How will Bitcoin price react as Bank of Japan holds interest rate at 0.75%?

Bitcoin Magazine

Bitcoin Price Fights For $90,000 Despite Fed Rate Cuts

The bitcoin price fell on Wednesday night into Thursday, even after the U.S. Federal Reserve lowered interest rates, as Fed Chair Jerome Powell signaled a cautious approach heading into 2026.

On Wednesday, the Fed cut its benchmark rate by 25 basis points to 3.50%–3.75%, a move widely expected by markets. However, the 9–3 split among Federal Open Market Committee (FOMC) members and Powell’s hawkish remarks during the press conference tempered investor enthusiasm for risk assets, including cryptocurrencies.

One official favored a deeper 50-basis-point cut, while two voted against any reduction.

The Bitcoin price briefly jumped over $94,000 but then dropped below $90,000 and stabilized around $89,730 at the time of writing.

Bitfinex analysts shared with Bitcoin Magazine that the Fed’s unexpectedly hawkish tone surprised markets, causing a price reversal and kept risk appetites in check.

The Fed’s updated “dot plot” shows little consensus for more than a single 25-basis-point cut in 2026, with stronger growth forecasts and shifting tax policy limiting near-term easing.

Timot Lamarre, director of market research at Unchained, wrote to Bitcoin Magazine that “

There is so much to be bullish about in the bitcoin space – from Square facilitating bitcoin payments to large institutions like Vanguard now allowing their clients access to bitcoin ETFs to quantitative tightening coming to an end.”

Lamarre said that bitcoin’s recent price movements show a gap between growing adoption and the price increase that usually comes with higher demand.

Bitcoin price’s recent pullback also reflects broader market concerns. Technology stocks, including Oracle, suffered after disappointing earnings and warnings about slower-than-expected AI-related profits.

Oracle shares fell 11% in after-hours trading following revenue and profit forecasts below analysts’ expectations.

The Fed’s outlook for 2026 suggests only one additional rate cut, fewer than markets had anticipated. Asian stock markets declined, and U.S. equity futures pointed lower, while European trading remained subdued.

Standard Chartered recently revised its year-end Bitcoin forecast, lowering its target from $200,000 to $100,000, citing a slowdown in corporate treasury buying and reliance on ETF inflows to support future price gains.

Bernstein analysts recently said that they see a structural shift in Bitcoin’s market cycle, meaning that the traditional four-year pattern has broken. They forecast an elongated bull cycle driven by steady institutional buying, which offsets retail selling, and minimal ETF outflows.

The bank raised its 2026 price target to $150,000 and expects the cycle to peak near $200,000 in 2027, maintaining a long-term 2033 target of roughly $1 million per BTC.

Meanwhile, JPMorgan remains bullish over the next year, projecting a gold-linked, volatility-adjusted Bitcoin target of $170,000 within six to twelve months, factoring in market fluctuations and mining costs.

Analysts say Bitcoin’s decline after the Fed announcement reflects a “sell the fact” dynamic. “The market had fully priced in the cut ahead of time,” said Tim Sun, senior researcher at HashKey Group. “Concerns over political and economic developments in 2026, combined with potential inflation from AI-driven capital expenditure, are weighing on risk sentiment.”

Last week, Bitcoin price saw a volatile ride, dipping to $84,000 before bulls pushed it up to $94,000, then dropping slightly below $88,000, and closing the week at $90,429.

The market now faces key support at $87,200 and $84,000, with deeper support zones around $72,000–$68,000 and $57,700.

Resistance levels stand at $94,000, $101,000, $104,000, and a thick zone between $107,000–$110,000, with momentum likely slowing above $96,000.

Typically, rate cuts lead to bullish momentum, but the market may have already priced in this month’s rate cut. The bitcoin price has fallen roughly 28% since its October all-time high.

