Coinbase reportedly interested in acquiring South Korean crypto exchange Coinone

Sweden’s Armed Forces detected two Russian Su-35S fighter jets and one Tu-22M3 bomber flying over the Baltic Sea on January 23, prompting a response by Swedish Air Force quick reaction alert aircraft. According to a statement published by the Swedish Armed Forces, the aircraft were identified by Sweden’s incident readiness forces, which were scrambled to […]

Sweden’s Armed Forces detected two Russian Su-35S fighter jets and one Tu-22M3 bomber flying over the Baltic Sea on January 23, prompting a response by Swedish Air Force quick reaction alert aircraft. According to a statement published by the Swedish Armed Forces, the aircraft were identified by Sweden’s incident readiness forces, which were scrambled to […] South Korean crypto exchanges recorded a 62% surge in stablecoin trading volumes as the won fell to multi-year lows against the dollar, prompting platforms to intensify marketing campaigns around dollar-pegged tokens.

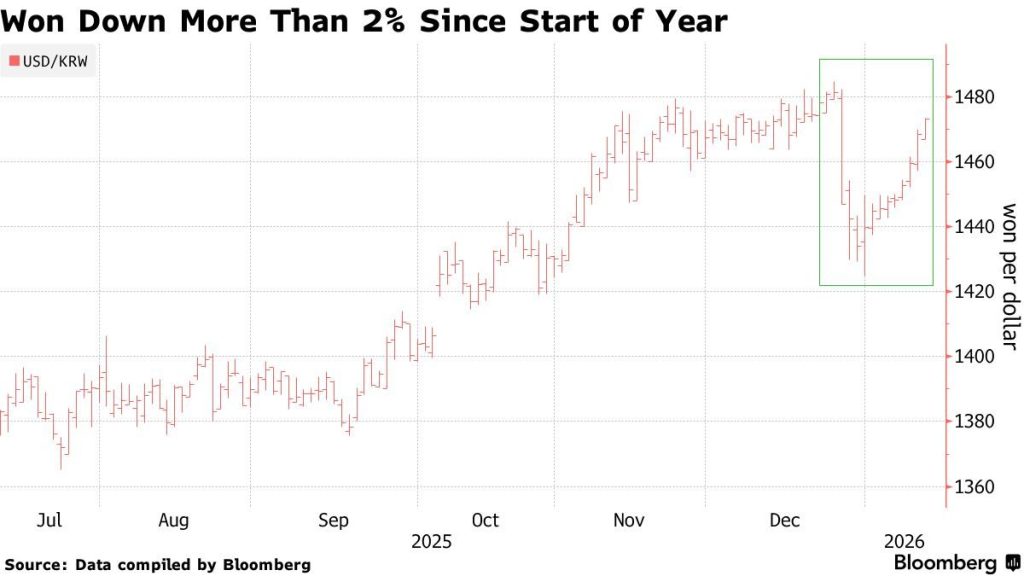

According to The Korea Times, trading volume in Tether (USDT) across the nation’s five major won-based exchanges climbed to 378.2 billion won ($261 million) when the exchange rate exceeded 1,480 won per dollar last Wednesday, citing CryptoQuant data.

The spike follows mounting currency pressures that pushed the won through nine consecutive days of declines against the dollar, marking its longest losing streak since 2008, Bloomberg reported.

Major exchanges, including Korbit, Coinone, Upbit, and Bithumb, launched aggressive promotional campaigns centered on stablecoins, including USDC and USDe, waiving trading fees and distributing rewards to boost volumes during what industry officials described as a downturn in broader crypto markets.

According to The Chosun Daily, South Korea’s major commercial banks slashed dollar deposit interest rates to near zero in response to government pressure to defend the exchange rate.

Shinhan Bank cut its annual rate from 1.5% to 0.1% starting January 30, while Hana Bank reduced rates from 2% to 0.05% for its Travelog Foreign Currency Account.

The coordinated move followed the authorities’ summoning of bank executives and their request that they “refrain from excessive marketing that encourages foreign currency deposits such as dollars.”

Banks responded by introducing incentives for won conversion, with Shinhan offering a 90% preferential rate for customers converting dollar deposits back to won, plus an additional 0.1 percentage point rate boost for those subscribing to won-term deposits afterward.

Dollar deposit balances at the five major banks fell 3.8% from month-end to 63.25 billion dollars as of January 22, marking the first decline after three consecutive months of surges.

Corporate deposits, which account for 80% of all dollar holdings, dropped sharply from 52.42 billion dollars at year-end to 49.83 billion dollars, suggesting that the authorities’ recommendation to sell dollars spot, combined with perceptions that the exchange rate had peaked, was driving the decline.

