Why Is Crypto Down Today? – January 26, 2026

The crypto market is down today again. The cryptocurrency market capitalisation decreased by 0.8% over the past 24 hours, now standing at $3.05 trillion. At the time of writing, 93 of the top 100 coins recorded price drops. The total crypto trading volume stands at $139 billion.

Crypto Winners & Losers

We started the new week very much in the red. As of Monday morning (UTC), all top 10 coins per market capitalisation have posted price drops over the past 24 hours.

Bitcoin (BTC) fell by 0.7%, currently trading at $87,860. This is the smallest drop on the list,

Ethereum (ETH) decreased by 1.5%, changing hands at $2,892.

The highest fall among the top 10 is Solana (SOL)’s 3.3% to the price of $122.

It’s followed by Dogecoin (DOGE)’s drop of 1.6%, now trading at $0.1213.

At the same time, Tron (TRX) fell the least: 0.4% to $0.2953.

Moreover, of the top 100 coins per market cap, 93 have seen their price drop today.

MYX Finance (MYX) fell the most. It’s down 14%, now trading at $5.86.

Monero (XMR) follows, with a decrease of 5.4%, currently standing at $466.

Of the green coins, River (RIVER) stands at the top, having jumped by 43% to the price of $84.7.

The next on the list is Algorand (ALGO), which saw an increase of 2.3% to $0.1189.

The rest are up 1.3% and less per coin.

Macro uncertainty triggered over $550 million in crypto liquidations as BTC and ETH came under pressure.

QCP analysis notes that crypto assets traded in a narrow range over the weekend before coming under pressure in early Asian hours, triggering over $550 million in leveraged long liquidations. BTC briefly tested $86K before finding support, while Ethereum fell to the $2,785 area.…

— Wu Blockchain (@WuBlockchain) January 26, 2026

Meanwhile, the UK’s Financial Conduct Authority (FCA) moved into the final stage of consultations on a set of proposed crypto regulations. The FCA said it is seeking feedback on 10 proposed rules, describing this as the “final step” in the consultation process.

“These proposals continue our progress towards an open, sustainable and competitive crypto market that people can trust,” the regulator said.

— Ryan (King) Solomon (@IOV_OWL) January 23, 2026

BREAKING: The UK Just Moved to Fully Integrate Crypto Firms Into the FCA Rulebook pic.twitter.com/mGBJ61hLLB

BTC May See Belated Reaction

Gadi Chait, Investment Manager at Xapo Bank, commented that recent weakness in Bitcoin follows a brief recovery last week, “set against a backdrop of macroeconomic developments that have influenced risk assets broadly.”

A convergence of factors drives volatility across markets. These include heightened geopolitical tensions and ongoing conflicts. Renewed focus on US strategic positioning toward Greenland and Donald Trump’s address at Davos “added to an already unsettled global environment.”

Regulatory uncertainty, especially in the US, and macroeconomic pressures add to this. “Central bank policy divergence, including expectations around further tightening by the Bank of Japan and the continued reduction of liquidity by the US Federal Reserve, continues to shape market behaviour.”

Chait says that, “amid this uncertainty, traditional commodities have rallied, while Bitcoin has underperformed. The reasons for this divergence are not yet clear, though such sequencing across asset classes is not without precedent.”

“It remains possible that Bitcoin’s response emerges later, particularly as volatility subsides. For long-term participants, however, short- to medium-term price fluctuations remain a familiar feature rather than a signal of impaired fundamentals,” Chait concluded.

Moreover, Petr Kozyakov, Co-Founder and CEO at Mercuryo, argued that as a speculative asset, BTC has come under sustained selling pressure, and altcoins have followed suit.

“While the fortunes of the digital asset space will always be viewed through a lens fixated on token prices, the bigger picture is one of continued stablecoin adoption and the steady development of payment infrastructure,” he says.

