Bitcoin Whales Are Back: 104K BTC Added As $1M Transfers Surge

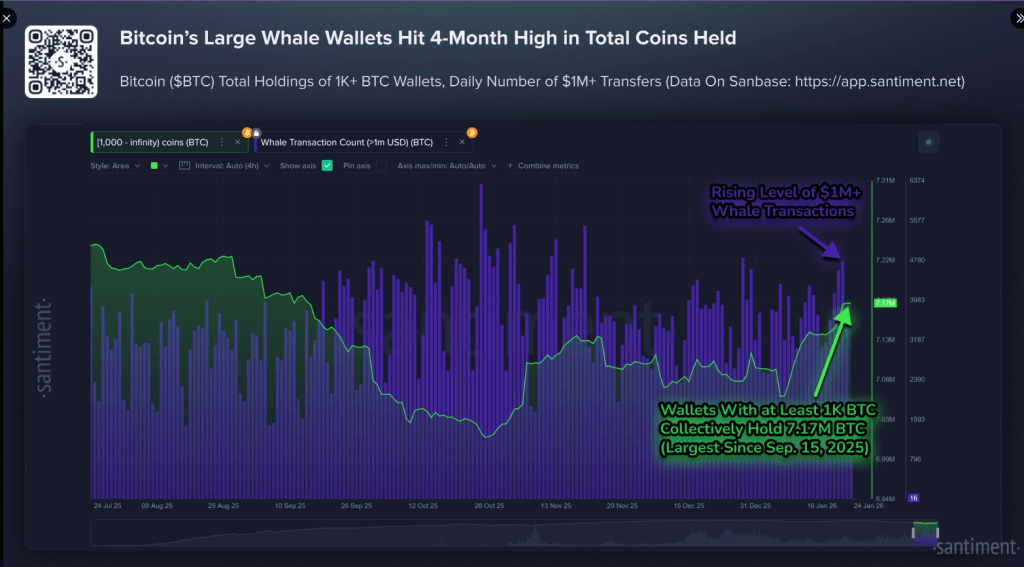

Whale-sized Bitcoin holders are piling up more coins even as prices wobble. According to blockchain tracker Santiment, wallets holding at least 1,000 BTC added 104,340 BTC in recent weeks.

Reports note that total supply held by these large wallets hit 7.17 million BTC, the highest level since September 15, 2025. Mid-sized holders joined in too, adding roughly $3.21 billion worth of Bitcoin between January 10 and January 19. Small retail wallets moved the other way, offloading about 132 BTC, worth around $11.66 million.

Whales Push Their Stakes Higher

The numbers point to patient buying by big players. Large transfers of $1 million or more have climbed to a two-month high, which suggests heavy participants are active on the network again.

According to Santiment, this kind of flow is often tied to institutions and wealthy investors moving coins between custody, exchanges, and private wallets.

Some of those moves are driven by strategic choices; some are meant to secure holdings. Either way, a growing pile in whale hands changes where supply sits.

Smaller holders are stepping back, while the so-called smart money increases exposure. Reports say mid-sized wallets — those holding between 10 and 10,000 BTC — were net buyers in the same stretch.

Large Bitcoin whales are accumulating at an encouraging pace, wallets with at least 1K $BTC have collectively accumulated 104,340 more coins (a +1.5% rise). Additionally, the amount of $1M+ daily transfers is back up to 2-month high levels.

Chart: https://t.co/CJOfiOBbWU pic.twitter.com/4loxDFtUdb

— Santiment (@santimentfeed) January 25, 2026

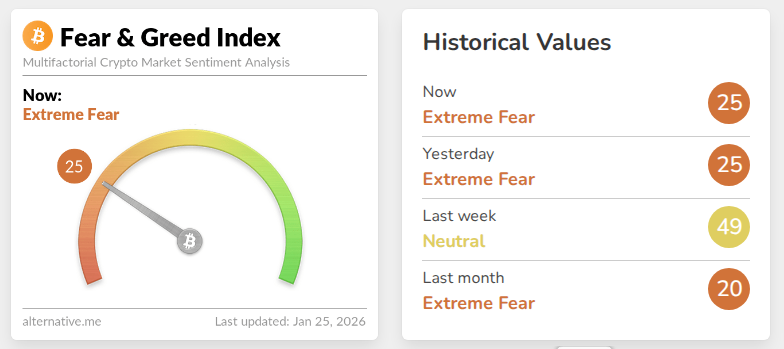

Bitcoin’s price has not matched the upbeat on-chain action. Trading was around $87,730 at one point, with intraday swings between $86,500 and $87,500.

The alpha crypto asset was down about 0.5% over 24 hours and roughly 5.4% over the prior week. Volumes have ticked up, though, which makes the case that some investors are stepping in at these levels.

The picture is mixed: on-chain accumulation suggests a base is being formed, but macro headlines keep the market on edge.

