ICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

This post is brought to you in paid partnership with Apollo.io January is the season for audits. We audit our finances, our habits, and our wardrobes. But for anyone running a revenue team, the most critical audit you can perform right now is on your software stack. Most sales operations are messy. You have one […]

The post Don’t let a messy tech stack slow your growth in 2026 appeared first on Digital Trends.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

More ads are coming to App Store search results starting in March, Apple shared on an advertising help page. The company first said that it would increase the number of App Store ads last month, and this new rollout of search ads will begin on Tuesday, March 3, according to a developer email viewed by MacRumors.

"Search is the way most people find and download apps on the App Store, with nearly 65 percent of downloads happening directly after a search," Apple says. "To help give advertisers more opportunities to drive downloads from search results, Apple Ads will introduce additional ads across search queries." Up until this point, ads for related apps have appeared at the top of search results, but now they'll also appear "further down in search results," according to Apple.

App Store activity makes up a significant portion of what Apple calls its "services" business. The company makes money on every App Store transaction, whether it's an app download or an in-app purchase, and increasingly, by selling ad space to companies looking to reach users. App Store ads are hardly new, but the number of ads has steadily increased over the years. Apple added ads to the Today tab in 2022 — a space that's already home to editorial curation that doubles as marketing — and in 2025, Bloomberg reported the company planned to bring ads to Apple Maps.

Apple's decision to rebrand its advertising business from Apple Search Ads to Apple Ads in April 2025 was maybe the best indication that the company was interested in expanding the number of places it would help partners try and reach customers. And it makes sense: the company's billions of devices, each pre-installed with default apps, are some of the most valuable real estate it owns.

This article originally appeared on Engadget at https://www.engadget.com/apps/apple-will-begin-showing-more-app-store-ads-starting-in-march-192031226.html?src=rss

©

Read more of this story at Slashdot.

Bitcoin Magazine

Epoch Ventures Predicts Bitcoin Hits $150K in 2026, Declares End of 4-Year Halving Cycle

Epoch, a venture firm specializing in Bitcoin infrastructure, issued its second annual ecosystem report on January 21, 2026, forecasting robust growth for the asset despite a subdued 2025 performance.

The 186-page document analyzes Bitcoin’s price dynamics, adoption trends, regulatory outlook, and technological risks, positioning the cryptocurrency as a maturing monetary system. Key highlights include a prediction that Bitcoin will reach at least $150,000 USD by year-end, driven by institutional inflows and decoupling from equities. The report also anticipates the Clarity Act failing to pass, though its substance on asset taxonomy and regulatory authority may advance through SEC guidance. Additional forecasts cover gold rotations boosting Bitcoin by 50 percent, major asset managers allocating 2 percent to model portfolios, and Bitcoin Core maintaining implementation dominance.

Eric Yakes, CFA charterholder and managing partner at Epoch Ventures, brings over a decade of finance expertise to the Bitcoin space, having started his career in corporate finance and restructuring at FTI Consulting before advancing to private equity at Lion Equity Partners, where he focused on buyouts. He left traditional finance in recent years to immerse himself in Bitcoin, authoring the influential book “The 7th Property: Bitcoin and the Monetary Revolution,” which explores Bitcoin’s role as a transformative monetary asset, and has since written extensively on its technologies and ecosystem. Yakes holds a double major in finance and economics from Creighton University, positioning him as a key voice in Bitcoin venture capital through Epoch, a firm dedicated to funding Bitcoin infrastructure.

