience, arguing that earlier compromises made in pursuit of adoption no longer need to define the network’s future.

“2026 is the year that we take back lost ground in terms of self-sovereignty and trustlessness,” Buterin said in an X post.

Together, record activity, falling fees, and rising participation suggest Ethereum is entering a new phase, one where scale no longer comes at the expense of accessibility.

As reported, the Ethereum Foundation has elevated post-quantum security to a core strategic focus, forming a dedicated Post Quantum team and committing $2 million to the effort.

Announced by Ethereum researcher Justin Drake, the initiative will be led by Thomas Coratger alongside Emile, a contributor to leanVM.

Drake said the foundation has been working on quantum-resilience research quietly for years, dating back to early discussions in 2019, before formally making it a top-level priority.

The foundation’s plan spans research, development, and ecosystem coordination.

This includes new developer calls focused on user-facing security, two $1 million cryptography prize programs, active multi-client post-quantum testing networks, and a series of global workshops aimed at accelerating collaboration and readiness across the Ethereum ecosystem.

The post ETH More Likely to Hit $2,000 Than Reclaim $4,000: Analyst appeared first on Cryptonews.

The cryptocurrency market faced a sharp correction in the early hours of January 26, with BTC erasing its entire monthly progress. After peaking at $97,000 on January 14, Bitcoin slid approximately 10.9% to briefly dip below the $87,000 mark. This volatility has pushed the January return to -0.5%, reflecting a broader “risk-off” sentiment across the digital asset space. The pullback is being attributed largely to rising uncertainty around U.S. government shutdown, alongside broader risk-off sentiment across global markets.The GameFi sector bore the brunt of the sell-off, dropping nearly 5%, led by double-digit losses in Axie Infinity (AXS). While Ethereum fell below $2,900, some assets showed resilience; notably, River (RIVER) surged 30% and Beam (BEAM) rose 19%, suggesting that despite the macro-level decline, specific project catalysts continue to drive isolated pockets of growth.

But what else is happening in crypto news today? Follow our up-to-date live coverage below.

The post [LIVE] Crypto News Today: Latest Updates for Jan. 26, 2026 – BTC Slumps 11% From Monthly High Below $87K Amid Market Wide Slump appeared first on Cryptonews.

XRP price extended losses and traded below $1.880. The price is now consolidating and might decline further if it remains below $1.920.

XRP price failed to stay above $1.950 and started a fresh decline, like Bitcoin and Ethereum. The price declined below $1.920 and $1.90 to enter a short-term bearish zone.

The price even spiked below $1.850. A low was formed at $1.810, and the price is now consolidating losses. There was a recovery wave above $1.850. The price cleared the 23.6% Fib retracement level of the downward move from the $1.963 swing high to the $1.810 low, but the bears remained active.

The price is now trading below $1.90 and the 100-hourly Simple Moving Average. If there is a fresh upward move, the price might face resistance near the $1.8850 level and the 50% Fib retracement level of the downward move from the $1.963 swing high to the $1.810 low. There is also a key bearish trend line forming with resistance at $1.885 on the hourly chart of the XRP/USD pair.

The first major resistance is near the $1.90 level. A close above $1.90 could send the price to $1.950. The next hurdle sits at $2.00. A clear move above the $2.00 resistance might send the price toward the $2.050 resistance. Any more gains might send the price toward the $2.120 resistance. The next major hurdle for the bulls might be near $2.20.

If XRP fails to clear the $1.90 resistance zone, it could start a fresh decline. Initial support on the downside is near the $1.840 level. The next major support is near the $1.820 level.

If there is a downside break and a close below the $1.820 level, the price might continue to decline toward $1.780. The next major support sits near the $1.750 zone, below which the price could continue lower toward $1.70.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now near the 50 level.

Major Support Levels – $1.840 and $1.820.

Major Resistance Levels – $1.8850 and $1.90.

