Massive US Storm Forces Bitcoin Miners Offline – What Does That Mean for Bitcoin Holders?

A severe Arctic blast sweeping across the United States has forced Bitcoin miners to take more than 110 exahashes per second of computing power offline, temporarily slowing block production to 12 minutes as operators curtail operations to ease strain on regional power grids, according to The Miner Mag.

The widespread shutdowns mark one of the largest coordinated mining curtailments since the 2021 Texas grid crisis, with FoundryUSA’s hashrate dropping nearly 60% since Friday.

Real-time data from Mining Pool Stats shows FoundryUSA’s hashrate fell from approximately 340 EH/s to roughly 242 EH/s over the weekend, while Luxor recorded a similar decline from about 45 EH/s to around 26 EH/s.

Smaller reductions appeared across Antpool and Binance Pool, though these pools serve less U.S.-concentrated operations, suggesting total curtailments may exceed the initial 110 EH/s estimate, The Miner Mag reported.

UPDATE: #Bitcoin hashrate on FoundryUSA is down by nearly 200 EH/s, or 60%, since Friday amid continued curtailment. Temporary block production slows down to 12 minutes

— TheMinerMag (@TheMinerMag_) January 25, 2026https://t.co/e51LyWoxjs pic.twitter.com/uIrCD5JudD

Grid Operators Report Stability Despite Extreme Cold

The hashrate pullback coincided with a severe Arctic air mass pushing subfreezing temperatures, snow, and ice deep into the central and eastern United States.

Grid operators across multiple states issued conservation alerts as heating demand surged, yet Texas’s grid operator ERCOT reported on Friday that conditions remained stable despite the cold weather.

The stability contrasts sharply with February 2021, when Winter Storm Uri triggered widespread outages and prolonged blackouts across the state.

Since that crisis, Texas has added substantial large-load capacity, much of it tied to Bitcoin mining and data center operations.

Unlike traditional industrial loads, many Bitcoin miners participate in demand response programs, allowing them to rapidly curtail consumption during periods of grid stress.

As noted by The Miner Mag, this flexible-load model represents a dynamic shift from the 2021 scenario, when such infrastructure did not exist to support grid balancing during extreme weather events.

— TheMinerMag (@TheMinerMag_) January 23, 2026

The U.S. #AI compute boom is running into a familiar problem.

Local communities aren’t buying it.

If this sounds familiar to #bitcoin miners, that’s because it is.

Singapore-based miner Bitdeer, which operates over 293,000 rigs globally, including facilities in Texas, said in a statement that it does not anticipate major disruptions from the storm.

A company spokesperson explained that the Electric Reliability Council of Texas considers Bitcoin miners “large flexible loads,” meaning they can curtail electricity usage on request, unlike other industrial users with firm electrical demands.

“Bitdeer stands ready to fully support the grid should supply constraints occur,” the spokesperson added.

The curtailments come as Bitcoin’s seven-day average network hashrate had already declined to about 992 EH/s, down roughly 13.7% from the all-time high of above 1.15 ZH/s reached in October, according to data reported by The Miner Mag last week.

The moderation follows Bitcoin’s market price falling nearly 30% from its October peak, prolonging pressure on mining economics by keeping competition for block rewards elevated even as revenues per unit of computing power fell.

Storm Threatens 60 Million People Across 1,800 Miles

The massive winter storm extends for 1,800 miles from far west Texas to the mid-Atlantic coast, threatening to affect upwards of 60 million people across more than a dozen states, according to AccuWeather.

AccuWeather Senior Vice President Evan Myers warned that the combination of snow, ice, and bitter cold across such a large area would “stall daily life for days,” with some power outages lasting through extended periods as Arctic air charges in behind the storm.

About 60 million people will experience icing conditions, with potentially 1 million people without power for an extended period, AccuWeather estimated.

AccuWeather Chief Meteorologist Jon Porter noted that many areas hit hard by Hurricane Helene in September 2024 still have temporary power lines that “may come down more easily than permanent lines,” potentially stretching recovery resources and personnel to the limit across North Carolina and other affected states.

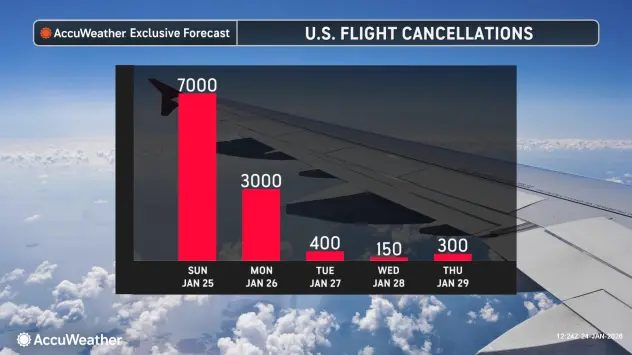

The storm’s intensity has already prompted thousands of flight cancellations across the region as airlines deal with displaced aircraft and crews.

AccuWeather Storm Warning Meteorologist William Clark cautioned that “entire supply chains may break down from prolonged days of extensive interstate closures,” warning that critical supplies, including pharmaceuticals and basic necessities, may become scarce in the hardest-hit areas.

The United States controls nearly 38% of the global Bitcoin hashrate according to estimates from Hashrate Index, making American mining operations critical to network security.

The post Massive US Storm Forces Bitcoin Miners Offline – What Does That Mean for Bitcoin Holders? appeared first on Cryptonews.