Zcash price rise and fall explained by a 100-year market theory

Coinbase (COIN), the largest cryptocurrency exchange in the US, has experienced a significant decline in its stock valuation, dropping nearly 40% from its peak of $444 in July to its current trading level of around $271 per share. This, amid market fluctuations and heightened volatility in the broader crypto market, impacting the exchange’s stock performance.

Despite these challenges, analysts at Bernstein hold an optimistic outlook on Coinbase’s stock price, suggesting a potential new bullish phase that could propel COIN to surpass previous all-time highs and reach levels above $500.

Bernstein maintains a price target of $510 on Coinbase, underlining the exchange’s shift from a trading-centric platform to what analysts dub an emerging “everything exchange.”

Analysts led by Gautam Chhugani highlighted the delicate market conditions, citing crypto price fluctuations influencing listed crypto-exposed equities.

However, Bernstein distinguishes the current market environment from past crypto downturns, noting that speculative excess primarily affects what they refer to as “MSTR copycats,” referencing Strategy’s (previously MicroStrategy) stock performance.

Central to Bernstein’s bullish thesis is Coinbase’s strategic diversification away from volatile spot trading revenue. They assert that exchange is evolving into a comprehensive financial platform.

The analysts emphasize that clearer regulatory guidelines in the US could drive a revaluation of these business lines, bridging the gap with offshore competitors benefiting from faster token listings and fundraising fees.

Coinbase’s foray into token issuance through a launchpad-style model, exemplified by Monad’s (MON) recent listing, demonstrates growing market interest. Bernstein notes that these launches, directly influencing trading activity, can stimulate a cycle of issuance, listing, and heightened trading volume.

Looking ahead, one of the exchange’s most notable catalysts is the upcoming product showcase on December 17, anticipated to unveil developments in tokenized equities, prediction markets, and other tools expanding the exchange’s offerings beyond spot crypto trading.

The integration with Deribit is also expected to further bolster Coinbase’s derivatives expansion, positioning the exchange closer to platforms like Robinhood as both entities diversify their product offerings.

On the consumer front, the exchange’s Base app, focusing on wallet services, payments, and social features, acts as a centralized access point for the broader token markets, reaffirming the analysts’ bullish predictions.

Bernstein’s reaffirmed “Buy” rating on Coinbase with a massive $510 price target underscores the firm’s confidence in COIN’s growth trajectory. Monness Crespi’s recent upgrade from “Neutral” to “Buy” with a $375 target further adds to the bullish sentiment surrounding the stock’s valuation amid falling prices.

Featured image from DALL-E, chart from TradingView.com

The crypto market has dipped by 1.5% today, as investors remain nervous ahead of the Federal Reserve’s next FOMC meeting on Tuesday and Wednesday.

Bitcoin and Ethereum are down by just under 2% in 24 hours, while XRP and Solana have suffered falls of around 4%.

Yet the market’s total capitalization ($3.2 trillion) has risen by 5.5% since Tuesday and by 7% since November 23, as the mood warms after a period of AI-bubble-related fears.

Now may therefore be a very good time to buy again, just as coins begin regaining strength, but before they rise too much.

We’ve therefore picked the best altcoin to buy now, a new ERC-20 token called PEPENODE ($PEPENODE) that’s aiming to make mining much more accessible.

PEPENODE’s approach to mining is simple: give users the ability to build their own virtual mining rigs, which they can run in order to earn rewards in external tokens, such as Fartcoin and Pepe (it will add other coins in the future).

Upgrading Nodes is like leveling up in life.

— PEPENODE (@pepenode_io) December 5, 2025

Suddenly everything feels easier.https://t.co/FaKIaBpf4I pic.twitter.com/FHs8HwglBs

Users can build their rigs by spending PEPENODE tokens to buy more virtual nodes, which they can upgrade and combine in order to earn more mining rewards.

The more nodes they have and the more they’ve upgraded them, the more rewarding PEPENODE’s mining system will be for users.

This creates a huge incentive to acquire more PEPENODE, which users can also stake for a passive income, with its current APY at 570%.

Demand for the new token could therefore be substantial, pushing its price up over time.

What’s also attractive about PEPENODE’s mining system is its flexibility: users can make their mining rigs as large as they like, but they can also sell off their nodes if they wish to scale down.

Such features help to explain why the coin is already proving so popular, with its presale having raised $2.27 million.

This is a very positive figure for such a new token and offers some sign of its future potential.

Investors can tap into this future potential by going to the official PEPENODE website, where the coin is currently selling $0.0011778.