A growing stash by big holders can support a future rally if external stress eases. Yet prices move on more than Bitcoin flows. Large transfers and rising accumulation mean demand exists under the surface, but that demand has yet to fully push the market higher.

Macro Risks And Market JittersGeopolitical worries are casting a long shadow. Reports say US President Donald Trump has moved warships toward areas of tension, and prediction markets show a significant chance that the US could strike Iran by June.

Trade friction with Canada over recent auto rules has raised fresh political noise, and Polymarket shows the probability of a US government shutdown above 70%. These are real risks that can lift oil, rattle markets, and sap appetite for risk assets.

Featured image from Unsplash, chart from TradingView

BNB (@cz_binance)

BNB (@cz_binance)

En primicia, Valora Analitik conoció que Protección se prepara para lanzar desde Colombia un fondo con exposición a Bitcoin. El producto no estará enfocado en la especulación de corto plazo, sino en ampliar las opciones de diversificación con una gestión integral de riesgos y…

En primicia, Valora Analitik conoció que Protección se prepara para lanzar desde Colombia un fondo con exposición a Bitcoin. El producto no estará enfocado en la especulación de corto plazo, sino en ampliar las opciones de diversificación con una gestión integral de riesgos y…

(@DonWedge)

(@DonWedge)

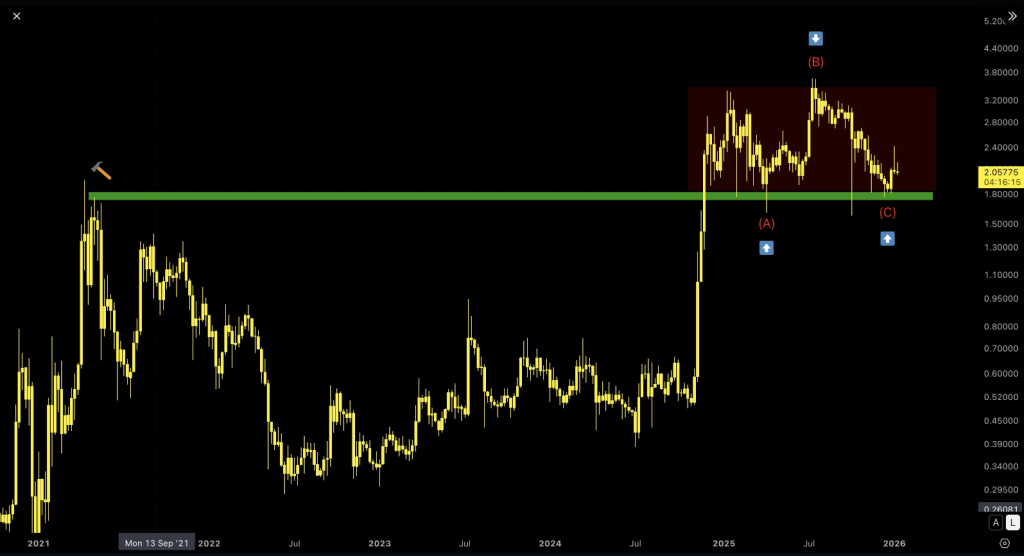

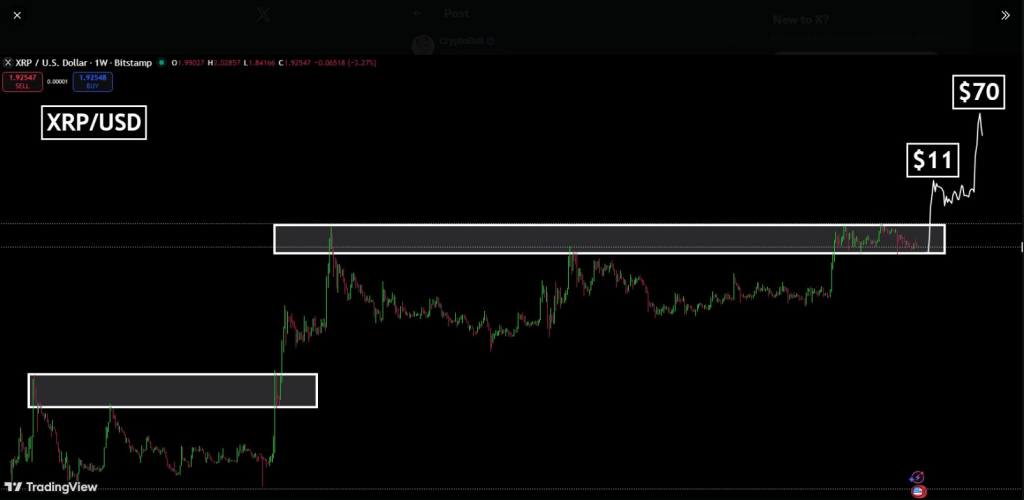

ChartNerd

ChartNerd  (@ChartNerdTA)

(@ChartNerdTA)