We Did the Math: How Much an Energy-Efficient Fridge Saves vs. a 10-year-old Model

Bitcoin largest holders are steadily increasing their exposure, even as prices weaken and global uncertainty intensifies. Key Points Wallets holding at least 1,000 BTC added 104,340 BTC in recent weeks.

Bloomberg Senior Commodity Strategist, Mike McGlone, has warned of a potential XRP price breakdown below a pivotal support level. This warning comes on the back of the ongoing corrective wave that has dominated the broader crypto market.

A combination of on-chain and market activity is supporting bullish sentiment for Shiba Inu despite the ongoing consolidation. Yesterday, millions of Shiba Inu disappeared from exchanges, hinting at renewed accumulation despite price uncertainties.

Shiba Inu has slipped further as traders continue to watch a key trend indicator, with volatility easing and funding rates slightly positive. Shiba Inu (SHIB) has changed hands slightly lower over the past 24 hours, down about 0.8% to around $0.000007695.

A prominent Cardano community member argues that ADA’s current ranking as the 10th biggest token reflects market misunderstanding rather than technological inferiority. Critics have widely interpreted Cardano’s position as the 10th biggest cryptocurrency as a sign of low adoption or innovation.

The recent retracement has brought Cardano to a key buying zone, suggesting that a possible recovery could be in the pipeline. Specifically, the current price level marks the support area in a broader descending channel, an area that could determine the near- and mid-term price development for Cardano.

Jeel, a subsidiary of Riyad Bank, has signed a partnership with Ripple to explore advanced blockchain applications aimed at strengthening financial services across Saudi Arabia.

More big news from the Middle East! @Ripple is partnering with @Jeelmovement, the innovation arm of @RiyadBank, to advance Saudi Arabia’s financial future through blockchain innovation

— Reece Merrick (@reece_merrick) January 26, 2026

The Kingdom’s visionary leadership has established Saudi Arabia as a forward-thinking… pic.twitter.com/KhQ7giluhE

In a press release shared with CryptoNews, the firm said the partnership will focus on developing secure and transparent digital infrastructure that can support the Middle East.

The agreement is part of growing institutional interest in blockchain payment systems and digital asset technologies as Saudi Arabia continues positioning itself as a regional leader.

The deal will also assess how blockchain technology can improve the speed, cost efficiency and transparency of cross-border payments, a key area of opportunity for the Gulf region’s remittance and trade corridors.

Beyond payments Jeel and Ripple will also explore use cases in digital asset custody and tokenization. These technologies are increasingly viewed as foundational components of next-generation financial markets, allowing the storage of digital assets and the representation of real-world assets on blockchain networks.

Jeel and Ripple will also jointly develop proofs-of-concept within Jeel’s regulatory sandbox allowing Ripple’s blockchain solutions to be tested in a controlled and compliant environment.

The firm’s will examine how blockchain-enabled payment corridors can improve international remittance experiences while also evaluating custody frameworks.

“This partnership with Ripple reflects our strategy of using the Jeel Sandbox to responsibly explore next-generation financial infrastructure,” said George Harrak CEO of Jeel.

“By combining regulated experimentation with global blockchain expertise, we are building the foundations to evaluate scalable use cases that enhance cross-border payments and digital asset capabilities in line with the Kingdom’s long-term digital ambitions,” adds Harrak.

The sandbox approach is expected to help demonstrate scalable and interoperable digital financial infrastructure that could contribute to the modernization of Saudi Arabia’s banking ecosystem.

For Jeel, the partnership strengthens its position as a pioneer in regulated blockchain experimentation, expanding its innovation capabilities beyond traditional fintech acceleration programs. The collaboration also supports Riyad Bank’s broader ambition to evaluate future-ready digital financial services.

Ripple, meanwhile, gains strategic access to Saudi Arabia’s fast-growing fintech landscape through Jeel’s institutional network and innovation platform.