This price will rise later today and will continue to rise until the sale enters its final phase, just before PEPENODE lists.

Potential buyers should therefore act quickly, since the available signs suggest that PEPENODE has the potential to be one of 2026’s biggest new alts.

It will have a max supply of 210 billion PEPENODE, with allocations divided between node rewards, liquidity, development, marketing, and its treasury.

Its unique mining system is the main reason why it’s our best altcoin to buy now, and its upcoming launch could coincide with a major market recovery and rally.

Visit the Official Pepenode Website Here

The post Best Altcoin to Buy Now – 5 December appeared first on Cryptonews.

A prominent Cardano supporter just warned the community that the layer-2 scaling solution Hydra may not be as safe as they think. Are investors’ funds at risk, and does this justify a bearish Cardano price prediction?

If you want to use Hydra, you trust the operators of Hydra Head.

— Cardano YOD₳ (@JaromirTesar) December 4, 2025

You are only in control of your funds if you are one of the Hydra Head operators.

When you lock ADA into a Hydra Head, you sign a transaction with your private key. The transaction sends ADA into an on-chain… pic.twitter.com/hbh78guPLY

In a lengthy X post, a pseudonymous user named YODA, known for his support of the Cardano network for years, highlighted a potential flaw in the design of Hydra. This technical weakness would supposedly allow node operators to have a say on what happens with users’ tokens.

He clarified that the funds locked up in the L2 and delegated to third-party Hydra Heads (validators) are fully in control of the latter, not the owner.

In theory, if Hydra Heads collude and introduce false transactions, they would be able to sign them without necessarily having access to the private keys of the original owner of the ADA tokens.

“Every update requires signatures from all Hydra Head operators. Those signatures are made using the private keys of the operators, not the users,” YODA emphasized.

He added: “If they collude, they can ALL sign a malicious snapshot that splits all the funds between them.”

Aside from Dogecoin (DOGE), Cardano (ADA) has been one of the worst-performing top 10 tokens this year, with total losses now reaching 49%.

The daily chart shows that the token has found support temporarily at $0.40.

However, ADA has been on a strong downtrend and is not yet showing signs of a trend reversal. The price needs to climb above $0.52 to reverse this downtrend.

Otherwise, ADA may face a much more dramatic correction to $0.32, meaning a total downside risk of 25%.

Well-established tokens like ADA have struggled to reach higher highs during this cycle. However, a new crypto presale called Maxi Doge ($MAXI) has managed to raise over $4 million in just a few weeks to launch its community-centered meme coin.

Maxi Doge ($MAXI) is an Ethereum meme coin that aims to bring together an army of like-minded ‘degens’ who are not afraid to make YOLO trades to get out of mom’s basement.

Through fun competitions like Maxi Gains and Maxi Ripped, token holders will compete by showcasing their highest-yielding traders to earn rewards and bragging rights.

They also get exclusive access to a hub through which they can share ideas, insights, setups, and more.

This is a vibrant community that fully embraces the energy that comes with bull markets.

Finally, up to 25% of the presale’s proceeds will be used to invest in high-potential projects.

The gains will be used to fund the project’s marketing efforts to make $MAXI known.

To buy $MAXI before the presale ends, simply head to the official Maxi Doge website and link up a compatible wallet like Best Wallet.

Either swap USDT or ETH to get this token or use a bank card instead.

Visit the Official Maxi Doge Website HereThe post Cardano Price Prediction: Crypto Researcher Says New Hydra Upgrade Not 100% Secure – Could All Wallets Get Drained? appeared first on Cryptonews.

A cybersecurity firm just identified malicious code on the official Pepe website that could drain visitors’ wallets.

This development threatens to undermine investor trust and favors a bearish Pepe price prediction. But could it really go to zero?

According to Blockaid, a firm dedicated to detecting fraud in the crypto space, the site contains code known as “Inferno Drainer,” designed to immediately siphon funds from any connected wallet.

— Blockaid (@blockaid_) December 4, 2025

Blockaid's system has identified a front-end attack on @pepecoineth.

The sites contain a code of inferno drainer. pic.twitter.com/ugor0Um1jU

The firm told Cointelegraph: “Blockaid detected Inferno drainer code on the Pepe front end, matching a known drainer family we regularly identify.

This is a front-end compromise, where users are redirected to a fake site that injects malicious code to drain wallets.”

The site reportedly auto-downloads malicious code onto users’ computers or mobile phones, which will execute automatically.

Meme coins have experienced big losses in 2025 as the market has shunned this entire category despite the May-October altseason.

The token has lost more than three-quarters of its value since the start of the year. This reflects the market’s lack of appetite for PEPE.

