Binance Founder CZ Addresses Trump‑Related Controversy In Latest Statement

Binance founder and former CEO Changpeng Zhao (CZ) has pushed back against growing scrutiny surrounding his relationship with President Donald Trump, saying his ties to the president and his family have been widely misunderstood following Trump’s decision to grant him a pardon last year.

CZ Rejects Allegations Of Binance’s Political Links

Attention on Zhao intensified after President Trump issued a pardon in October 2025, a move that prompted renewed criticism from Democratic lawmakers and fueled questions about Binance’s alleged political and business connections.

Addressing the controversy in a recent interview with CNBC, Zhao said claims of a business relationship with the Trump family are inaccurate. “There’s no business relationship whatsoever,” Zhao stated. The former executive added that the narrative surrounding the pardon and Binance’s alleged ties to Trump had been “misconstrued.”

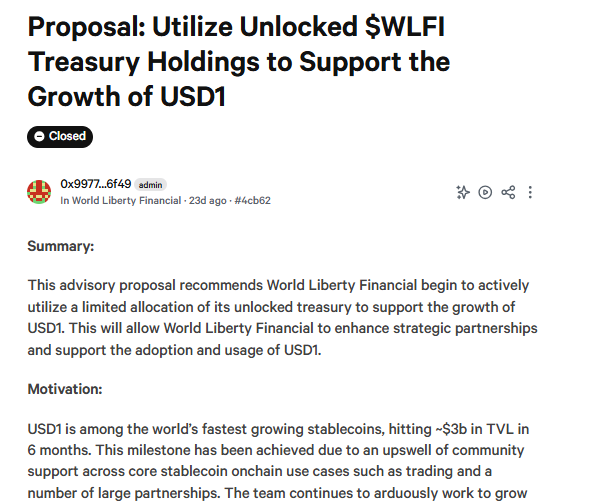

Much of the scrutiny centers on Binance’s connection to the Trump-linked decentralized finance (DeFi) venture World Liberty Financial (WLFI).

That connection traces back to a $2 billion investment made in March 2025 by MGX, a state‑owned firm based in Abu Dhabi, United Arab Emirates. MGX invested in Binance using USD1, a stablecoin created by World Liberty Financial.

Zhao emphasized that the payment method was chosen by the investor, not Binance. “MGX is the investor. They choose USD1,” he said. “My request to them was they pay us in crypto. I don’t want to deal with banks, really.”

According to Zhao, the use of the venture’s USD1 stablecoin has been wrongly interpreted as evidence of a deeper relationship. “Many people misconstrued that,” he added.

WLFI Push Back On Political Influence Claims

In a statement, WLFI spokesperson David Wachsman said the company played no role in the pardon process. “As we have stated many times, WLFI is not a political organization and had zero role in the pardon process,” Wachsman said. “To imply otherwise is dangerous and false.”

Trump himself downplayed any personal connection in a November interview with CBS’s 60 Minutes. “I have no idea who he is,” the president said of Zhao. Trump added that he had been told Zhao was “a victim, just like I was and just like many other people, of a vicious, horrible group of people in the Biden administration.”

Additional attention has focused on Binance’s lobbying efforts in Washington. NBC News reported during the week of the pardon that Binance had hired Checkmate Government Relations, a lobbying firm led by Charles McDowell, who is a friend of Donald Trump Jr.

According to disclosures, the firm was paid $450,000 to lobby the White House and the Treasury Department on matters including “executive relief” and digital asset‑related financial services policy.

Zhao denied that any lobbying effort was connected to his pardon. “There is a lot of media saying that there is some deal in place to get me the pardon,” he told CNBC in Davos. “As far as I know, that does not exist at all.”

Binance’s former CEO also said he has never spoken directly with President Trump. “The closest that I got to him was today when he was doing the Board of Peace session,” Zhao said. “I was in the audience, about 30 to 40 feet away from him.”

At the time of writing, Binance Coin (BNB) was trading at $893, having recorded a 4% drop over the previous week. However, it is one of the few cryptocurrencies to have retained gains year-to-date, with an increase of 30% in that time.

Featured image from OpenArt, chart from TradingView.com