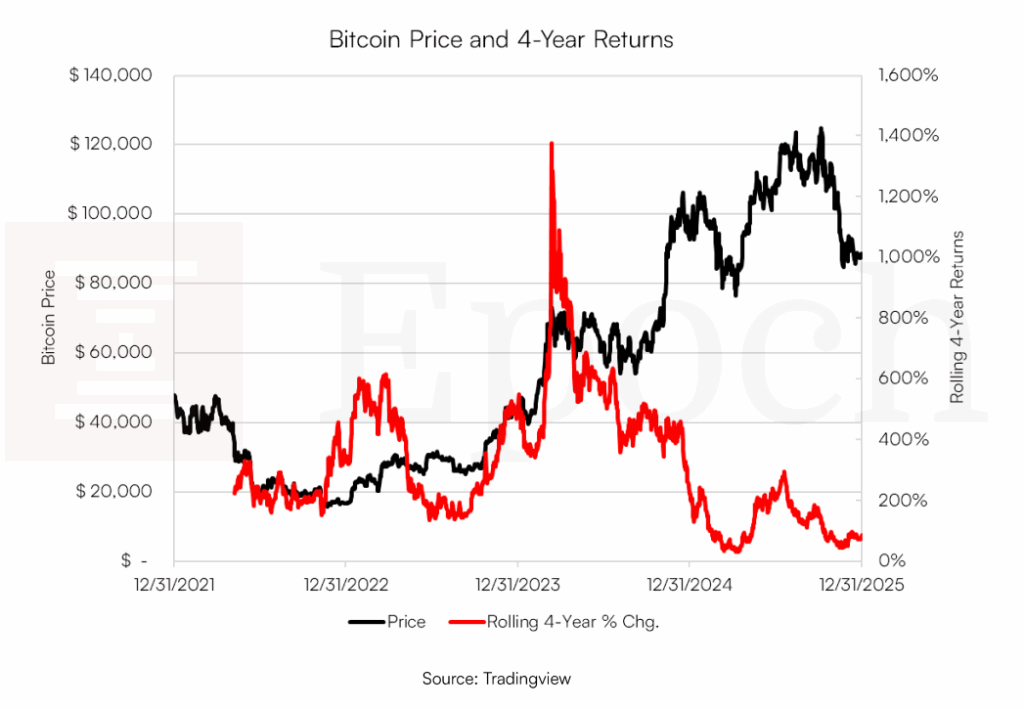

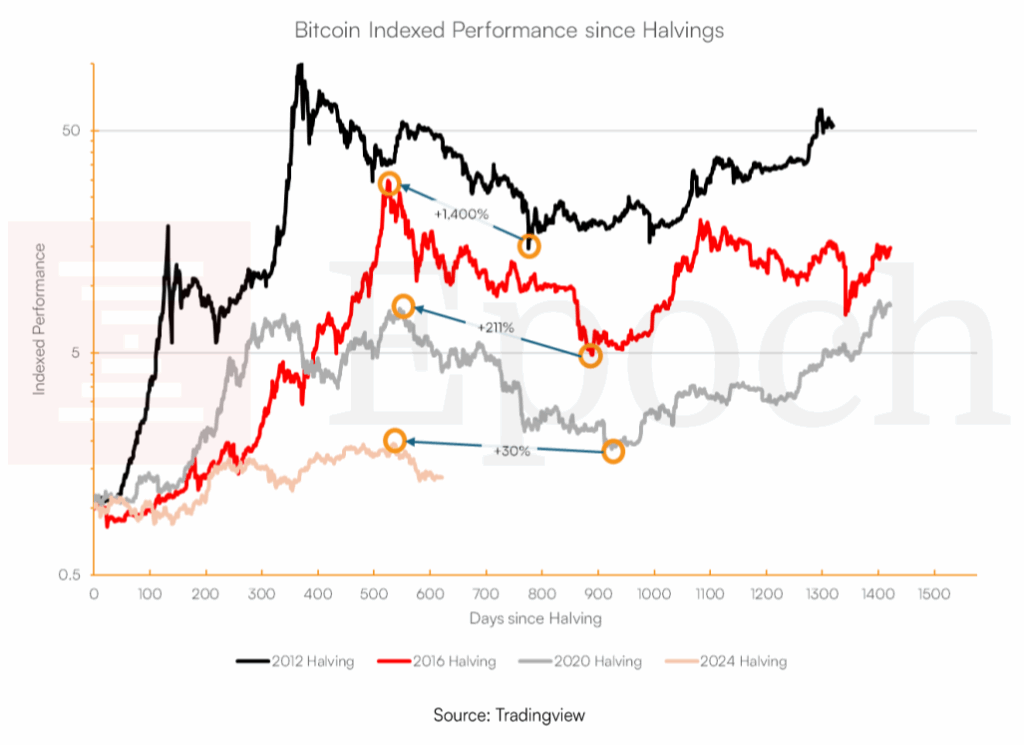

Bitcoin closed 2025 at $87,500, marking a 6 percent annual decline but an 84 percent four-year gain that ranks in the bottom 3 percent historically. The report states the death of the 4-year cycle in no uncertain terms: “We believe cycle theory is a relic of the past, and the cycles themselves probably never existed. The fact is that Bitcoin is boring and growing gradually now. We make the case for why gradual growth is precisely what will drive a ‘gradually, then suddenly’ moment.”

The report goes on to discuss cycle theory in depth, presenting a view of the future that’s becoming the new market expectation: less volatility to the downside, slow and steady growth to the upside.