He continues: “The evolution of the digital token space is being driven by merger and acquisition activity, alongside the inherent efficiencies of blockchain-based technology and its ability to operate around the clock, at speed and at lower cost.”

“This reality is increasingly unavoidable for financial institutions still reliant on technology that dates back to the 1960s. Away from daily price movements, a quiet revolution is most definitely afoot,” Kozyakov concluded.

Levels & Events to Watch Next

At the time of writing on Monday morning, BTC was changing hands at $87,860. While the coin begun the day at the intraday high of $88,800, it relatively swiftly dropped to the low of $86,126. It has recovered somewhat since.

Over the past seven days, BTC decreased by 5.1%, trading in the $86,319–$93,252 range. It’s now 30% away from its all-time high of $126,080.

Failing to hold the current level risks additional pullbacks towards the $85,000 level, followed by $84,300 and $83,800.

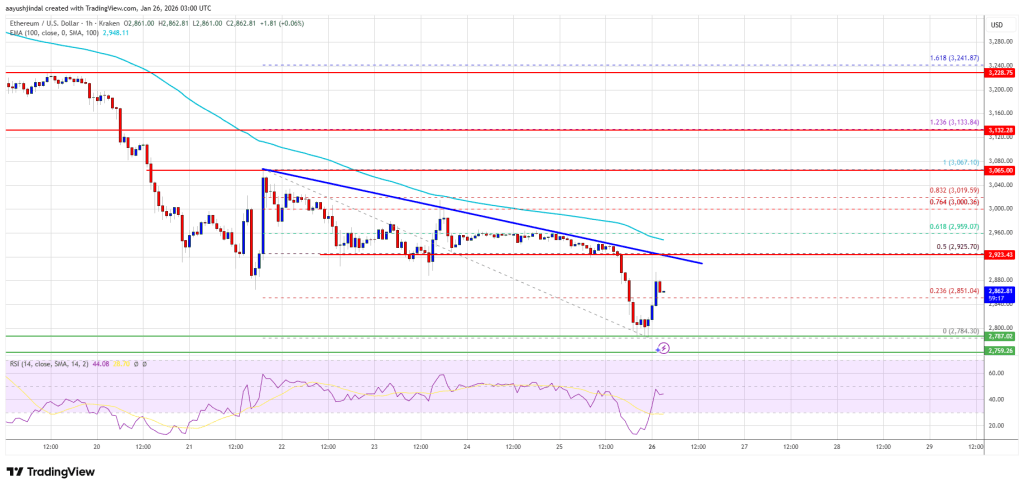

At the same time, Ethereum was trading at $2,892. Earlier in the day, it traded at the intraday high level of $2,941. However, it then plunged to the intraday low of $2,787. It managed to shift course and move higher following this drop.

In a week, ETH fell 9.2%, moving between $2,801 and $3,222. Moreover, it decreased 41% from its ATH of $4,946.

Currently, the price risks a fall toward $2,670 and $2,520 in the near term.

Additionally, according to Bloomberg Intelligence Senior Commodity Strategist Mike McGlone, it is more likely that ETH will revisit the $2,000 level than push upwards and above $4,000.

ETH has been stuck in the $2,000–$4,000 range since 2023. However, it is leaning toward the lower end of this range.

Ether appears to be heading toward the lower end of its $2,000-$4,000 range since 2023. I see greater risks of it staying below $2,000 than above $4,000, especially when stock market volatility rebounds. pic.twitter.com/1IAMV10Jwe

