UK Crypto Ownership Takes Biggest Hit Since 2021, Regulator Says

According to new research commissioned by the Financial Conduct Authority, the share of UK adults who hold cryptocurrencies has fallen to 8% in 2025, down from 12% a year earlier.

Survey Shows Smaller Numbers Holding Crypto

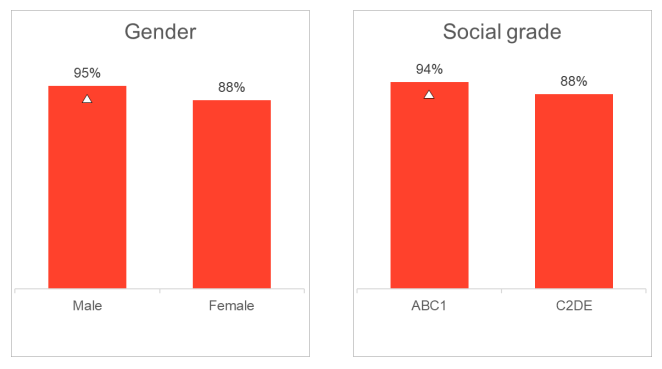

Fieldwork for the FCA study ran from 5th August to 2nd September 2025, using a YouGov online panel to collect a nationally representative sample of 2,353 interviews plus a boosted sample of people who own or previously owned crypto. Awareness of cryptocurrencies remains high at 91%, even as fewer people report owning them.

The drop marks the first fall in overall ownership in the last four years, although ownership is still about double the level recorded in 2021. That suggests some people who held small amounts have pulled back while a core of larger holders remains active.

Average Holdings Have Increased

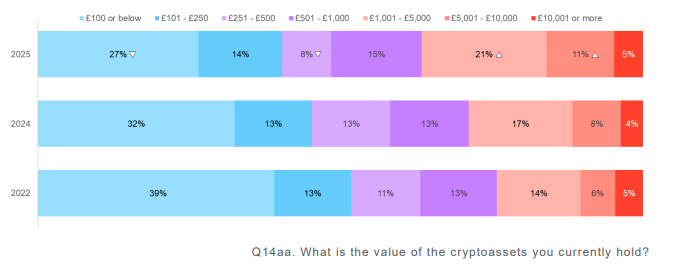

Reports have disclosed that the mix of holdings has shifted upward. The proportion of holders with crypto worth between £1,001 and £5,000 rose to over 20%, and those with holdings of £5,001 to £10,000 increased to around 10%.

At the same time, reported small holdings under £100 have declined. Many users also reported net gains in 2025, with a majority saying their portfolios rose in value over the year.

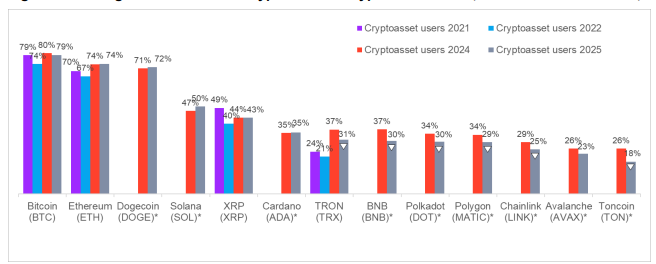

Among people who still hold crypto, Bitcoin is the most common asset at 57%, followed by Ether at 43%. Other tokens are far less widely held, though Solana registers with about 21% of holders. These figures point to concentration in a few large names even as overall participation shrinks.

The FCA published this research as part of a broader push to bring the sector under clearer rules. The regulator has launched consultations on proposals covering trading platforms, market safeguards and rules for staking, lending and custody. Reports show the consultation process is part of a wider government plan that aims to start formal regulation of cryptoassets by October 2027.

Traders and platforms will likely watch these trends closely. A smaller base of retail owners can mean less retail-driven volatility, but it can also reduce everyday familiarity with crypto in the wider public.

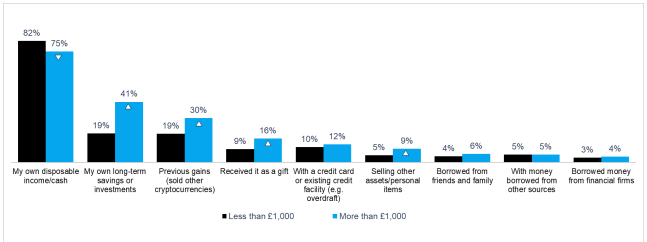

At the same time, higher average portfolio sizes raise the stakes for consumer losses when markets wobble. The FCA’s work on clearer rules comes amid growing government attention to market integrity and consumer protection.

In short, fewer Britons now report owning crypto, yet those who remain tend to hold larger sums and favor the top coins. The figures from the FCA suggest a market that is thinning at the edges while concentration and regulatory scrutiny rise.

Featured image from Unsplash, chart from TradingView