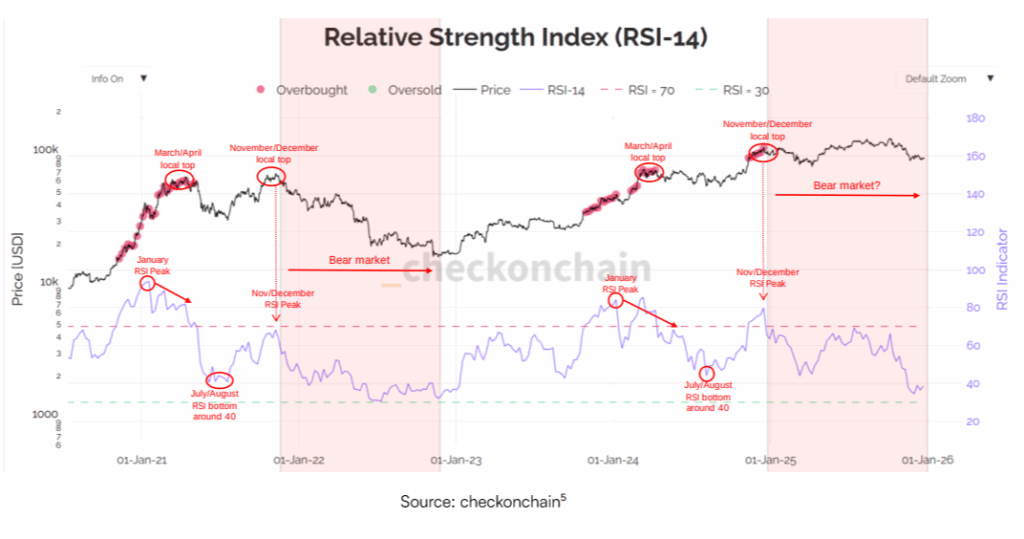

Price action suggests a new bull market commenced in 2026, with 2025’s drop from $126,000 to $81,000 potentially being a self-fulfilling prophecy due to cycle expectations, as RSI remained below overbought since late 2024, suggesting bitcoin already went through a bear market and we are commencing a new kind of cycle.

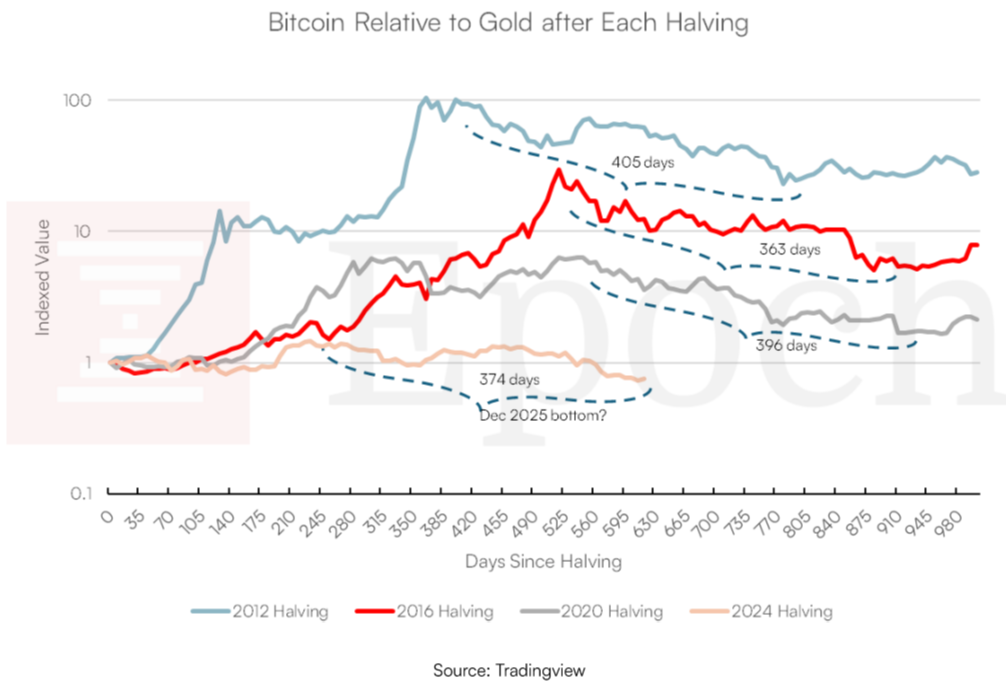

Versus gold, Bitcoin is down 49 percent from its highs, in a bear market since December 2024. Gold’s meteoric rise presents a potential price catalyst for bitcoin; a small rebalancing reallocation from gold of 0.5% would induce greater inflows than the U.S. ETFs; at 5.5%, it would equal bitcoin’s market capitalization. Gold’s rise makes bitcoin more attractive on a relative basis, and the higher gold goes, the more likely a rotation into bitcoin. Timing analysis, as seen in the chart below, which counts days from the local top, suggests Bitcoin might be nearing a bottom versus Gold.

In terms of volatility bitcoin has aligned with mega-caps like Tesla, with 2025 averages for Nasdaq 100 leaders exceeding Bitcoin’s, suggesting a risk-asset decoupling and limiting drawdowns. Long-term stock correlations persist, but maturing credit markets and safe-haven narratives may pivot Bitcoin toward gold-like behavior.