“Saudi Arabia’s visionary leadership has established the Kingdom as a forward-thinking global hub for digital transformation,” said Reece Merrick, Managing Director for the Middle East and Africa at Ripple. “Ripple has signed an MOU with Jeel to explore integrating secure, efficient blockchain solutions into the national financial architecture.”

The post Riyad Bank’s Jeel Partners With Ripple to Advance Blockchain Payments and Tokenization appeared first on Cryptonews.

Japanese Bitcoin treasury firm Metaplanet reported a 104.6 billion yen ($680 million) impairment on its Bitcoin holdings, reflecting the impact of last year’s market downturn on the value of its digital asset portfolio.

Key Takeaways:

In a press release issued Monday, the company said the impairment was recorded as a non-operating expense and does not affect cash flows or day-to-day operations.

Even so, the accounting charge is expected to weigh heavily on reported results for the fiscal year ended December 2025.

Including the Bitcoin-related write-down, Metaplanet now expects to post a consolidated ordinary loss of 98.56 billion yen ($640 million) and a consolidated net loss of 76.63 billion yen ($498 million).

The company also forecast a comprehensive loss attributable to shareholders of 54.02 billion yen ($351 million). Final earnings are scheduled for release on Feb. 16.

“While short-term accounting volatility is inherent to our business model, our medium-to-long-term BTC accumulation and capital strategy remain on track,” Metaplanet said, underscoring its commitment to maintaining Bitcoin as a core treasury asset.

The scale of the impairment reflects the company’s rapid accumulation of Bitcoin over the past year. By the end of 2025, Metaplanet held 35,102 BTC, up sharply from 1,762 BTC a year earlier.

According to a previous disclosure from Chief Executive Simon Gerovich, the firm spent $451.06 million during the fourth quarter of 2025 to expand its holdings, paying an average price of $105,412 per Bitcoin.

*Notice Regarding Revision of Full-Year Earnings Forecast for Fiscal Year Ending December 2025, Recording of Bitcoin Impairment Loss, and Announcement of Full-Year Earnings Forecast for Fiscal Year Ending December 2026* pic.twitter.com/VIKYRYb981

— Metaplanet Inc. (@Metaplanet) January 26, 2026

Bitcoin was trading near $87,500 at the end of December.

Despite the headline loss, Metaplanet raised its full-year 2025 guidance, pointing to stronger-than-expected performance in its Bitcoin income generation business.

That segment, which relies on derivatives and options strategies, has become a growing contributor to revenue.

The company now expects full-year revenue of 8.9 billion yen ($57.8 million), up 31% from its prior forecast, while operating income is projected at 6.3 billion yen ($41 million), representing a 33.8% increase.

Metaplanet cited more diversified funding, including the issuance of Series B perpetual convertible preferred stock and access to a $500 million credit facility, as key drivers of the upward revision.

Looking ahead, Metaplanet forecast revenue of 16 billion yen ($104 million) and operating income of 11.4 billion yen ($74 million) for fiscal 2026, with the Bitcoin income generation unit expected to account for the bulk of that growth.

Shares of Metaplanet listed in Tokyo fell 7.03% on Monday to 476 yen, while the company’s US-traded shares closed higher on Friday.

Last month, Metaplanet shareholders approved five proposals at an extraordinary meeting, clearing the way for two new classes of preferred shares designed to fund Bitcoin purchases while delivering fixed monthly and quarterly dividends to investors.

The Tokyo-listed company is now positioned to raise capital through dividend-paying securities rather than further diluting common stockholders.

The post Japan’s Metaplanet Takes $680M Accounting Hit on Bitcoin Holdings appeared first on Cryptonews.

