Crypto ally Rick Rieder emerges front‑runner for Fed Chair on Polymarket

The Supreme Court appears poised to deliver a contradictory message to the American people: Some independent agencies deserve protection from presidential whim, while others do not. The logic is troubling, the implications profound and the damage to our civil service system could be irreparable.

In December, during oral arguments in Trump v. Slaughter, the court’s conservative majority signaled it would likely overturn or severely weaken Humphrey’s Executor v. United States, the 90-year-old precedent protecting independent agencies like the Federal Trade Commission from at-will presidential removal. Chief Justice John Roberts dismissed Humphrey’s Executor as “just a dried husk,” suggesting the FTC’s powers justify unlimited presidential control. Yet just weeks later, during arguments in Trump v. Cook, those same justices expressed grave concerns about protecting the “independence” of the Federal Reserve, calling it “a uniquely structured, quasi-private entity” deserving special constitutional consideration.

The message is clear: Wall Street’s interests warrant protection, but the rights of federal workers do not.

The MSPB: Guardian of civil service protections

This double standard becomes even more glaring when we consider Harris v. Bessent, where the D.C. Circuit Court of Appeals ruled in December 2025 that President Donald Trump could lawfully remove Merit Systems Protection Board Chairwoman Cathy Harris without cause. The MSPB is not some obscure bureaucratic backwater — it is the cornerstone of our merit-based civil service system, the institution that stands between federal workers and a return to the spoils system that once plagued American government with cronyism, inefficiency and partisan pay-to-play services.

The MSPB hears appeals from federal employees facing adverse actions including terminations, demotions and suspensions. It adjudicates claims of whistleblower retaliation, prohibited personnel practices and discrimination. In my and Harris’ tenure alone, the MSPB resolved thousands of cases protecting federal workers from arbitrary and unlawful treatment. In fact, we eliminated the nearly 4,000 backlogged appeals from the prior Trump administration due to a five-year lack of quorum. These are not abstract policy debates — these are cases about whether career professionals can be fired for refusing to break the law, for reporting waste and fraud or simply for holding the “wrong” political views.

The MSPB’s quasi-judicial function is precisely what Humphrey’s Executor was designed to protect. This is what Congress intended to follow in 1978 when it created the MSPB in order to strengthen the civil service workforce from the government weaponization under the Nixon administration. The 1935 Supreme Court recognized that certain agencies must be insulated from political pressure to function properly — agencies that adjudicate disputes, that apply law to fact, that require expertise and impartiality rather than ideological alignment with whoever currently occupies the White House. Why would today’s Supreme Court throw out that noble and constitutionally oriented mandate?

A specious distinction

The Supreme Court’s apparent willingness to treat the Federal Reserve as “special” while abandoning agencies like the MSPB rests on a distinction without a meaningful constitutional difference. Yes, the Federal Reserve sets monetary policy with profound economic consequences. But the MSPB’s work is no less vital to the functioning of our democracy.

Consider what happens when the MSPB loses its independence. Federal employees adjudicating veterans’ benefits claims, processing Social Security applications, inspecting food safety or enforcing environmental protections suddenly serve at the pleasure of the president. Career experts can be replaced by political loyalists. Decisions that should be based on law and evidence become subject to political calculation. The entire civil service — the apparatus that delivers services to millions of Americans — becomes a partisan weapon to be wielded by whichever party controls the White House.

This is not hypothetical. We have seen this movie before. The spoils system of the 19th century produced rampant corruption, incompetence and the wholesale replacement of experienced government workers after each election. The Pendleton Act of 1883 and subsequent civil service reforms were not partisan projects — they were recognition that effective governance requires a professional, merit-based workforce insulated from political pressure.

The real stakes

The Supreme Court’s willingness to carve out special protection for the Federal Reserve while abandoning the MSPB reveals a troubling hierarchy of values. Financial markets deserve stability and independence, but should the American public tolerate receiving partisan-based government services and protections?