The report goes in-depth into other potential catalysts for 2026, defending its bullish thesis, such as:

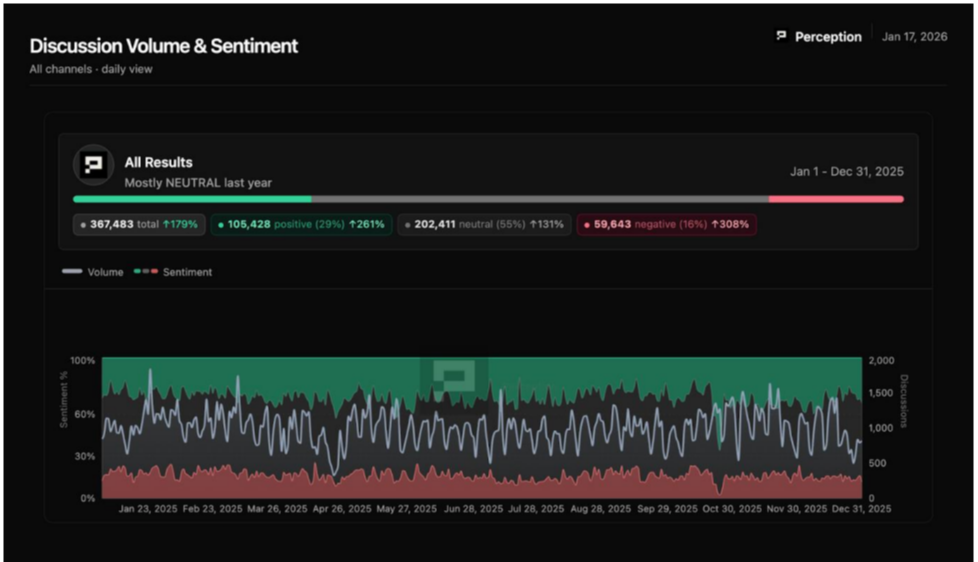

Analysis of 356,423 datapoints from 653 sources reveals a fractured sentiment landscape, with “Bitcoin is dead” narratives concluded. FUD is stable at 12-18 percent but the topics rotate, crime and legal themes are up 277 percent, while environmental FUD is down 41 percent.

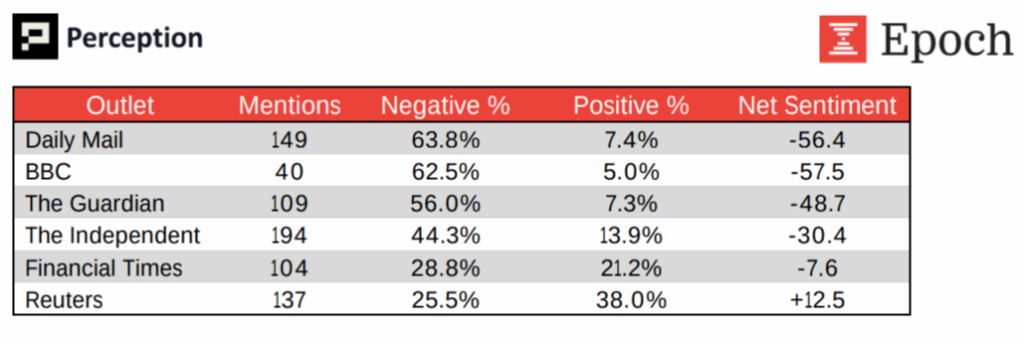

A 125-point perception gap exists between conference attendees (+90 positive) while tech media is generally negative at (-35). UK outlets show 56-64 percent negativity, 2-3 times international averages.

The Lightning Network coverage dominates podcasts at 33 percent but garners only 0.28 percent mainstream coverage, a 119x disparity. Layer 2 solutions are not zero-sum, with Lightning at 58 percent mentions and Ark up 154 percent.

Media framing has caused mining sentiment to swing 67 points: mainstream outlets cover the sector at 75.6 percent positive, while Bitcoin communities view it at only 8.4 percent positive, underscoring the importance of narrative and audience credibility for mining companies.