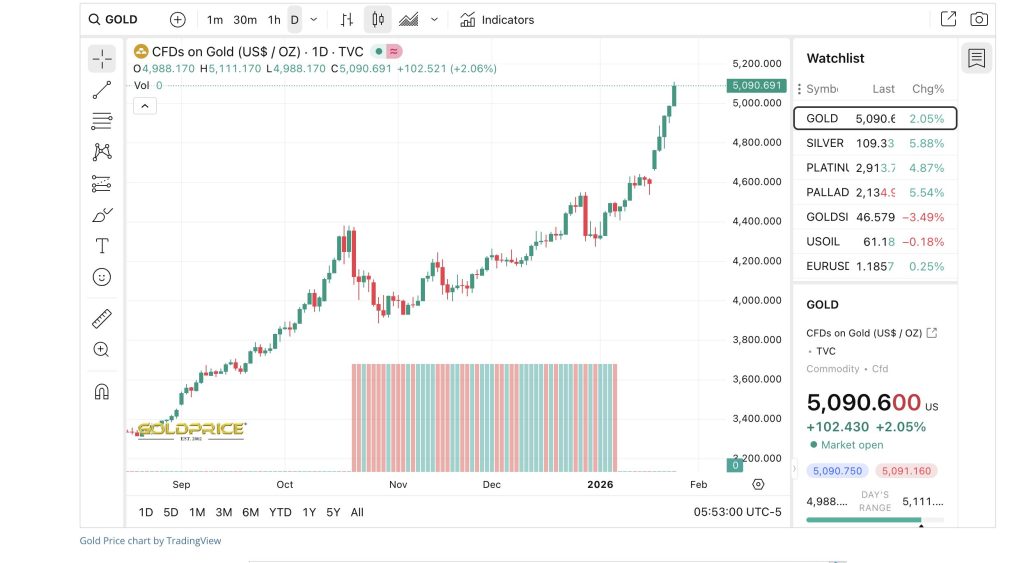

Gold’s rally is showing little sign of slowing as global markets head into 2026 with investors increasingly looking for refuge in traditional safe-haven assets amid geopolitical uncertainty.

According to Gracy Chen the CEO of crypto exchange Bitget says gold continues to act as “the world’s ultimate insurance policy,” as demand remains firm while broader financial markets adjust to shifting macroeconomic risks.

“Technically, the market is still in expansion mode,” Chen said pointing to Fibonacci extension levels that suggest gold could climb toward the $5,325–$5,400 range in the months ahead.

She added that strong buying interest holding around $4,830 indicates the current move is part of a sustained trend rather than a topping pattern.

Gold has benefited during periods of heightened global instability and Chen believes the current environment will continue to support its role as a defensive asset.

With many investors reassessing risk exposure across equities and emerging markets, the precious metal is once again being positioned as a portfolio hedge against inflation, geopolitical shocks and currency volatility.

The resilience of demand at key technical support levels suggests that gold’s rally is being driven by structural factors rather than short-term speculation.

Chen also drew parallels between gold’s trajectory and Bitcoin’s outlook arguing that the world’s largest cryptocurrency remains undervalued relative to its long-term potential.

“Bitcoin is on a similar trajectory considering it is an undervalued asset currently,” she said.

While Bitcoin remains sensitive to macroeconomic events Chen highlights several forces that could support an increasingly bullish breakout over the next year.

The key catalysts Chen points to continued institutional demand through spot Bitcoin ETFs which have provided steady inflows and reinforced Bitcoin’s growing role in mainstream portfolios.

She also notes that Bitcoin volatility has declined compared to major tech stocks showing maturation in the asset class.

In the policy arena ongoing progress on a US crypto market structure bill could also provide greater regulatory clarity, potentially unlocking further institutional participation.

Chen believes Bitcoin’s current market cycle may also be diverging from historical norms with structural adoption and regulatory momentum creating conditions for sustained upside.

“If these forces persist Bitcoin has a credible path toward $150,000–$180,000 by the end of 2026,” she said.

Chen’s outlook shows a broader theme emerging across global markets: investors are increasingly balancing traditional stores of value like gold with digital alternatives such as Bitcoin.

As geopolitical risks continue to linger and financial systems evolve both assets may continue to benefit from their roles as hedges—one rooted in centuries of history – the other driven by institutional adoption and technological change.

The post Bitget’s Gracy Chen Says Gold’s Bull Run Isn’t Over — Bitcoin May Be Undervalued appeared first on Cryptonews.

