Bitcoin Hits $0 on Paradex After Starknet Glitch — Mass Liquidations Force Rollback

Bitcoin briefly appeared to trade at zero on Paradex early Sunday after a technical failure during scheduled maintenance triggered mass liquidations across the decentralized perpetual futures exchange, forcing the team to announce a rare chain rollback to reverse the damage.

The incident unfolded shortly after Paradex carried out database maintenance at around 4:30 a.m. London time.

Within minutes, traders began reporting that prices on several perpetual markets, including Bitcoin, Ethereum, and Solana, had collapsed to near-zero levels.

— Sniper ₿ (@sniiperrB) January 19, 2026

Okay, when I posted the screenshot, I thought it was a UI bug.

Then I saw on the computer that the price came back after going to $0.

Now there are thousands of liquidations.

This doesn't look good for @paradexhttps://t.co/m4YbnfHkgN pic.twitter.com/QbKd3U432s

Screenshots and videos shared on social media showed a flood of liquidation alerts hitting the platform almost simultaneously, suggesting that the exchange’s pricing mechanism or oracle feed had malfunctioned during the update.

Timestamped alerts indicate the most intense activity occurred around 05:02 UTC on January 19, 2026.

Inside Paradex’s Chain Rollback After Mass Liquidations

During that brief window, long positions across multiple markets were liquidated at prices displayed as $0.00.

Bitcoin perpetual contracts saw numerous long liquidations at zero, while some short positions were closed at normal market prices near $92,600, pointing to an issue that disproportionately affected one side of the order book.

The sudden repricing automatically forced leveraged positions to close to prevent negative balances, amplifying the damage in a matter of seconds.

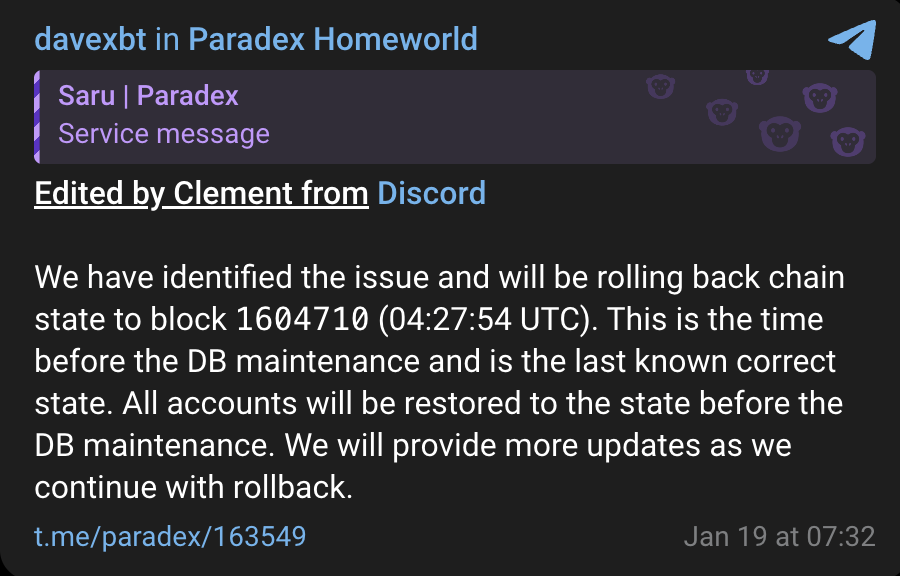

Roughly three hours after the event, Paradex director of engineering Clement Ho addressed users on Telegram, confirming that the team had identified the issue and would roll back the chain state to block 1,604,710, timestamped at 04:27:54 UTC.

Ho noted that this block represented the last known correct state before the maintenance began. Paradex later echoed the message on its website, stating that recovery efforts were underway and that all user funds remained safe.

A rollback in this context means reverting the blockchain and associated system state to a point before the faulty transactions occurred, effectively canceling all trades, deposits, and liquidations that took place after that block.

While improperly liquidated users may see their positions restored, any profits earned after the rollback point would also be erased.

Such actions are widely considered a last resort in decentralized systems because they undermine the principle of immutability that blockchains are designed to uphold.

Paradex Restores Services After Outage, Warns Users of Impersonation Scams

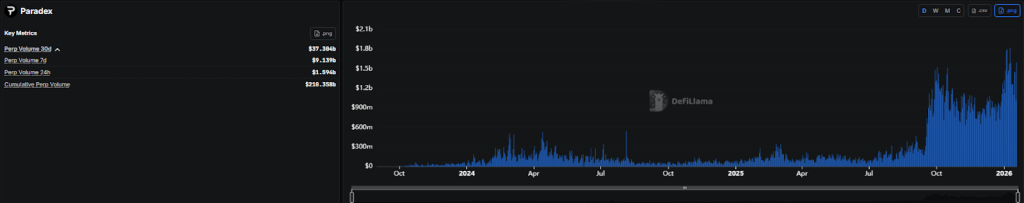

Paradex operates on Starknet as a decentralized perpetual futures exchange and has grown into a sizable venue for on-chain derivatives trading.

Data from DefiLlama shows the platform processed nearly $1.6 billion in trading volume the day before the incident and holds around $225 million in user deposits.

CoinGecko reported approximately $652 million in open interest over the past 24 hours, and over a 30-day period, Paradex ranks among the top ten decentralized perps exchanges, with more than $37 billion in reported trading volume.

Following the liquidations, Paradex reported a platform-wide service outage affecting its trading interface, APIs, blockchain components, bridge, and block explorer.

As part of its recovery process, the exchange said it would force-cancel all open orders except take-profit and stop-loss orders.

Later updates confirmed that the platform and vault withdrawals had been re-enabled, though deposits and withdrawals for Gigavault would remain paused for up to 24 hours.

We’ve received reports of fake support accounts posing as our team.

— Paradex (@paradex) January 19, 2026

Please remember:

+ Official updates only come from this account

+ We will never ask for your private keys

+ If another account messages you first, it is a scam

The team also issued warnings about fake support accounts impersonating Paradex staff during the outage, urging users to rely only on official channels.

The incident has renewed scrutiny around technical risk in on-chain derivatives markets, which have faced a series of disruptions in recent months.

Aster, a top perps exchange by volume, has suffered repeated losses after being targeted by sophisticated trading strategies, including a high-profile incident in September when following an abnormal price spike in its XPL perpetual contract.

The post Bitcoin Hits $0 on Paradex After Starknet Glitch — Mass Liquidations Force Rollback appeared first on Cryptonews.