Individual dollar deposits grew at a significantly slower pace, rising just 109.64 million dollars, compared with the previous month’s 1.09 billion dollar surge.

President Lee Jae-myung delivered a rare verbal intervention on the exchange rate during a January 21 press conference, stating authorities predicted the rate would drop to around 1,400 won within one to two months.

The won-dollar rate immediately fell from 1,481.4 won to 1,467.7 won following his remarks, closing at 1,471.3 won.

Market observers noted the unprecedented nature of a sitting president specifying both an exchange rate target and timeline, with Lee’s statement carrying significantly more weight than U.S. Treasury Secretary Scott Bessent’s earlier comment that the won’s recent decline was “inconsistent with Korea’s strong fundamentals.”

Meanwhile, demand for dollar exchange slowed as average daily won-to-dollar conversions reached 16.54 million dollars from January 1-22, while dollar-to-won conversions surged to 5.2 million dollars daily, significantly exceeding last year’s 3.78 million dollar average and indicating increased profit-taking.

In fact, according to CNBC, South Korea’s fourth-quarter GDP growth slowed to 1.5% year over year, missing economists’ forecasts of 1.9%, as construction investment shrank 3.9% and exports pulled back 2.1% from the previous quarter.

The won has lost nearly 2% against the greenback this year, making it one of Asia’s worst-performing currencies, while South Korean retail investors bought approximately 2.4 billion dollars of U.S. equities on a net basis through mid-January, up roughly 60% from the same period last year.

The broader economic slowdown comes as Seoul advances major crypto policy reforms despite regulatory gridlock over stablecoin governance.

Earlier this month, South Korea ended its nine-year corporate crypto trading ban, permitting listed companies to invest up to 5% of equity capital in top-20 cryptocurrencies, while lawmakers passed amendments to the Capital Markets Act and Electronic Securities Act establishing legal frameworks for tokenized securities trading beginning January 2027.

— Cryptonews.com (@cryptonews) January 12, 2026

South Korea has launched guidelines, allowing listed companies and professional investors to invest up to 5% of their equity capital crypto.#SouthKorea #CorporateCryptoInvestment #CryptoInvestmenthttps://t.co/d55u3TDsBF

Korea Exchange Chairman Jeong Eun-bo pledged to launch spot Bitcoin ETFs and extend trading hours to 24/7 as part of efforts to eliminate the “Korea discount,” though comprehensive digital asset legislation remains stalled amid disputes between the Financial Services Commission and the Bank of Korea over stablecoin issuance rules.

The post Stablecoin Trading Surges 62% in Korea as Dollar Strengthens Against Won appeared first on Cryptonews.

Home Assistant is arguably the best choice for anyone looking to start a smart home, but this is especially true for power users. If you want unhindered freedom to decide how your smart home functions and you’re not afraid to get your hands dirty, there’s no better choice.

South Korean authorities have come under scrutiny after a large stash of seized Bitcoin went missing during a routine check. The loss was discovered when officials found that some of the wallets that had been held as criminal evidence were empty.

According to multiple reports, the value of the missing Bitcoin is about 70 billion won — roughly $47.7–$48 million.

Reports say the gap showed up during a routine audit of confiscated digital assets at the Gwangju District Prosecutors’ Office.

An internal check flagged transfers from wallets that had been marked as evidence, and investigators traced the movement back to external addresses. The office immediately opened an inquiry to determine how access was lost and whether any recovery is possible.

Initial findings point to a phishing scam as the trigger. According to local coverage, a staff member accessed a fraudulent website that impersonated a legitimate service, and that interaction exposed passwords and private keys.

Once the credentials were captured, the Bitcoin was moved out in transactions that cannot be reversed.

Reports note that some of the access details for the seized assets were kept on portable drives rather than in hardened custody systems.

That practice appears to have made it easier for attackers to grab the keys once the phishing trap was sprung. Simple mistakes can cost millions when the asset is bearer-like and transfers are final.

The theft has raised hard questions about how state agencies handle crypto. Some experts say that the tools used by prosecutors were more suited to personal use than to government-level custody.

There are calls for stricter rules, multi-signature setups, and cold storage protocols that do not rely on easily copied passwords.

Blockchain records show the funds moving through several wallets after the initial transfer. That public trail gives investigators leads, but tracing tokens to a final cash-out point is often slow and requires cooperation from foreign exchanges and on-chain analytics firms. Reports say authorities are working with outside specialists to map the flow.

What Prosecutors Are Doing NextThe Gwangju prosecutors’ office has vowed a full probe, and officials are trying to reconstruct events step by step.

There are also signs that the incident will trigger a review of national procedures for holding seized digital property. Some lawmakers and legal experts have already called for clearer standards and oversight.

