DOJ Targets Crypto Fraud in ‘America First’ Blitz as AI Scams Spike 450%

The U.S. Department of Justice is intensifying its efforts on crypto-related fraud as it escalates to execute what the authorities refer to as an “America First” enforcement agenda in response to a surge of digital asset-related frauds driven more by artificial intelligence.

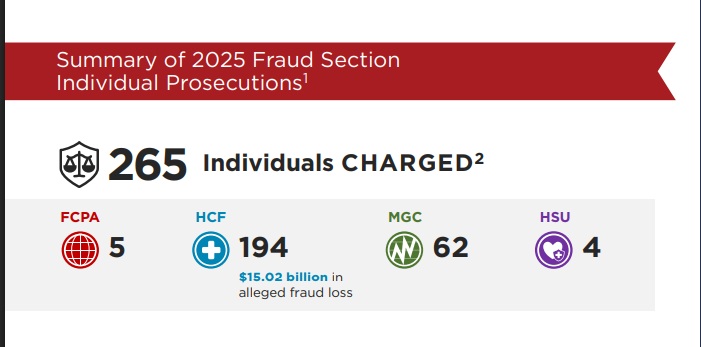

The shift was outlined in the DOJ Criminal Division Fraud Section 2025 Year in Review, published on Thursday, indicating prosecutors accused 265 defendants with a cumulative alleged loss on fraud cases of over $16 billion, nearly twice the amount reported the previous year.

Although the cases were in medical care, consumer protection, corporate fraud, and market manipulation, the DOJ said that cryptocurrency was increasingly becoming a type of payment rail, laundering, or asset category due to illicit funds.

In some significant cases, authorities seized crypto alongside cash, real estate, and luxury goods, showing the strong integration of digital assets into conventional fraudulent actions.

DOJ Health Care Fraud Crackdowns Lead to Major Crypto Seizures

One of the most prominent cases cited involved a $1 billion amniotic wound allograft fraud scheme that allegedly generated more than $600 million in improper Medicare payments.

Prosecutors charged Tyler Kontos, Joel Kupetz, and Jorge Kinds with targeting elderly and terminally ill patients for medically unnecessary procedures.

As part of the investigation, law enforcement seized more than $7.2 million in assets, including bank accounts and cryptocurrency.

The DOJ also highlighted the National Health Care Fraud Takedown carried out last year, the largest in the department’s history.

That operation charged 324 individuals across 50 federal districts for schemes involving more than $14.6 billion in intended losses.

Authorities confiscated more than $245 million in assets in the sweep, including significant amounts of cryptocurrency.

Simultaneously, the regulators prevented over $4 billion of fraudulent Medicare payments prior to their disbursement, indicating a more active, data-driven enforcement strategy.

Behind these cases is the DOJ Fraud Section, which operates through four specialized units that increasingly intersect with crypto-related crime.

Its units include foreign bribery, market and consumer fraud, healthcare fraud, and health and safety crimes, areas where digital assets and blockchain-based laundering are now frequently involved.

Prosecutors reported securing 235 convictions in 2025, including 25 trials across 17 federal districts.

AI-Assisted Scams Drive Sharp Rise in Crypto Fraud Losses

This enforcement surge comes as reported crypto fraud losses continue to climb. The FBI’s Internet Crime Complaint Center recorded more than 41,500 crypto investment scam complaints in 2024, with reported losses exceeding $5.8 billion.

Federal data shows total crypto scam losses reached roughly $9.3 billion last year, with older Americans disproportionately affected.

— Cryptonews.com (@cryptonews) April 24, 2025

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.#FBI #CryptoFraud #CryptoScamhttps://t.co/1Eb8KStAHk

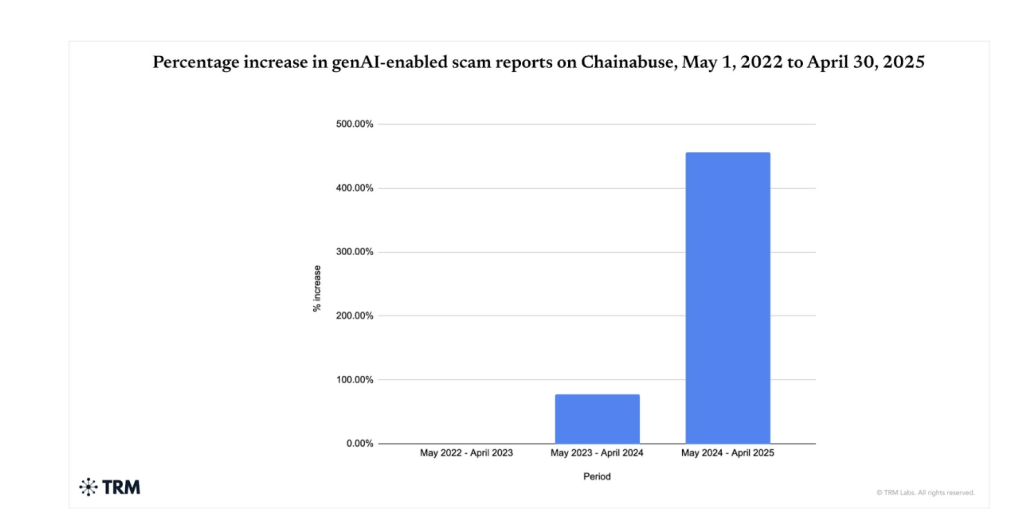

In 2025, blockchain analytics firms reported that average scam payments rose more than 250%, while AI-assisted scams have surged by more than 450%, as criminals deployed deepfake audio, synthetic identities, and automated phishing at scale.

In response, the DOJ and other agencies have launched coordinated initiatives aimed at transnational fraud networks, particularly so-called “pig butchering” scams linked to criminal groups operating in Southeast Asia.

A multi-agency strike force announced late last year has already seized and forfeited more than $401 million in cryptocurrency, including the largest bitcoin seizure in U.S. history.

Separately, the FBI’s Operation Level Up has notified thousands of potential victims and helped prevent hundreds of millions of dollars in additional losses.

Lawmakers have also moved to tighten the legal framework, as bipartisan bills introduced in Congress seek harsher penalties for AI-assisted fraud and stronger coordination across federal agencies to combat crypto-related scams.

In addition, two U.S. senators introduced the SAFE Crypto Act aimed at tightening the government’s response to cryptocurrency-related fraud.

The post DOJ Targets Crypto Fraud in ‘America First’ Blitz as AI Scams Spike 450% appeared first on Cryptonews.