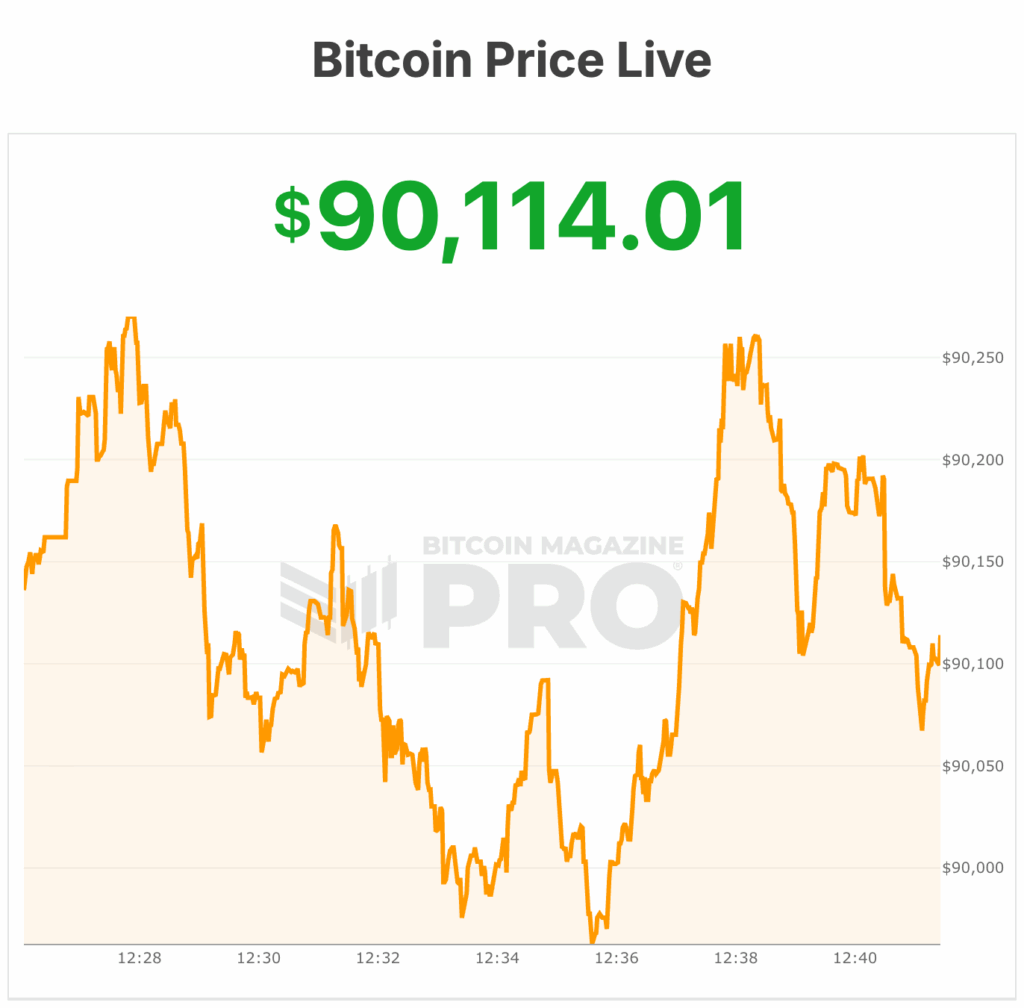

At the time of publishing, the bitcoin price is at $90,114.

This post Bitcoin Price Fights For $90,000 Despite Fed Rate Cuts first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Federal Reserve Cuts Interest Rates by 25 Basis Points

The Federal Reserve cut its benchmark interest rate by 25 basis points today, lowering the federal funds target range to 3.50%–3.75%. The move marked the central bank’s third rate cut of the year and its first since October.

The Federal Reserve said they made the cuts to support maximum employment and return inflation to 2%. Economic activity is expanding moderately, job gains have slowed, and inflation remains somewhat elevated, the Fed said.

Most officials voted for the cut, with three dissenting—one preferring a larger cut and two preferring no change. Policymakers said the decision reflects easing inflation pressures and a desire to support economic activity as growth moderates. The Fed had kept rates unchanged for several meetings after its October cut.

Fed officials also left their rate forecasts unchanged, signaling modest 25-basis-point cuts in 2026 and 2027, with expected 2026 unemployment at 4.4%, PCE inflation at 2.4% and GDP growth at 2.3%.

The 10-year Treasury yield has climbed this month even as expectations for a rate cut grew, signaling investor concern that easing policy now could reignite inflation and force rates higher later.

The Fed’s internal divisions add to that tension, as Jerome Powell heads up what is probably his final meeting as chair before President Trump names a successor, ending a tenure defined by consensus-building amid unusual discord.

Lower interest rates reduce borrowing costs for households and businesses. They can encourage spending, investment, and risk-taking across financial markets.

BREAKING:

— Bitcoin Magazine (@BitcoinMagazine) December 10, 2025Federal Reserve cuts interest rates by 25bps. pic.twitter.com/kiXG9hhVXM

Before these cuts, some said that inflation was easing, but regardless, the market widely expected a 25 basis-point rate cut.

At the same time, rate cuts can also signal concern about the economy’s trajectory.

In October, The Federal Reserve cut its benchmark interest rate by 25 basis points to a range of 3.75%–4% at its October meeting, following its previous cut in September. At the time, the Bitcoin price slipped from around $116,000 to lows of $111,000 that week.

Since then, Bitcoin has plunged to lows of $80,000.

Bitcoin’s response to rate cuts has varied in the past, with sharp volatility during the Fed’s emergency easing in 2020 and a more muted reaction to the September 2025 cut.

At the time, Chair Jerome Powell also signaled that the central bank is nearing the end of its quantitative tightening program, with balance-sheet runoff expected to stop by December. QT has been draining liquidity by allowing bonds to mature without reinvestment, pushing yields higher and tightening financial conditions.

At the time of writing, Bitcoin is showing lots of volatility and is trading near $92,500.

This post Federal Reserve Cuts Interest Rates by 25 Basis Points first appeared on Bitcoin Magazine and is written by Micah Zimmerman.