Featured image from Pexels, chart from TradingView

Nathaniel Chastain, a former product manager at OpenSea, will not face a retrial after federal prosecutors chose to drop their re-review of his insider trading case.

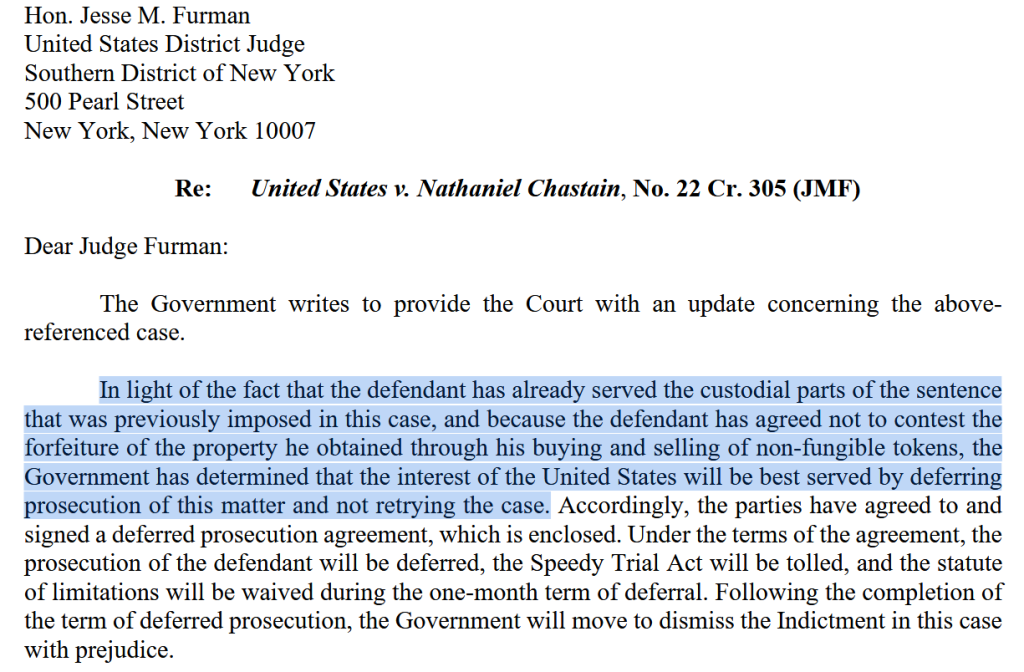

Reports say the US Attorney’s Office reached a deferred prosecution agreement with Chastain that will lead to dismissal of the charges once the agreement runs its course.

Prosecutors told a Manhattan federal court they would not retry Chastain following an appeals court ruling that tossed his earlier conviction.

Under the deferred prosecution deal, the government will dismiss the case about a month after notifying the court, and Chastain has agreed to forfeit roughly 15.98 ETH tied to the trades. He has already served three months in prison from his original sentence.

According to the US Court of Appeals for the Second Circuit, the jury in the first trial had been given the wrong instructions about what the wire fraud law covers.

The judges said confidential information only counts as property under the statute when it has commercial value to the employer, and jurors might otherwise convict someone for behavior that is unethical but not criminal. That legal point is at the heart of the reversal.

Reports note that prosecutors had called the matter the first-ever insider trading case tied to NFTs. Now, lower courts and enforcement teams will have to think carefully before using traditional fraud laws to police activity in NFT markets.

The ruling highlights a gap between old statutes and new kinds of online goods, which may push lawmakers to give clearer rules for how to treat confidential business signals related to crypto platforms.

Chastain was first charged in mid-2022 after prosecutors said he bought certain NFTs before they were featured on OpenSea’s homepage, then sold them after prices rose.

He was convicted at trial in 2023 of wire fraud and money laundering and received a sentence that included three months behind bars. The US Attorney’s Office originally described the scheme as a novel use of insider knowledge in digital markets.

With the deferred prosecution agreement in place for OpenSea, prosecutors can close this chapter without a new trial.

Chastain’s forfeiture of crypto assets and his already served time mean the government has secured some remedy, while the appellate decision leaves open big questions about when private business information can be treated as property for federal fraud charges.

Legal teams, judges, and regulators are likely to keep a close eye on how similar cases are handled in the future.

Featured image from Getty Images, chart from TradingView

I hate buying USB adapters because I vividly remember the days when they’d come free with every smartphone or USB-powered device. Though it’s not free, IKEA’s new USB-C adapter offers fast charging at the unbeatable price of $4.

US prosecutors have formally dropped their case against former OpenSea manager Nathaniel Chastain following an appeals court reversal that dismantled what was once positioned as the first NFT insider trading prosecution in American history.