Protecting the civil service is not some narrow special interest. It affects every American who depends on government services. It determines whether the Occupational Safety and Health Administration (OSHA) inspectors can enforce workplace safety rules without fear of being fired for citing politically connected companies. Whether Environmental Protection Agency scientists can publish findings inconvenient to the administration. Whether veterans’ benefits claims are decided on merit rather than political favor. Whether independent and oversight federal organizations can investigate law enforcement shootings in Minnesota without political interference.

Justice Brett Kavanaugh, during the Cook arguments, warned that allowing presidents to easily fire Federal Reserve governors based on “trivial or inconsequential or old allegations difficult to disprove” would “weaken if not shatter” the Fed’s independence. He’s right. But that logic applies with equal force to the MSPB. If presidents can fire MSPB members at will, they can install loyalists who will rubber-stamp politically motivated personnel actions, creating a chilling effect throughout the civil service.

What’s next

The Supreme Court has an opportunity to apply its principles consistently. If the Federal Reserve deserves independence to insulate monetary policy from short-term political pressure, then the MSPB deserves independence to insulate personnel decisions from political retaliation. If “for cause” removal protections serve an important constitutional function for financial regulators, they serve an equally important function for the guardians of civil service protections.

The court should reject the false distinction between agencies that protect Wall Street and agencies that protect workers. Both serve vital public functions. Both require independence to function properly. Both should be subject to the same constitutional analysis.

More fundamentally, the court must recognize that its removal cases are not merely abstract exercises in constitutional theory. They determine whether we will have a professional civil service or return to a patronage system. Whether government will be staffed by experts or political operatives. Whether the rule of law or the whim of the president will govern federal employment decisions.

A strong civil service is just as important to American democracy as an independent Federal Reserve. Both protect against the concentration of power. Both ensure that critical governmental functions are performed with expertise and integrity rather than political calculation. The Supreme Court’s jurisprudence should reflect that basic truth, not create an arbitrary hierarchy that privileges financial interests over the rights of workers and the integrity of government.

The court will issue its decisions over the next several months and when it does, it should remember that protecting democratic institutions is not a selective enterprise. The rule of law requires principles, not preferences. Because in the end, a government run on political loyalty instead of merit is far more dangerous than a fluctuating interest rate.

Raymond Limon retired after more than 30 years of federal service in 2025. He served in leadership roles at the Office of Personnel Management and the State Department and was the vice chairman of the Merit Systems Protections Board. He is now founder of Merit Services Advocates.

The post The Supreme Court’s dangerous double standard on independent agencies first appeared on Federal News Network.

© AP Photo/Julia Demaree Nikhinson

Pierre Rochard, CEO of The Bitcoin Bond Company, has formally requested that the Federal Reserve include Bitcoin as an explicit variable in its 2026 supervisory stress tests, arguing the asset’s extreme volatility and growing institutional adoption warrant standalone treatment in banking risk assessments.

The letter, submitted January 20 to the Federal Reserve Board, challenges the practice of grouping Bitcoin with other cryptocurrencies and proposes quantitative calibration based on the asset’s historical behavior dating back to 2015.

Rochard’s submission arrives as the US government navigates conflicting policies on Bitcoin holdings, amid recent confusion over whether forfeited assets from the Samourai Wallet case violated Executive Order 14233, which requires seized Bitcoin to be transferred to the Strategic Bitcoin Reserve rather than liquidated.

However, the Department of Justice later confirmed, through White House crypto advisor Patrick Witt, that the 57.5 BTC had “not been liquidated and will not be liquidated,” resolving speculation after blockchain analysts flagged a November transfer to a Coinbase Prime address.

It is in the United States national interest to become the Bitcoin Superpower.

— Pierre Rochard (@BitcoinPierre) January 20, 2026

To that end, the Federal Reserve should begin integrating bitcoin into its stress tests and scenarios.

I've sent in a comment letter explaining what I believe to be reasonable path forward. (1/3) pic.twitter.com/rDILZMpFv5

Rochard’s letter presents a detailed analysis showing Bitcoin’s 73.3% annualized realized volatility over the 2015-2026 sample period, compared to just 18.1% for the S&P 500 over the same timeframe.

