The difficulty of driving an EV in the “most beautiful race in the world”

On the first day of this year’s Mille Miglia, a voice rose from the crowds gathered on the shore of Lago di Garda to shout “no sound, no feeling!”at my Polestar 3. Italians love their cars, and they revealed a clear preference for internal combustion engines over the next four days and over 1,200 km of driving. But plenty of other spectators smiled and waved, and some even did a double-take at seeing an electric vehicle amid the sea of modern Ferraris and world-class vintage racers taking on this modern regulation rally.

I flew to Italy to join the Mille Miglia “Green,” which, for the past five years, has sought to raise awareness of sustainability and electric cars amid this famous (some might say infamous) race. And despite mixed reactions from the Italian crowds, our Polestar 3 performed quite well as it traced a historical route from Brescia to Rome and back.

The route snaked a trail through the Italian countryside based on the original speed race’s first 12 outings, but instead of going for overall pace, we spent five days competing against six other EVs for points based on time, distance, and average speed. Our team included a Polestar 2 and 4, and we faced a Mercedes-Benz G 580 with EQ Technology, an Abarth 600e, a Lotus Eletre, and a BYD Denza Z9GT saloon.

© Polestar

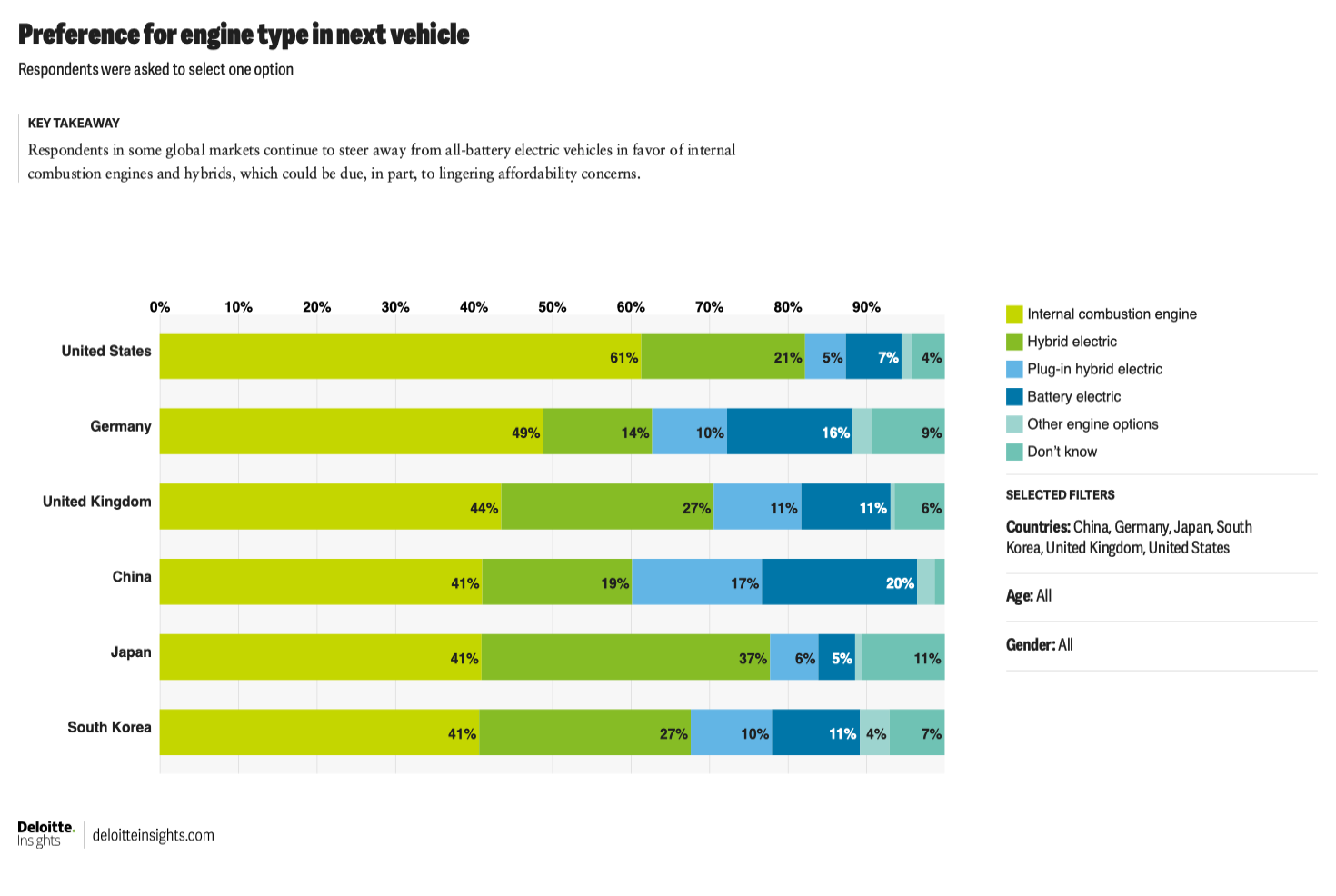

A graph showing preference for engine type in car buyers' next vehicle.

Credit:

Deloitte

A graph showing preference for engine type in car buyers' next vehicle.

Credit:

Deloitte