According to sources, the Justice Department announced Wednesday it would enter a one-month deferred prosecution agreement before dismissing the indictment with prejudice.

The decision closes a chapter that began in June 2022 when Chastain was arrested and charged with wire fraud and money laundering for using confidential information to purchase NFTs before they were featured on OpenSea’s homepage.

The case attracted widespread attention as prosecutors attempted to apply traditional financial crime statutes to emerging digital asset markets.

Manhattan US Attorney Jay Clayton, a former SEC chair, told the federal court that prosecutors would not retry the case given Chastain had already served three months in prison and agreed not to contest forfeiture of 15.98 ETH worth $47,330.

“The interest of the United States will be best served by deferring prosecution of this matter and not retrying the case,” Clayton wrote in the court filing.

The collapse stems from a July 2024 appeals court decision that found the trial jury received flawed instructions.

The 2nd US Circuit Court of Appeals ruled 2-1 that jurors were improperly told they could convict Chastain based solely on unethical behavior rather than actual theft of property with commercial value.

Judge Steven Menashi wrote last year August that the lower court erred by allowing conviction even if the information Chastain used lacked tangible value to OpenSea.

The appeals panel sharply criticized jury instructions that permitted conviction based on violations of “broad notions of honesty and fair play,” warning such standards could criminalize nearly any deceptive act.

The court found the featured NFT data was not monetized by OpenSea and was not treated internally as a valuable asset, making it too “ethereal” to qualify as property under federal wire fraud statutes.

Chastain was convicted in May 2023 after prosecutors accused him of exploiting his role to buy dozens of NFTs shortly before they appeared on OpenSea’s homepage between June and September 2021.

After tokens were featured and prices increased, he sold them at two- to five-times profit using anonymous wallets. The government alleged he made over $57,000 through the scheme.

US Attorney Damian Williams had described the case as a warning to digital asset markets when announcing charges. “NFTs might be new, but this type of criminal scheme is not,” Williams said.

“As alleged, Nathaniel Chastain betrayed OpenSea by using its confidential business information to make money for himself.“

The conviction came after a week-long trial, with prosecutors charging wire fraud rather than securities fraud since NFTs have not been legally classified as securities.

More than 300 defense attorneys had filed letters supporting dismissal, arguing that treating confidential business information as property would “criminalize a broad swath of conduct.“

The dropped prosecution aligns with a broader shift in federal crypto enforcement under the Trump administration.

As reported by Cryptonews earlier today, a Cornerstone Research report found the SEC initiated just 13 crypto-related actions in 2025, down 60% from 33 in 2024 and the lowest level since 2017.

The agency has dismissed multiple high-profile cases including those against Coinbase, Kraken, Consensys, and Cumberland DRW.

The SEC also closed its investigation into OpenSea in February 2025 after issuing a Wells notice in August 2024 that alleged the platform functioned as an unregistered securities marketplace.

— Cryptonews.com (@cryptonews) February 22, 2025

The SEC has officially ended its investigation into NFT marketplace @OpenSea, according to the company’s founder, @dfinzer.#SEC #OpenSeahttps://t.co/OtOT6c3WMd

At that time, OpenSea founder Devin Finzer called the closure “a win for everyone who is creating and building in our space.“

For now, Chastain will not face supervision by US Pretrial Services and can seek return of the $50,000 fine and special assessment paid following his conviction.

Notably, the global NFT market cap currently stands at $2.56 billion, down 6.72% in the last 24 hours with total sales volume reaching $3.68 million, according to CoinGecko data.

The figure represents an 84.78% decline from the market’s peak of $16.82 billion in April 2022, when digital collectibles were among the hottest assets in crypto and the Chastain case was first unfolding.

The post DOJ Drops OpenSea NFT Fraud Case After Appeals Court Overturns Conviction appeared first on Cryptonews.

South Korean prosecutors are investigating the disappearance of a significant amount of Bitcoin that had been confiscated as criminal proceeds, after an internal audit suggested the assets may have vanished while under state custody.

The Gwangju District Prosecutors’ Office believes the loss likely occurred during the management period last year and is treating the incident as a suspected phishing attack, raising fresh concerns over how seized digital assets are stored and safeguarded.

According to a senior prosecution source cited by local media, preliminary internal assessments suggest the missing Bitcoin was worth roughly 70 billion won, or about $48 million, at the time of the loss.

An official at the prosecutor’s office stated that the investigators are striving to establish the locations of the seized properties, but they could not verify any additional information at the moment.

Local news states that the bitcoin was linked to an illegal gambling situation and that it was being seized as an illegal piece of property when it was lost.

The estimates reported in the domestic media indicate that the value might be in tens of billions of won, which would translate to several million dollars, but those numbers have not been verified by prosecutors.

