The State of Bitcoin Self-Custody in 2026 W/ Casa CEO

Bitcoin Magazine

The State of Bitcoin Self-Custody in 2026 W/ Casa CEO

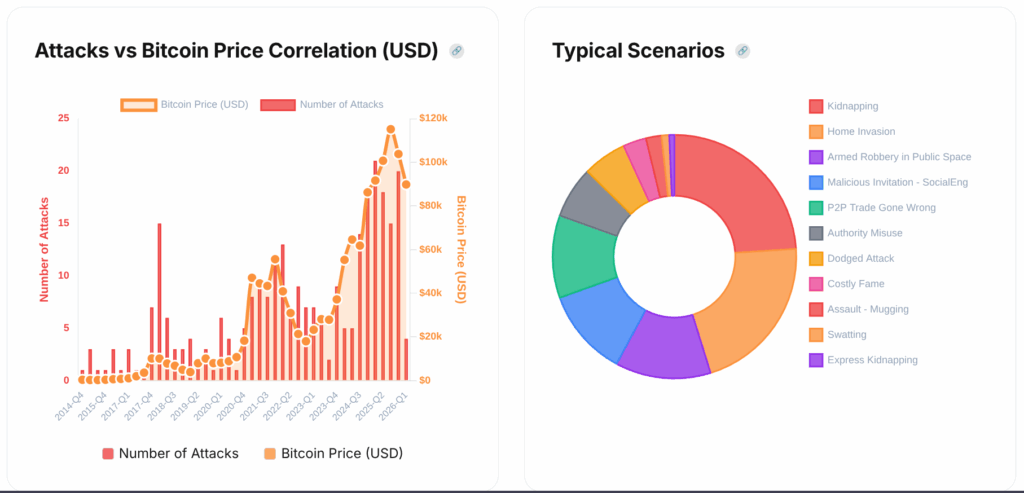

As Bitcoin enters 2026 with sustained institutional adoption and price stability following the 2024-2025 bull run, self-custody remains a cornerstone of the asset’s sovereignty promise. Yet the landscape has evolved significantly. Spot Bitcoin ETFs have unlocked access to passive investors comfortable with Wall Street’s “trust me, bro” brokerage models, while physical attacks on crypto users have surged to record levels, known as “wrench attacks”. So, is self-custody a thing of the past, a dead meme many of us fell for, or is it transforming as Bitcoin matures?

In a recent interview with Bitcoin Magazine, Casa CEO Nick Neuman provided a candid perspective of these dynamics, positioning his company’s multisig solutions as a bridge between the vision of pure self-sovereignty and practical usability for high-value holders, tailor-made to deal with modern security challenges and even geopolitical risk.

Casa, founded in 2018, targets users securing meaningful Bitcoin amounts—typically five figures or more—where financial freedom is more important than convenience. Neuman described Casa’s north star as “maximizing sovereignty and security in the world” through Bitcoin and private key cryptography. In recent years, this has solidified into “building the Swiss bank for the sovereign individual”—a service for those who view money as integral to personal autonomy.

Bitcoin Magazine has covered the company’s progress extensively throughout the years, including a November 2024 interview with Neuman by Frank Corva and a June 2025 story on its partnership with Swiss platform Relai for multisig security and inheritance planning.

