Crypto Sell-Off: Binance, Coinbase, Dump Over $2 Billion In Bitcoin As Prices Dip Below $90,000

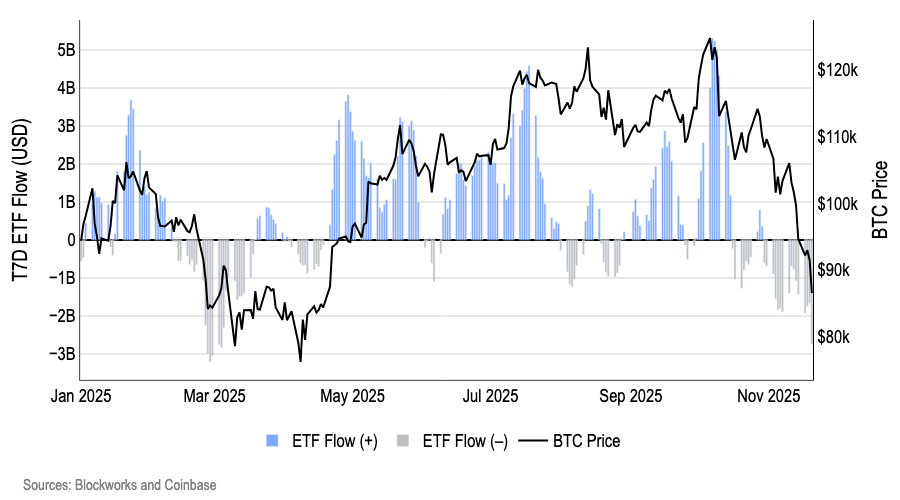

The cryptocurrency market experienced another wave of liquidations on Friday, with Bitcoin (BTC) prices dipping below the critical support level of $90,000. This decline followed a brief rally that had seen its price rise approximately $3,000 above this threshold earlier in the week.

Crypto Market Faces $430 Million In Liquidations

Data from CoinGlass reveals that nearly $430 million in liquidations occurred across the crypto market over the past 24 hours, predominantly affecting leveraged long positions, which accounted for about $350 million.

During this period, Bitcoin underwent a 3.5% retracement, with its price settling at just above $89,120—a stark 29% below its all-time high of over $126,000 reached in October.

Market expert OxNobler recently highlighted the role of both retail and institutional investors in this downturn. In a post on social media platform X, OxNobler detailed the reason behind Bitcoin’s decline: significant sell-offs by major players.

According to the analyst, the world’s largest cryptocurrency exchange, Binance, sold 4,000 BTC; U.S.-based Coinbase (COIN) liquidated 5,675 BTC; and traditional finance giant Fidelity sold 3,288 BTC. Additionally, market maker Wintermute offloaded 1,793 BTC.

Notably, the analyst pointed out that Strategy, formerly MicroStrategy, which is the largest public company holder of Bitcoin with over 650,000 coins, has also sold over 3,820 coins in this same time frame.

The firm’s sell-off comes on the heels of speculation regarding Strategy’s potential to liquidate some of its holdings due to the substantial losses affecting its financial performance amid declining Bitcoin prices.

When Strategy CEO Phong Le was questioned about the possibility of selling off Bitcoin, he acknowledged that while the firm’s former CEO, Michael Saylor, has consistently opposed selling, circumstances may change if the company’s stock trades below the net value of its Bitcoin holdings, which aligns with the recent actions taken by the firm.

Coinbase Analysts Predict December Recovery

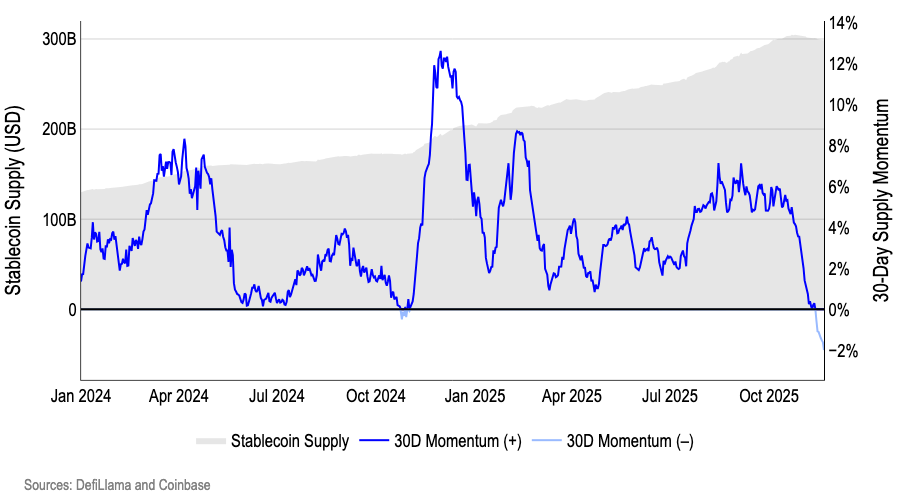

Interestingly, while these institutional sell-offs have contributed to the current market dip, Coinbase’s institutional division has projected a potential recovery for the crypto market in December, citing improving liquidity, a 92% probability of the Federal Reserve (Fed) cutting rates, and supportive macroeconomic conditions.

Analysts have pointed out several reasons for optimism, including the recovery of liquidity, the resilience of the “AI bubble,” and the attractiveness of short US dollar trades at current levels.

However, OxNobler warned that the situation may not be so straightforward. Alongside the activities of major institutions, he noted that BlackRock, the world’s largest asset manager, had recently sold $130 million worth of Bitcoin and Ethereum (ETH).

Furthermore, Vitalik Buterin, one of Ethereum’s co-founders, seems to have resumed selling Ethereum, with millions of ETH being moved from the foundation’s wallet through Gnosis Safe.

Ultimately, OxNobler asserts that these institutional activities may have a hand in manipulating crypto prices and preventing them from climbing to higher levels and key resistance points.

Featured image from DALL-E, chart from TradingView.com