Why MSCI’s Upcoming Decision on Bitcoin Treasury Companies Matters

Bitcoin Magazine

Why MSCI’s Upcoming Decision on Bitcoin Treasury Companies Matters

In a move that could shape corporate Bitcoin adoption, index provider MSCI is set to decide whether to exclude companies holding significant Bitcoin reserves from its global benchmarks. The outcome, due January 15, may influence billions in forced selling and set precedents for how Wall Street views Bitcoin as a treasury asset.

MSCI Inc., a New York-based publicly traded company listed on the NYSE with a market capitalization of $43.76 billion and a stock price of $565.68 as of January 2, is a key player in the investment world. It curates over 246,000 equity indexes daily, with more than $18.3 trillion in assets under management benchmarked to them. These indices serve as blueprints for funds and portfolios, helping investors gain exposure to specific market segments.

Unlike the NASDAQ, which operates as both a stock exchange where companies list and trade and a composite index tracking those listings, MSCI focuses solely on index creation. The S&P 500, managed by S&P Dow Jones Indices, is similarly an index but targets the 500 largest U.S. companies by market cap. MSCI’s offerings, such as the MSCI World Index covering developed markets, provide broader global and thematic coverage, influencing trillions in investment decisions.

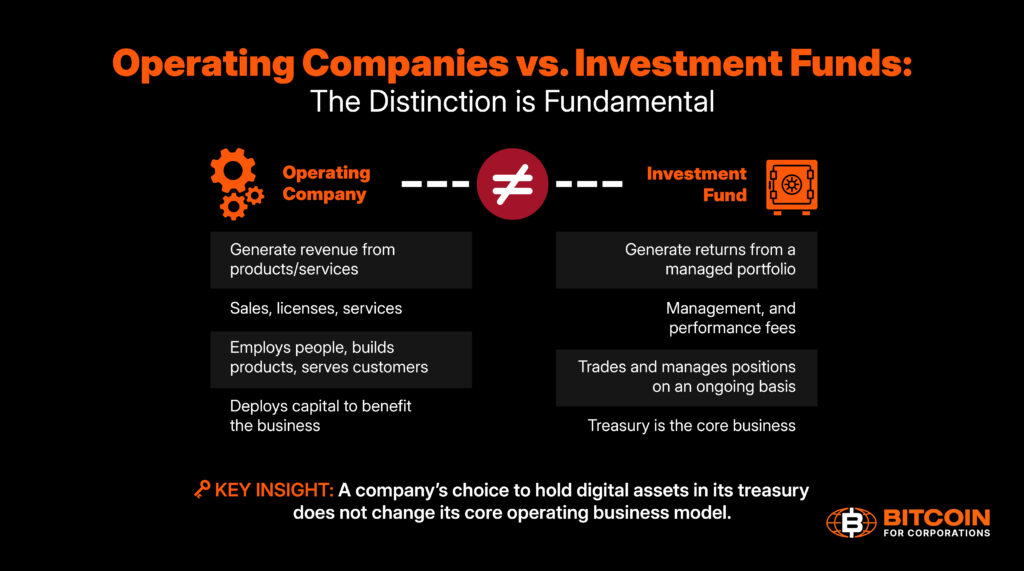

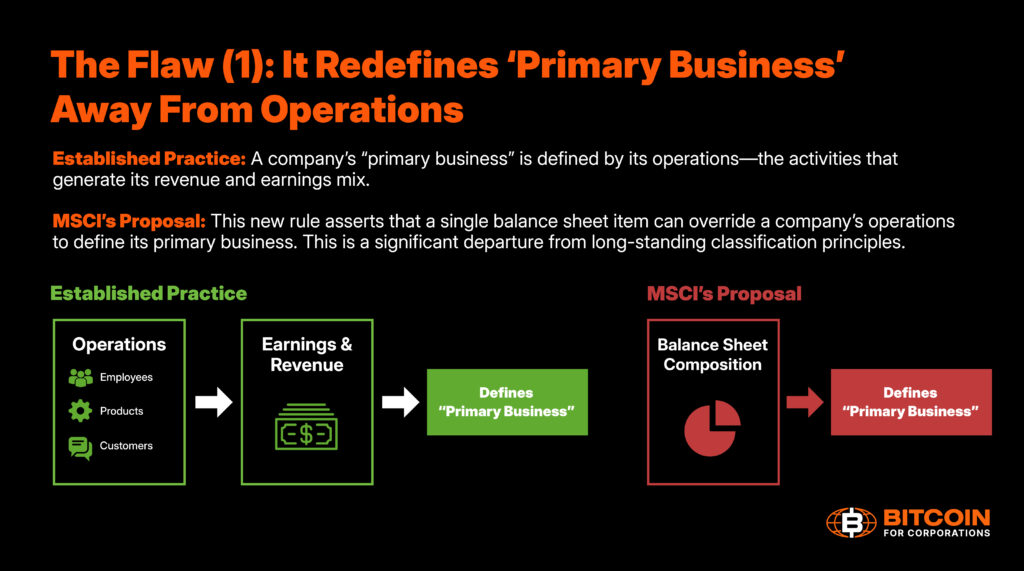

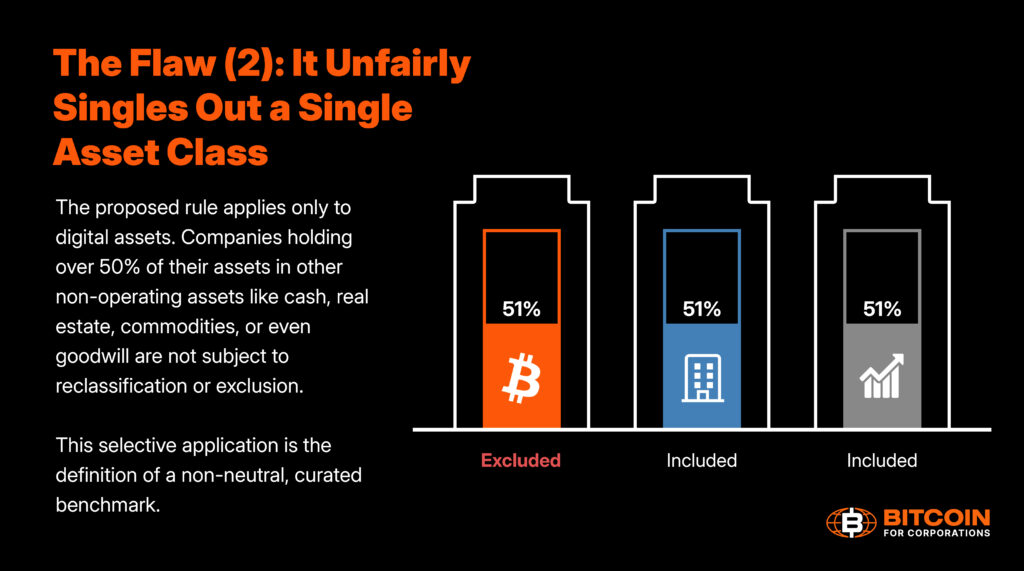

The issue began on October 10, 2025, when MSCI issued a consultation proposal to exclude companies with 50% or more of their assets in digital assets like Bitcoin or other cryptocurrencies from its Global Investable Market Indexes. The rationale: such firms operate more like funds than traditional businesses. The proposal named 39 companies, including Bitcoin holders like Strategy and Metaplanet. The announcement triggered an immediate market reaction, with Bitcoin experiencing a sharp intraday plunge of roughly $12,000 on the same day, marking the start of a broader price correction.

Broader awareness grew in late November 2025, when JPMorgan analysts highlighted the risks in a report, estimating $2.8 billion in outflows from Strategy alone and up to $8.8 billion if other index providers followed suit. This may have amplified selling pressure on affected stocks and contributed to Bitcoin’s ongoing pullback amid a broader market downturn. Estimates of total forced selling, if implemented, range from $10 billion to $15 billion over a year, per Bitcoin for Corporations (BFC) analysis.