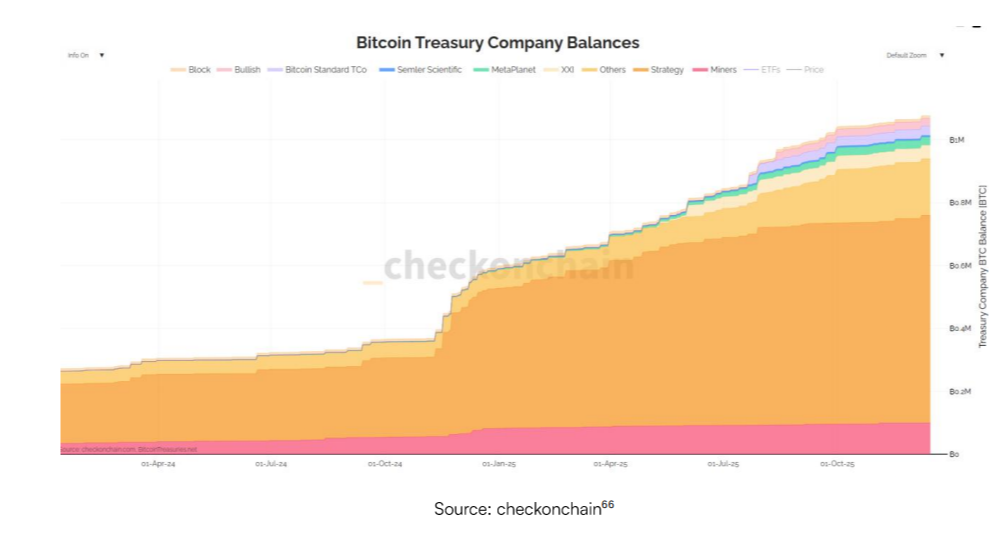

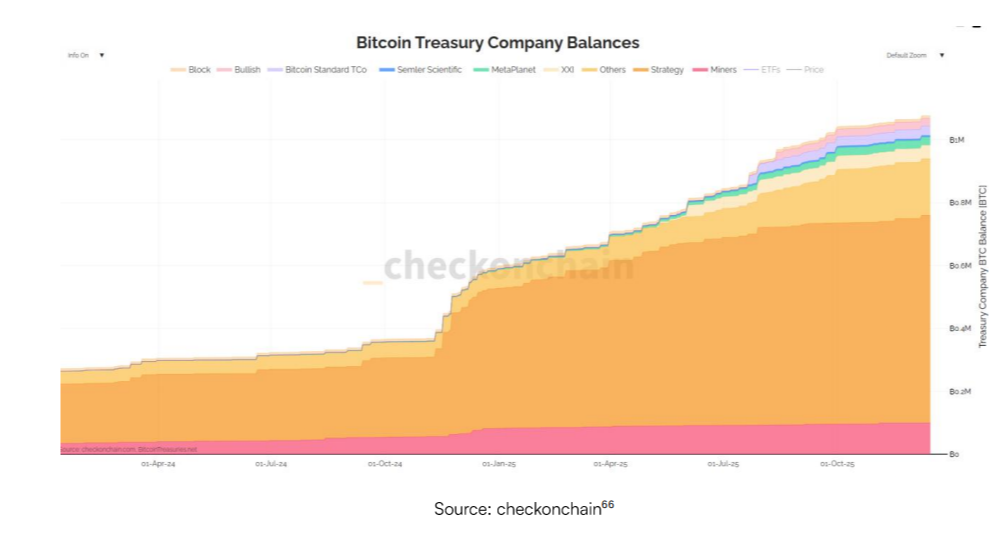

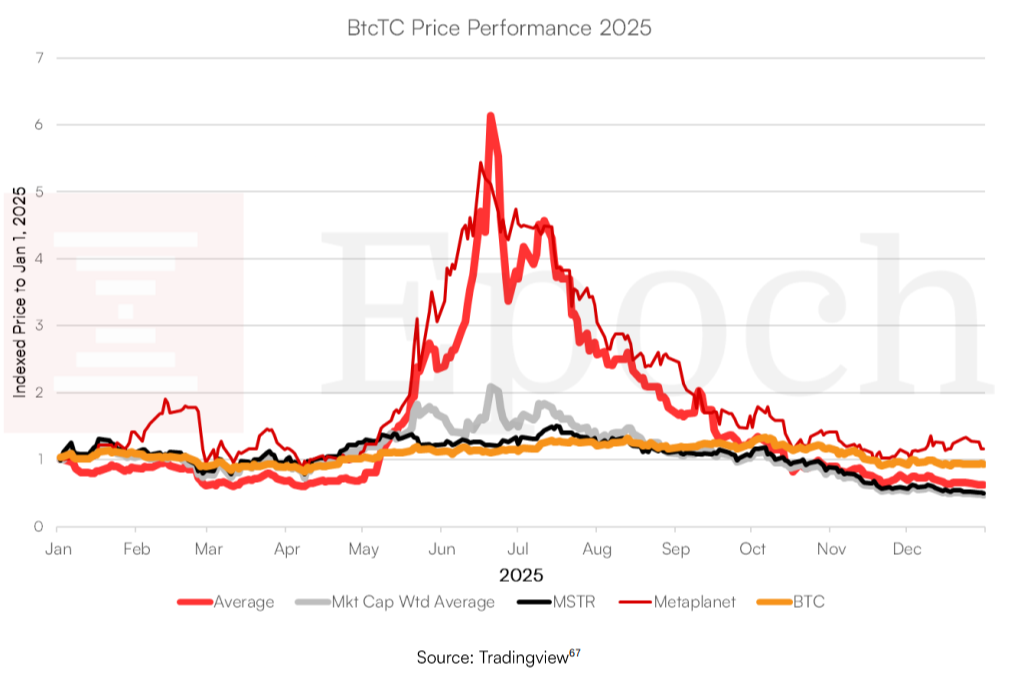

More companies added Bitcoin to their balance sheets in 2025 than in any previous year, marking a major step in corporate adoption. Established firms that already held Bitcoin—known as Bitcoin treasury companies, or BtcTCs—bought even larger amounts, while new entrants went public specifically to raise money and purchase Bitcoin. According to the report, public company bitcoin holdings increased 82% y/y to ₿1.08 million and the number of public companies holding bitcoin grew from 69 to over 191 throughout 2025.65 Corporations own at least 6.4% of total Bitcoin supply – public companies 5.1% and private companies 1.3%. This created a clear boom-and-bust pattern throughout the year.

Company valuations rose sharply through mid-2025 before pulling back when the broader Bitcoin price corrected. The report explains that these public treasury companies offer investors easier access through traditional brokers, the ability to borrow against holdings, and even dividend payments, though with dilution risks. In contrast, buying and holding Bitcoin directly remains simpler and preserves the asset’s full scarcity.

Looking ahead, Epoch expects Japan’s Metaplanet to post the highest multiple on net asset value (mNAV)—a key valuation metric—among all treasury companies with a market cap above $1 billion. The firm also predicts that an activist investor or rival company will force the liquidation of one underperforming treasury firm to capture the discount between its share price and the actual value of its Bitcoin holdings.

Over time, these companies will stand out by offering competitive yields on their Bitcoin. In total, treasury companies acquired roughly 486,000 BTC during 2025, equal to 2.3 percent of the entire Bitcoin supply, drawing further corporate interest in Bitcoin. For business owners considering a Bitcoin treasury, the report highlights both the growth potential and the risks of public-market volatility.

