Billionaire Michael Saylor’s Strategy Buys 2,932 Bitcoin for $264M

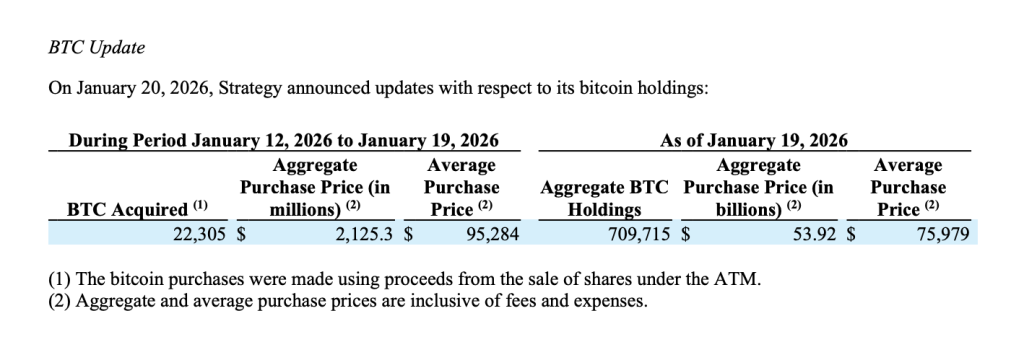

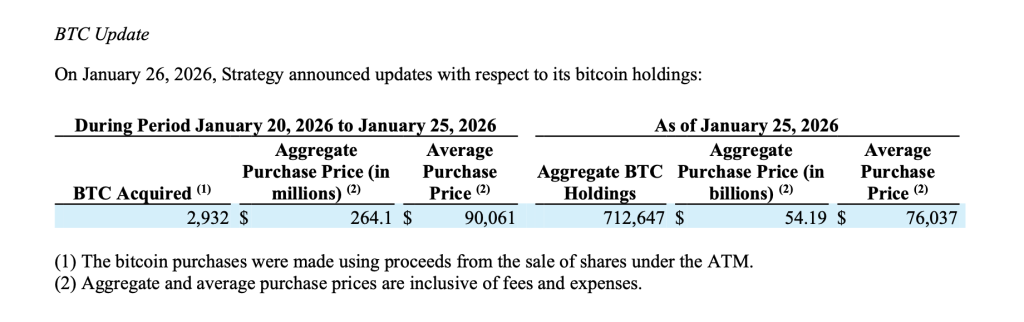

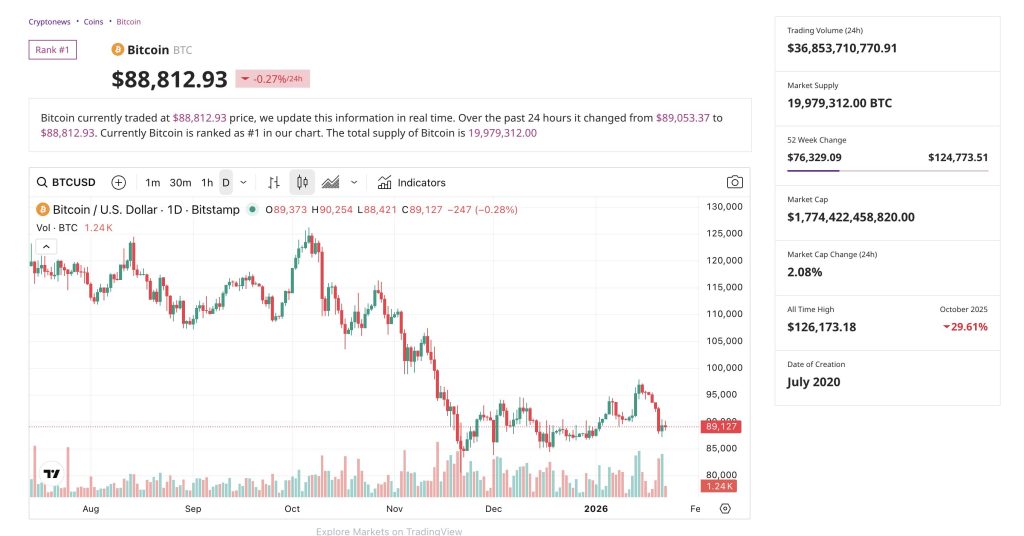

Michael Saylor’s Strategy has expanded its Bitcoin treasury again, acquiring an additional 2,932 BTC for approximately $264.1 million during the period from Jan. 20 to Jan. 25.