Crypto markets entered the new week on the back foot as a wave of macro uncertainty sparked heavy liquidations across major digital assets.

Key Takeaways:

After trading in a tight range over the weekend, prices slid during early Asian hours, triggering more than $550 million in leveraged long liquidations, according to market data cited by QCP Asia.

Bitcoin briefly dipped to the $86,000 level before stabilizing, while Ethereum fell toward the $2,785 area.

The pullback stood in contrast to traditional safe havens, with gold and silver extending their recent rally as investors rotated into lower-risk assets.

Market participants point to a cluster of macro developments driving the move, according to QCP.

Chief among them were comments from President Donald Trump on the possibility of imposing 100% tariffs on Canadian imports, renewed concern over a looming partial shutdown of the US government, and ongoing uncertainty around potential US-Japan coordination to arrest further weakness in the yen.

Currency markets remain a key pressure point. A “rate check” on USD/JPY by the New York Fed late last week signaled growing sensitivity to yen depreciation, with the 160 level widely viewed as a threshold that could prompt intervention.

While the pair has since pulled back, it continues to trade near two-month highs around 154, prompting investors to unwind short-yen positions rather than risk sudden policy action.

QCP analysis notes that crypto assets traded in a narrow range over the weekend before coming under pressure in early Asian hours, triggering over $550 million in leveraged long liquidations. BTC briefly tested $86K before finding support, while Ethereum fell to the $2,785 area.…

— Wu Blockchain (@WuBlockchain) January 26, 2026

US domestic politics are adding another layer of tension. Although broader risk sentiment found some relief after Canadian Prime Minister Mark Carney said Ottawa has no plans to pursue a free trade deal with China, fiscal negotiations in Washington remain unresolved.

House Republicans have advanced spending bills that include roughly $64.4 billion for border security and the Department of Homeland Security, while Senate Democrats have indicated they will block the measures.

With current government funding set to expire on January 30, failure to reach an agreement would result in a partial shutdown.

Markets appear to be taking that risk seriously. Polymarket odds currently imply roughly a 75% chance of a shutdown by January 31, a dynamic that echoes last autumn’s fiscal standoff, which coincided with a sharp drawdown in crypto prices.

Derivatives markets are already reflecting a more cautious stance. Put skews and implied volatility have risen across maturities, with traders rolling downside protection in bitcoin options from the 88,000 level toward 85,000, according to QCP.

Alongside ongoing geopolitical and fiscal headlines, markets face a busy week that includes major technology earnings and a Federal Reserve policy decision.

While the Fed is expected to hold rates steady, investors will be watching closely for any shift in Chair Jerome Powell’s guidance.

“With multiple macro risks unresolved, crypto prices are likely to chop around in the near term, pending greater clarity, particularly around the risk of a US government shutdown,” QCP said.

The post Macro Fears Trigger $550M Crypto Liquidations – What’s Really Going On? appeared first on Cryptonews.

