Prediction Markets vs Meme Coins: Is This Where Crypto’s Next Alpha Lives?

Prediction markets are emerging as one of the fastest-growing corners of crypto just as meme coins retreat from their recent peak, setting up a broader debate across the industry about where speculative capital is heading in 2026.

The comparison gained momentum after Kalshi’s head of crypto, John Wang, described prediction markets as “the meme coins of 2023,” arguing that both capture attention during periods when traders are searching for asymmetric opportunities.

JUST IN: Head of crypto at Kalshi John Wang says “prediction markets are the memecoins of 2023.” pic.twitter.com/ZtGGHBSaht

— Whale Insider (@WhaleInsider) December 15, 2025

The remark landed as meme coin activity cooled sharply following a volatile run that defined much of the last two years.

Meme Coins Had Their Moment — Is This the Collapse Phase?

Meme coins surged in 2023, driven by new token launches and heavy social media exposure.

The sector’s total market capitalization reached nearly $22 billion by the end of that year, while trading activity expanded dramatically.

Data from the period shows average trading volume rising more than ninefold over the first eleven months.

Two intense rallies defined the year, particularly an April–May burst fueled by highly speculative launches.

That speculative energy carried into 2024, when meme coins climbed to an estimated peak market cap of around $150 billion in December, helped by Dogecoin, Shiba Inu, Pepe, and a wave of political-themed tokens.

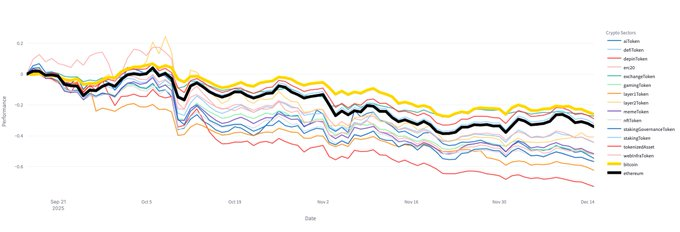

The reversal was equally sharp. By late 2025, the sector’s total value had fallen below $42 billion, with daily volumes shrinking and individual tokens losing most of their prior gains.

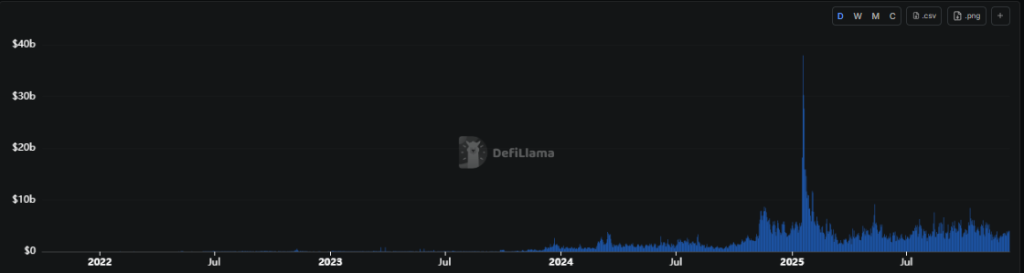

Market data now shows memecoin trading volumes down roughly 85% from their highs, reflecting a broad pullback in risk appetite.

Are Traders Done With Meme Coins? Prediction Markets Are Quietly Taking Over

As meme coins faded, prediction markets moved in the opposite direction.

