Bitcoin Price Prediction: CZ Predicts a 2026 Crypto “Supercycle” — Will BTC Break Out and Hit New Highs Above $126K?

At the ongoing Bitcoin MENA Conference in Abu Dhabi, Binance founder Changpeng Zhao (CZ) suggested a crypto “supercycle” could emerge in 2026.

Analysts believe this could push the Bitcoin price prediction beyond the current cycle high of $126,000.

CZ’s Bold Vision Sees Bitcoin Catching Up with Gold

Just four days earlier at Binance Blockchain Week 2025, CZ debated the Bitcoin value proposition opposite Peter Schiff, senior economist and founder of Euro Pacific Asset Management.

CZ just said “we might see a supercycle.” pic.twitter.com/9aatNffTdC

— Ash Crypto (@AshCrypto) December 9, 2025

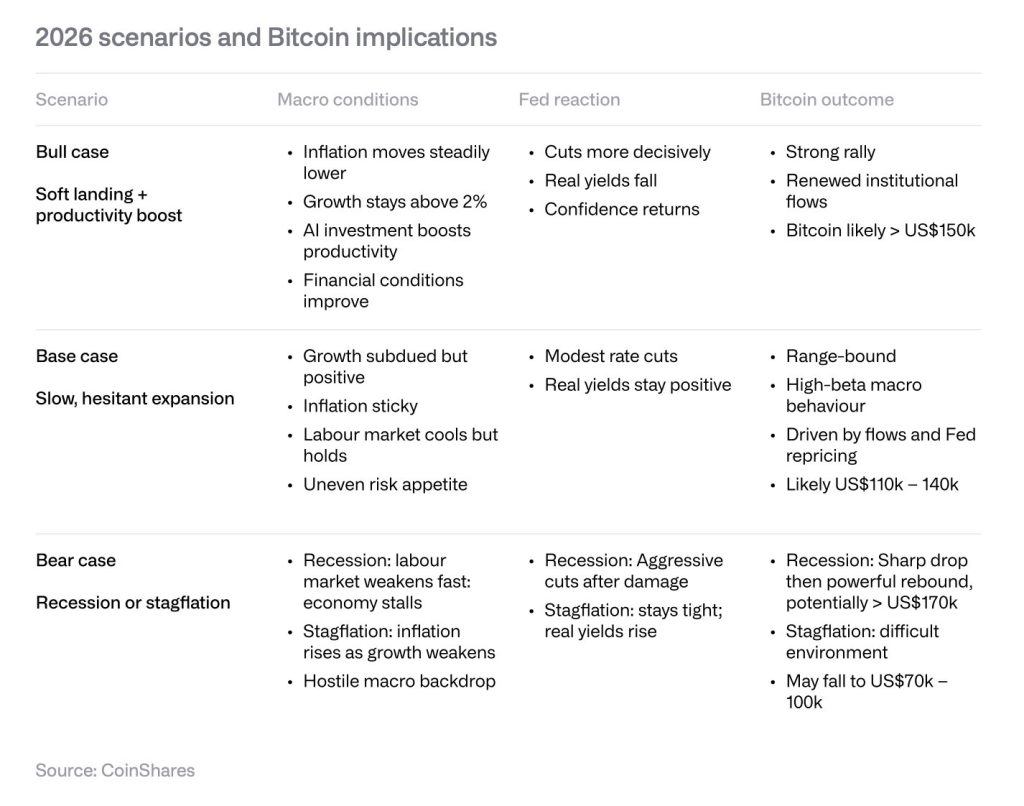

During the discussion, CZ projected Bitcoin could experience a significant rally in 2026, potentially matching gold’s performance, which has surged over 60% year-to-date compared to Bitcoin’s 5.7% decline over the same period.

Moreover, the Bitcoin hash ribbon indicator has now flashed green, historically signaling favorable entry points for market participants.

The hash chart reveals the 30-day moving average of hashrate dropping below the 60-day MA, a pattern indicating miner capitulation that typically coincides with major price discounts and long-term accumulation opportunities.

This comes as Bitcoin experienced a short squeeze that propelled the price through the $94,000 resistance level.

Crypto analyst Trader Mayne notes Bitcoin is currently testing the yearly open around $93,000, with potential to extend gains toward $98,000 and subsequently $106,000.

Bitcoin Price Prediction: $106K Next as MACD Flips Bullish

The daily chart shows Bitcoin attempting to break free from a multi-week descending trendline after spending most of November in controlled decline.

Price is now pushing above diagonal resistance with noticeably increased volume, indicating buyers are re-entering the market.

The MACD has crossed bullish and is accelerating upward from deeply oversold levels, a configuration that typically precedes mid-term reversals rather than temporary bounces.

Price is also reclaiming the daily pivot zone, suggesting momentum is shifting from defensive consolidation toward early recovery.

If this breakout holds, Bitcoin is positioned to retest major pivot levels around $98,000–$100,000, which will serve as the first significant barrier to trend reversal.

A decisive close above that range would unlock movement toward $105,000–$110,000.

However, failure to maintain support above the trendline would pull the price back toward the $85,000–$82,000 support band, where lower pivot levels align with the former breakdown zone.

Bitcoin’s First Real Layer 2 Token $HYPER Could Skyrocket Next

Bitcoin isn’t the only asset investors anticipate experiencing a supercycle in 2026

Bitcoin Hyper ($HYPER) is another project generating substantial attention as it develops the first genuine Layer 2 solution for Bitcoin, utilizing Solana-based technology to deliver speed and scalability while preserving Bitcoin’s security model.

Powered by a fast and scalable Solana-based Layer 2 infrastructure, the project has raised over $29M to enable developers to launch Bitcoin-native decentralized applications.

This provides BTC holders with new opportunities to deploy their assets productively, using on-chain tools built specifically for the Bitcoin ecosystem.

As leading wallets and exchanges integrate this scaling solution, demand for $HYPER is anticipated to go up very fast.

To acquire $HYPER before the next price increase, visit the official Bitcoin Hyper website and connect your preferred wallet (such as Best Wallet).

You can swap USDT or SOL for the token at the current presale price of $0.013395, or use a bank card for direct purchase.

Visit the Official Bitcoin Hyper Website HereThe post Bitcoin Price Prediction: CZ Predicts a 2026 Crypto “Supercycle” — Will BTC Break Out and Hit New Highs Above $126K? appeared first on Cryptonews.