Solana Price Prediction: Can SOL Reverse The Massive 40% YoY Price Collapse?

Solana price is down by a lot. The Solana chart has closed with red candles for 3 months straight, leaving many traders in disbelief over how bad the price action has been. When you zoom out, something feels off.

With only 11 days left in 2025, SOL is still set to surpass ETH in annual revenue for the first time. This is mainly due to the strong start of the year. In recent months, however, these metrics have declined significantly.

Total Solana traders are down 87% from the January highs, falling from 4.8 million active wallets to just 624,000.

Solana has no traders left, everyone turned into a coin deployer pic.twitter.com/590Q9WsMgd

— bong (@bon_g) November 13, 2025

Solana Price Prediction: What To Do When You Like Solana

Coinbase CEO Brian Armstrong posted on X saying he likes Solana, a nice gesture for a project going through a hard time. Thanks, Brian.

It is not surprising, though. Coinbase made every Solana-based coin tradable on the platform about a week ago. That move alone shows where Solana stands when it comes to adoption.

Solana is currently bouncing just to survive. It has been trading in the $144 to $120 range for a good while now. A move below $120 would mean breaking an 18 month support level for Solana, which is something bulls do not want to see.

The bounce pushed RSI back to neutral levels around 47, but if momentum does not pick up, a dip toward $100 becomes very likely.

This setup remains valid as long as Solana does not break above $144 and regain the momentum it showed earlier this year.

Bitcoin Hyper ($HYPER) Might Be The Layer 2 Of Choice For 2026

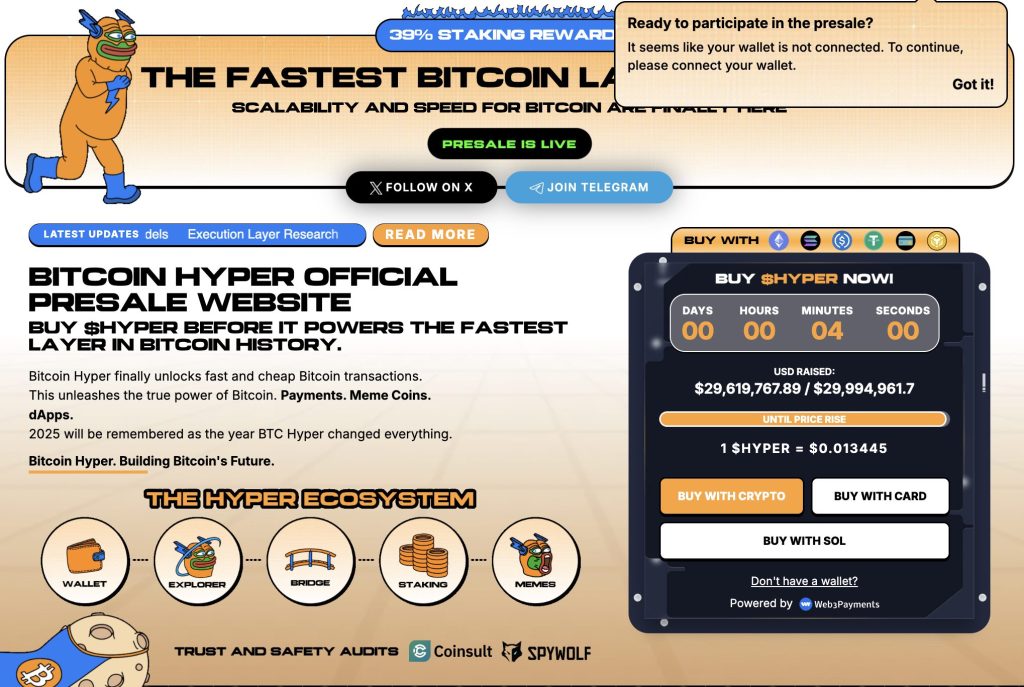

Bitcoin Hyper ($HYPER) is starting to stand out as one of the few projects still building aggressively while the broader market struggles. Instead of competing with altcoins directly, Hyper is targeting Bitcoin’s biggest weakness: speed and usability.

Built as a Bitcoin Layer 2 powered by Solana-style performance, Bitcoin Hyper unlocks fast transactions, low fees, and full access to DeFi, staking, NFTs, and meme coins, all while staying anchored to Bitcoin’s security. Through the Hyper Bridge, users can move BTC onto the Hyper network and receive a 1:1 representation with near-instant finality.

This effectively turns idle Bitcoin into a productive asset, opening the door to yields, payments, and on-chain applications that were previously impossible on Bitcoin itself.

Early interest has been strong, with Bitcoin Hyper already raising over $29.6M from investors betting that Bitcoin-based DeFi will be one of the dominant narratives going into 2026. The project is also offering a 39% APY staking option for early participants, which has helped drive demand even during market weakness.

As capital rotates away from overextended altcoins and back toward Bitcoin-centric ecosystems, Bitcoin Hyper is positioning itself as a core infrastructure play rather than a short-term hype trade.

Visit the Official Bitcoin Hyper Website HereThe post Solana Price Prediction: Can SOL Reverse The Massive 40% YoY Price Collapse? appeared first on Cryptonews.