Ethereum price extended losses and traded below the $2,865 zone. ETH is now consolidating losses and might aim for a recovery if it clears $2,920.

Ethereum price failed to remain stable above $2,950 and extended losses, like Bitcoin. ETH price declined below $2,880 and $2,865 to enter a bearish zone.

The bears even pushed the price below $2,840. The price finally tested $2,800 and is currently consolidating losses. There was a minor upside above the 23.6% Fib retracement level of the downward wave from the $3,067 swing high to the $2,784 swing low.

Ethereum price is now trading below $2,900 and the 100-hourly Simple Moving Average. If the bulls can protect more losses below $2,800, the price could attempt another increase.

Immediate resistance is seen near the $2,920 level. There is also a bearish trend line forming with resistance at $2,920 on the hourly chart of ETH/USD. The first key resistance is near the $2,960 level or the 61.8% Fib retracement level of the downward wave from the $3,067 swing high to the $2,784 swing low. The next major resistance is near the $3,000 level. A clear move above the $3,000 resistance might send the price toward the $3,065 resistance.

An upside break above the $3,065 region might call for more gains in the coming days. In the stated case, Ether could rise toward the $3,120 resistance zone or even $3,150 in the near term.

If Ethereum fails to clear the $2,920 resistance, it could start a fresh decline. Initial support on the downside is near the $2,840 level. The first major support sits near the $2,800 zone.

A clear move below the $2,800 support might push the price toward the $2,780 support. Any more losses might send the price toward the $2,720 region. The main support could be $2,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $2,800

Major Resistance Level – $2,920

Reports say the Ethereum Foundation has started a new team to prepare the network for possible quantum computer attacks. These machines could one day break the math behind wallets and signatures. The team’s work is moving from research into practical tests and experiments, which has drawn attention across the crypto community.

Based on reports, Thomas Coratger will lead the effort. The team includes cryptographers and engineers already testing new systems on devnets. Some work ties into a project called leanVM and a researcher named Emile, who focuses on building simple quantum-safe tools. The goal is to test new algorithms in real software while keeping current transactions running smoothly.

Today marks an inflection in the Ethereum Foundation’s long-term quantum strategy.

We’ve formed a new Post Quantum (PQ) team, led by the brilliant Thomas Coratger (@tcoratger). Joining him is Emile, one of the world-class talents behind leanVM. leanVM is the cryptographic…

— Justin Drake (@drakefjustin) January 23, 2026

A $1 million prize has been set for improvements to the Poseidon hash function. Another $1 million prize supports broader post-quantum research. In total, roughly $2 million are being offered to labs and independent developers to design and test quantum-resistant solutions. Reports say this funding is meant to speed up work and show what can realistically replace current signatures.

Multi-client devnets are already active. Developers are experimenting with new signature types to see what works and what fails. Biweekly sessions led by researchers like Antonio Sanso let teams share results and update code. A Post-Quantum Day is scheduled for March 2026 before ETHCC, with a larger event planned in October 2026 to show progress and plan next steps.

Quantum computers could, in theory, break the ECDSA and secp256k1 schemes used today. That risk is not immediate but serious enough that Ethereum is acting now. Reports note users should watch for official guidance, follow wallet updates, and avoid reusing addresses once upgrades roll out.

Community reaction has been mixed. Some online discussions praised the careful planning, while traders noticed a small dip in ETH price. Others questioned how upgrades would reach millions of wallets and what happens to old keys. The Foundation’s approach is to test solutions early so users and services are better protected when changes happen.

This step is part of Ethereum’s long-term plan for safety. Tests will continue, standards will be debated, and progress will be shared publicly. By acting now, Ethereum aims to reduce risk and make future transitions smoother for everyday users and the network as a whole.

Featured image from Unsplash, chart from TradingView

For most of the week, the Ethereum price has remained in a range-bound spell, putting in no significant movement outside of the $3,000 and $2,880 price boundaries. Amid rising speculations, an on-chain analysis has recently been put out, which provides an answer to the question.