The early evidence indicates that the bitcoin was stored in a portable USB, as opposed to a more durable custody system.

The wallet password was also reported to have been revealed to a third party during a regular examination of confiscated items, which provided an opportunity to illegally access it and transfer money.

— Cryptonews.com (@cryptonews) December 23, 2025

@KoinlyOfficial warns a third-party breach may have exposed user emails but stresses that no wallet, transaction, tax, or portfolio data was shared with Mixpanel.#CryptoSecurity #CryptoTax #Koinlyhttps://t.co/ASDxMchfyg

The case is one of the most recent high-profile cases of stolen cryptocurrency being re-stolen by law enforcement via social engineering instead of technical merits.

Phishing attacks are deceptive, not technical, as they take advantage of a trusting party. In a more institutionalized environment, they usually prosper through human error and poor internal controls as opposed to blockchain weaknesses.

The Gwangju District Prosecutors’ Office is no stranger to large crypto seizure cases. In March 2024, it pursued the recovery of roughly 170 billion won, or about $127 million at the time, in Bitcoin linked to another illegal gambling operation.

The seizure of digital assets has been gradually institutionalized in South Korea in recent years after several landmark Supreme Court decisions made it clear that cryptocurrencies can be regulated as property under the Criminal Procedure Act.

— Cryptonews.com (@cryptonews) January 9, 2026

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.#SouthKorea #Bitcoinhttps://t.co/3fa5PxHMMG

Such a legal basis was initially established in 2018, when the Supreme Court decided that cryptocurrencies are intangible assets and have economic value and thus can be seized in case they are linked to a crime.

Later judicial decisions have further broadened the power of the seizure, and a December case verified that the bitcoin kept on domestic exchanges like Upbit and Bithumb may also be confiscated.

The recent case arrived on the day when the South Korean regulators are busy increasing control over the crypto industry.

In January, financial regulators announced an intention to test a payment freeze system whereby investigators can temporarily freeze crypto-related accounts before the suspected illicit funds are taken off or deposited in an offshore account.

The post South Korea Probes Theft of Seized Bitcoin Worth $48M in Suspected Phishing Heist appeared first on Cryptonews.

Sleep apnea is a debilitating disease that many sufferers don’t even realize they have. Those afflicted with the condition will regularly stop breathing during sleep as the muscles in their throat relax, sometimes hundreds of times a night. Breathing eventually resumes when the individual’s oxygen supply gets critically low, and the body semi-wakes to restore proper respiration. The disruption to sleep causes serious fatigue and a wide range of other deleterious health effects.

Treatment for sleep apnea has traditionally involved pressurized respiration aids, mechanical devices, or invasive surgeries. However, researchers are now attempting to develop a new drug combination that could solve the problem with pharmaceuticals alone.

There are a variety of conditions that fall under the sleep apnea umbrella, with various causes and a range of imperfect treatments. Perhaps the most visible is obstructive sleep apnea (OSA), in which the muscles in the throat relax during sleep. Under certain conditions, and depending on anatomy, this can lead the airway to become blocked, causing a cessation of breathing that requires the sufferer to wake to a certain degree to restore proper respiration. Since the 1980s, OSA has routinely been treated with the use of Continuous Positive Airway Pressure (CPAP) machines, which supply pressurized air to the face and throat to forcibly keep the airway open. These are effective, except for one major problem—a great deal of patients hate them, and compliance with treatment is remarkably poor. Some studies have shown up to 50% of patients give up on CPAP treatment within a year due to discomfort around sleeping with a pressurized air mask.

Against this backdrop, a simple pill-based treatment for sleep apnea is a remarkably attractive proposition. It would allow the treatment of the condition without the need for expensive, high-maintenance CPAP machines which a huge proportion of patients hate using in the first place. Such a treatment is now close to being a reality, under the name AD109.

The treatment aims to directly target the actual cause of obstructive sleep apnea. OSA is a neuromuscular condition, and one that only occurs during sleep—as those afflicted with the disease don’t suffer random airway blockages while awake. When sleep occurs, neurotransmitter levels like norepinephrine tend to decrease. This can can cause the upper airway muscles to excessively relax in sleep apnea sufferers, to the point that the airway blocks itself shut. AD109 tackles this issue with a combination of drugs—an antimuscarinic called aroxybutynin, and a norepinephrine reuptake inhibitor called atomoxetine. In simple terms, the aroxybutynin blocks so-called muscarinic receptors which decrease muscle tone in the upper airway. Meanwhile, the atomoxetine is believed to simultaneously improve muscle tone in the upper airway by maintaining higher activity in the hyperglossal motor neurons that control muscles in this area.