Strategy has acquired 2,932 BTC for ~$264.1 million at ~$90,061 per bitcoin. As of 1/25/2026, we hodl 712,647 $BTC acquired for ~$54.19 billion at ~$76,037 per bitcoin. $MSTR $STRC https://t.co/RooLfEvniX

— Michael Saylor (@saylor) January 26, 2026

The company disclosed that the purchases were made at an average price of $90,061 per Bitcoin, inclusive of fees and expenses.

The update reinforces Strategy’s position as the largest corporate holder of Bitcoin globally, continuing its multi-year accumulation strategy that has become central to its balance sheet approach.

Total Bitcoin Holdings Reach 712,647 BTC

Following the latest acquisition, Strategy reported that it now holds a total of 712,647 BTC as of Jan. 25.

The company said its aggregate Bitcoin purchases total roughly $54.19 billion, with an average acquisition price of $76,037 per Bitcoin. The figures show the scale of Strategy’s long-term bet on Bitcoin as a treasury reserve asset, accumulated across multiple market cycles.

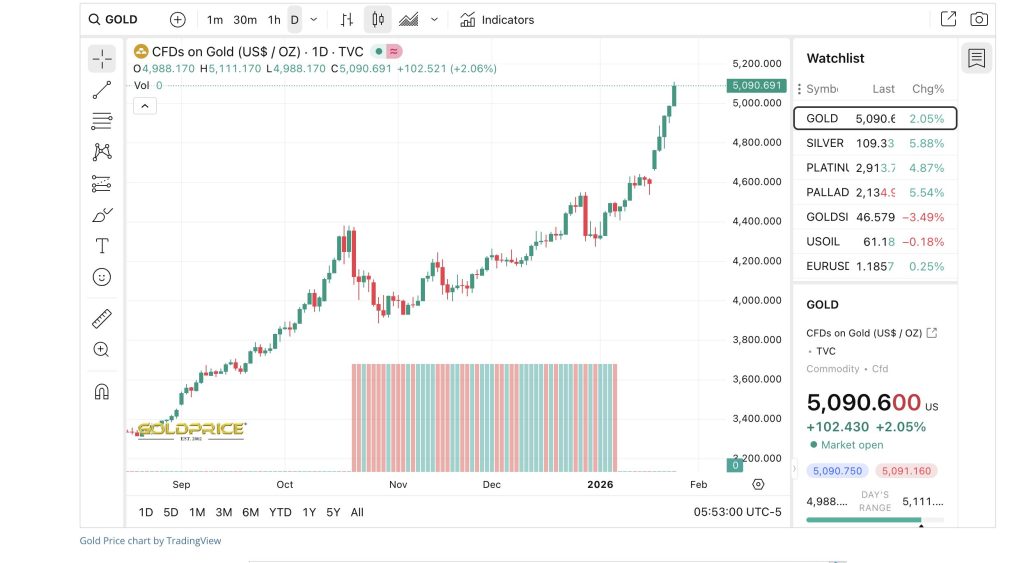

Strategy’s growing holdings show its belief that Bitcoin represents a superior store of value over time, particularly amid concerns around currency debasement and global macro uncertainty.

Purchases Funded Through Share Sales Under ATM Program

Strategy disclosed that the recent Bitcoin purchases were funded through proceeds generated from the sale of shares under its at-the-market offering program.

During the Jan. 20–25 period, the company sold approximately 1.57 million shares of its Class A common stock, generating net proceeds of about $257 million. Strategy also issued roughly 70,201 shares of its variable rate preferred stock, raising an additional $7 million.