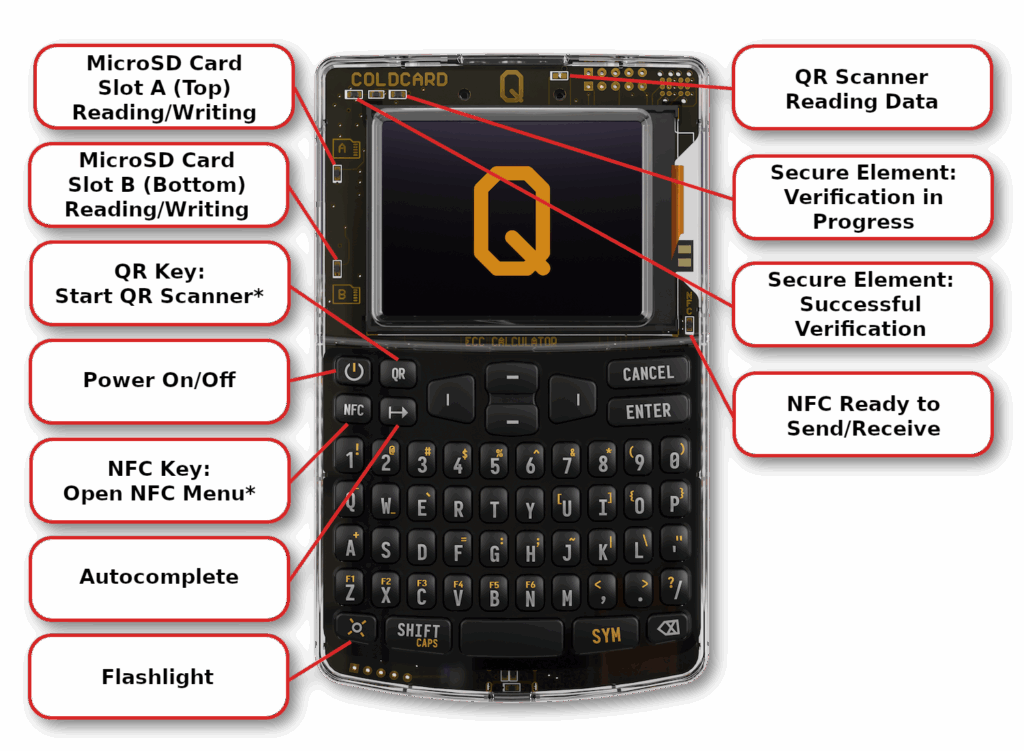

ETFs and the Promise of Convenience

“Not everyone wants to be a sovereign individual right now,” Neuman noted when discussing the challenges self-custody faces in 2026, pointing to an increasingly obvious reality: Bitcoin self-custody demands high personal responsibility and a significant amount of technical competence. These remain true despite best efforts in user interface design. NVK, the founder of the Coldcard Q, has joked publicly that trying to design self-custody products capable of resisting nation-state intrusions, with “grandma” levels of ease of use, might be a pipe dream. At the very least, the personality type and technical competence needed for maximum self-custody remain a limiting factor on the realization of the cypherpunk utopia.

ETFs offer plug-and-play exposure to a new and broad userbase, while self-custody appeals mostly to high-agency users unwilling to accept black-box custodian risks — and that’s the good news, “at scale, you simply can’t afford to trust that Coinbase or anyone else is getting every process right,” he said.

Institutions such as family offices, corporations, custody banks, and investment funds are also starting to understand the risks of outsourcing Bitcoin custody. Neuman revealed that “Increasingly over the last year, Casa is helping large institutions that need to have provable security and provable control to secure their assets,” adding that institutions “are starting to realize that in a lot of ways regulators are requiring them to have actual control over this asset.”

In 2025, for example, the OCC clarified that national banks and federal savings associations have the liberty to custody crypto assets for clients, adding the caveat that “As with any activity, a bank must conduct crypto-asset custody activities, including via a sub-custodian, in a safe and sound manner and in compliance with applicable law”. The GENIUS Act provided further structure by giving the green light to full reserve Stablecoins in U.S. financial markets.

The SEC’s January 2025 rescission of SAB 121 (via SAB 122) removed capital penalties for crypto custody, making it more practical for banks. Some banks publicly known to be developing independent crypto custody platforms for their users include BNY Mellon, State Street, Citi, and JPMorgan. This is in contrast to outsourcing all custody to the most popular custodians like Coinbase, which some worry poses systemic risks to the Bitcoin network and its investors.

Neuman points out that self-custody multi-signature platforms like Casa address the concerns and needs of institutional players. Multisig requires multiple keys to sign a valid transaction, but also enables key rotations for personnel changes, with added auditability. “If someone who controlled a key leaves, you can rotate that key out completely… We make that process straightforward, and for institutions, we’ve added extra guardrails, auditability, and visibility,” said Neuman.

As a result of this growing trend, we might soon start to see a wave of competition in retail facing custodial bank-like services in the U.S., while institutional players might begin to decouple from the plug-and-play custody outsourcing we have seen so far, a step towards custody decentralization of Bitcoin.

Defeating Wrench Attacks

Physical coercion attacks—known as “$5 wrench attacks”—reached unprecedented levels in 2025. Jameson Lopp, Casa’s chief security officer, maintained a decade-long database, documenting approximately 65–70 incidents, the highest on record, with at least four fatalities. Alena Vranova, co-founder of Trezor, now running a wrench attack prevention startup called Glok.me, places the number at 292, breaking down the data into various categories.