Thus far, clinical testing has been positive, suggesting the synergistic combination of drugs may be able to improve airflow for sleep apnea patients. Phase 1 and Phase 2 clinical trials have been conducted to verify the safety of the treatment, as well as its efficacy at treating the condition. Success in the trials was measured with the Apnea-Hypopnea Index (AHI), which records the number of airway disruptions an individual has per hour. AHI events were reduced by 45% in those taking AD109 when compared to the placebo group in a phase 2 trial featuring 211 participants. It achieved this while proving generally safe in early testing without causing detectable detriments to attention or memory. However, some side effects were noted with the drug—most specifically dry mouth, urinary hesitancy, and a level of insomina. The latter being particularly of note given the drug’s intention to improve sleep.

Testing on AD109 continues, with randomized Phase 3 trials measuring its performance in treating mild, moderate, and severe obstructive sleep apnea. For now, commercialization remains a ways down the road. And yet, for the first time, it appears promising that modern medicine will develop a simple drug-based treatment for a disease that leaves millions fatigued and exhausted every day. If it proves viable, expect it to become a major pharmaceutical success story and the hottest new drug on the market.

It operates under Israel's National Program for AI R&D Infrastructure, marking the nation's transition from AI consumer to AI power broker.

The post Israel Activates National AI Supercomputer appeared first on TechRepublic.

It operates under Israel's National Program for AI R&D Infrastructure, marking the nation's transition from AI consumer to AI power broker.

The post Israel Activates National AI Supercomputer appeared first on TechRepublic.

This sweeping update introduces measures to identify and potentially exclude "high-risk" third countries and companies across 18 essential sectors.

The post EU’s New Cybersecurity Act Could Ban High-Risk Suppliers appeared first on TechRepublic.

The hackers trick victims into accessing GitHub or GitLab repositories that are opened using Visual Studio Code.

The post North Korean Hackers Target macOS Developers via Malicious VS Code Projects appeared first on SecurityWeek.

This sweeping update introduces measures to identify and potentially exclude "high-risk" third countries and companies across 18 essential sectors.

The post EU’s New Cybersecurity Act Could Ban High-Risk Suppliers appeared first on TechRepublic.

South Korea’s top regulators are reportedly reviewing how local cryptocurrency exchanges work with banks, aiming to create a more balanced playing field.

The current system often links each crypto exchange to just one bank, limiting choice and creating high entry barriers for smaller firms.

Though this setup isn’t officially required by law, it has become widespread due to anti-money laundering and identity verification rules.

The Financial Services Commission and the Fair Trade Commission are now coordinating a review to see whether this long-standing practice is stifling competition and reinforcing the dominance of a few large exchanges.

Under the existing system, exchanges need to form exclusive partnerships with domestic banks to allow customers to deposit and withdraw Korean won.

Without that link, they can’t offer basic fiat services.

The model emerged in response to growing demands for transparency and risk control, but may now be working against smaller market participants.

A recent study commissioned by the government explored how current crypto regulations impact competition.

According to findings reported by local outlet Herald Economy, researchers concluded that the one-to-one exchange-bank setup makes it harder for newer or smaller exchanges to access banking services.

Even though it helps manage financial risks, applying the same strict standards across the board may be excessive when firms vary in size, volume, and risk profile.

The study also noted that most Korean won-based crypto trading happens on just a few large platforms, making the market highly concentrated.

The research pointed out that when a few platforms dominate trading volume, they benefit from deeper liquidity and faster transactions.

This creates a cycle where users are more likely to choose the bigger players, further limiting the reach of smaller exchanges.

As long as banking access remains difficult, that pattern is unlikely to change.

This concentration may make the market less dynamic, reduce innovation, and restrict consumer options.

As a result, the current setup could be reinforcing the position of already-powerful exchanges, rather than encouraging healthy competition.

The review of crypto-banking links comes alongside delays in broader legislative changes.

The Digital Asset Basic Act, which is expected to reshape the country’s crypto regulation, was initially scheduled for submission before the end of 2023.

However, on December 31, lawmakers pushed it back to 2026.

The bill proposes allowing the launch of stablecoins backed by the Korean won, as long as the issuing companies store their reserve assets with approved custodians such as banks.

The delay stems from disagreements over how to supervise stablecoin issuers and whether a new oversight body should pre-approve them.

The Financial Services Commission is also weighing how to allow both financial and non-financial firms to take part in this sector without compromising on safety.

The goal is to support innovation while maintaining strong regulatory safeguards.

The post South Korea may target fairer crypto market with banking rule changes: report appeared first on CoinJournal.

South Korean officials have unveiled a major international cryptocurrency crime ring involved in laundering approximately 150 billion won, equivalent to around $101.7 million, through an unauthorized foreign exchange scheme.