The meme coin has temporarily found support at $0.0000040 following a robust jobs report in the United States. Although the Relative Strength Index (RSI) shows a mild bullish divergence, the price still needs to climb above $0.0000055 to reverse its latest downtrend.

PEPE may not hit zero after the news, as the website does not compromise the token’s smart contract.

However, the lack of coordination from the lead team does favor a bearish outlook as Pepe’s community engagement seems weak.

In contrast, a new crypto presale inspired by the Pepe viral meme called Pepenode ($PEPENODE) has managed to raise nearly $2.3 million to launch its fun mine-to-earn (M2E) game.

Crypto mining has commonly been associated with expensive hardware, complex algorithms, and so on.

Pepenode ($PEPENODE) is here to change that by introducing an M2E model that allows users to easily launch virtual mining servers.

By buying $PEPENODE, players can launch as many mining rigs as they want to earn points and compete to make it to the leaderboard.

Top miners receive airdrops of popular meme coins like Bonk ($BONK) and Fartcoin ($FARTCOIN) from the project’s rewards pool.

In addition, they can upgrade their setup to increase their output by investing additional $PEPENODE tokens. Up to 70% of the tokens used will be burned forever to reduce the circulating supply.

Mining has never been this easy, and the crypto community will soon start to notice. As such, the demand for $PEPENODE should skyrocket as more users join the platform.

To buy $PEPENODE at its presale price, simply head to the official Pepenode website and link up a compatible wallet (e.g. Best Wallet).

You can either swap USDT or ETH for this token or use a bank card to invest in seconds.

Visit the Official Pepenode Website HereThe post Pepe Price Prediction: Official PEPE Website Hacked and Infects Visitors With Malware – Is PEPE About to Go to Zero? appeared first on Cryptonews.

Brad Garlinghouse argues that Bitcoin has yet to realise its full bullishness this cycle, and with it, bullish XRP price predictions may still be on track.

Speaking at Binance Blockchain Week 2025, he dismissed the current bearish mood around crypto as temporary and completely out of sync with the fundamentals supporting the market.

2026 has the potential to be “the most bullish year in crypto yet,” with institutions paving the way for a $180,000 Bitcoin.

— Crypto Rover (@cryptorover) December 3, 2025

BREAKING:

RIPPLE $XRP CEO BRAD GARLINGHOUSE PREDICTS BITCOIN WILL HIT $180,000 BY THE END OF 2026. pic.twitter.com/uIRgKm7zIr

The pro-crypto regulatory shift in the U.S. has unlocked one-fifth of global GDP, with institutional-level demand only just being tapped into with the introduction of ETFs.

And they have only just permeated the mainstream with traditional asset manager giants outside of digital-native firms playing “catch-up,” introducing their vast clientele.

Garlinghouse rejects the idea that ETF demand has peaked, noting the few crypto offerings represent just 1–2% of all ETF assets, a tiny fraction that leaves enormous upside.

XRP is a standout beneficiary with steps towards regulation, like the GENIUS stablecoin Act, paving the way for its infrastructure, like stablecoins, to become mainstream.

Ripple’s stablecoin approvals in Abu Dhabi and Dubai reinforce that point; stablecoins are no longer experimental, they’re becoming embedded in real financial systems.

December is shaping a strong launchpad into 2026 with a strong confluence of support laying the groundwork for a 4-month descending channel breakout.

The lower boundary of this consolidation is about to be retested, aligning with the level that has provided a firm bottom market throughout the bullish phase of the market cycle at $1.90.

A strong technical setup for a launchpad, and momentum indicators could support it.

While its most recent attempt has ended in rejection, the RSI is now testing the 50 neutral line after weeks in deep oversold territory. Strength is building towards a bullish shift.

While the MACD verges on a death cross below the signal line, it may prove short-lived as XRP nears the confluence zone.

The key breakout threshold lies at $2.70, a former strong support level that recently flipped to resistance. Reclaiming this zone could confirm a breakout targeting an 80% upside move to $3.70.

And with further U.S. interest rate easing expected into and growing institutional involvement, the setup could extend much higher, eyeing $5 in the approach of past all-time highs for a 150% run.

With market conditions shaping up for a 2026 bull run, capital is rotating into the next high-upside contender, and increasingly, SUBBD ($SUBBD).

Positioned as an AI-powered content platform, SUBBD is redefining the $85 billion subscriber economy by giving creators true ownership and fans genuine access.

Never miss a sale again.

