CoinShares Debunks Tether Collapse Fears After Hayes Warning

CoinShares head of research James Butterfill has dismissed insolvency concerns surrounding Tether following warnings from BitMEX founder Arthur Hayes, who claimed a 30% drop in the stablecoin issuer’s Bitcoin and gold holdings could wipe out its equity.

Butterfill’s December 5 market update affirmed that Tether maintains over $181 billion in total reserves against roughly $174.45 billion in liabilities, leaving a surplus of approximately $6.78 billion.

The dismissal comes as crypto markets navigate turbulence in Japanese government bonds and softer US employment data that showed a -32,000 print versus forecasts of +10,000.

Hayes sparked controversy on November 30 by arguing Tether is “running a massive interest rate trade” that positions the company for Federal Reserve rate cuts while exposing it to dangerous volatility through its $22.8 billion allocation to gold and Bitcoin.

The Tether folks are in the early innings of running a massive interest rate trade. How I read this audit is they think the Fed will cut rates which crushes their interest income. In response, they are buying gold and $BTC that should in theory moon as the price of money falls.… pic.twitter.com/ZGhQRP4SVF

— Arthur Hayes (@CryptoHayes) November 29, 2025

Tether CEO Counters Insolvency Claims with Financial Data

CEO Paolo Ardoino swiftly refuted Hayes’s assessment with detailed disclosures showing Tether Group’s total assets reach approximately $215 billion.

The executive explained that the company holds roughly $7 billion in excess equity on top of its stablecoin reserves, plus another $23 billion in retained earnings as part of Tether Group equity.

Bitcoin and gold represent just 12.6% of total reserves, with over 70% held in short-term U.S. Treasuries.

“S&P made the same mistake of not considering the additional Group Equity nor the ~$500M in monthly base profits generated by U.S Treasury yields alone,” Ardoino stated, suggesting critics are “either bad at math or have the incentive to push our competitors.“

re: Tether FUD

— Paolo Ardoino

From latest attestation announcement (Q3 2025):

"Tether will continue to maintain a multi-billion-dollar excess reserve buffer and an overall proprietary Group equity approaching $30 billion."

Tether had (at end of Q3 2025) ~7B in excess equity (on top of the…(@paoloardoino) November 30, 2025

The company generated more than $10 billion in profit this year from interest income on reserve assets, making it one of the most efficient cash-generating businesses globally with just 150 employees.

His defense followed S&P Global’s November 26 downgrade of USDT’s peg-stability rating from 4 to 5, citing increased exposure to “high-risk” assets and “persistent gaps in disclosure.”

Ardoino responded defiantly, declaring, “We wear your loathing with pride,” while positioning Tether as “the first overcapitalized company in the financial industry, with no toxic reserves.”

The rating action carries profound implications under MiCA regulations, which prohibit USDT from EU exchanges with a “5” rating, potentially shifting institutional liquidity toward competitors like Circle’s USDC.

Industry Veterans Challenge Hayes’s Fundamental Analysis

Joseph Ayoub, former head of digital asset research at Citi, noted Hayes overlooked critical distinctions between Tether’s disclosed reserves and total corporate holdings.

The analyst explained that Tether maintains a separate equity balance sheet comprising mining operations and corporate reserves that aren’t publicly reported under the company’s “matching philosophy” for reserve disclosure.

“Tether isn’t going insolvent, quite the opposite; they own a money printing machine,” Ayoub concluded, pointing to the company’s roughly $120 billion in interest-yielding Treasuries generating approximately 4% returns since 2023.

I spent 100’s of hours writing research on tether for @Citi. @CryptoHayes missed a few key points.

— Joseph (@JosephA140) November 30, 2025

1) 𝐓𝐡𝐞𝐢𝐫 𝐝𝐢𝐬𝐜𝐥𝐨𝐬𝐞𝐝 𝐚𝐬𝐬𝐞𝐭𝐬 =/ 𝐚𝐥𝐥 𝐜𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐚𝐬𝐬𝐞𝐭𝐬

When tether generates $ they have a separate equity balance sheet which they don’t… https://t.co/pHSRr245Up

Banks operate on significantly lower fractional reserves of 5-15% in liquid assets compared to Tether’s overcollateralized structure. However, traditional institutions benefit from central bank lender-of-last-resort support that Tether lacks.

Hunter Horsley, CEO of Bitwise Invest, characterized Tether’s structure as “better than fractional banking reserves,” while CryptoQuant CEO Ki Young Ju dismissed Hayes’s warning as motivated by trading position management.

Former FT Alphaville editor Izabella Kaminska offered a deeper structural analysis, suggesting Tether’s thick equity buffer and retained earnings model creates “a capital structure that looks a lot like the banking model academic Anat Admati advocates: much thicker equity buffers, far less leverage, and minimal maturity mismatch.“

Kaminska noted that if Tether’s depositor base proves willing to redeem directly in gold during stress situations, the metal becomes “the natural last-resort funding asset for its shadow/grey exposures and a hard-asset substitute for the lender-of-last-resort support that banks get from central banks.”

— Izabella Kaminska (@izakaminska) November 30, 2025

Analysts are overlooking how stablecoins that retain earnings (aka Tether) are evolving into something structurally unusual.

The reality is, as Tether’s retained earnings accumulate, they operate economically like a very thick equity buffer — far beyond the capitalisation… https://t.co/KXtsrG52kU

This cross-border redemption channel operates without dependence on synchronized regulatory frameworks.

The controversy emerges as Tether expands beyond stablecoin issuance into commodity trade lending, having deployed approximately $1.5 billion in credit across oil, cotton, wheat, and agricultural markets.

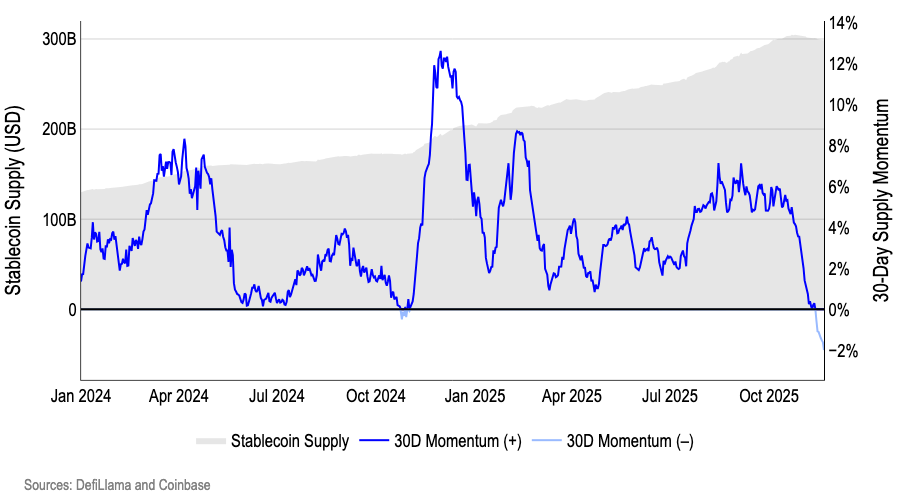

The company’s Q3 attestation showed USDT issuance increased by more than $17 billion during the quarter, lifting circulating supply above $174 billion, with October figures surpassing $183 billion.

The post CoinShares Debunks Tether Collapse Fears After Hayes Warning appeared first on Cryptonews.