Stablecoins Hit $284B – Are Banks Really at Risk? Analysts Weigh In

The global stablecoin market has crossed $284 billion in circulation, reviving a long debate about whether the growth of stablecoin poses a real threat to traditional banks or simply reflects a new layer of financial infrastructure evolving alongside them.

That question took center stage this week after historians and economists Niall Ferguson and Manny Rincon-Cruz argued that fears of bank destabilization are overstated, even as banking groups intensify their opposition to stablecoin rewards.

"No one is surprised when banks and other financial incumbents argue against measures that might promote innovation. But the argument that stablecoins are a source of instability — and interest-bearing ones especially so — is a bad one. The opposite is quite likely to be true."

— Niall Ferguson (@nfergus) January 26, 2026

In an opinion piece published by Bloomberg, Ferguson and Rincon-Cruz framed stablecoins as fundamentally different from volatile crypto assets such as Bitcoin.

While speculative tokens behave more like financial derivatives, they argued, fiat-backed stablecoins function as payment instruments whose growth has accelerated following the passage of the U.S. GENIUS Act last summer.

— Cryptonews.com (@cryptonews) July 18, 2025

Weekly Crypto Regulation Roundup: Trump signed the GENIUS Act into law — the first major U.S. crypto bill to clear Congress.#CryptoRegulation #GeniusActhttps://t.co/fSH8DZnCIo

The legislation established the first comprehensive federal framework for payment stablecoins, limiting reserves to cash, bank deposits, and short-dated U.S. Treasuries, while prohibiting issuers from making loans or paying interest directly to tokenholders.

Since the law took effect, the stablecoin sector has expanded quickly.

Banks Sound Alarm as Stablecoins Expand Beyond Payments

Treasury Borrowing Advisory Committee data cited in the opinion piece showed that fiat-backed stablecoins have surpassed $284 billion, dominated by Tether’s USDT and Circle’s USDC, which together account for more than 90% of the supply.

The payments, trading liquidity, and demand for cross-border settlements are projected to reach between $2 trillion and $3 trillion in the market by 2028, as cited by Treasury officials.

Banks, however, have pushed back, as industry groups have warned that stablecoins, particularly when paired with rewards offered by exchanges or platforms, could draw deposits away from the banking system.

The American Bankers Association and the Bank Policy Institute have argued that large-scale migration of deposits would raise banks’ funding costs and reduce credit availability/

— Cryptonews.com (@cryptonews) January 7, 2026

US community bankers are urging Congress to close what they see as a loophole allowing stablecoin rewards.#Crypto #bankshttps://t.co/2uuk96PfXH

JPMorgan executives have referred to interest-bearing digital dollars as the establishment of a parallel banking system that lacks the same levels of protection.

The push by banking lobbyists to change the proposed CLARITY Act, an expanded crypto market structure bill, provoked resistance by crypto companies and led to delays in Senate hearings.

Coinbase Chief Legal Officer Paul Grewal publicly rejected claims that stablecoin rewards threaten financial stability, saying there is no evidence of systemic risk and that competition should not be conflated with instability.

No question @nfergus is right. There is zero evidence–zero–that stablecoin interest, yield or rewards destabilizes the banking system. There is tons of evidence that they provide real competition to banks. Those are two very different things. https://t.co/XPrwVu5TCX

— paulgrewal.eth (@iampaulgrewal) January 26, 2026

History Tells a Different Story on Stablecoins and Banks

Ferguson and Rincon-Cruz countered the banks’ narrative by turning to history.

They said that stablecoins were more like bank notes than deposits, and that historically, notes and deposits increased together, as opposed to crowding out.

They referred to some statistics indicating that since the introduction of the USDC in 2018, American bank deposits have grown by over $6 trillion, while stablecoins increased by roughly $280 billion, and both have been increasing in the same direction.

They observed that stablecoin rewards are not new and have not caused deposit flight even in times when banks were paying close to no interest.

The same sentiments were recently reiterated by the Circle CEO, Jeremy Allaire, in Davos at the World Economic Forum.

— Cryptonews.com (@cryptonews) January 22, 2026

Circle CEO rejects bank warnings on stablecoin yields as "absurd," citing money market precedent as transaction volumes reach $33 trillion in 2025.#Stablecoin #Circlehttps://t.co/kPQw5xYpBh

Allaire rejected speculations that a stablecoin reward might disrupt banking, asserting that it was the same as loyalty programs provided in regular finance.

