Tom Lee’s BitMine Corners 3.5% of Ethereum Supply as Treasury Tops With 4.24M ETH Buy

BitMine Immersion Technologies, a New York–listed company chaired by Fundstrat’s Tom Lee, has quietly built one of the largest concentrated positions in Ethereum ever disclosed by a single entity.

In an update published on January 26, BitMine said it now holds 4,243,338 ether, giving the company control of roughly 3.52% of Ethereum’s total circulating supply.

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) January 26, 2026

BitMine provided its latest holdings update for January 26th, 2026:

$12.8 billion in total crypto + "moonshots":

– 4,243,338 ETH at $2,839 (@coinbase)

– 193 Bitcoin (BTC)

– $200 mllion stake in Beast Industries @MrBeast

– $19 million stake in Eightco Holdings (NASDAQ: $ORBS)…

At the time of disclosure, the position was valued at roughly $12 billion, making BitMine the largest Ethereum treasury in the world and the second-largest crypto treasury overall, behind Strategy Inc., formerly Strategy, which holds more than 700,000 bitcoin.

BitMine Accelerates ETH Accumulation as Prices Slide

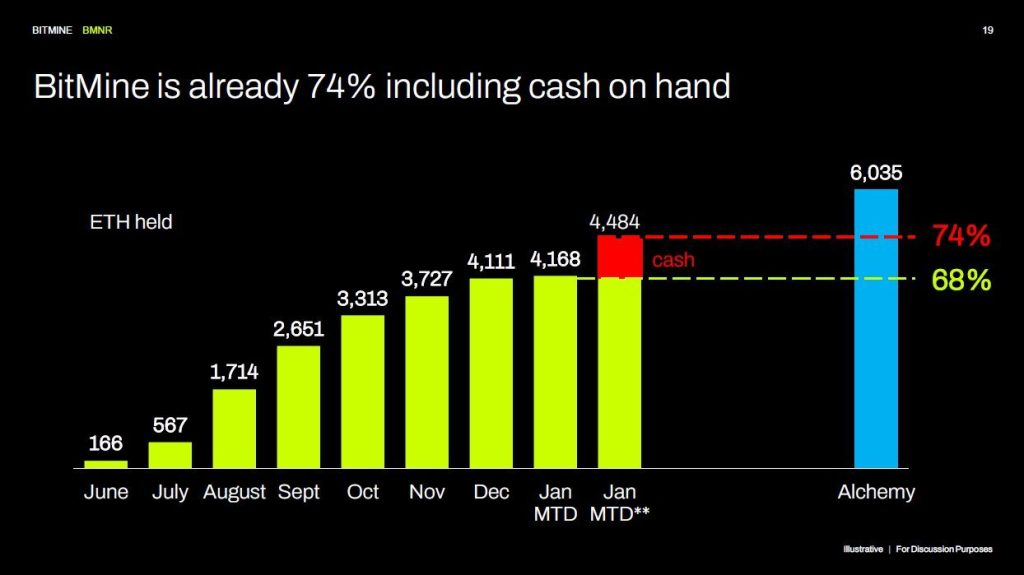

The disclosure shows how quickly BitMine’s balance sheet has expanded over the past six months.

Weekly purchase data shared by the company indicates steady accumulation since late October, 2025, with particularly large buying activity in December.

In the week ending January 26 alone, BitMine added just over 40,000 ETH, following purchases of more than 35,000 ETH the prior week and several six-figure ETH buys in December.

Last week the company bought the dip, purchasing $110M worth of Ethereum.

— Cryptonews.com (@cryptonews) January 21, 2026

BitMine @BitMNR now controls 3.48% of Ethereum’s total supply after adding $110M in $ETH during the dip, moving closer to its “Alchemy of 5%” goal.#Ethereum #BitMinehttps://t.co/W74cW2b8XH

The pace of accumulation has continued even as ether prices softened, with ETH down double digits over the past month amid broader market volatility.

Ethereum is currently trading at $2,940.44, showing a 2.0% increase over the past hour, which suggests short-term buying pressure returning to the market.

On a 24-hour basis, ETH is up a modest 0.4%, indicating relatively stable price action despite broader market fluctuations.

However, over the past seven days, Ethereum has declined by 8.4%, reaching as low as $2,787.

BitMine’s total crypto, cash, and equity holdings now stand at $12.8 billion, according to the company.

In addition to its Ethereum position, the firm holds 193 bitcoin, $682 million in cash, a $200 million stake in Beast Industries, and a smaller equity position in Eightco Holdings.

BitMine’s Ethereum Bet Moves Closer to the 5% Mark

The company trades on the NYSE American under the ticker BMNR and was last priced around $28.50, down modestly on the day and slightly lower over the past week.

The Ethereum accumulation is central to BitMine’s stated long-term strategy, as it has publicly set a goal of acquiring 5% of Ethereum’s total supply, a target it refers to as the “alchemy of 5%.”

Based on current supply estimates, reaching that level would require roughly 6 million ETH.

At current market prices, closing that gap would require several billion dollars in additional capital.

BitMine Expands Ethereum Staking as Holdings Grow

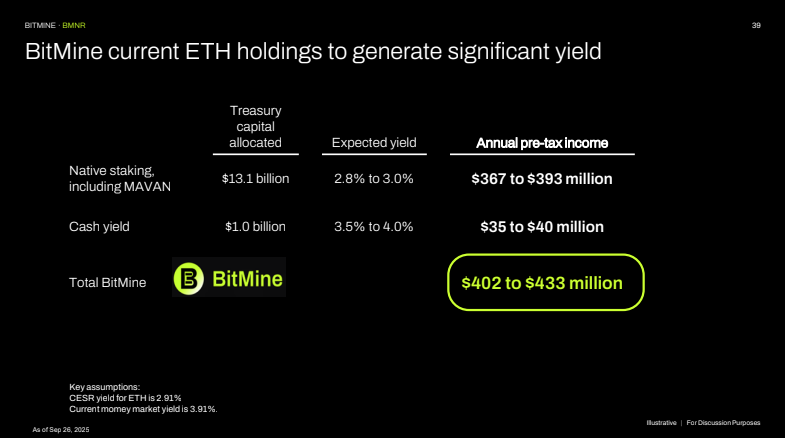

Beyond holding ether on its balance sheet, BitMine is also expanding its staking operations. As of January 25, the company had staked 2,009,267 ETH, worth about $5.7 billion, representing nearly half of its total holdings.

Using the composite Ethereum staking rate of roughly 2.81%, BitMine estimates that a fully deployed staking strategy could generate about $374 million in annual fees, or more than $1 million per day.

For now, the company relies on external staking providers, but it plans to launch its infrastructure, known as the Made in America Validator Network, or MAVAN, in early 2026.

— Cryptonews.com (@cryptonews) December 30, 2025

BitMine @BitMNR plans an early-2026 launch of its MAVAN validator network, aiming to turn a $12B Ether treasury into staking yield at scale.#BitMine #Staking https://t.co/YOlkeNouQu

Chairman Tom Lee has framed the Ethereum strategy as a long-term bet on institutional adoption of blockchain technology.

Speaking after last week’s World Economic Forum meeting in Davos, Lee said discussions among policymakers and business leaders increasingly point to the convergence of traditional finance, crypto, and artificial intelligence.

He pointed to Ethereum’s role in tokenization and financial infrastructure projects as evidence that Wall Street is already building on the network.

The post Tom Lee’s BitMine Corners 3.5% of Ethereum Supply as Treasury Tops With 4.24M ETH Buy appeared first on Cryptonews.