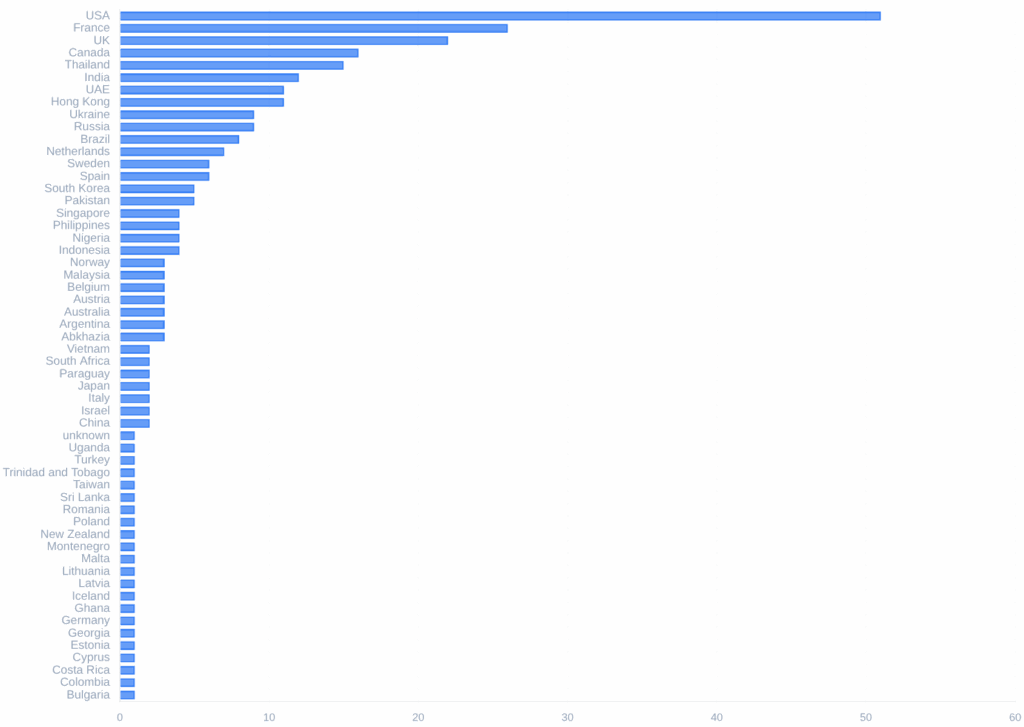

France emerged as a hotspot, with at least 10 reported wrench attacks in 2025, often linked to tax reporting, potentially exposing addresses and identities, including a case where a tax official was convicted for selling taxpayer data to criminals. The United States is leading the pack in total numbers of known crypto-related attacks.

However, it is important to weigh data of this sort with a grain of salt. It should be considered on a per capita basis, as countries like the U.S. have close to 400 million residents compared to France with around 70 million. Comparisons to fiat fraud like identity theft and other forms of violent crime are often not included in these type statistics. It is nevertheless an alarming trend and a common talking point, giving crypto users pause when deciding to take self-custody.

Neuman believes, however, that the public is misunderstanding the problem at hand, thinking that giving custody to a third party is actually the solution; it is not. He shared a non-violent case that challenges this “just use a custodian” narrative: A Casa client was drugged and coerced at a bar. Funds in Casa’s multisig stayed secure due to dispersed keys — the user did not have enough keys on him to sign a transaction — but a small Coinbase balance was drained from the client’s phone app. “It just completely flips the prevailing wisdom,” Neuman noted, “Actually, that doesn’t always solve the problem.”

Best practices on this front revolve around not becoming a target in the first place, as in not becoming an influencer flaunting crypto wealth. But it also means not exposing data that reveals you have crypto wealth, a privacy risk legacy finance is particularly vulnerable to, as seen by the incredible rise in financial data hacks and identity theft. Though hardware wallet manufacturers like Ledger have suffered multiple payment infrastructure-related hacks that have resulted in user data being compromised, putting users at risk.

Casa counters physical threats of this sort with multisig key distribution, making it so that users do not have enough access to their Bitcoin to be able to send it all under duress. The app also includes an emergency lockdown feature, and the recovery key Casa holds in these multi-sig accounts won’t co-sign a transaction without proper authentication. Users can configure their Casa service to require video verifications and pre-arranged duress procedures. “If you have used our product correctly and followed our guidance, you can be assured that the attacker at least won’t get your money,” Neuman explained.

Casa’s pseudonymous support—allowing users to avoid sharing names, faces, or locations—draws from Lopp’s own experiences, including being swatted, and is embedded in the company’s privacy-focused DNA.