The analysis documents a maximum drawdown of 83.8% from peak to trough, with daily return tails ranging from -10.0% at the 1st percentile to 10.7% at the 99th percentile, far exceeding typical asset behavior.

“Bitcoin’s risk profile is unusually idiosyncratic and materially non-linear: it has experienced repeated, deep peak-to-trough drawdowns and sustained periods of very high realized volatility,” Rochard wrote.

He argued these properties affect valuations, margin requirements, counterparty exposures, and liquidity demands “in ways that cannot be reliably inferred from other scenario variables.“

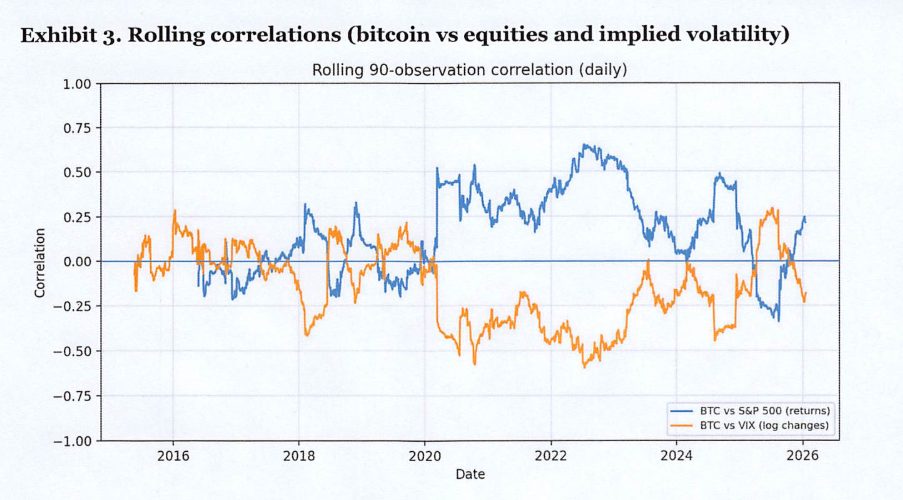

The submission includes rolling correlation analysis demonstrating Bitcoin’s unstable dependence structure with macro-financial variables, with correlation between Bitcoin and S&P 500 returns ranging from negative to strongly positive across 90-observation windows.

Rochard warned that “a fixed ‘beta’ mapping from equities (or risk sentiment) to bitcoin will understate risk in some regimes and overstate it in others,” making explicit scenario variables essential for consistent stress testing across banks.

Rochard recommends that the Federal Reserve provide quarterly Bitcoin price paths for baseline, adverse, and severely adverse scenarios, with optional daily paths for global-market-shock datasets.

He suggests three calibration methods:

“The calibration goal is not to forecast bitcoin, but to supply a consistent and severe, but plausible, path that stress tests can translate into market and counterparty outcomes,” Rochard explained.

He emphasized that firms without Bitcoin exposure could simply ignore the variable, while those with direct or indirect exposure would gain “transparency, reproducibility, and consistent scenario translation” rather than relying on inconsistent proxy assumptions.

The timing coincides with broader market stress, as Bitcoin plunged to $88,000 amid $1.07 billion in liquidations over 24 hours while gold surged past $4,800 per ounce.

The divergence has renewed debate over Bitcoin’s role as either a risk asset or a strategic reserve, particularly after President Trump’s threats to impose tariffs on Greenland triggered a flight from US assets.

CEO of Galaxy, Mike Novogratz, noted “the gold price is telling us we are losing reserve currency status at an accelerating rate,” adding that Bitcoin “is disappointing as it is still being met with selling.”

The gold price is telling us we are losing reserve currency status at an accelerating rate. The long bond selling off is not a good sign either. $BTC is disappointing as it is still being met with selling. I will reiterate it has to take out 100-103k to regain its upward…

— Mike Novogratz (@novogratz) January 20, 2026

The Federal Reserve’s comment period for the 2026 stress test scenarios closes February 21.