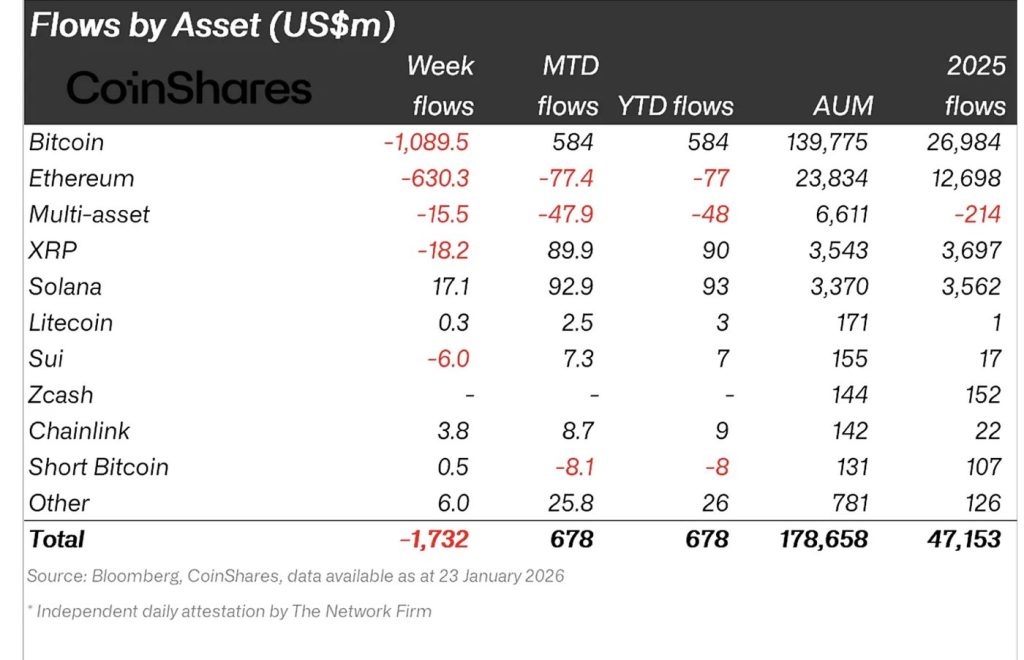

Digital asset investment products saw sharp outflows last week with investors pulling $1.73 billion, the largest weekly decline since mid-November 2025, according to CoinShares report authored by head of research James Butterfill.

CoinShares notes that the wave of redemptions reflects persistent bearish sentiment, driven by fading expectations for interest rate cuts, negative price momentum and growing disappointment that digital assets have not yet benefited from the broader “debasement trade.”

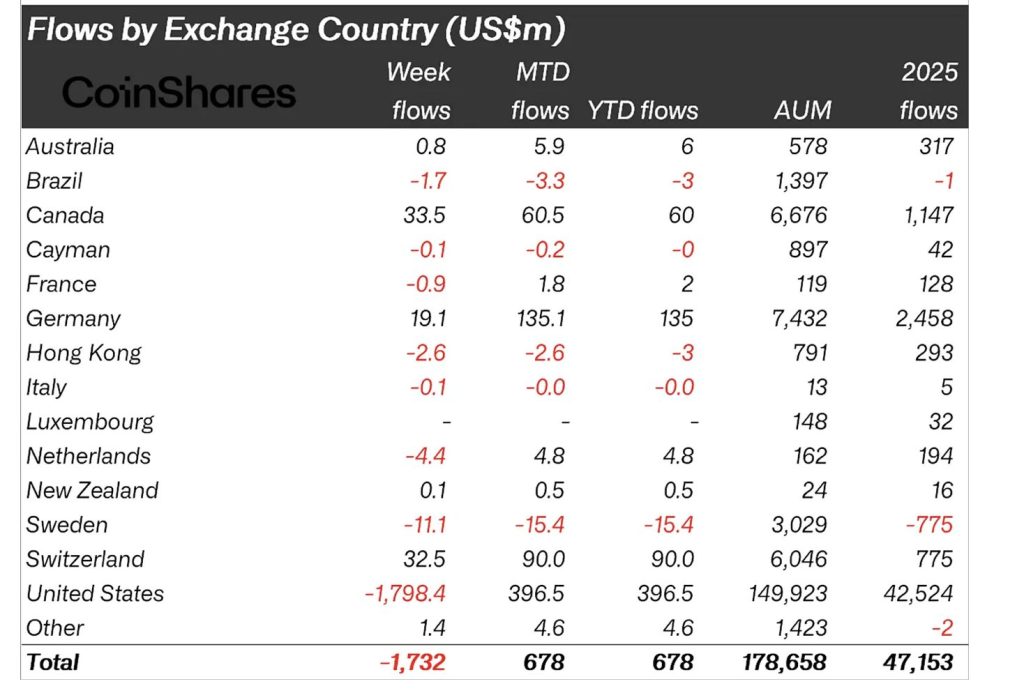

Outflows were heavily concentrated in the United States, which accounted for nearly $1.8 billion, while sentiment was more mixed across Europe and Canada.