Geopolitical Hedge

The brokerage model of Bitcoin custody, such as ETFs, further insulates users from organized crime types of wrench attacks, but introduces new risks like rehypothecation – sale of fake shares or under-collateralized paper Bitcoin. Furthermore, Neuman points out that criminals could still come after ETF users, thinking they have self-custody bitcoin as well, “it doesn’t really solve the problem of you getting hurt.” ETFs are also vulnerable to politically motivated persecution.

Casa has observed this specific use case, which it refers to as a geopolitical hedge, where political operatives or influencers protect their wealth from the current political administration in their countries, in times when they find themselves on the back foot. “Right now, we see that Democrats are worried about the Trump administration confiscating their money… But four years ago… we had people who were Republicans doing the exact same thing,” Neuman explained.

Clients of this sort set up Bitcoin wallets that are outside of the immediate reach of the current administration, by, for example, giving a key to a law firm outside of the country, placed in foreign safe deposit boxes, with trustees, or family members, ensuring mobility if domestic assets are frozen. Casa’s recovery key also provides everyday usability without frequent travel, with manual authentication of the user. Bitcoin, in this example, serves as a solution to what you might as well call a nation-state-level wrench attack.

Self-Custody Insurance

A new generation of insurance has also emerged to serve Bitcoin holders who take self-custody. Specifically, companies like AnchorWatch and Bitsurance protect user wealth up to certain limits backed by giants like Lloyd’s of London. If a user does get kidnapped, they can potentially give up their insured coins, minimizing harm to themselves, and then call their insurer, who will have a strong incentive to prevent that from happening.

Neuman acknowledged the innovation but highlighted limitations: “When a lot of people think about insurance with their self-custody, they’re thinking about… affordable insurance… And that just doesn’t exist.” Broad coverage often requires transaction approvals, increasing provider reliance—a compromise many sovereign users reject. Casa, nevertheless, has explored partnerships with this emerging insurance industry.

The Self-Custody Specialist

the client advisory role in bitcoin self-custody, specialized team, story or two? quote. ledger screen story rofl.

Casa has also developed a specialized advisory team, focused on serving its client base with tools the company developed. Advisors complete a six-month training program, shadowing experts who serve clients in emergency situations, as well as answer normal questions and educate their users. “Our advisors bring humanity to Bitcoin, and they bring humanity to helping you be a sovereign individual… that’s really valuable in this world of don’t trust verify,” Neuman said.

Clients praise advisors by name. A recent Bitcoin wallet rescue mission by Casa saved 100 BTC for a pseudonymous client with a Ledger hardware wallet whose screen had died—advisors shipped a replacement Ledger and guided the user to replace the screen themselves. A case study is forthcoming.

Open-Source and Self-Custody

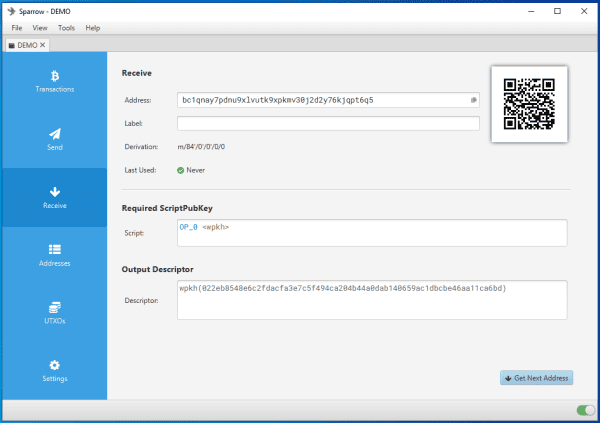

With a lean team of about 35, Casa optimizes for longevity, open-sourcing software products selectively, like their recent YubiKey integration. Their wallet, while not open-source, does not tend to do transaction signing, since its user base primarily signs transactions with hardware wallets that are often already open-source. The Casa app primarily helps users assemble the necessary key material, and according to Neuman, the Casa app’s behaviour can be verified and replicated by using advanced desktop wallets like Sparrow.

Overall, while some recent trends appear to put self-custody on the back foot, the cypherpunk vision continues to move forward, looking to address real-world user needs and threats, one step at a time. Quietly developing a new layer of property rights defense that the highest agency player in the world is now keenly aware of.

This post The State of Bitcoin Self-Custody in 2026 W/ Casa CEO first appeared on Bitcoin Magazine and is written by Juan Galt.