Senator Cynthia Lummis, who previously criticized potential government Bitcoin sales as squandering “strategic assets while other nations are accumulating bitcoin,” has proposed legislation to acquire up to 1 million Bitcoin over five years through budget-neutral methods, including tariff revenue and revalued gold reserves.

The post Bitcoin Advocate Urges Federal Reserve to Add BTC to Stress Tests appeared first on Cryptonews.

The broader crypto market is seeing an unexpected uptick, with the Bitcoin, Ethereum, and Dogecoin prices among the top coins recording gains. This sharp increase in value follows the release of US economic data, which indicates positive trends in unemployment and consumer spending. Additionally, potential regulatory changes stemming from a proposed bill are also fueling market momentum and boosting investor confidence across the sector.

After consolidating for days following their last rebounds, Bitcoin, Ethereum, and Dogecoin are surging again amid a series of recent US data reports. The US Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI) for all urban consumers earlier on Tuesday, January 13, covering December 2025.

The CPI report revealed that prices rose 0.3% on a seasonally adjusted basis last month, with the year-over-year all items index up 2.7% unadjustment. The shelter index increased 0.4% in December, making it the largest contributor to the overall rise. Meanwhile, food prices rose 0.7% both at home and away, and energy rose 0.3%. This increase in CPI data tends to affect cryptocurrency price movements, as moderate inflation often reduces fears of aggressive rate hikes by the US Federal Reserve (FED), encouraging investors to allocate funds to alternative stores of value like BTC and higher risk assets like ETH and DOGE.

In addition to the CPI data, the US jobs report, released on January 9, showed that 50,000 jobs were added in December 2025. Although this was below the revised 56,000 in November and lower than the initial forecast of 60,000, it was still a significant and positive result for investors. While changes in job reports do not directly affect cryptocurrency price action, they can influence investor sentiment by increasing the likelihood of an interest rate cut.

The crypto market has also been bullish ahead of the US Senate Banking Committee’s vote on the CLARITY Act on January 15, 2026. If passed, the bill is expected to provide clearer legal frameworks for digital assets in the US. Subsequently, the regulatory progress will reduce uncertainty and encourage more institutional participation in the crypto market.

Overall, the combination of the US CPI release, jobs report, and potential regulatory clarity is what’s driving the market. Traders are responding favorably to these developments, reflecting renewed optimism.

Fueled by positive economic data, Bitcoin’s price has increased by over 3% so far today, rising from around $91,000 to over $94,000 at the time of writing. CoinMarketCap data also shows that Ethereum has seen even stronger gains, surging more than 6% to trade above $3,300. Meanwhile, Dogecoin has risen by over 6%, reaching $0.148.

Spot Bitcoin exchange-traded funds listed in the US recorded a sharp revival in inflows on Wednesday, signalling renewed institutional engagement after weeks of uneven activity.

The move marked the strongest single-day intake in more than a month and coincided with shifting expectations around US monetary policy.

While Bitcoin’s price action remains constrained by heavy supply levels, ETF flows suggest investors are reassessing exposure through regulated products as macro conditions evolve.

US spot Bitcoin ETFs recorded $457 million in net inflows on Wednesday, their highest daily total since mid-November.

Fidelity’s Wise Origin Bitcoin Fund led the session, attracting roughly $391 million and accounting for the bulk of the inflows.

BlackRock’s iShares Bitcoin Trust followed with around $111 million, according to data from Farside Investors.

The latest intake pushed cumulative net inflows for US spot Bitcoin ETFs above $57 billion.

Total net assets climbed past $112 billion, equivalent to about 6.5% of Bitcoin’s total market capitalisation.

The figures underline the growing role ETFs play in shaping institutional access to Bitcoin exposure.

The inflow revival comes after a choppy period through November and early December, when ETF activity swung between modest inflows and sharp outflows.

That instability reflected cautious positioning amid uncertain price direction and tightening liquidity conditions.

The last time spot Bitcoin ETFs recorded inflows above $450 million was on November 11, when funds drew roughly $524 million in a single day.

The renewed activity suggests investors may be positioning earlier in anticipation of changing macro conditions, rather than responding to short-term price momentum.