Data support the scale of stablecoin usage beyond speculation. Global stablecoin transaction value reached $33 trillion in 2025, up 72% year-over-year.

Circle-issued digital dollar USDC processed $18.3 trillion worth of transactions, leading the stablecoin transaction boom that totalled $33 trillion in 2025.#StablecoinTransaction #CircleUSDC #USDThttps://t.co/8qYgLMVfmX

— Cryptonews.com (@cryptonews) January 9, 2026

USDC processed $18.3 trillion in payments, while USDT handled $13.3 trillion.

The International Monetary Fund has acknowledged the efficiency gains stablecoins offer in cross-border payments, while cautioning about risks in emerging markets and the need for regulatory coordination.

The post Stablecoins Hit $284B – Are Banks Really at Risk? Analysts Weigh In appeared first on Cryptonews.

Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.

Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.

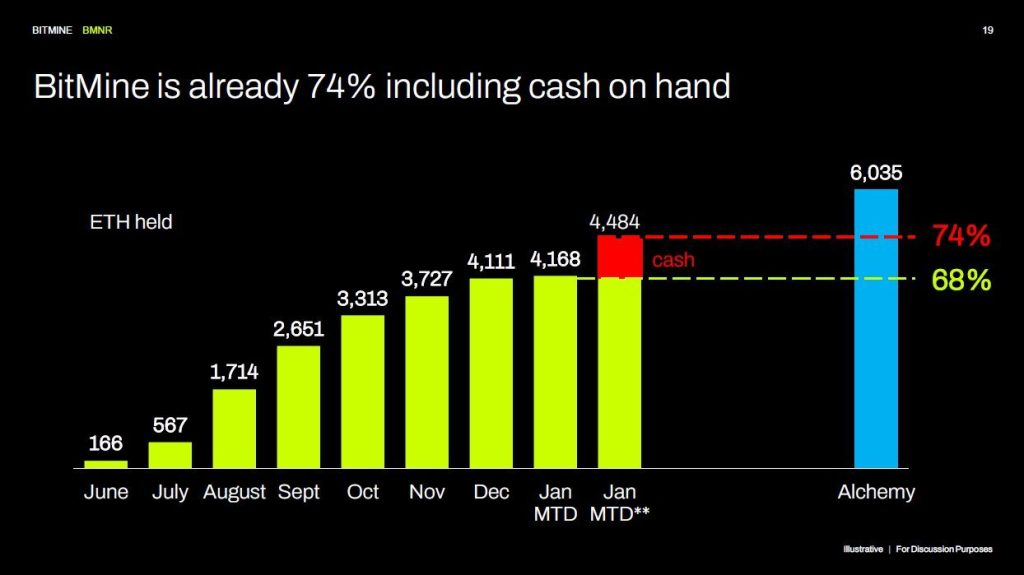