— Mike McGlone (@mikemcglone11) January 25, 2026

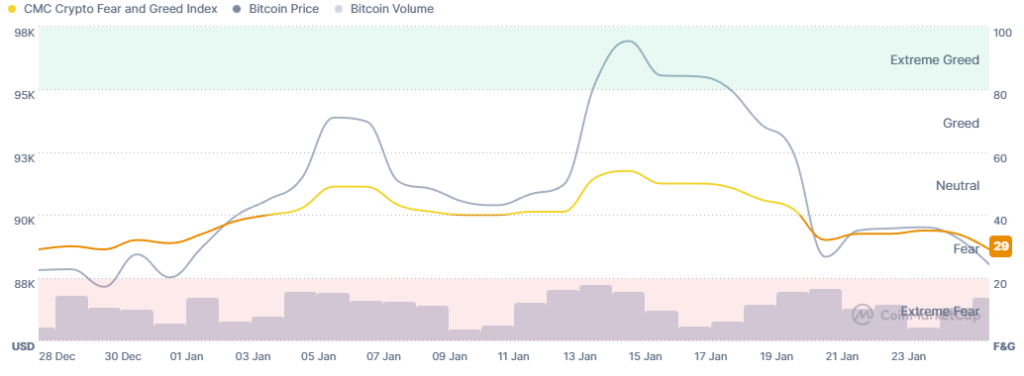

Meanwhile, the crypto market sentiment exited the neutral zone a week ago, and it has continued falling lower within the fear zone since.

The crypto fear and greed index decreased further over the weekend, currently standing at 29, compared to 34 seen over the weekend.

Unsurprisingly, given the market conditions, the sentiment reflects the overall worry and caution. It is now possible that the metric will drop further.

ETFs Continue The Red Streak

The US BTC spot exchange-traded funds (ETFs) posted another day of outflows on Friday, totalling $103.57 million. This is the fifth consecutive day of negative flows.

The total net inflow has pulled back yet again and now stands at $56.49 billion.

Of the twelve ETFs, two recorded outflows, and none saw inflows. BlackRock let go of $101.62 million, and Fidelity followed with $1.95 million in outflows.

Moreover, the US ETH ETFs posted outflows as well on 22 January, with $41.74 million – a similar level as the day earlier. With this fourth consecutive red day, the total net inflow now stands at $12.3 billion.

Of the nine funds, two ETH ETFs posted outflows, and two saw inflows. BlackRock recorded $44.49 million in outflows, followed by Grayscale’s $10.8 million.

At the same time, Grayscale Mini Trust took in 9.16 million, followed by Fidelity’s $4.4 million in inflows.

Meanwhile, Japan’s Financial Services Agency is reportedly planning to add cryptocurrencies to the list of assets eligible for spot ETF products.

Japan would likely approve its first set of spot crypto ETFs as early as 2028, ending the agency’s ban on spot crypto ETFs.

— Cryptonews.com (@cryptonews) January 26, 2026

Japan’s Nomura Holdings and SBI Holdings are developing the first crypto ETF products, awaiting approval for listing on the Tokyo Stock Exchange. #JapanCryptoETF #NomuraHoldings #SBIHoldingshttps://t.co/zT14u2QbqK

Quick FAQ

- Did crypto move with stocks today?

The crypto market has seen yet another drop over the past day. Meanwhile, the US stock market closed the week with a mixed picture. That said, it also posted a second consecutive red week. By the closing time on Friday, 23 January, the S&P 500 was up 0.033%, the Nasdaq-100 increased by 0.34%, and the Dow Jones Industrial Average fell by 0.58%. Due to high volatility, investors are shifting their money into safe-haven assets, particularly gold.

- Is this drop sustainable?

For now, the drops may continue in the near- to mid-term, pushed by macroeconomic developments. Occasional smaller and brief jumps are expected, intersecting the current trend.

The post Why Is Crypto Down Today? – January 26, 2026 appeared first on Cryptonews.

Vitalik Buterin: Verkle Trees Implementation to Benefit Ethereum Stakers and Network Nodes

Vitalik Buterin: Verkle Trees Implementation to Benefit Ethereum Stakers and Network Nodes Ethereum community member Eugenio Reggianini has proposed a technical framework to align Ethereum with EU GDPR rules.

Ethereum community member Eugenio Reggianini has proposed a technical framework to align Ethereum with EU GDPR rules.