ETF flows have increasingly become a barometer for how institutions interpret broader financial signals.

Macro expectations shifted further on Wednesday after US President Donald Trump said he plans to appoint a new Federal Reserve chair who strongly supports cutting interest rates.

Speaking during a national address marking the first year of his second term, Trump said he would announce a successor to current Fed Chair Jerome Powell early next year.

He added that all known finalists favour lower rates than current levels.

Lower interest rates are generally viewed as supportive for risk assets such as crypto, as they ease financial conditions and improve liquidity.

Against this backdrop, spot Bitcoin ETFs appear to be attracting capital as a relatively direct way to express macro-driven positioning.

Despite stronger ETF inflows, Bitcoin’s market structure remains under pressure.

The asset has returned to price levels last seen nearly a year ago, leaving a dense supply zone between $93,000 and $120,000 that continues to cap recovery attempts.

This has pushed the amount of Bitcoin held at a loss to around 6.7 million BTC, the highest level of the current cycle, according to Glassnode.

Glassnode data also points to fragile demand across both spot and derivatives markets.

Spot buying has been selective and short-lived, corporate treasury flows episodic, and futures positioning continues to de-risk rather than rebuild conviction.

Until sellers are absorbed above $95,000 or fresh liquidity enters the market, Bitcoin is likely to remain range-bound, with structural support forming near $81,000.

The post Spot Bitcoin ETF sees sharp inflow revival amid shifting US rate signals appeared first on CoinJournal.

Bitcoin Magazine

![]()

Bitcoin Price Fights For $90,000 Despite Fed Rate Cuts

The bitcoin price fell on Wednesday night into Thursday, even after the U.S. Federal Reserve lowered interest rates, as Fed Chair Jerome Powell signaled a cautious approach heading into 2026.

On Wednesday, the Fed cut its benchmark rate by 25 basis points to 3.50%–3.75%, a move widely expected by markets. However, the 9–3 split among Federal Open Market Committee (FOMC) members and Powell’s hawkish remarks during the press conference tempered investor enthusiasm for risk assets, including cryptocurrencies.

One official favored a deeper 50-basis-point cut, while two voted against any reduction.

The Bitcoin price briefly jumped over $94,000 but then dropped below $90,000 and stabilized around $89,730 at the time of writing.

Bitfinex analysts shared with Bitcoin Magazine that the Fed’s unexpectedly hawkish tone surprised markets, causing a price reversal and kept risk appetites in check.

The Fed’s updated “dot plot” shows little consensus for more than a single 25-basis-point cut in 2026, with stronger growth forecasts and shifting tax policy limiting near-term easing.

Timot Lamarre, director of market research at Unchained, wrote to Bitcoin Magazine that “

There is so much to be bullish about in the bitcoin space – from Square facilitating bitcoin payments to large institutions like Vanguard now allowing their clients access to bitcoin ETFs to quantitative tightening coming to an end.”

Lamarre said that bitcoin’s recent price movements show a gap between growing adoption and the price increase that usually comes with higher demand.

Bitcoin price’s recent pullback also reflects broader market concerns. Technology stocks, including Oracle, suffered after disappointing earnings and warnings about slower-than-expected AI-related profits.

Oracle shares fell 11% in after-hours trading following revenue and profit forecasts below analysts’ expectations.

The Fed’s outlook for 2026 suggests only one additional rate cut, fewer than markets had anticipated. Asian stock markets declined, and U.S. equity futures pointed lower, while European trading remained subdued.

Standard Chartered recently revised its year-end Bitcoin forecast, lowering its target from $200,000 to $100,000, citing a slowdown in corporate treasury buying and reliance on ETF inflows to support future price gains.

Bernstein analysts recently said that they see a structural shift in Bitcoin’s market cycle, meaning that the traditional four-year pattern has broken. They forecast an elongated bull cycle driven by steady institutional buying, which offsets retail selling, and minimal ETF outflows.