— SUBBD (@SUBBDofficial) March 26, 2025

As a top creator, your audience is global. It's just not possible to cater to everyone – you can't be online 24/7

That's where your personal AI Assistant comes in, to handle requests and secure payments. Sleep peacefully knowing you're making money… pic.twitter.com/ju9VjLBmea

By cutting out the middlemen, $SUBDD puts control back in the hands of those who create real value.

Creators can monetize directly, while fans gain access to exclusive content, early releases, and meaningful interactions through token-gated perks.

The concept is already gaining traction. $SUBBD nears $1.4 million in presale, as investors back the shift toward a decentralized creator economy.

With SUBBD, both sides of the community win — creators earn more, and fans get closer while embracing the decentralization use cases crypto was built for.

Visit the Official SUBBD Website HereThe post XRP Price Prediction: Ripple CEO Says Bitcoin Will Double by 2026 – How High Can XRP Go? appeared first on Cryptonews.

The newest iteration of Alibaba’s so-called “ChatGPT rival,” Qwen3-MAX, has rolled out fresh AI-driven price forecasts for XRP, Cardano, and Dogecoin as the month draws to a close. The model warns that all three cryptocurrencies could experience heightened turbulence over the coming weeks, with major moves possible in either direction.

Below are Qwen3-MAX’s two-track predictions showing both the potential upside and the risks each asset may face throughout December.

In its pessimistic projection, Alibaba’s model suggests Ripple’s XRP ($XRP) could retreat from its current $2.06 level to around $0.15, a drop of roughly 93%, should bearish sentiment continue dominating the market.

Such a correction would contrast sharply with XRP’s powerful performance earlier this year, when the token soared to a new seven-year high of $3.65 in July following Ripple’s pivotal legal win over the U.S. Securities and Exchange Commission.

Throughout most of 2025, XRP has hovered between $2 and $3. Its relative strength index (RSI) now sits at a neutral 37 and is downtrending as traders cash in on profits today from a brief price bounce yesterday.

However, Alibaba’s bullish outlook paints a very different picture, one in which XRP surges 385% to touch $10 before New Year’s Eve, almost tripling its all-time high.

The recent debut of nine U.S. spot XRP ETFs could fuel a wave of institutional interest this holiday season, echoing the early inflows seen when Bitcoin and Ethereum ETFs first launched.

More ETF approvals are anticipated in the coming months, increasing the probability that 2026 becomes a transformative year for XRP. Investors who accumulate now may find themselves well-positioned ahead of that shift.

Cardano ($ADA) remains one of the most academically rigorous and research-driven blockchain ecosystems. Launched by Ethereum co-founder Charles Hoskinson, the network prioritizes peer-reviewed development, security, scalability, and long-term sustainability.

With a market cap exceeding $15.6 billion and more than $189 million in TVL, Cardano continues to stand out among layer-1 networks thanks to its active development community and expanding suite of decentralized applications.

According to Alibaba AI, ADA could surge to approximately $10 by early 2026, an extraordinary 2,274% climb from its current price at $0.4212 and more than triple its 2021 peak of $3.09.

Analysts note that Cardano’s carefully paced upgrades and robust fundamentals could position it as a major winner in the next DeFi-centric bull cycle.

Still, Alibaba’s bearish prediction warns that ADA could slip toward $0.10 if macro weakness worsens, representing a downside of just over 76% from today’s price.

Dogecoin ($DOGE), initially created in 2013 as a parody of the crypto boom, now accounts for roughly $21.7 billion in market value, representing nearly half of the $45.8 billion meme-coin sector.

The token formed several bullish chart setups in late summer and early autumn, but momentum has since cooled. In Alibaba’s more negative scenario, DOGE could sink to $0.02, a drop of about 86% from its current price of $0.1387.

Dogecoin’s all-time high of $0.7316 came during the retail-driven mania of 2021, and its long-discussed $1 milestone remains elusive. Yet Alibaba’s bullish case suggests DOGE could actually rally 1,700% to $2.50, or 18x its current price.

Meanwhile, real-world adoption continues to grow: Tesla accepts DOGE for merchandise, and payment platforms including PayPal and Revolut support DOGE transactions.

While Alibaba AI highlights the upside potential for major blue-chip cryptocurrencies, early-stage presale tokens potentially deliver far larger percentage gains. One fast-growing contender is Maxi Doge ($MAXI), which has already brought in nearly $4.3 million as it positions itself as the next breakout Doge-themed meme coin.

MAXI’s narrative follows Maxi Doge, a canine crypto bro and degen distant relative to the original Dogecoin. Maxi is obsessed with lifting weights, trading meme coins with 1,000x leverage, and cultivating a degen community across social media to help him usurp Dogecoin’s throne.

