OPINION — One of the most enduring security issues in South Asia has been rekindled by the recent border conflicts between the Taliban-led Afghanistan and Pakistan military regimes. Diplomatic efforts by Qatar and Turkey have resulted in a tenuous ceasefire after days of fierce fighting that claimed scores of lives on both sides, offering a little respite from the rising violence. However, talks for a lasting peace have since collapsed. The crisis reveals long-standing structural tensions along one of the most volatile frontiers in the world that have their roots in militant activity, historical enmity, and disputed sovereignty.

Escalation and Triggers of Conflict

Intense fighting broke out along several stretches of the 2,600-kilometer Afghanistan-Pakistan Durand line in early October 2025, especially close to Spin Boldak–Chaman and the Kurram tribal areas. Each side accused the other of starting the conflict. The Taliban-led government denounced Pakistan's retaliatory bombings as a violation of national sovereignty, while Pakistan asserted that militants connected to the Tehrik-i-Taliban Pakistan (TTP) were conducting cross-Durand line attacks from Afghan territory. According to reports, Pakistani air raids in the provinces of Kandahar and Paktika killed dozens of civilians. Taliban members retaliated by attacking a number of Pakistani military installations, with the opposing side suffering heavy losses. Afghan traders are losing millions of dollars every day as a result of the conflict's rapid disruption of humanitarian and commercial routes, which led to the closure of important Durand line crossings.

This breakdown was not the first. Pakistan has long accused the Afghan Taliban of harbouring the TTP, a group committed to destroying Pakistan's government but philosophically linked with Kabul's leadership. The Taliban have refuted these claims, stating that Afghanistan forbids the use of its territory against other countries. However, the Durand Line, from the colonial era, continues to function as a political and geographic fault line, trapping both sides in a never-ending blame game.

The Doha-Istanbul Ceasefire Agreement

An emergency ceasefire agreement was reached on October 19, 2025, following nearly a week of fighting, thanks to intensive mediation by Qatar and Turkey. Both parties committed to immediately stopping offensive operations, prohibiting cross-Durand line attacks, and setting up systems for ensuring compliance under the agreement. To address implementation and verification procedures, a follow-up meeting was planned for October 25 in Istanbul. The deal was heralded as a diplomatic victory, particularly since Turkey and Qatar, who both have comparatively open lines of communication with the Taliban leadership, were instrumental in facilitating communication between two regimes which do not trust one another.

Khawaja Muhammad Asif, the defence minister for the Pakistani military dictatorship, underlined that Islamabad would evaluate the truce based on the Taliban's capacity to control the TTP. "This agreement will be broken by anything coming from Afghanistan," he cautioned. The Taliban's stated position that Afghanistan "will not allow its soil to be used against any country" was reaffirmed by Zabihullah Mujahid, the regime's spokesperson. Although these declarations show official dedication, they conceal more profound disparities in ability and perspective. The Taliban government sees the threat as a matter of border integrity and sovereignty, whereas Pakistan primarily sees it through the prism of counterterrorism. It will take more than diplomatic words to bridge different viewpoints.

Istanbul Talks

The follow-up talks in Istanbul — intended to turn the Doha truce into an enforceable framework—ended without a resolution after four days of negotiations. Reporting from multiple outlets indicates that mediators could not bridge the gap over concrete action against TTP networks allegedly operating from Taliban controlled soil and over how to verify any commitments. Pakistani regime’s officials briefed that Kabul was unwilling to accept binding steps to rein in or relocate the TTP; Afghan sources countered that the Taliban does not command or control the TTP and rejects responsibility for cross-Durand line attacks.

On the eve of, and during, the Istanbul round, Pakistan’s defence minister publicly warned that failure would risk “open war,” underscoring how narrow the window is for diplomacy if violence resumes along the frontier. While he acknowledged the ceasefire had broadly held for several days, he framed the talks’ success as contingent on Kabul’s verifiable curbs on the TTP. Reports say talks in Istanbul have restarted in another attempt for a deal.