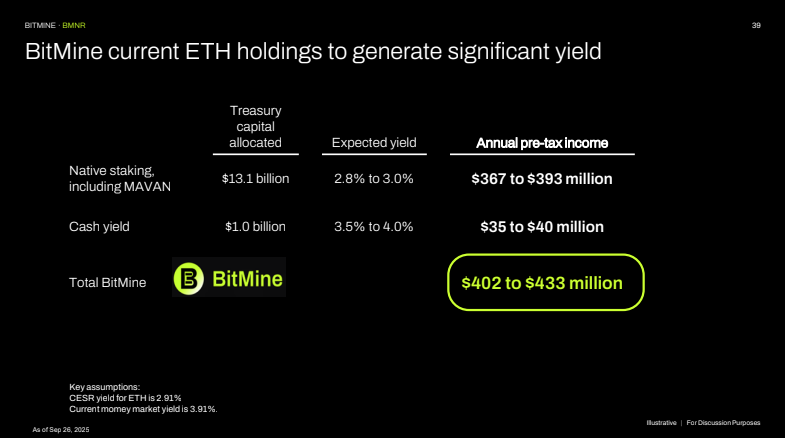

BitMine

BitMine

BitMine

BitMine

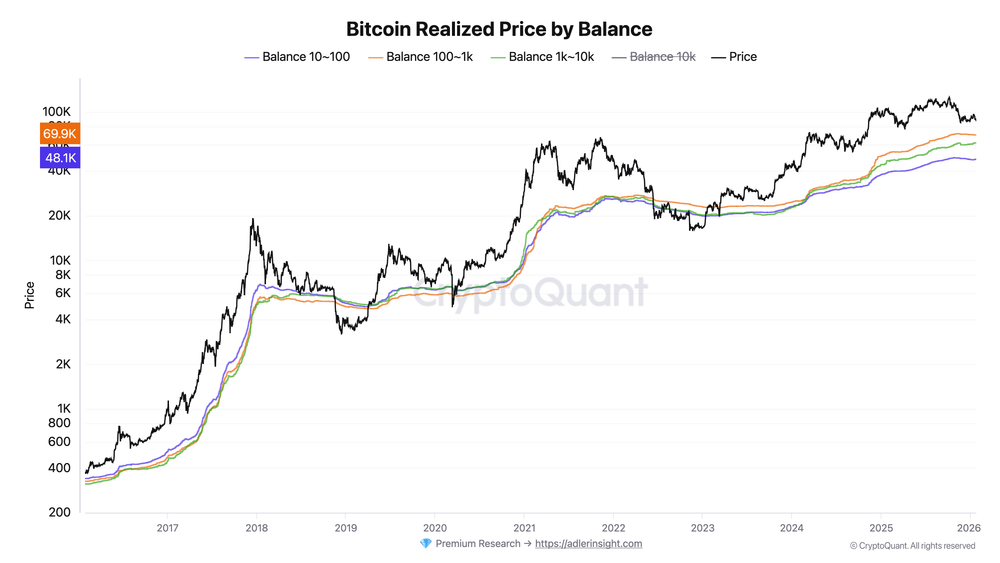

Adler Jr (@AxelAdlerJr)

Adler Jr (@AxelAdlerJr)

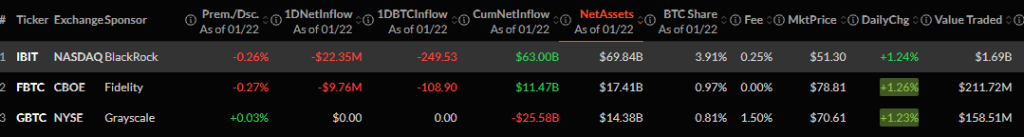

Digital asset investment products saw sharp outflows last week, with investors pulling $1.73B — the largest weekly decline since mid-November 2025, according to CoinShares.

Digital asset investment products saw sharp outflows last week, with investors pulling $1.73B — the largest weekly decline since mid-November 2025, according to CoinShares.

(@matchametaxyz)

(@matchametaxyz)

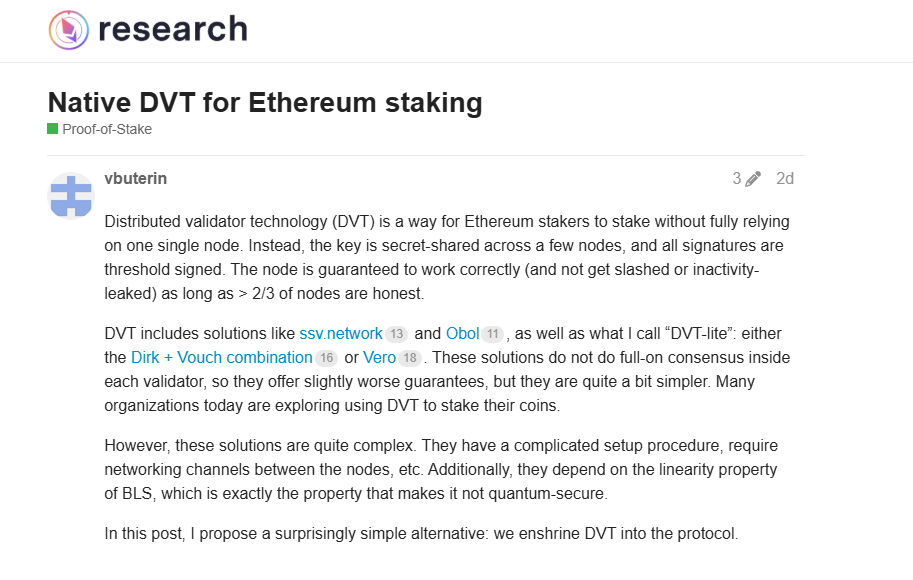

Vitalik Buterin: Verkle Trees Implementation to Benefit Ethereum Stakers and Network Nodes

Vitalik Buterin: Verkle Trees Implementation to Benefit Ethereum Stakers and Network Nodes Ethereum community member Eugenio Reggianini has proposed a technical framework to align Ethereum with EU GDPR rules.