In total, the company generated about $264 million in net proceeds, which were then deployed toward Bitcoin accumulation.

The disclosure also shows that Strategy retains major remaining capacity for future issuances, including billions of dollars available across multiple stock and preferred equity programs.

Corporate Bitcoin Accumulation Continues Into 2026

Strategy’s continued purchases come as institutional adoption of Bitcoin remains a major theme entering 2026, with more companies exploring crypto as a long-term balance sheet asset.

The firm has consistently framed Bitcoin as a scarce, inflation-resistant reserve that can outperform cash and traditional holdings over extended time horizons. While the strategy remains controversial due to Bitcoin’s volatility, Strategy has maintained its commitment to accumulation even during periods of market weakness.

With over 712,000 BTC now on its balance sheet, Strategy’s exposure to Bitcoin price movements is unmatched among public companies, making it a key bellwether for corporate crypto adoption.

As the company continues leveraging equity issuance to fund purchases, investors will closely watch how its aggressive treasury strategy evolves alongside broader market conditions in 2026.

The post Billionaire Michael Saylor’s Strategy Buys 2,932 Bitcoin for $264M appeared first on Cryptonews.

In 2026, prediction models will be used to collectively decide what is true and what is not [true] and as a guide for fact-checking, analysts say.

In 2026, prediction models will be used to collectively decide what is true and what is not [true] and as a guide for fact-checking, analysts say.

Senate Judiciary leaders oppose blockchain developer protections in crypto bill, warning exemptions modeled on Lummis-Wyden BRCA could block money laundering prosecutions.

Senate Judiciary leaders oppose blockchain developer protections in crypto bill, warning exemptions modeled on Lummis-Wyden BRCA could block money laundering prosecutions. Crypto market structure bill – Clarity Act – has been further delayed by the US Senate Banking Committee until late February or March.

Crypto market structure bill – Clarity Act – has been further delayed by the US Senate Banking Committee until late February or March. Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.

Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes. The SEC opened just 13 crypto enforcement cases in 2025, down 60% from 2024, with most new actions under Chair Paul Atkins focused on fraud.

The SEC opened just 13 crypto enforcement cases in 2025, down 60% from 2024, with most new actions under Chair Paul Atkins focused on fraud.