The Cipher Brief brings expert-level context to national and global security stories. It’s never been more important to understand what’s happening in the world. Upgrade your access to exclusive content by becoming a subscriber.

Key unresolved issues

First, TTP-focused measures: Islamabad sought explicit commitments (dismantling safe havens, detentions/relocations, or handovers of wanted militants), while Kabul insists it won’t allow Afghan territory to be used against neighbours but resists operations that might trigger internal backlash or fracture ties with sympathetic factions. No binding text on TTP was agreed.

Second, a verification and incident-prevention mechanism: negotiators discussed joint hotlines, third-party monitoring, or liaison teams stationed in cross-Durand line hubs to investigate incidents in real time. Talks stalled over scope, authority, and who would adjudicate disputes.

Third, the Durand Line: Pakistan has fenced large stretches and wants coordinated patrols and recognized crossing protocols; the Taliban does not formally recognize the Durand Line as an international boundary, making technical fixes politically sensitive. This gap persisted in Istanbul.

Fourth, trade and crossings: business lobbies on both sides pushed for a timetable to reopen Spin Boldak–Chaman and other checkpoints for normal commerce and humanitarian flows, but negotiators did not finalize sequencing (security steps first vs. parallel reopening).

Fifth, refugees and returns: Islamabad raised concerns around undocumented Afghans and cross-Durand line facilitation; Kabul pressed for humanitarian safeguards. No durable arrangement was announced.

Obstacles to Durable Peace

The structural issues threatening Afghanistan-Pakistan ties are still mostly unaddressed in spite of the truce. First, the ceasefire does not include militant organisations like the TTP. Their independence severely restricts the enforceability of the agreement. According to analysts, the Taliban are reluctant to use force to fight the TTP because of ethnic and ideological ties that make internal Afghan politics more difficult.

Second, monitoring is quite challenging because of the porous nature of the Durand-line. Pakistan has unilaterally fenced off significant portions of the Durand Line, whereas Afghanistan does not formally recognise it as an international border. Recurrent conflicts are exacerbated by this lack of mutual recognition, especially when it comes to security patrols and cross-Durand line trading.

Third, there is still an imbalance of interests. Attacks by militants coming from Afghanistan are the problem for Pakistan. Pakistan's repeated airstrikes and backing of anti-Taliban groups are the source of Kabul's resentment. Joint security coordination is hampered by these conflicting narratives.

Fourth, pressure from within both governments is increasing. While the Taliban in Afghanistan must strike a compromise between meeting external demands and preserving their credibility among nationalist and tribal factions, public annoyance in Pakistan has increased due to an increase in attacks on security forces. Internal resentment could result from any impression of giving in.

Last but not least, the economic aspect introduces another level of complication. Afghanistan relies significantly on cross-border trade through Pakistan for imports and transit to global markets. Significant financial losses and humanitarian difficulties have resulted from the bridge closures. Unless trade flows restart fully, the truce will have limited practical effects.

Need a daily dose of reality on national and global security issues? Subscriber to The Cipher Brief’s Nightcap newsletter, delivering expert insights on today’s events – right to your inbox. Sign up for free today.

The Strategic and Regional Implications

There are wider ramifications for South and Central Asia from the crisis and the resulting truce.

Stability and militancy in the region: Should the truce fail, transnational militant networks, such as IS-K and al-Qaida elements, may gain more confidence. Resuming hostilities might destabilise the entire region, as these organisations flourish in uncontrolled border areas.

Taliban governance: The truce also serves as a litmus test for the Taliban's ability to govern. Global opinions of its legitimacy as a ruling power will be influenced by its capacity to maintain territorial control, interact diplomatically, and quell militant groups.

Realignments in diplomacy: The participation of Qatar and Turkey demonstrates how regional diplomacy is changing. Both nations have established themselves as go-betweens that can interact with the Taliban government without granting official recognition. Their mediation highlights a changing power dynamic in South Asia, where non-Western actors are having a greater impact on resolving disputes.

Economic and humanitarian impact: The conflict's humanitarian effects go beyond its security implications. Food and medical supplies have been disrupted by the closing of the Cross-Durand line, and the situation for displaced people on both sides of the frontier is getting worse. Maintaining peace will depend on reopening trade channels and making sure help is delivered.

