Nomura-Backed Laser Digital Launches Tokenised Bitcoin Yield Fund Targeting Excess Returns

Nomura’s crypto subsidiary, Laser Digital, has launched a natively tokenised Bitcoin yield strategy directed at institutional and eligible accredited investors seeking income on top of long-only BTC exposure.

In a press release shared with CryptoNews, the company explains that Laser Digital Bitcoin Diversified Yield Fund SP (BDYF) combines directional Bitcoin exposure with income-generating, market-neutral strategies designed to deliver excess returns over Bitcoin across market cycles.

The fund is positioned as an evolution of Laser Digital’s Bitcoin Adoption Fund, which launched in 2023 ahead of the first U.S. spot Bitcoin ETFs.

First Natively Tokenised Bitcoin Yield Fund

Laser Digital said BDYF is the world’s first natively tokenised Cayman-domiciled Bitcoin yield fund. Unlike traditional tokenised structures that rely on special-purpose vehicles or feeder funds, the tokenised share class is issued directly at the main fund level, allowing on-chain ownership alongside traditional share classes.

Tokenisation is handled exclusively by KAIO, while Komainu serves as the fund’s main custodian. The structure allows for in-kind contributions, atomic settlement, and streamlined on-chain fund administration, according to the firm.

Strategy: Growth Plus Income

The fund is designed to maintain long-term, long-only exposure to Bitcoin while actively monetising carry-like opportunities through diversified market-neutral strategies, including arbitrage, lending, and options.

Laser Digital said the strategy prioritises capital preservation over yield chasing, with institutional-grade risk controls intended to ensure income generation does not compromise the safekeeping of underlying BTC.

The fund targets long-term Bitcoin holders such as digital-asset treasury entities, traditional institutions, and sovereign allocators, with a goal of delivering more than 5% excess net returns over BTC performance across rolling 12-month periods, depending on market conditions.

Why Launch Now

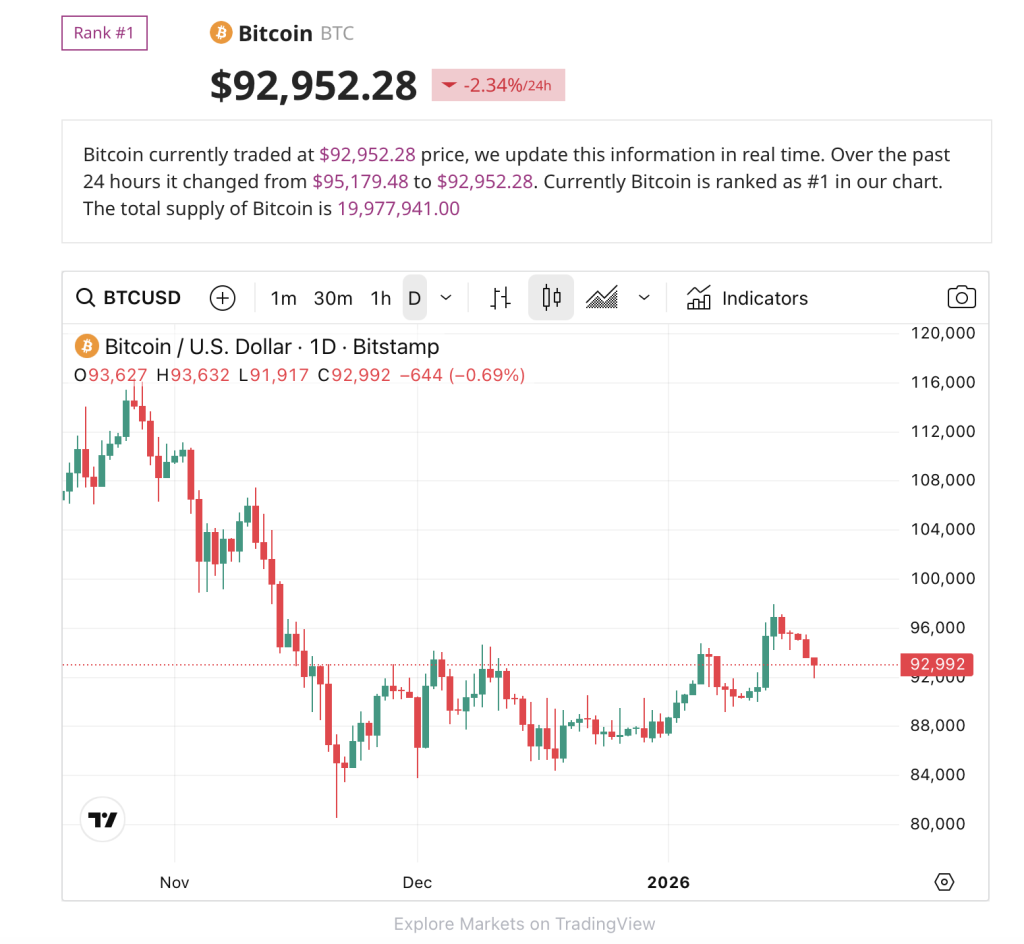

Laser Digital said the launch reflects Bitcoin’s maturation into a mainstream institutional asset with deep liquidity and increasingly robust market infrastructure.

At the same time, macro uncertainty, persistent inflation risk, and rising correlations across traditional asset classes are pushing allocators to seek diversifiers that can also generate income.

The objective, the firm said, is to turn a passive Bitcoin allocation into a more capital-efficient exposure that retains upside participation while producing a sustainable income stream aligned with institutional mandates.

Executive Commentary

Jez Mohideen, co-founder and CEO of Laser Digital, said recent volatility has pointed out growing demand for yield-bearing crypto strategies. “Yield-bearing, market-neutral funds built on calculated DeFi strategies are the natural evolution of crypto asset management,” he said.

Sebastien Guglietta, head of Laser Digital Asset Management, adds that while Bitcoin functions as a store of value, it does not naturally generate yield. “Our strategy seeks to address that gap by offering a sustainable income stream for long-term Bitcoin holders,” he said.

Regulatory and Product Line Context

Laser Digital Middle East FZE, a regulated virtual asset service provider under Dubai’s VARA regime, acts as investment manager to the fund.

BDYF joins the firm’s existing actively managed strategies, including the Laser Digital Carry Fund and the Multi-Strategy Fund, as part of its expanding institutional digital asset offering.

In October, it emerged that Nomura Holdings is preparing to deepen its presence in Japan’s digital asset market as crypto activity surges, with its wholly owned subsidiary Laser Digital Holdings seeking a license to offer trading services to institutional clients.

— Cryptonews.com (@cryptonews) October 3, 2025

Nomura’s Swiss-based unit Laser Digital is seeking a license in Japan to offer institutional crypto trading, signaling confidence in the country’s digital asset market.#japan #nomura https://t.co/wVDTAt8jvk

The post Nomura-Backed Laser Digital Launches Tokenised Bitcoin Yield Fund Targeting Excess Returns appeared first on Cryptonews.