As an ERC-20 token, MAXI benefits from Ethereum’s energy-efficient proof-of-stake network and its massive developer ecosystem, advantages that Dogecoin’s older Bitcoin-style proof-of-work consensus mechanism does not offer.

The ongoing presale includes staking rewards of up to 72% APY, although yields decrease as more participants join in.

MAXI is currently priced at $0.0002715 in its active presale phase, with automated price increases scheduled in upcoming rounds. Buyers can participate using MetaMask or Best Wallet.

Dogecoin stands no chance!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post China’s Alibaba AI Predicts the Price of XRP, Cardano, Dogecoin by the End of 2025 appeared first on Cryptonews.

The crypto market is bleeding as leveraged liquidations intensify, sending Bitcoin back below $90,000.

Analysts are warning that if bulls fail to defend the critical $84,000 support level, Bitcoin’s price prediction could tilt into a full-blown bear market.

Over the last four hours, more than $200 million in leveraged positions have been liquidated across the crypto market.

Bitcoin is down over 3%, while Ethereum has plunged over 4%. The bloodbath has wiped out over $100 billion in total market capitalization today.

— The market periodical (@tmp_periodical) December 5, 2025

BREAKING:

Crypto liquidations have resumed, sending Bitcoin back below $90,000.

Over the last 4 hours, more than $200 million in leveraged positions have been wiped out.

Volatility is back.pic.twitter.com/YCmzcQdkab

The carnage follows today’s massive options expiry event, which traders had been monitoring closely.

A staggering $3.357 billion worth of BTC options with a max pain point at $91,000 expired today, alongside $668 million worth of ETH options with a max pain at $3,050.

Prominent trader TraderThanos is leaning heavily bearish as the 5-day candle closes below $93,000.

“Maybe we get another retest of 93k-93.2k. That would align more perfectly with my current bias. The next leg down takes us to 76k,” he warned.

Thanos highlighted a critical technical breakdown: “This is the first time price is trading under those Moving Averages since June/July of 2023,” referring to the 100 EMA and 100 MA on the 5-day timeframe.

If price stays beneath these moving averages, he expects a drop to the $72,000-$76,000 range.

Adding to the bearish sentiment, the odds of Bitcoin hitting $80,000 by year-end have now surpassed 40% on Polymarket.

Bitcoin is trading below all major moving averages on the 4-hour chart, keeping the broader structure tilted bearish.

The 200-MA near $95,000 remains the key resistance that must be reclaimed to restore bullish momentum, but repeated rejections show sellers aggressively defending that zone.

Immediate support sits around $84,000, which stabilized the price during the last flush.

However, if Bitcoin fails to bounce strongly from this level, the broader corrective structure could extend toward deeper support near $76,000, where a more meaningful reversal becomes likely.

Bitcoin’s direction remains biased lower as long as it stays capped under $95,000.

A reclaim of that level would signal trend restoration, but until then, indicators point toward continued weakness.

As Bitcoin struggles, investors are turning to Bitcoin Hyper ($HYPER), a project working on bringing speed and affordability to Bitcoin’s blockchain for decentralized applications.

Built on Solana-based architecture, Bitcoin Hyper accelerates transaction speeds while slashing network fees.

This enables developers to deploy DeFi platforms, meme coins, and payment solutions that Bitcoin holders can access without abandoning the original blockchain.

The presale has raised over $29 million, with tokens priced at $0.013375 and strong institutional interest driving momentum.

Early investors can benefit from presale pricing at the current $0.013385 price, with some analyses suggesting potential 10-15X ROI by 2026.

To buy $HYPER at its discounted presale price, head to the official Bitcoin Hyper website and link your wallet, such as Best Wallet.

Then connect a wallet (Best Wallet, MetaMask, or Coinbase Wallet) and select payment (ETH, USDT, BNB, SOL, or USDC).You can also use a bank card for instant access.

Visit the Official Bitcoin Hyper Website HereThe post Bitcoin Price Prediction: $200M in Leveraged Liquidations Pushes BTC Under $90K — Can Bitcoin Avoid a Breakdown Below $84K? appeared first on Cryptonews.