The Korea Customs Service (KCS) announced on Monday that three Chinese nationals have been referred to prosecution for purported violations of the Foreign Exchange Transactions Act.

Local media reports have pointed out that between September 2021 and June of last year, the suspects allegedly laundered their funds by allegedly manipulating both domestic and international cryptocurrency accounts in conjunction with Korean bank accounts.

According to the KCS, the criminal activities were disguised as legitimate expenses, including cosmetic surgery fees for foreigners and educational costs for students studying abroad.

The accused ring utilized a complex operation to evade scrutiny from financial authorities. They reportedly bought crypto in multiple countries, transferred the assets to digital wallets in South Korea, converted them into Korean won, and funneled the money through various local bank accounts to further conceal their operations.

This action comes as South Korea is actively debating a new regulatory framework for its crypto market. Despite the growing popularity of digital assets as a common investment among local households, authorities have recently intensified their oversight on cryptocurrency transactions.

In a move towards greater regulation, the government revealed plans to broaden its anti-money laundering (AML) framework and emphasized the implementation of the Travel Rule—a compliance measure that requires sharing information on crypto transfers, effective even for transactions below 1 million won (approximately $680).

In addition to addressing money laundering concerns, the South Korean government outlined its 2026 Economic Growth Strategy, which includes plans to introduce Bitcoin (BTC) Exchange-Traded Funds (ETFs) this year.

This announcement marks a significant policy shift, as cryptocurrency-based exchange-traded funds (ETFs) have been banned in South Korea since 2017.

Despite reaffirming its position in 2024, post the US Securities and Exchange Commission’s (SEC) approval of similar products, the South Korean government has now pointed to the success of crypto funds in the US and Hong Kong as influencing factors for this change.

The country’s Financial Services Commission (FSC) is also set to expedite the next phase of its digital asset legislation this quarter, aiming to establish a clear regulatory framework for stablecoins.

While the Second Phase of the Virtual Asset User Protection Act has faced delays until early 2026 due to disagreements between the FSC and the Bank of Korea (BOK), major policy decisions have been made.

As reported by Bitcoinist, these will include investor protection measures like no-fault liability for cryptocurrency operators and safeguards that separate bankruptcy risks for stablecoin issuers.

South Korea is also ready to lift its longstanding ban on institutional cryptocurrency trading, with anticipations of this initiative commencing later this year. Reports suggest that the FSC may impose limitations on corporate cryptocurrency investments, restricting them to 5% of a company’s equity capital.

Featured image from DALL-E, chart from TradingView.com

Seoul investigators say they have disrupted a secret money-transfer network that moved roughly 150 billion won—about $102 million—into and out of South Korea using a mix of mobile payment apps and cryptocurrencies.

Reports say three people have been formally accused under the country’s foreign exchange laws after a probe that traced the scheme over several years.

According to the Korea Customs Service, the group collected money from customers using platforms like WeChat Pay and Alipay, then used those funds to buy virtual coins abroad.

Those coins were shifted into digital wallets in Korea and converted to Korean won through many bank accounts.

The pattern was basic and careful. Cash or mobile transfers arrived from overseas. Crypto purchases followed in multiple countries to avoid any one regulator seeing the full trail.

Finally, the funds were funneled into local accounts under different names. This took place over a long window, from September of 2021 until June of last year, investigators say.

According to reports, the ring hid the origin of money by dressing transfers up as ordinary expenses — payments for cosmetic surgery, fees for overseas study, and trade-related charges. Those labels made the flows look normal on paper and helped the group slip past routine checks.

Bank transfers were layered with small, seemingly legitimate payments. That made suspicious activity harder to spot until customs officers pieced together patterns across accounts and platforms.

At that point, the scope became clear: these were not isolated transfers but a linked series of transactions designed to wash large sums.

Investigators arrested and referred three Chinese nationals for prosecution, saying the suspects handled the bulk of the scheme’s operations.

Records show almost 150 billion won was moved in the period under review. Authorities have opened cases under the foreign exchange transactions law and are seeking to trace the remaining funds.

The case underlines how easy it can be for cross-border payment tools and crypto markets to be used together.

Regulators in Korea have been tightening rules for both mobile wallets and exchanges in recent months, and courts have allowed seizures of crypto assets in criminal probes. That legal backdrop helped the customs office act when the patterns surfaced.

Featured image from Dao Insights, chart from TradingView

Starting January 28, 2026, Google Play will stop allowing downloads and updates of overseas crypto exchange and wallet apps in South Korea unless those platforms prove they are registered with the country’s Financial Intelligence Unit (FIU).

