Ethereum Stalls In A Critical Zone As Breakout Structures Wait For Confirmation

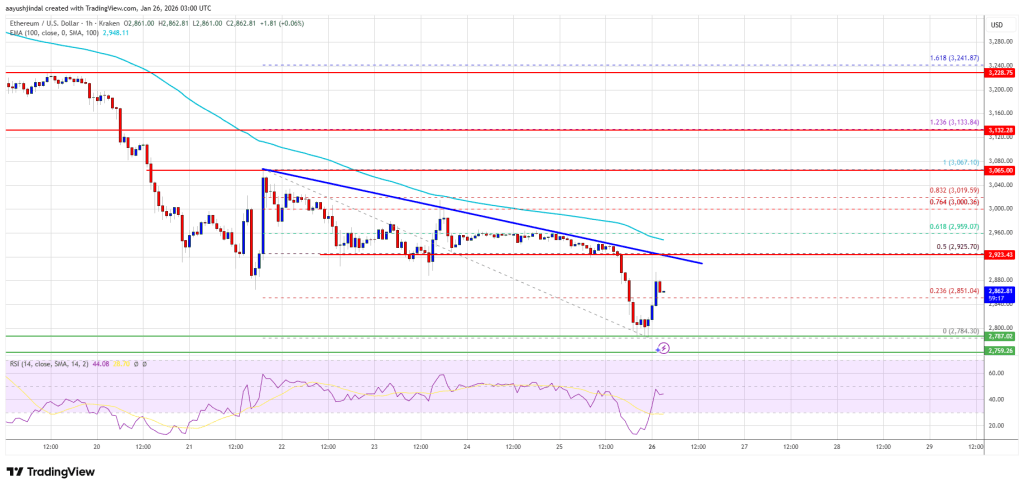

Ethereum remains under pressure in a key support zone, teetering between a potential rebound and further decline. While bullish patterns like the cup-and-handle and ascending triangle are shaping up, confirmation is required before any decisive move.

Last Defense Zone: $2,274–$2,104 And The Libra Reversal Setup

Kamile Uray shared that Ethereum is currently trying to hold above the critical support zone between $2,775 and $2,623. This area has become a key battleground for bulls and bears, with buyers attempting to defend it to prevent further downside. If this support continues to hold, ETH could regain short-term stability and make another attempt to move higher.

On the upside, a sustained bounce from this zone could allow Ethereum to revisit the pink box resistance around the $3,445 level. A clean breakout above this resistance would activate bullish structures such as a cup-and-handle or an ascending triangle, signaling growing bullish momentum and opening the path toward the $3,894 level. However, this becomes possible if ETH manages to close above the $3,661 peak, confirming the formation of the first major high.

The $3,894 level carries technical significance, as it represents the 0.618 Fibonacci retracement of the most recent downward wave. A decisive close above this level would suggest continuation of the recovery. Failure to hold above it, however, could trigger renewed selling pressure and lead to another corrective move lower.

On the downside, if Ethereum loses the $2,623 support, a deeper decline toward the pink box zone between $2,274 and $2,104 would become likely. This area is notable for the potential formation of a bullish Libra pattern. Should reversal confirmation emerge from this zone, ETH could attempt another recovery phase, with the broader objective of retesting its previous highs.

Waiting For Confirmation: ETH’s Next Move Depends On Price Action

Ethereum is currently following the trajectory outlined by Crypto Candy in a recent update on X. As predicted, the asset dipped into the lower support range between $2,600 and $2,700 and is now attempting to stage a recovery from the zone. Should this upward momentum persist, the immediate objective for bulls is a return to the $3,070 level.

However, for Ethereum to firmly re-enter bullish territory and shift the broader market structure, it must close decisively above the $3,070 threshold. This level serves as the primary gateway for any sustained recovery beyond the current relief rally. Until that breakout occurs, the prevailing market bias remains firmly bearish, as the failure to reclaim and hold above $3,070 suggests that the path of least resistance is still to the downside, with lower price points remaining the primary expectation for the short term.

En primicia, Valora Analitik conoció que Protección se prepara para lanzar desde Colombia un fondo con exposición a Bitcoin. El producto no estará enfocado en la especulación de corto plazo, sino en ampliar las opciones de diversificación con una gestión integral de riesgos y…

En primicia, Valora Analitik conoció que Protección se prepara para lanzar desde Colombia un fondo con exposición a Bitcoin. El producto no estará enfocado en la especulación de corto plazo, sino en ampliar las opciones de diversificación con una gestión integral de riesgos y…