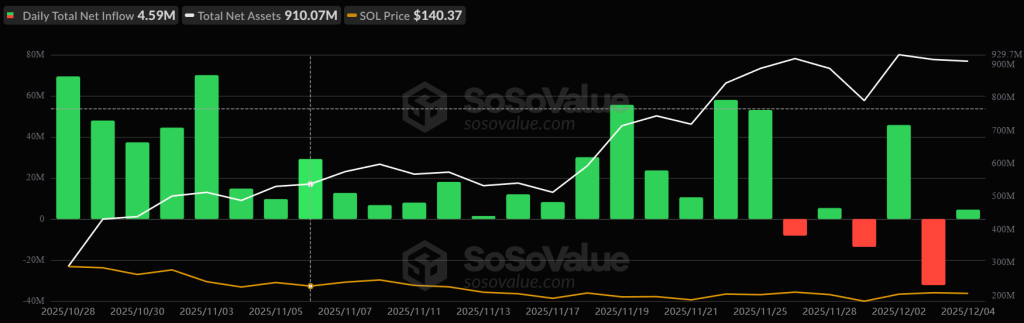

Institutions are jumping at the opportunity to gain exposure to SOL staking yields, contributing 3.1 million SOL in a testament to bullish Solana price predictions.

As the designated staking backend for institutional products, Staking service Marinade has seen its Total Value Locked (TVL) increase 3 fold to $436 million over November.

This adoption has been catalysed with the launch of several spot SOL staking ETFs as a regulated means to gain access to the altcoin’s yields.

Over November, these ETFs saw a 22-day inflow streak despite amounting to the second-worst month of the year. TradFi markets chose to buy the dip on SOL as other ETFs like Bitcoin bled.

Demand that only stands to grow with fresh touch points for institutional-grade exposure, like the recently unlocked 50 million clientele of the second-largest asset manager, Vanguard.

As the favored accumulation strategy over Bitcoin, Solana is in a favorable position to outperform the leading cryptocurrency if the bull run returns for 2026.

December is shaping a strong launchpad into 2026 as Solana forms a clean double-bottom pattern along a firm support throughout the bullish phase of this market cycle at $120.

And with momentum indicators verging on bullishness, the structure is acting as a clear bottom to the two-month Solana price decline.

While its most recent attempt has ended in rejection, the RSI is now testing the 50 neutral line after weeks in deep oversold territory. The MACD has also built a strong lead on the signal line.

Both suggest the early stages of a fresh uptrend as buyers step back in.

Still, the Solana price has faltered at the double-bottom neckline around $145, a level it must reclaim as support for the $210 target to play out.

Such a shift would set up a retest of the wider year-long descending-triangle resistance, creating a breakout scenario targeting levels near $500 for a potential 260% gain.

Though a near-term catalyst, such as a decision to ease U.S. interest rates next week, may be required to stimulate risk sentiment.

And with further macroeconomic easing expected through 2026 and growing institutional involvement, the setup could extend toward a much larger move, eyeing $ 1,000 for a 630% run.

Those who jumped to Solana as an alternative Layer 1 to the leading crypto may be forced to reconsider, as the Bitcoin ecosystem finally addresses its biggest limitation: ecosystem growth.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security and stability with Solana’s speed, creating a new Layer-2 network that unlocks scalable and efficient use cases Bitcoin couldn’t support alone.

The project has already raised over $30 million in presale, and post-launch, even a small share of Bitcoin’s trading volume could push its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have capped Bitcoin’s potential – just as the market turns bullish

Visit the Official Bitcoin Hyper Website HereThe post Solana Price Prediction: Institutions Pile In as Staking Hits 3.1M SOL – Could SOL Overtake Bitcoin in 2026? appeared first on Cryptonews.

Wall Street is preparing to welcome a major player to the New York Stock Exchange as Twenty One Capital moves toward its public debut.

This Bitcoin price prediction examines what the landmark listing could mean for BTC’s trajectory amid ongoing market volatility.

Bitcoin treasury firm Twenty One Capital, Inc., has received shareholder approval for its business combination with Cantor Equity Partners (CEP).

The transaction is expected to close around December 8, with the merged entity’s Class A common stock anticipated to begin trading on December 9 under the ticker symbol XXI.

“Game on. See you at the NYSE on Tuesday,” Twenty One CEO and co-founder Jack Mallers posted on X.

— Jack Mallers (@jackmallers) December 4, 2025

In July, Twenty One Capital announced it would hold about 43,500 BTC, currently worth approximately $4 billion, when it begins trading, following an addition of 5,800 BTC from stablecoin giant Tether.

This positions the firm as potentially the third-largest corporate Bitcoin holder, trailing only Strategy and Bitcoin miner MARA.

Twenty One, which was first announced in April, is a collaborative venture between Tether, Bitfinex, Cantor Fitzgerald, and SoftBank.

The company’s name refers to Bitcoin’s total possible supply of 21 million coins, with about 19.95 million BTC mined to date.