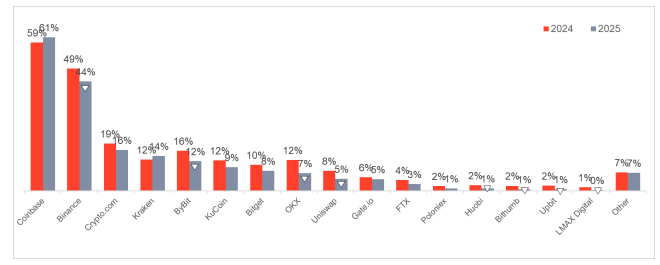

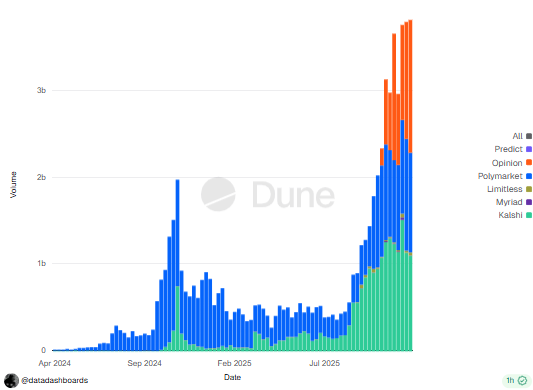

Platforms such as Kalshi, Polymarket, and Limitless recorded a combined $44 billion in trading volume this year, with Kalshi alone reaching $1 billion in weekly volume, driven largely by sports and political contracts.

Source: dune/datadashboards

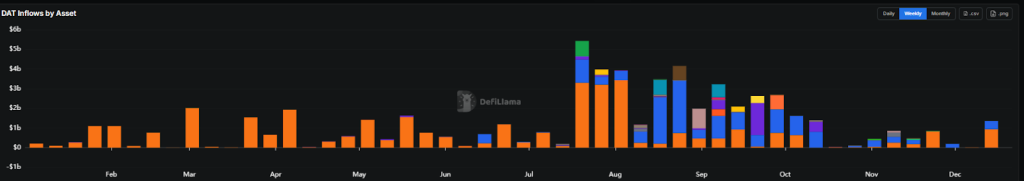

On-chain prediction markets have expanded even faster. Monthly volume has jumped from under $100 million in early 2024 to more than $13 billion today, a 130-fold increase, according to joint research from Keyrock and Dune Analytics.

Non-sports markets, including economics, politics, and technology-related events, accounted for most of the growth in 2025.

The structure of prediction markets differs sharply from memecoins, a point repeatedly raised by industry participants.

Prediction Markets vs Memecoins

— shaams

Watch in 2x speed

– "Memecoins will die like NFTs. Prediction markets will take over" (starts @ 0:16)

– Flaws in prediction markets (starts @ 2:25)

– Flaws in memecoins (starts @ 5:24)

– Prime @Pumpfun > prime @Polymarket (starts @ 5:59) https://t.co/ARppIQ8cTO pic.twitter.com/cesTAQNYEH(@shaams) December 16, 2025

Prediction contracts allow traders to buy “yes” or “no” shares tied to a specific outcome, with prices reflecting implied probabilities and settling through oracles once events conclude.

Supporters argue this creates clearer pricing and limits some of the manipulation risks that have plagued low-liquidity token markets.

Honestly makes sense why people are just moving over to Polymarket and all these other prediction market platforms. You don’t have to worry about 12 year olds bundling coins, you don’t have worry about your “favorite” kol shilling a coin then full clipping soon after, you don’t…

— GH0STEE (@gh0stee) December 15, 2025

Critics counter that returns are capped by design, making it harder for smaller traders to achieve outsized gains compared with early-stage memecoin trades.

Can Prediction Markets Kill Meme Coins?

Framing the trend as “prediction markets killing memecoins” misses the point.

Memecoins are not dead. Liquidity has simply receded, and that contraction is affecting many other crypto sectors as well.

History shows that meme-driven markets tend to hibernate, not disappear. When volatility returns and risk appetite expands, memecoins can resurface quickly.

At the same time, prediction markets are clearly earning a durable user base. Their growth isn’t purely cyclical hype; it’s being driven by real-world events, regulatory clarity in some jurisdictions, and demand for structured speculation. That gives them a resilience memecoins often lack during downturns.

The more likely outcome is coexistence, not replacement.

Memecoins will continue to dominate during speculative surges and attention-driven cycles. Prediction markets will attract traders seeking clarity, probability-based pricing, and event-driven exposure. They serve different psychological and financial needs.

If anything, the current shift shows a maturing crypto market, one where capital rotates rather than evaporates and where speculation takes multiple forms instead of clustering around a single narrative.

The post Prediction Markets vs Meme Coins: Is This Where Crypto’s Next Alpha Lives? appeared first on Cryptonews.