In their latest QuickTake post on CryptoQuant, analytics platform Arab Chain reveals that there has been a fall in active Ethereum derivatives contracts across major exchanges, as indicated by data from the Ethereum: Open Interest-All Exchanges, All Symbol metric. Typically, rising Open Interest (OI) across exchanges indicates that more traders are entering leveraged positions. On the other hand, falling OI reflects more exits of leveraged positions, and by extension, reduced aversion to risk.

In the Quicktake post, Arab Chain highlights that open interest across exchanges has dipped to about $16.9 billion, marking the lowest level reached since mid-December last year. This, in turn, reflects an overall reduction in risk appetite across the Ethereum derivatives market. Because there is less speculative activity, there are also reduced risks of liquidations. Hence, the Ethereum price stands a higher chance of consolidating.

While exchanges in general are recording significant pull-outs from the derivatives market, Binance has shown an outlier performance. Arab Chain highlights that the world’s largest exchange by trading volume has instead recorded about $7.5 billion in Open Interest. Interestingly, this reading slightly exceeds the December average range of $6.8–$7.4 billion.

The divergence between the Open Interest values across all exchanges and that of Binance suggests that, while market participants are reducing their risk exposure, there is still liquidity in the derivatives market. Rather than a blatant exit, it has been repositioned toward the deeper and more liquid venue.

Arab Chain also explains that this behavior indicates a change in market operations from a higher-risk trading environment to one more price and risk efficient. In conclusion, the large traders are yet to make their exits but are merely reducing their exposure, while holding high-quality positions on Binance.

In addition, Ethereum’s proximity to the $3,000 price — especially as OI declines — shows that the market has been absorbing the deleveraging events while showing little selling pressure. Ultimately, Binance’s OI retaining levels above December’s support the idea that the market still has strong derivatives backing. Hence, the broader picture remains bullish. As of this writing, Ethereum trades at $2,958, reflecting a 0.33% growth since the past day, according to CoinMarketCap data.

Featured image from Pexels, chart from Tradingview.com

The Bitcoin Spot ETFs continue to witness a volatile start to 2026, with back-to-back weeks showing sharply contrasting performance. After netting a staggering $1.42 billion in weekly netflows on January 16, market momentum soon swung the opposite way in line with a Bitcoin decline, forcing a net outflow of $1.33 billion over the last week. A similar phenomenon was seen in the first two weeks of the year, after an initial net deposit of $458.77 million by January 2 was followed by a net outflow of $681.01 million by January 9. This investor behavior suggests a highly reactive market with little long-term confidence.

In analyzing the most recent wave of withdrawals in the Bitcoin Spot ETF market, data from SoSoValue shows that the fourth trading week of January recorded no single day with a positive netflow. The heaviest outflows totaled $708.71 million on January 21, followed by the smallest daily outflow of $32.11 million on January 22.

Looking at individual funds, BlackRock’s IBIT, the market leader, suffered the largest net outflows valued at $537.49 million. As usual, Fidelity’s FBTC ranks a close second with redemptions surpassing deposits by $451.50 million. Other Bitcoin Spot ETFs with heavy net outflows also included Grayscale’s GBTC, Bitwise’s BITB, and Ark Invest’s ARKB, which suffered losses estimated at $172.09 million, $66.25 million, and $76.19 million, respectively.

Meanwhile, VanEck’s HODL, Valkyrie’s BRRR, and Franklin Templeton’s EZBC also experienced net outflows between $6 million and $11 million. Notably, Grayscale’s BTC, Invesco’s BTCO, WisdomTree’s BTCW, and Hashdex’s DEFI recorded the least activity with zero netflows. At press time, total net assets for the Bitcoin Spot ETFs stand at $115.88 billion, with BlackRock’s IBIT accounting for over 54% of these holdings, as the undisputed market leader. Meanwhile, total cumulative net inflow is presently valued at $56.49 billion.