Bitcoin products recorded outflows of $1.09 billion, the largest since mid-November 2025, showing that investor confidence has yet to recover following the October 2025 price crash.

Ethereum followed with $630 million in outflows while XRP investment products saw an additional $18.2 million exit the market — highlighting broad-based weakness across major assets.

Butterfill addes that minor inflows into short-Bitcoin products — totalling just $0.5 million — suggest bearish positioning remains limited, but overall sentiment has not meaningfully improved.

Solana was also a notable exception attracting $17.1 million in inflows and bucking the wider negative trend. Smaller altcoins such as Binance-linked products ($4.6 million) and Chainlink ($3.8 million) also posted modest gains.

While the US dominated the outflows, CoinShares reports that other regions saw investors take advantage of price weakness to add to long positions.

Switzerland recorded inflows of $32.5 million, Canada added $33.5 million, and Germany saw $19.1 million in inflows. Sweden and the Netherlands both posted smaller outflows of $11.1 million and $4.4 million respectively.

The divergence suggests that while US-based investors are reducing exposure some international allocators continue to view pullbacks as entry opportunities.

Despite near-term bearishness in fund flows CoinShares Research maintains a bullish long-term outlook based on its updated adoption-based valuation model.

The framework models Bitcoin as a global savings asset competing with deposits, gold, real estate, and bonds. Using conservative assumptions — including sub-1% disposable income allocation and a reduced flow-to-market-cap multiple of 3.5x — CoinShares projects Bitcoin ownership could rise from roughly 560 million owners in 2025 to 1.16 billion by 2029.

Under this scenario Bitcoin’s valuation floor could reach approximately $317,000 by 2029 implying a potential 3.2x return from mid-November 2025 levels, notes the firm.

CoinShares stressed that the model is designed to estimate price-supporting bottoms rather than speculative cycle peaks with ETF growth and emerging-market adoption continuing to accelerate global participation.

The post Crypto Funds Shed $1.73B as Bearish Sentiment Deepens: CoinShares appeared first on Cryptonews.

Changpeng “CZ” Zhao confirmed he has no plans to return to Binance despite receiving a presidential pardon from Donald Trump three months ago.

Speaking at his first World Economic Forum appearance in Davos, the former CEO detailed his prison experience, the pardon process, and his current government advisory work on crypto regulation.

“Much more freedom, much more liberated,” Zhao said about the October 20 pardon’s psychological impact. “I was a free man before but with a felon status. But now I’m a real free man.“

Zhao served four months in federal prison after pleading guilty in November 2023 to violating the Bank Secrecy Act.

His first day involved a “pretty brutal” strip search where authorities required him to “strip naked,” “lift your balls,” and “flip over, spread your butt cheeks, cough three times.“

His first cellmate was serving 30 years for double murder. “I’m not usually very emotionally stable,” Zhao said about coping.

“So I just thought, at four months, I just got to get through it, right?” Despite legal advice that no one in U.S. history had been jailed for a single Bank Secrecy Act violation, he received prison time while most bank CEOs get deferred prosecution agreements.

Media speculation in March 2025 prompted Zhao to apply after major publications suggested he should receive one.

“It was actually all the media that says I might be trying to get a pardon,” he explained. “If all the media like you know Wall Street Journal, Bloomberg, New York Times are saying that I should be getting a pardon,” he decided to apply.

He never met Trump directly. “I never got in front of Trump,” Zhao said, noting the process remained “like a black box. I don’t know what the process is.”

He was “about 30, 40 feet away from him” during a Davos session but never shook hands. “I just waited and waited and waited and then suddenly it happened.“

A candid conversation from Davos – on prison, pardon, and what freedom means going forward.

— CZ

Full interview on @CNBC with @andrewrsorkin. Focused on building what’s next. pic.twitter.com/x94llJFac2BNB (@cz_binance) January 25, 2026

Zhao now focuses on Giggle Academy, a free education platform, while working with YZLabs and mentoring BNB Chain founders.

