CZ’s YZi Labs in Boardroom Coup Bid for World’s Largest BNB Treasury

CEA Industries Inc. (NASDAQ: BNC), the company that only months ago was promoted as the largest publicly traded BNB treasury in the United States, is now at the center of an escalating governance battle after Changpeng “CZ” Zhao’s YZi Labs filed a sweeping consent solicitation with the U.S. Securities and Exchange Commission.

The filing marks a direct attempt to overhaul the company’s board, unwind recent bylaw changes, and install new leadership at a firm that has seen its share price collapse despite holding one of the largest institutional BNB positions on record.

YZi Labs Moves to Replace BNC Directors After Months of Governance Disputes

The preliminary Schedule 14A, submitted Monday, asks BNC shareholders to approve expanding the board of directors, repealing any amendments made after July, and electing a new slate of directors nominated by YZi Labs.

The filing includes a white consent card allowing shareholders to formally support or reject the proposals.

If a majority of outstanding shares consent, YZi Labs would gain the ability to restructure the board through written authorization without the need for a shareholder meeting.

YZi Labs, which holds roughly 5% of BNC’s outstanding shares, argued in its statement that the current board has failed to provide timely disclosures, execute on corporate actions, or maintain basic investor communications.

The firm said BNC shareholders “deserve a well-functioning board” and warned that failure to act would lead to “further destruction of shareholder value.”

The consent solicitation follows months of tension between the two sides, documented through repeated requests for information and governance concerns raised by YZi Labs.

The dispute intensified after CEA Industries’ $500 million PIPE financing in August, which funded the company’s transformation into a BNB-focused digital asset treasury.

— Cryptonews.com (@cryptonews) July 10, 2025

@10XCapitalUSA launches $BNB treasury company backed by @YZiLabs targeting US public listing as corporate adoption explodes beyond Bitcoin-only strategies into BNB ecosystem.#BNB #Treasuryhttps://t.co/OaYEWjhoGV

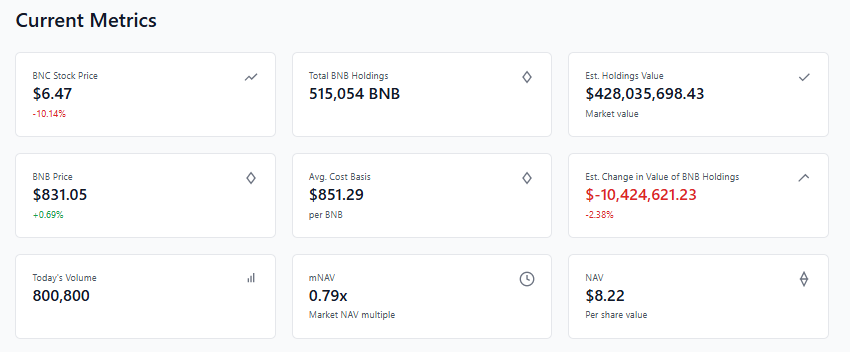

Shares soared more than 600% in July as the treasury strategy was announced, but the company’s stock has since fallen over 92%, closing recently at around $6.47, even as BNB itself reached a record high above $1,300 in October before retreating to the $820 range.

— Cryptonews.com (@cryptonews) October 10, 2025

BNB Hits Second ATH This Month, Crosses $1,300 Barrier

Binance Coin (BNB) surged past $1,300 on October 6, 2025, marking its second all-time high within hours after initially breaking $1,200 earlier in the day, as the token flipped XRP to become the third-largest…

BNC’s reported net asset value stands at $8.09 per share, pushing the stock’s mNAV multiple down to roughly 0.8×.

Filing Accuses CEA Industries of Operational Lapses and Leadership Conflicts

YZi Labs’ filing lists a range of operational failures, including delays in filing registration documents for an at-the-market offering, a lack of investor updates, and an unfinished investor relations website months after the PIPE.

It also says the company provided no regular reporting on net asset value, BNB yield, or accumulation rates.

The group raised further concerns over branding confusion, with the company switching between “CEA Industries” and “BNB Network Company” without clear guidance to investors.

The filing also cites potential conflicts of interest within the leadership structure. CEO David Namdar, director Hans Thomas, and former 10X Capital executive Russell Read all have ties to 10X Capital, the firm responsible for managing BNC’s digital asset treasury.

According to YZi Labs, Namdar and Thomas took part in discussions promoting other crypto treasury ventures while leading BNC, prompting questions about their focus and independence.

The firm said it repeatedly sought clarity on executive employment terms and management fees but did not receive responses.

The battle comes as CEA Industries holds one of the world’s largest disclosed BNB treasuries, with approximately 480,000 to 515,000 BNB accumulated at an average cost near $851 per token.

At recent prices, the holdings are valued around $412 million, alongside $77.5 million in cash.

The company has previously stated its goal is to accumulate 1% of BNB’s total supply by the end of 2025.

The names of YZi Labs’ proposed director nominees remain redacted in the preliminary filing. CEA Industries has not yet issued a public response to the consent solicitation.

The post CZ’s YZi Labs in Boardroom Coup Bid for World’s Largest BNB Treasury appeared first on Cryptonews.