Ethereum community member Eugenio Reggianini has proposed a technical framework to align Ethereum with EU GDPR rules.

Masked gunmen steal crypto USB in France as prosecutors reveal tax official sold government database access identifying crypto investors to criminal gangs for 800 euros per operation.

Masked gunmen steal crypto USB in France as prosecutors reveal tax official sold government database access identifying crypto investors to criminal gangs for 800 euros per operation.

@RevolutApp may buy a US bank with a national charter to fast-track its American expansion and bypass the lengthy process of obtaining its own licence.

@RevolutApp may buy a US bank with a national charter to fast-track its American expansion and bypass the lengthy process of obtaining its own licence. The OCC has conditionally approved five crypto firms, including

The OCC has conditionally approved five crypto firms, including

Telegram CEO Pavel

Telegram CEO Pavel  Governments are expected to start treating AI data centers and energy-backed computing power as strategic infrastructure in 2026, similar to how oil reserves are managed.

Governments are expected to start treating AI data centers and energy-backed computing power as strategic infrastructure in 2026, similar to how oil reserves are managed.

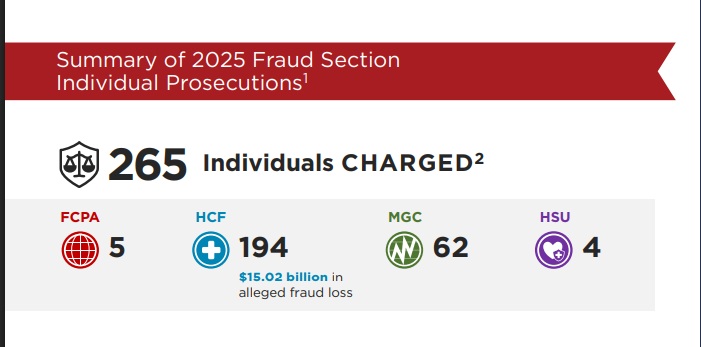

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.

ANNOUNCING

ANNOUNCING

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure.

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure. BNB (@cz_binance)

BNB (@cz_binance)  The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.

The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.

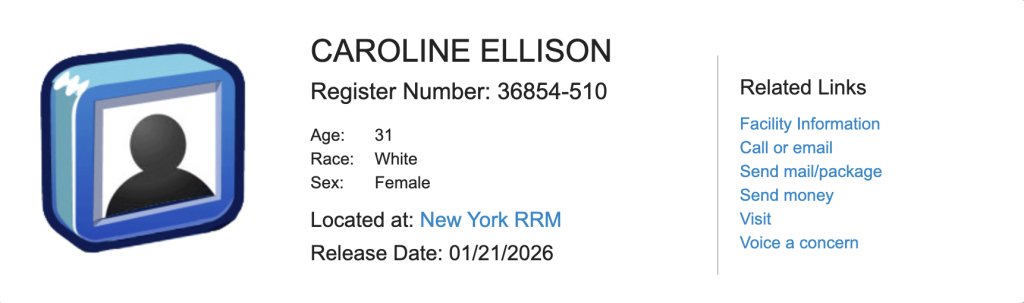

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.

OneCoin’s legal chief pleaded guilty to money laundering and wire fraud charges, according to a statement released today from the U.S. Attorney’s Office for the Southern District of New York.

OneCoin’s legal chief pleaded guilty to money laundering and wire fraud charges, according to a statement released today from the U.S. Attorney’s Office for the Southern District of New York.

Coinbase says crypto market structure bill more complex than stablecoin framework but global competition will force congressional action this year.

Coinbase says crypto market structure bill more complex than stablecoin framework but global competition will force congressional action this year.

(@suji_yan)

(@suji_yan)