Asia Market Open: Bitcoin Holds $87k As Shares Nudge Up On Mixed US Jobs Report

Bitcoin rose about 2% in Asian hours on Wednesday as regional shares edged higher, and traders kept one eye on Thursday’s US inflation print for clues on how much room the Federal Reserve has to cut rates in 2026.

Equity markets remained measured across the region after a mixed US jobs report and soft purchasing managers’ data left investors debating whether growth is cooling fast enough to justify easier policy.

Akshat Siddhant, lead quant analyst at Mudrex, said “Despite this uncertainty, Bitcoin exchange reserves sitting at record lows have supported the upside, giving bulls an edge. Attention now turns to the upcoming CPI data, which will shape expectations around a potential Fed rate cut.”

“If momentum holds, BTC could advance toward $90,000, with support gradually moving higher to the $86,000 zone,” he added.

Market snapshot

- Bitcoin: $87,274, up 1.9%

- Ether: $2,948, up 0.5%

- XRP: $1.93, up 3.4%

- Total crypto market cap: $3.05 trillion, up 1.3%

Tech Rebound Lifts Asian Mood As CPI Looms

S&P 500 futures slipped 0.1% as the CPI release moved to the top of the macro calendar.

Technology shares helped lift sentiment after a bruising stretch. South Korea’s KOSPI gained 0.6% and Hong Kong’s Hang Seng added 0.3%, as buyers returned to large-cap tech names and the broader AI complex.

Some of that lift spilled into the robotaxi theme in Hong Kong. Pony AI and WeRide climbed more than 3% each, tracking strength in Tesla after chief executive Elon Musk said the carmaker was testing robotaxis with no human safety drivers.

On Wall Street, the Nasdaq finished Tuesday higher and the S&P 500 and Dow ended lower, with healthcare and energy weighing. Investors parsed delayed economic releases after a recent government shutdown slowed data collection, and the market treated the numbers as directionally useful rather than definitive.

Payroll Surprise Fails To Ease Growth Concerns

A Labor Department report showed nonfarm payrolls rose by 64,000 jobs in November after an October drop linked to government spending cuts, and the unemployment rate climbed to 4.6%. Separate figures showed retail sales were flat in October, slightly below economists’ expectations.

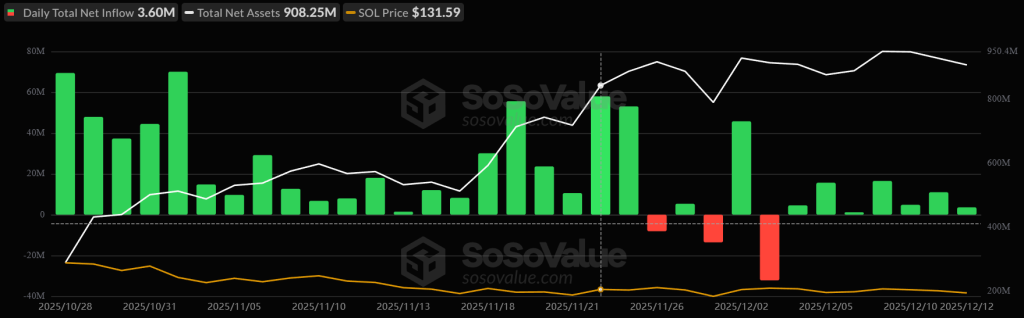

Nic Puckrin, an investment analyst and co-founder of Coin Bureau, said year-end tax-loss selling is adding pressure, with Bitcoin among the assets where many investors are sitting on losses.

He said that dynamic could weigh on prices into the end of 2025 and leaves room for a slide below $80,000 if the sell-off deepens. In the near-term, he pointed to the ETF cost basis around $83,800 as a key level, with further support near $81,200, which he described as the market’s true mean.

Japan Gains On Trade Data As Rate Hike Bets Build

In Greater China, the Shanghai Shenzhen CSI 300 rose 0.5% and the Shanghai Composite stayed flat, as investors waited for clearer signs of fiscal support from Beijing after a run of soft November data.

Elsewhere, Australia’s ASX 200 dipped 0.2% and Singapore’s Straits Times index fell 0.3%, and data showed Singapore’s non-oil exports rose in November.

Japan’s Nikkei 225 added 0.3% and the broader Topix gained 0.1% after trade data showed exports beat expectations, a signal that overseas demand is supporting growth into year-end. Traders also watched the Bank of Japan ahead of Friday’s policy decision, with markets leaning toward a rate increase as the yen stays weak and inflation remains sticky.

US rate expectations also sat under a leadership storyline, after the Wall Street Journal reported President Donald Trump is set to interview Fed Governor Christopher Waller on Wednesday for the chair role, adding another variable to a week already driven by CPI risk.

The post Asia Market Open: Bitcoin Holds $87k As Shares Nudge Up On Mixed US Jobs Report appeared first on Cryptonews.