Bitcoin is showing signs of weakening after failing to break through the $94,000 rejection block, which has acted as a strong ceiling throughout the past month. The chart clearly shows a sequence of lower highs forming right beneath this level, indicating that sellers are still in control.

Even though price briefly formed a higher high on the most recent bounce, momentum quickly faded, and the market slipped back below the key mid-range structure.

The bullish double-bottom that launched the prior rally has now run into resistance strong enough to stall the trend, and the current lower-high structure points toward exhaustion on the buyer side.

If Bitcoin loses strength below $90,000, the next support sits around $87,000. However, the major downside target remains the liquidity pocket between $82,000 and $81,400.

Unless price reclaims $94,000 with conviction, the structure favors a downside sweep toward $81,000 before any meaningful rebound materializes.

As Bitcoin consolidates, Maxi Doge ($MAXI) is surging in popularity as an Ethereum-based meme coin fusing gym-bro culture with high-leverage futures trading utility.

Priced at just $0.0002715 in its ongoing presale, the token has raised over $4.2 million, drawing interest from whales amid Dogecoin’s momentum.

Audited by Coinsult and SOLIDProof, $MAXI enters its final presale stages with imminent price hikes before exchange listings.

To buy $MAXI at $0.0002715, visit the official presale site and connect an Ethereum-compatible wallet like Best Wallet.

You can pay using crypto or a bank card to complete the purchase in seconds.

The post Bitcoin Price Prediction: Wall Street to List $4 Billion Bitcoin Firm – How High Can BTC Go? appeared first on Cryptonews.

The Bureau of Economic Analysis released long-delayed September PCE inflation data showing headline PCE at 2.8% year-over-year, matching expectations and ticking up from 2.7% in August. Core PCE—the Fed’s preferred inflation gauge—improved to 2.8% from 2.9%, beating the 2.9% forecast.

Bitcoin held steady around $92,000 on the release, with the in-line data keeping December rate cut odds anchored at 86% for the Fed’s December 9-10 FOMC meeting.

The core PCE decline is encouraging for dovish policymakers, though the headline increase shows inflation remains above the Fed’s 2% target.

Coming on the heels of today’s shockingly strong jobless claims (191K vs 219K expected), the Fed faces conflicting signals—inflation cooling gradually but employment showing unexpected resilience.

Alternative data provider Truflation noted the disconnect between the delayed September official data and current conditions, reporting their real-time PCE at just 2.13% and core PCE at 2.6% using “millions of price data points from real purchases, as opposed to surveyed prices.”

BEA just released their September (!) PCE data.

— Truflation (@truflation) December 5, 2025

September PCE: 2.8% (previous 2.7%, expected 2.8%)

September Core PCE: 2.8% (previous 2.9%, expected 2.9%)

Meanwhile, Truflation has been reporting daily PCE data using independent data sources:

Truflation PCE today: 2.13%… pic.twitter.com/aGGWfitx6i

The gap highlights the challenge facing Fed Chair Powell—September’s data is already two months old, collected before the government shutdown, and may not reflect current economic conditions.

Markets are now weighing whether improving core inflation (2.8% vs 2.9%) combined with QT that ended December 1 justifies a rate cut, or whether today’s robust labor market data (191K jobless claims, lowest since 2022) argues for patience.

Bitcoin’s muted reaction suggests crypto traders are taking a wait-and-see approach into next week’s blackout period before the December 9-10 Fed meeting.

The technical setup shows resistance at $93,000 and the descending trendline that’s capped rallies since November 11, with support holding at $92,000.

The total crypto market cap sits at $3.1 trillion as traders weigh whether the combination of cooling core inflation and strong employment creates the “goldilocks” scenario for risk assets, or whether the Fed interprets resilient labor markets as justification to pause easing.

With core PCE moving in the right direction but still 80 basis points above target, the December rate cut remains probable but not guaranteed—especially if policymakers view today’s 191K jobless claims as evidence the economy doesn’t need additional stimulus.

The post [LIVE] Bitcoin Price Watch: September PCE Inflation Hits 2.8% as Expected—Will Fed Cut Rates in December? appeared first on Cryptonews.