The Bitcoin Treasury Companies section of the report explores:

Epoch predicts the Clarity Act—a proposed bill to clarify digital asset oversight by dividing authority between the SEC and CFTC—will not pass Congress in 2026. However, the report expects the bill’s main ideas, including clear definitions for asset categories and regulatory jurisdiction, to advance through SEC rulemaking or guidance instead. The firm also forecasts Republican losses in the midterm elections, which could trigger new regulatory pressure on crypto, most likely in the form of consumer protection measures aimed at perceived industry risks. On high-profile legal cases, Epoch does not expect pardons for the founders of Samurai Wallet or Tornado Cash this year, though future legal appeals or related proceedings may ultimately support their defenses.

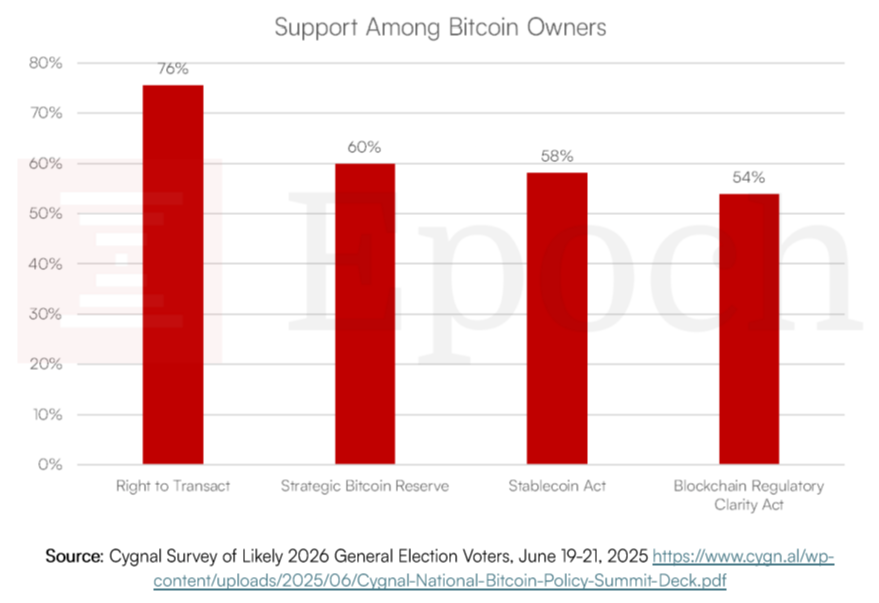

The report takes a critical view of recent legislative efforts, arguing that bills like the GENIUS Act (focused on stablecoins) and the Clarity Act prioritize industry lobbying over the concerns of everyday Bitcoin users, especially the ability to hold and control assets directly without third-party interference (self-custody).

The report points out a discrepancy between what crypto-owning voters want — a majority preferring above all, the right to transact. While the Clarity and Genius Acts focus on less popular special interests, they just fall within the 50% support range. Epoch warns that “This deviation between the will of the voters and the will of the largest industry players is an early warning sign of the potential harm from regulatory capture (intentional or otherwise)”.