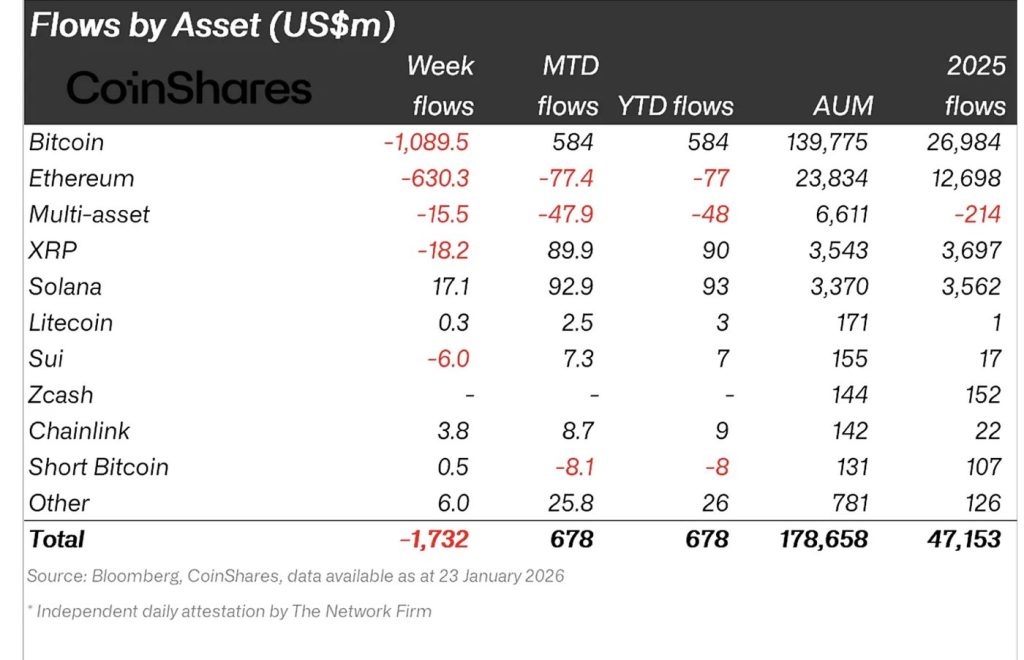

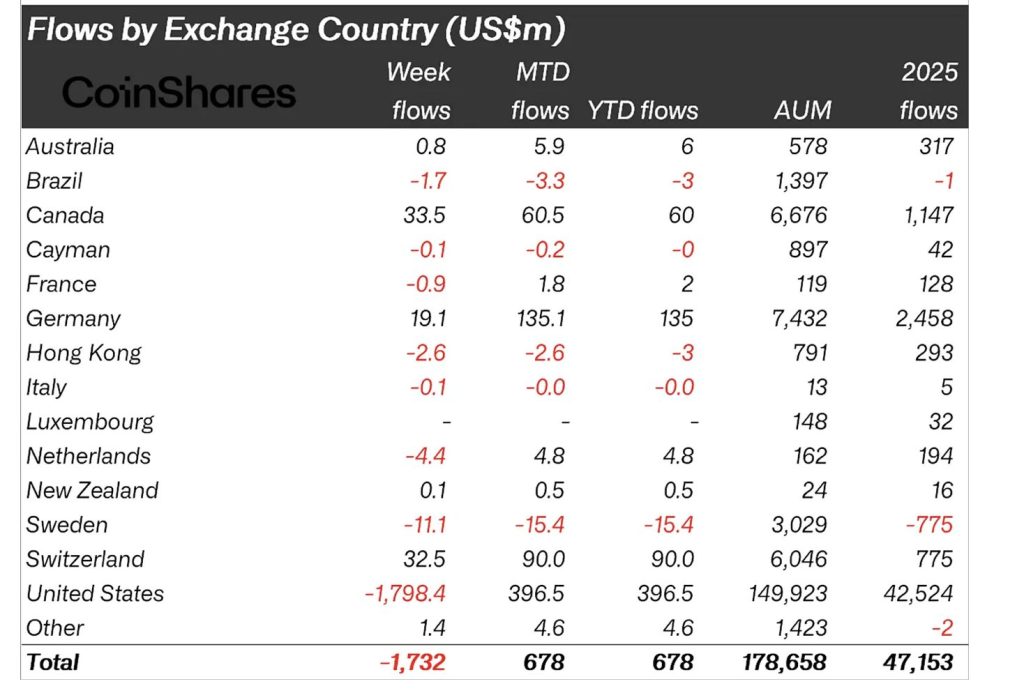

Digital asset investment products saw $2.17bn in weekly inflows, the strongest since Oct 2025, according to CoinShares.

Digital asset investment products saw $2.17bn in weekly inflows, the strongest since Oct 2025, according to CoinShares.

France conducts AML inspections on Binance and Coinhouse among 100+ entities for MiCA licenses with only 4 firms approved before June 2026 deadline.

France conducts AML inspections on Binance and Coinhouse among 100+ entities for MiCA licenses with only 4 firms approved before June 2026 deadline.

Nomura’s Swiss-based unit Laser Digital is seeking a license in Japan to offer institutional crypto trading, signaling confidence in the country’s digital asset market.

Nomura’s Swiss-based unit Laser Digital is seeking a license in Japan to offer institutional crypto trading, signaling confidence in the country’s digital asset market.

BitGo has expanded its institutional OTC trading platform to support derivatives, strengthening its push to offer regulated infrastructure for digital asset strategies.

BitGo has expanded its institutional OTC trading platform to support derivatives, strengthening its push to offer regulated infrastructure for digital asset strategies.

(@nansen_ai)

(@nansen_ai)