Related Reading: Monero, Zcash, And Dash Prohibited In India Amid Money-Laundering Crackdown

According to more data from SoSoValue, the Ethereum Spot ETFs also witnessed massive levels of redemptions in the last trading week, resulting in a net outflow of $611.17 million. Similar to its Bitcoin counterpart, the BlackRock ETHA also produced the largest net withdrawals valued at $431.50 million. Presently, the total net assets for the Ethereum Spot ETFs are valued at $17.70 billion, representing 4.99% of Ethereum’s market cap. Meanwhile, the cumulative total net inflow is valued at $12.30 billion.

Ethereum is trading in the $2,930–$2,950 range as of January 25, 2026, consolidating after a broader pullback from January highs above $3,400. The move lower reflects near-term macro caution and heavy ETF-related selling rather than a breakdown in network fundamentals.

With Bitcoin hovering near $89,000 and risk sentiment mixed, ETH has shifted into a range-bound phase where price is lagging underlying activity.

Short-term pressure has largely come from spot ETH ETF outflows, which exceeded $600 million between January 20–23, led in part by a single-day $250 million exit from BlackRock’s ETHA. This selling has cooled momentum and kept ETH capped below the $3,000 handle.

However, the flow data points more toward rotation and profit-taking than institutional abandonment. On-chain tracking shows whales accumulating roughly $1 billion worth of ETH during the recent correction, while funding rates and open interest have reset from crowded long conditions. That combination suggests leverage is being flushed, not confidence.

Beneath the price, Ethereum’s network activity remains strong. Daily active addresses have climbed toward 1.3 million, while transaction counts are holding between 1.9 million and 2.2 million per day.

Validator behavior reinforces this trend: exit queues are near zero, entry queues are rebuilding, and staking participation continues to rise, tightening circulating supply.

Low fees and improved efficiency post-upgrades are also driving sustained DeFi and app usage, reinforcing a “price weak, fundamentals firm” dynamic that has historically preceded larger trend moves.

On the geopolitical front, the tensions are rising between the U.S. and Iran as Iran’s Revolutionary Guard warns it is “more ready than ever” amid U.S. warships moving toward the Middle East. The warning comes after Iran’s recent crackdown on protests, which left thousands dead, and Trump has set strict red lines for military action, including preventing mass executions and violence against civilians.

Despite these geopolitical tensions, Ethereum (ETH) continues to rise. This shows that investors remain confident in Ethereum’s growth, likely supported by strong developments like the Ethereum Foundation prioritizing post-quantum security.

Today marks an inflection in the Ethereum Foundation's long-term quantum strategy.

— Justin Drake (@drakefjustin) January 23, 2026

We've formed a new Post Quantum (PQ) team, led by the brilliant Thomas Coratger (@tcoratger). Joining him is Emile, one of the world-class talents behind leanVM. leanVM is the cryptographic…

Technically, Ethereum price prediction is bearish as ETH is holding above $2,850–$2,900, a key support zone aligned with prior demand and Fibonacci confluence. RSI remains subdued near 35–40, signaling caution but not capitulation.

A reset toward support followed by a reclaim of $3,060 would reopen upside toward $3,190–$3,400, while a clean break below $2,800 would risk a deeper retracement toward $2,700.

Looking ahead, Ethereum’s 2026 roadmap adds weight to the longer-term case. The upcoming Glamsterdam upgrade and later Hegota phase focus on scalability, efficiency, and sustainability, building on blob infrastructure progress and accelerating Layer-2 adoption.

With over 8.7 million new contracts deployed entering the year, analysts increasingly view 2026 as a potential breakout period if macro conditions stabilize.

Ethereum (ETH/USD) Trade setup: Accumulate near $2,850–$2,900, target $3,190–$3,400, invalidation below $2,700.

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.9 million, with tokens priced at just $0.013635 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the PresaleThe post Ethereum Price Prediction: $3,000 Rejected, But On-Chain Data Tells Another Story appeared first on Cryptonews.