The report is particularly critical of the way the GENIUS Act set up the regulatory structure for stablecoins. The paragraph on the topic is so poignant that it merits being printed in its entirety:

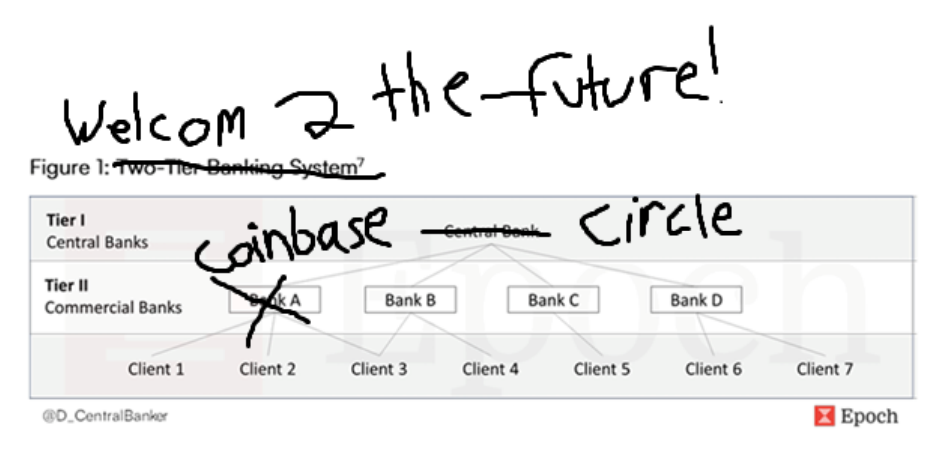

“Meet the new boss, same as the old boss:

Last year, in our Bitcoin Banking Report, we discussed the structure of the 2-tier banking system in the US (see figure below). In this system, the Central Bank pays a yield on the deposits it receives from the Tier II Commercial banks, who then go on to share a portion of that yield with their depositors. Sound familiar?

The compromise structure in the GENIUS Act essentially creates a parallel banking system where stablecoin issuers play the role of Tier I Central Banks and the crypto exchanges play the role of Tier II Commercial Banks.

To make matters worse, stablecoin issuers are required to keep their reserves with regulated Tier II banks and are unlikely to have access to Fed Master accounts. The upshot of all this is that the GENIUS act converts a peer-to-peer payment mechanism into a heavily intermediated payment network that sits on top of another heavily intermediate payment network.”

The report goes into further depth on topics of regulation and regulatory capture risk, closing the topic with an analysis of how the CLARITY Act might and, in their opinion, should take shape.

Quantum Computing Risk

Concerns about quantum computing potentially breaking Bitcoin’s cryptography surfaced prominently in late 2025, in part contributing to institutional sell-offs as investors reacted to headlines about rapid advances in the field. The Epoch report attributes much of this reaction to behavioral biases, including loss aversion—where people fear losses more than they value equivalent gains—and herd mentality, in which market participants follow the crowd without independent assessment. The authors describe the perceived threat as significantly overhyped, noting that claims of exponential progress in quantum capabilities, often tied to “Neven’s Law,” lack solid observational evidence to date.

“Neven’s law states that the computational power of quantum computers increases at a double exponential rate of classical computers. If true, the timeline to break Bitcoin’s cryptography could be as short as 5 years.

However, Moore’s law was an observation. Neven’s law is not an observation because logical qubits are not increasing at such a rate.

Neven’s law is an expectation of experts. Based on our understanding of expert opinion in the fields we are knowledgeable about, we are highly skeptical of expert projections,” the Epoch report explained.

They add that current quantum computers have not succeeded in factoring numbers larger than 15, and error rates increase exponentially with scale, making reliable large-scale computation far from practical. The report argues that progress in physical qubits has not yet translated into the logical qubits or error-corrected systems needed for factorization of the large numbers underpinning Bitcoin’s security.

Implementing quantum-resistant signatures prematurely — which do exist — would introduce inefficiencies, consuming more block space on the network, while emerging schemes remain untested in real-world conditions. Until meaningful advances in factorization occur, Epoch concludes the quantum threat does not warrant immediate priority or network changes.

Mining Expectations

The report forecasts that no company among the top ten public Bitcoin miners will generate more than 30 percent of its revenue from AI computing services during the 2026 fiscal year. This outcome stems from significant delays in the development and deployment of the necessary infrastructure for large-scale AI workloads, preventing miners from pivoting as quickly as some market narratives suggested.