The Road Ahead

The establishment of cooperative verification systems, a quantifiable decline in militant attacks, and the resumption of trade are important markers to keep an eye on. If any party breaks the agreement, the area can quickly revert to hostilities. It will be a careful balancing act for Pakistan to keep pressure on the Taliban without inciting escalation. The ability of the Taliban to control militant organisations while maintaining internal unity and sovereignty will be put to the test in Afghanistan. Supporting monitoring, communication, and de-escalation procedures is essential for regional partners, especially Qatar and Turkey, to continue their mediation efforts beyond symbolic diplomacy. As of October 28, the Istanbul process has adjourned without a deal, leaving these markers unmet and the ceasefire’s durability uncertain until verifiable steps are negotiated.

In the end, the ceasefire between Afghanistan and Pakistan serves as an example of the potential and vulnerability of regional diplomacy in a post-Western security context. In addition to bilateral discussions, broad regional collaboration tackling the interconnected problems of militancy, Durand-line governance, and economic interdependence will be necessary for a lasting peace. The willingness of both regimes to turn promises into tangible, verifiable action will determine whether this armistice develops into long-lasting stability or just serves as another brief break in a lengthy history of antagonism.

The Cipher Brief is committed to publishing a range of perspectives on national security issues submitted by deeply experienced national security professionals.

Opinions expressed are those of the author and do not represent the views or opinions of The Cipher Brief.

Have a perspective to share based on your experience in the national security field? Send it to Editor@thecipherbrief.com for publication consideration.

Read more expert-driven national security insights, perspective and analysis in The Cipher Brief

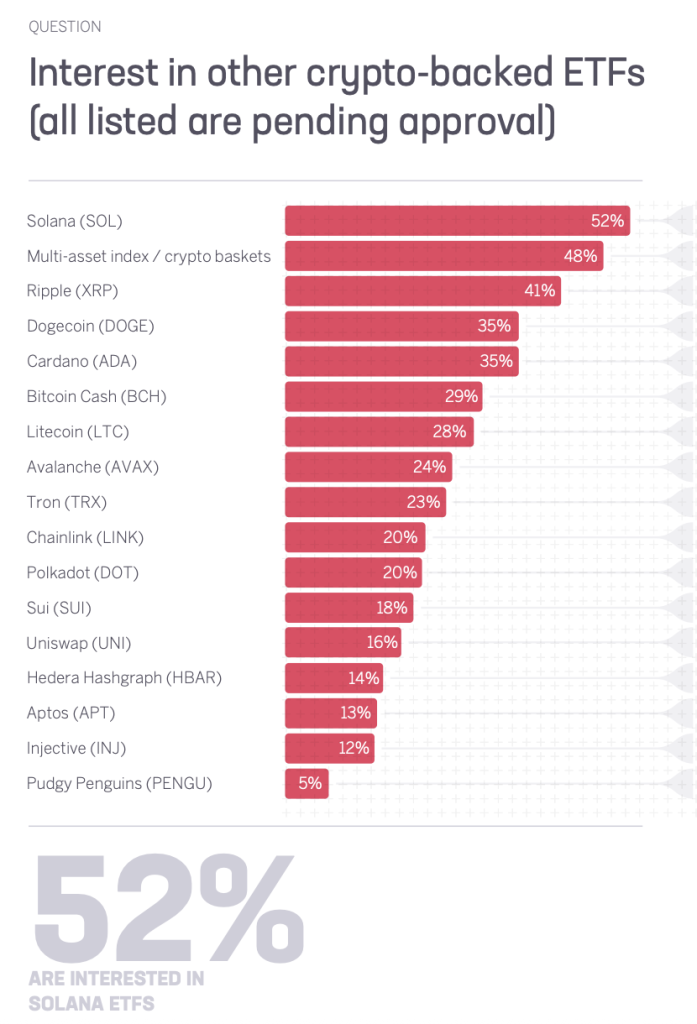

South Korea is the second-largest crypto market…