According to Google’s new rule, developers listing crypto exchange or custodial wallet apps must upload evidence that their VASP registration has been accepted by the FIU through the developer console. This is not a technical tweak — it ties app distribution directly to local regulatory approval.

The result is immediate and practical. For Android users in Korea, apps from major overseas platforms will no longer be available for new installs or for updates through Google Play. Existing installations might keep working for a while, but they will not receive app updates or security fixes via the official store.

Based on reports, 27 domestic platforms have completed FIU registration, including well-known names such as Upbit and Bithumb. That leaves several major international exchanges without the needed paperwork, pushing them outside Google Play’s Korean marketplace.

For many users, this change will be felt quickly. If you rely on an overseas app to manage positions or move funds, the inability to download updates may make routine tasks harder and raise security risks. Web access to exchanges will remain an option, but it’s less convenient and sometimes less secure than using an official app.

Foreign exchanges face several demands to gain FIU acceptance. They often must set up a local legal entity, put in place anti-money-laundering systems, and obtain national information security certifications before their VASP filings are accepted. These steps can be costly and time consuming.

How The Market Might ShiftSome analysts say the move will push more trading volume toward Korea-registered firms. Others warn that it could encourage risky workarounds — such as downloading APKs from third-party sites or using VPNs — which expose users to fraud and malware. Reports say that upgrades to app-store rules follow earlier enforcement moves and aim to close gaps in oversight.

App availability will be tied to regulatory paperwork. If a platform shows FIU acceptance in Google’s console, its app can stay listed and updated. If not, the app will be removed or blocked from being updated in Korea’s Play Store.

Featured image from Unsplash, chart from TradingView

As South Korea intensifies its push for crypto regulation, lawmakers have advanced a bill to establish a legal framework for issuing and trading security token offerings (STOs) using distributed ledger technology (DLT).

On Thursday, South Korea’s National Assembly passed key amendments to the Capital Markets Act and the Electronic Securities Act, creating a legal framework for the issuance and distribution of tokenized securities.

According to an official government release, the revised rules define tokenized securities as a broad category that extends to both debt and equity products, and recognize them as legitimate financial instruments.

The amendments to the Electronic Securities Act will allow qualified issuers to launch tokenized securities using distributed ledger technology. Meanwhile, the Capital Markets Act changes will enable the products to be traded as investment contract securities on brokerages and other licensed intermediaries.

Notably, the existing Capital Markets Act prohibited the distribution through securities firms, deeming investment contract securities “unsuitable for distribution due to their non-standard characteristics.”

The changes are “expected to enhance accessibility to investments and improve the provision of investment information for these securities,” the official government release stated.

After legislative approval, the bill will be submitted to the State Council, followed by official presidential promulgation. Therefore, the legislation is expected to be enacted one year after being signed into law, tentatively in January 2027.

Moreover, the Financial Services Commission (FSC) is set to lead the implementation, forming a joint “Token Securities Council” with relevant agencies to ensure seamless preparatory work, including the development of supporting infrastructure and enhanced safeguards.

The consultation body will comprise the FSC, the Financial Supervisory Service, the Korea Securities Depository, the Financial Investment Association, industry participants, and experts.

This major step follows South Korea’s efforts to develop and establish clear, comprehensive rules to regulate the local crypto industry. Last week, the government shared its 2026 Economic Growth Strategy, which included a plan to open its market to Bitcoin (BTC) Exchange-Traded Funds (ETFs) this year.

Crypto-based ETFs have been banned in South Korea since 2017. In 2024, the country’s regulator reaffirmed its stance after the US Securities and Exchange Commission (SEC) approved the investment products. However, it has now cited the success of the US and Hong Kong’s crypto funds as a key factor for their shift.

The FSC will also accelerate the next phase of its digital asset legislation this quarter to establish a clear regulatory framework for stablecoins. As reported by Bitcoinist, South Korea’s Second Phase of the Virtual Asset User Protection Act was delayed until the start of 2026 due to an ongoing disagreement between the FSC and the Bank of Korea (BOK).

The financial authorities have been clashing for months over rules related to the issuance and distribution of stablecoins, disagreeing on the extent of banks’ role in the issuance of won-pegged tokens.

Nonetheless, the main policies of the crypto framework have been decided, set to include investor protection measures, such as no-fault liability for crypto asset operators and isolation of bankruptcy risks for stablecoin issuers.

Moreover, the country is lifting its long-standing ban on institutional crypto trading, which is anticipated to begin later this year. According to local reports, the FSC is considering a rule to limit corporate cryptocurrency investments at 5% of a company’s equity capital.

Under the latest proposal, eligible firms would be able to allocate up to 5% of equity capital per year to digital assets, limited to the top 20 cryptocurrencies by market capitalization. The final draft version could be released as early as January or February.