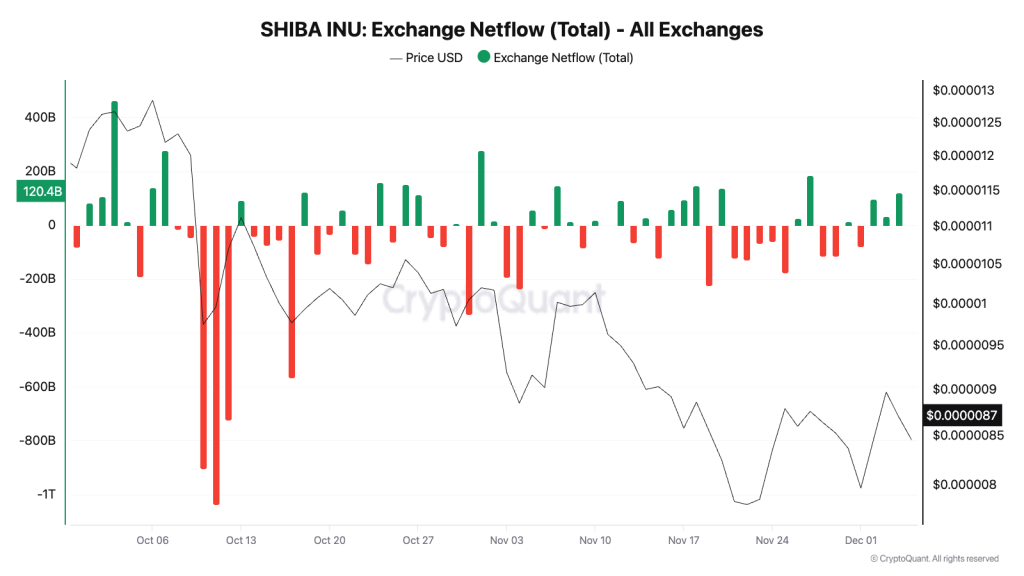

A mysterious wallet linked to a whale has been consistently withdrawing SHIB from Coinbase into a fresh, clean address. By the end of the accumulation streak, the wallet held 169.13 billion SHIB, worth about 1.49 million dollars at current prices.

Arkham data shows the wallet received six transactions from the same Coinbase hot wallet, all within a 24-hour window. The sizes vary from 11 billion SHIB to 81 billion SHIB, which makes it clear this was intentional accumulation, not random buying.

The wallet has not sent anything out, and whales of this size usually try to hide their moves, so this one is surprisingly obvious.

This is a repetitive pattern, looking at the exchange netflow chart from CryptoQuant, SHIB flows to exchanges have mostly been negative, which signals accumulation. Even so, the price has continued to trend lower over the last three months since the memecoin market has not been in great shape.

Memecoins plunged to their lowest valuation of 2025, dropping to a combined market cap of 39.4 billion dollars, according to CoinMarketCap data.

However, the sector is starting to show signs of life again. Memecoins added more than 4 billion dollars in market cap over the last three days of December. Even with that bounce, the total is still about 10% lower than last month.

That tells you how much interest has faded. The clearest proof is trading volume, which has collapsed more than 54% month over month.

Shiba, of course, was hit by the same decline, since it is one of the leaders in the memecoin market. The team is planning a privacy upgrade using fully homomorphic encryption on its Shibarium layer 2 network in 2026. This upgrade could help increase demand for the coin.

SHIB is currently sitting at 0.0000084, the same level it previously bounced from before rallying to the 0.000009 resistance. Bulls need to defend this area again, and if they manage to hold it, a retest of that first resistance is back on the table.

If this level fails, the price could drop toward the demand zone, which is a key support area. It is a must-hold zone because losing it would open the door for SHIB to print new lows before 2026.

The RSI is sitting around 43 and trending toward oversold territory, which could support a short-term bearish move if momentum continues to weaken.

The broader memecoin sector is still crawling out of its lowest valuation of 2025. Volume is down, sentiment is weak, and most of the big names are still stuck in heavy downtrends.

That is exactly the kind of environment where new projects with actual momentum sneak in and steal the spotlight. PepeNode is doing precisely that.

With 2.20 million dollars raised already and an insane 570% APY, the project is positioning itself as one of the few memecoins showing real traction while the rest of the market sleeps. Investors hunting for early-cycle opportunities are piling in quietly, hoping to catch the rotation before it becomes obvious.

Unlike most meme plays that rely on hype spikes, PepeNode is building around staking incentives that keep holders locked in. High APY rewards reduce selling pressure, tighten supply, and let momentum build internally even when the broader market is flat.

If memecoins truly wake up in early 2026, the projects that built a base during the dead period tend to outperform everything else on the way up. PepeNode is setting itself up to be one of those.

Visit the Official Pepenode Website HereThe post Shiba Inu Price Prediction: Mysterious Whale Empties Coinbase Wallet – Massive Bull Market About to Start? appeared first on Cryptonews.