“I also spent quite a lot of a lot of time talking with about a half about a dozen governments about you know how to regulate crypto, how to do tokenization, how to do stable coins,” he said.

He firmly ruled out returning to Binance. “I haven’t really needed to go back. I didn’t really want to,” he stated.

“I don’t think it’s good for me to go back. I think we should leave room for strong leaders to grow.” His involvement today is minimal, revealing, “When I want to give them advice, I just write it on Twitter.“

When asked about potential refunds of Binance’s $4.3 billion settlement, Zhao said, “If we get any refund, we will be investing that in America, to show our appreciation,” though he clarified he had not requested one.

— Cryptonews.com (@cryptonews) November 17, 2025

Former @Binance CEO @cz_binance says any refund of Binance’s $4.3 billion DOJ settlement would be reinvested in the United States.#Crypto #Binancehttps://t.co/yhb5gQfAlN

Notably, Zhao predicted a “super cycle” in 2026 that could break Bitcoin’s four-year pattern. “I have very strong feelings that you will probably be a super cycle” in 2026, he told CNBC.

“Normally, Bitcoin follows four year cycles historically,” Zhao explained.

“If you look at historic data like every four years you know there’s an all-time high and then there’s a drop. But I think this year given the US being so pro crypto and every other country is kind of following, I do think we will see this we will probably break the four year cycle.“

Zhao doesn’t trade despite his holdings. “I don’t trade at all,” he said. “I just hold Bitcoins. I hold BNB. I don’t do day trading.” On long-term predictions, he stated, “If you look at a 10, five, 10 year horizon, it’s very easy to predict. We’re going to go up.“

The pardon has drawn fierce opposition from Democratic lawmakers, who question its timing and the circumstances surrounding it.

Senator Elizabeth Warren wrote that “the convergence of Mr. Zhao’s pardon application and Binance’s financial entanglements with the President’s family presents urgent concerns regarding the integrity of our justice system.“

Representative Maxine Waters also called it “an appalling but unsurprising reflection of his presidency.“

Despite these allegations, Trump claimed he doesn’t know who Zhao is, calling the case “a Biden witch hunt.”

White House press secretary Karoline Leavitt also defended the decision, noting the case had “no allegations of fraud or identifiable victims.“

In response to mounting criticism, Zhao’s attorney, Teresa Goody Guillén, dismissed corruption allegations as “false statements” based on “fundamental misunderstandings” of blockchain technology, arguing that Zhao “never should have been prosecuted.“

— Cryptonews.com (@cryptonews) November 16, 2025

CZ's attorney dismisses pardon corruption allegations as Democratic lawmakers investigate alleged Binance ties to Trump's crypto venture.#CZ #Trumphttps://t.co/0WLLMpcu7i

While CZ confirmed he will not be returning the exchange, reports, however, indicate that Binance is exploring options to re-enter the U.S. market.

The post CZ Declares He Won’t Return to Binance After Trump Pardon – What’s Going On? appeared first on Cryptonews.

The disruption began Saturday (5am Pacific time, Jan .24) affecting approximately 1.8 billion Gmail users worldwide with widespread email misclassification.

The post Gmail Spam Filter Breakdown Affects 1.8B Users appeared first on TechRepublic.

Linux running inside a PDF. An actual working operating system with a terminal where you can type commands. Open a PDF in Chrome. Wait 30 seconds. You now have a working Linux terminal. No installation, no software, just a 6MB file that boots an entire operating system.

A high school student named Allen built this, the same kid who previously crammed Doom into a PDF. Before that he made tools to bypass school software restrictions and exploits to boot Linux on locked-down Chromebooks.

![]() Jasmine Sun / @jasmine's substack:

Jasmine Sun / @jasmine's substack:

Claude Code can feel daunting, and most people's problems are not software-shaped, but it is clearly autonomous and the home-cooked app renaissance is great — are your problems software-shaped? — ∙ Paid — If you tell a friend they can now instantly create any app, they'll probably say “Cool!