The bank raised its 2026 price target to $150,000 and expects the cycle to peak near $200,000 in 2027, maintaining a long-term 2033 target of roughly $1 million per BTC.

Meanwhile, JPMorgan remains bullish over the next year, projecting a gold-linked, volatility-adjusted Bitcoin target of $170,000 within six to twelve months, factoring in market fluctuations and mining costs.

Analysts say Bitcoin’s decline after the Fed announcement reflects a “sell the fact” dynamic. “The market had fully priced in the cut ahead of time,” said Tim Sun, senior researcher at HashKey Group. “Concerns over political and economic developments in 2026, combined with potential inflation from AI-driven capital expenditure, are weighing on risk sentiment.”

Last week, Bitcoin price saw a volatile ride, dipping to $84,000 before bulls pushed it up to $94,000, then dropping slightly below $88,000, and closing the week at $90,429.

The market now faces key support at $87,200 and $84,000, with deeper support zones around $72,000–$68,000 and $57,700.

Resistance levels stand at $94,000, $101,000, $104,000, and a thick zone between $107,000–$110,000, with momentum likely slowing above $96,000.

Typically, rate cuts lead to bullish momentum, but the market may have already priced in this month’s rate cut. The bitcoin price has fallen roughly 28% since its October all-time high.

At the time of publishing, the bitcoin price is at $90,114.

This post Bitcoin Price Fights For $90,000 Despite Fed Rate Cuts first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

![]()

Federal Reserve Cuts Interest Rates by 25 Basis Points

The Federal Reserve cut its benchmark interest rate by 25 basis points today, lowering the federal funds target range to 3.50%–3.75%. The move marked the central bank’s third rate cut of the year and its first since October.

The Federal Reserve said they made the cuts to support maximum employment and return inflation to 2%. Economic activity is expanding moderately, job gains have slowed, and inflation remains somewhat elevated, the Fed said.

Most officials voted for the cut, with three dissenting—one preferring a larger cut and two preferring no change. Policymakers said the decision reflects easing inflation pressures and a desire to support economic activity as growth moderates. The Fed had kept rates unchanged for several meetings after its October cut.

Fed officials also left their rate forecasts unchanged, signaling modest 25-basis-point cuts in 2026 and 2027, with expected 2026 unemployment at 4.4%, PCE inflation at 2.4% and GDP growth at 2.3%.

The 10-year Treasury yield has climbed this month even as expectations for a rate cut grew, signaling investor concern that easing policy now could reignite inflation and force rates higher later.

The Fed’s internal divisions add to that tension, as Jerome Powell heads up what is probably his final meeting as chair before President Trump names a successor, ending a tenure defined by consensus-building amid unusual discord.

Lower interest rates reduce borrowing costs for households and businesses. They can encourage spending, investment, and risk-taking across financial markets.

BREAKING:

— Bitcoin Magazine (@BitcoinMagazine) December 10, 2025Federal Reserve cuts interest rates by 25bps. pic.twitter.com/kiXG9hhVXM

Before these cuts, some said that inflation was easing, but regardless, the market widely expected a 25 basis-point rate cut.

At the same time, rate cuts can also signal concern about the economy’s trajectory.

In October, The Federal Reserve cut its benchmark interest rate by 25 basis points to a range of 3.75%–4% at its October meeting, following its previous cut in September. At the time, the Bitcoin price slipped from around $116,000 to lows of $111,000 that week.

Since then, Bitcoin has plunged to lows of $80,000.

Bitcoin’s response to rate cuts has varied in the past, with sharp volatility during the Fed’s emergency easing in 2020 and a more muted reaction to the September 2025 cut.

At the time, Chair Jerome Powell also signaled that the central bank is nearing the end of its quantitative tightening program, with balance-sheet runoff expected to stop by December. QT has been draining liquidity by allowing bonds to mature without reinvestment, pushing yields higher and tightening financial conditions.

At the time of writing, Bitcoin is showing lots of volatility and is trading near $92,500.

This post Federal Reserve Cuts Interest Rates by 25 Basis Points first appeared on Bitcoin Magazine and is written by Micah Zimmerman.