Tether Makes All-Cash $1.1B Bid to Buy Juventus, but Offer Rejected

Tether has launched an all-cash bid to acquire Italy’s Juventus Football Club, an offer that was reportedly swiftly turned down.

Key Takeaways:

- Tether made a $1.1 billion all-cash bid to buy Juventus, but Exor swiftly rejected the offer.

- Tether signaled it remains interested and is willing to invest €1 billion to develop the team.

- The move expands Tether’s growing footprint in sports and investment sectors.

The stablecoin issuer said Friday it had submitted a binding offer to Exor, the Agnelli family’s holding company, seeking to purchase its 65.4% controlling stake.

The Agnelli dynasty has controlled Juventus for more than a century, making the bid one of the most audacious takeover attempts in European football this year.

Juventus Shares Jump as Tether’s $1.1B Takeover Bid Is Rejected

Juventus, valued at roughly €944 million ($1.1 billion), saw its share price rise 2.3% Friday to €2.23 ($2.62).

Tether said that if Exor accepted the deal, it would immediately launch a public tender for all remaining shares at the same price.

However, according to AFP, Exor has already rejected the proposal, with a source close to the company stating simply: “Juventus is not for sale.”

Despite the rebuff, Tether is positioning itself as a long-term suitor. CEO Paolo Ardoino said the company was prepared to invest €1 billion ($1.1 billion) to strengthen the club if a deal were ever reached.

“Tether is in a position of strong financial health and intends to support Juventus with stable capital and a long horizon,” Ardoino said, adding that he grew up following the team.

“As a boy, I learned what commitment, resilience, and responsibility meant by watching Juventus face success and adversity with dignity.”

Tether Submits Proposal to Acquire Juventus Football Club

— Tether (@Tether_to) December 12, 2025

Read more: https://t.co/CDv8OosqFU

Tether, issuer of the $118 billion stablecoin USDT, has pushed aggressively into new sectors over the past year, pouring money into artificial intelligence, robotics and health-tech ventures.

Its move into football has been gradual. The company quietly bought a stake in Juventus in February and increased its holding to more than 10% in April.

It has also gained influence inside the club. In October, Tether nominated deputy investment chief Zachary Lyons and Francesco Garino to Juventus’s board, and shareholders approved Garino’s appointment last month.

Tether Could Become the World’s Most Profitable Company, Analyst Says

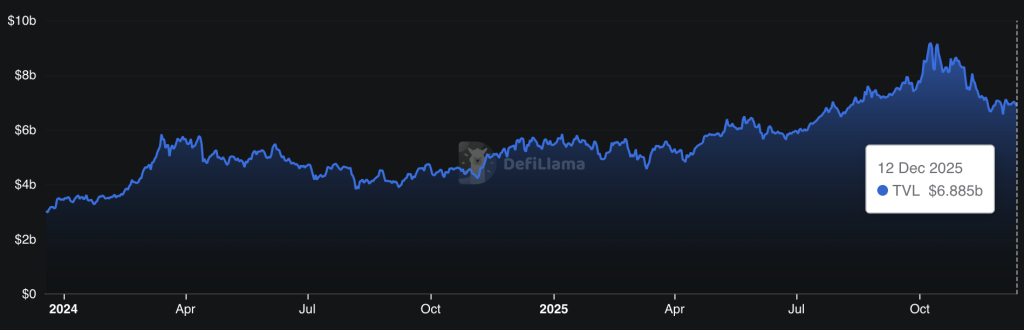

Tether appears unstoppable right now, with the world’s largest stablecoin issuer on track to generate approximately $15 billion this year.

Bitwise’s chief investment officer, Matt Houga, recently predicted that Tether could become the world’s most profitable company, potentially overtaking Saudi Aramco.

It’s the world’s third-largest digital asset with a market capitalization of $183.8 billion, up 50% compared to this time last year.

Although Tether maintains strong cash reserves, recent reports suggest that the company may seek $20 billion in new capital for a 3% ownership stake.

Such a transaction would establish a valuation near $500 billion, eclipsing Netflix and Samsung while approaching iconic financial services brands like Mastercard.

The firm has simultaneously expanded its precious metals holdings, with its gold reserves now exceeding $12 billion.

The post Tether Makes All-Cash $1.1B Bid to Buy Juventus, but Offer Rejected appeared first on Cryptonews.