Media coverage of Bitcoin mining shows a stark divide depending on who is framing the discussion. Mainstream outlets tend to portray the industry positively—75.6 percent of coverage is favorable, often emphasizing energy innovation, job creation, or economic benefits—while conversations within Bitcoin communities remain far more skeptical, with only 8.4 percent positive sentiment. This 67-point swing in net positivity highlights how framing and audience shape perceptions of the same sector, with community credibility remaining a critical factor for mining companies seeking to maintain support among Bitcoin holders.

The report has a lot more to offer including analysis of layer two systems and Bitcoin adoption data on multiple fronts, it can be read on Epoch’s website for free.

This post Epoch Ventures Predicts Bitcoin Hits $150K in 2026, Declares End of 4-Year Halving Cycle first appeared on Bitcoin Magazine and is written by Juan Galt.

A drive-by download attack is a type of cyber threat where malicious software is downloaded and installed on a user’s device without their knowledge or consent simply by visiting a compromised or malicious website. Unlike traditional malware attacks, users often do not have to click a link or open an attachment — the infection can […]

The post What are drive-by download attacks? first appeared on StrongBox IT.

The post What are drive-by download attacks? appeared first on Security Boulevard.

This story first appeared in The Debrief, our subscriber-only newsletter about the biggest news in tech by Mat Honan, Editor in Chief. Subscribe to read the next edition as soon as it lands.

It’s supposed to be frigid in Davos this time of year. Part of the charm is seeing the world’s elite tromp through the streets in respectable suits and snow boots. But this year it’s positively balmy, with highs in the mid 30s, or a little over 1°C. The current conditions when I flew out of New York were colder, and definitely snowier. I’m told this is due to something called a föhn, a dry warm wind that’s been blowing across the Alps.

I’m no meteorologist, but it’s true that there is a lot of hot air here.

On Wednesday, President Donald Trump arrived in Davos to address the assembly, and held forth for more than 90 minutes, weaving his way through remarks about the economy, Greenland, windmills, Switzerland, Rolexes, Venezuela, and drug prices. It was a talk lousy with gripes, grievances and outright falsehoods.

One small example: Trump made a big deal of claiming that China, despite being the world leader in manufacturing windmill componentry, doesn’t actually use them for energy generation itself. In fact, it is the world leader in generation, as well.

I did not get to watch this spectacle from the room itself. Sad!

By the time I got to the Congress Hall where the address was taking place, there was already a massive scrum of people jostling to get in.

I had just wrapped up moderating a panel on “the intelligent co-worker,” ie: AI agents in the workplace. I was really excited for this one as the speakers represented a diverse cross-section of the AI ecosystem. Christoph Schweizer, CEO of BCG had the macro strategic view; Enrique Lores, HP CEO, could speak to both hardware and large enterprises, Workera CEO Kian Katanforoosh has the inside view on workforce training and transformation, Manjul Shah CEO of Hippocratic AI addressed working in the high stakes field of healthcare, and Kate Kallot CEO of Amini AI gave perspective on the global south and Africa in particular.

Interestingly, most of the panel shied away from using the term co-worker, and some even rejected the term agent. But the view they painted was definitely one of humans working alongside AI and augmenting what’s possible. Shah, for example, talked about having agents call 16,000 people in Texas during a heat wave to perform a health and safety check. It was a great discussion. You can watch the whole thing here.

But by the time it let out, the push of people outside the Congress Hall was already too thick for me to get in. In fact I couldn’t even get into a nearby overflow room. I did make it into a third overflow room, but getting in meant navigating my way through a mass of people, so jammed in tight together that it reminded me of being at a Turnstile concert.

The speech blew way past its allotted time, and I had to step out early to get to yet another discussion. Walking through the halls while Trump spoke was a truly surreal experience. He had truly captured the attention of the gathered global elite. I don’t think I saw a single person not starting at a laptop, or phone or iPad, all watching the same video.

Trump is speaking again on Thursday in a previously unscheduled address to announce his Board of Peace. As is (I heard) Elon Musk. So it’s shaping up to be another big day for elite attention capture.

I should say, though, there are elites, and then there are elites. And there are all sorts of ways of sorting out who is who. Your badge color is one of them. I have a white participant badge, because I was moderating panels. This gets you in pretty much anywhere and therefore is its own sort of status symbol. Where you are staying is another. I’m in Klosters, a neighboring town that’s a 40 minute train ride away from the Congress Centre. Not so elite.

There are more subtle ways of status sorting, too. Yesterday I learned that when people ask if this is your first time at Davos, it’s sometimes meant as a way of trying to figure out how important you are. If you’re any kind of big deal, you’ve probably been coming for years.

But the best one I’ve yet encountered happened when I made small talk with the woman sitting next to me as I changed back into my snow boots. It turned out that, like me, she lived in California–at least part time. “But I don’t think I’ll stay there much longer,” she said, “due to the new tax law.” This was just an ice cold flex.

Because California’s newly proposed tax legislation? It only targets billionaires.

Welcome to Davos.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Read more of this story at Slashdot.