Solana Price Could Crash Below $5 – The Document That Has Taken The Community By Storm

A crypto analyst has issued a stark warning to the SOL community, predicting that the Solana price could crash below $5. The expert’s bearish thesis is based on an extensive review of US federal court documents, suggesting that ongoing legal challenges and potential flaws in the Solana blockchain could lead to the end of the cryptocurrency.

Analyst Predicts Solana Price Crash And Annihilation

A crypto analyst who calls himself ‘NoLimit’ on X has released a report that has sent shockwaves through the Solana community. He shared court documents suggesting SOL could be nearing its end, with a potential price drop below $5 over the next two years. Currently trading at $122, this would represent a staggering 95.9% decline.

In his post, NoLimit revealed that he had spent more than 12 hours analyzing court documents, claiming that the findings are highly concerning to Solana. The report highlights recent developments in a US federal court where a second amended class action complaint has been allowed to proceed.

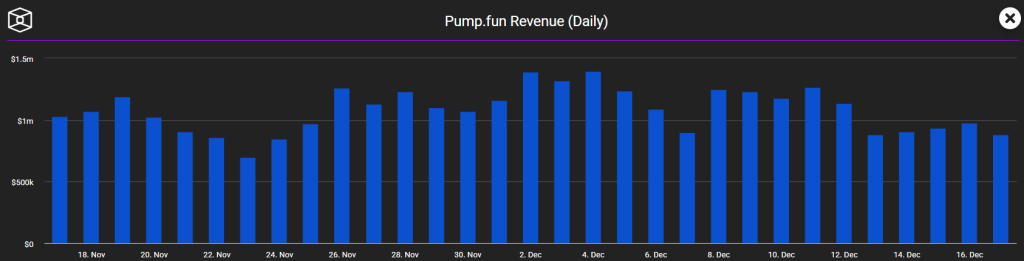

The analyst noted that the lawsuit involved Pump.fun, Solana Labs, and several other entities linked to the Solana ecosystem. He stated that the court’s decision to proceed shows there is enough evidence to pursue legal actions, putting SOL’s operations under significant scrutiny.

The allegations focus on insiders seemingly gaining unfair advantages during meme coin launches. According to NoLimit, Plaintiffs claimed that Solana’s validator system and transaction-priority tools allowed certain players to buy tokens faster and cheaper. At the same time, retail investors were left at a disadvantage as prices exploded and collapsed minutes or seconds later. The analyst notes that many investors had experienced this same issue on Pump.fun.

NoLimit disclosed that the lawsuit contends these outcomes, in which insiders sell for profit and retail loses everything, were not accidental but rather a result of the system. The complaint directly ties the alleged insider behavior to SOL, not just to the apps built on the blockchain. If this argument gains legal traction, the analyst notes that it could position the crypto network as a platform for risky coin launches, a host for bad actors, and a contributor to potential market manipulation.

NoLimit also warns that if regulators or courts determine that these meme coin launches operate like unregistered securities or that Solana’s infrastructure enabled unfair access, the chain’s core narrative of being fast, cheap, and permissionless could become a liability. Such a development could scare off institutional investors and large-scale funds, possibly leading to the end of Solana.

Solana Legal Troubles Put Market Trust At Risk

NoLimit warns that the most alarming part of Solana’s present legal issues is the potential impact on institutional confidence. According to him, nearly half of SOL’s circulating supply is controlled by ecosystem-linked institutions, insiders, early investors, VCs, and foundations. He emphasized that a mass sell-off from these holders could trigger a severe market reaction.

The analyst highlighted that the key concern is what could happen if trust in SOL collapses. He stated that in crypto markets, trust drives prices, not fundamentals, and when it breaks, crashes can be substantial. Past cases like FTX, Luna, and Celsius show how quickly liquidity can disappear and valuations can plummet.