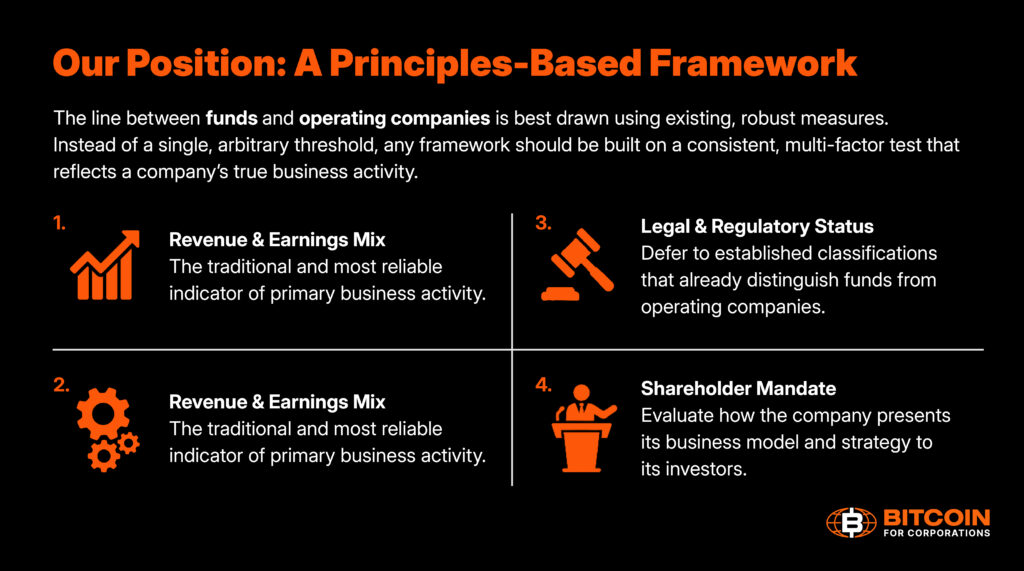

The consultation period, open for stakeholder feedback, closed on December 31, 2025. BFC, a coalition accelerating corporate Bitcoin adoption, mobilized quickly. They launched a website detailing the proposal’s flaws, including a technical appendix outlining potential market impacts. BFC drafted a letter opposing the change, gathering over 1,500 signatures in two weeks and delivering it to MSCI on December 30. Eight of the 39 affected companies are BFC members.

After initial outreach, BFC held a call with MSCI’s head of research and leadership. “We had a very constructive conversation,” said George Mekhail, BFC’s executive director. “I think they were very much still in a listening and learning posture. I think a lot of this just really has to do with a lack of education and understanding of Bitcoin itself, as well as these Bitcoin treasury companies and the significance of their operating businesses.”

Mekhail noted the proposal appeared driven by genuine analytical concerns rather than malice, triggered by Metaplanet’s recent preferred share issuance, not Strategy’s larger holdings. A key gap: MSCI made no distinction between Bitcoin and other cryptocurrencies, treating all digital assets alike. This has fostered temporary alignment between Bitcoin advocates and the broader crypto sector in opposition, highlighting an ongoing education gap between the Bitcoin industry and Wall Street institutions.

Next, MSCI announces its decision on January 15, 2026. If approved, exclusions take effect February 1. Mekhail outlined three scenarios: implementation (worst case, forcing sales), a delay for further review (most likely, per his assessment), or full withdrawal (best case). Polymarket bettors currently give a 77% chance of Strategy’s delisting from MSCI by March 31.

Most financial fallout would hit Strategy, which holds the vast majority of affected Bitcoin treasuries. Founder Michael Saylor’s firm has engaged MSCI directly, issuing its own letter and working behind the scenes. Other opposition includes letters from Strive Asset Management and investor Bill Miller.

Industry pushback has been robust and visible, with no major groups publicly supporting the proposal. This asymmetry underscores Bitcoin’s organized, motivated constituency versus dispersed critics, echoing dynamics in recent political shifts like the 2024 U.S. election.

A withdrawal would boost corporate Bitcoin strategies; implementation could deter treasuries. As Mekhail put it, “The most bullish outcome is that they take it to heart and they withdraw the proposal.” The decision tests Wall Street’s adaptation to Bitcoin’s role in balance sheets.

Bitcoin Magazine is wholly owned by BTC Inc., which operates Bitcoin For Corporations, a platform focused on corporate adoption of Bitcoin. BFChas a variety of relationships with Bitcoin businesses, including some of those mentioned in this article.

This post Why MSCI’s Upcoming Decision on Bitcoin Treasury Companies Matters first appeared on Bitcoin Magazine and is written by Juan Galt.