ASTER Slumps 75% to New Lows as Hyperliquid Pulls Ahead — Is the Perp DEX Race Already Over?

A sharp sell-off in Aster’s token is drawing fresh attention to the decentralized perpetuals trading sector, even as overall derivatives activity remains historically high.

ASTER fell roughly 75% from its peak to trade near new lows this week, showing the growing gap between platforms that are capturing durable trading interest and those struggling to hold on once incentives fade.

The decline has unfolded as Hyperliquid extends its lead over rivals, raising questions about whether the race among perp-focused decentralized exchanges is already tilting decisively in one direction.

Hyperliquid Pulls Ahead as ASTER Selloff Deepens

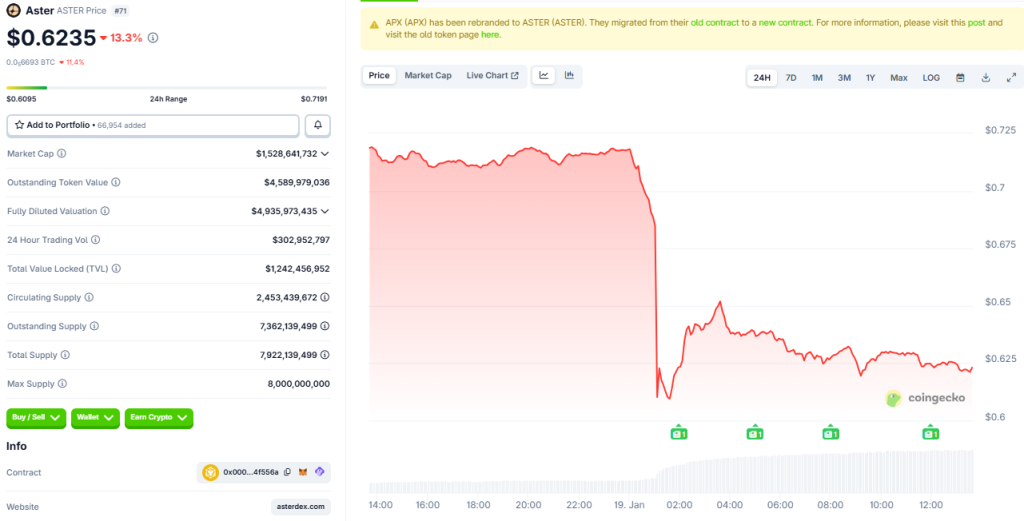

At the time of writing, ASTER was trading around $0.62, down more than 13% over the past 24 hours. The decline follows weeks of sustained weakness, with the token down over 11% in the last seven days and nearly 74% below its all-time high of $2.41.

Trading activity surged during the selloff, with 24-hour volume jumping more than 300% to over $300 million, pointing to heightened short-term positioning rather than a recovery in confidence.

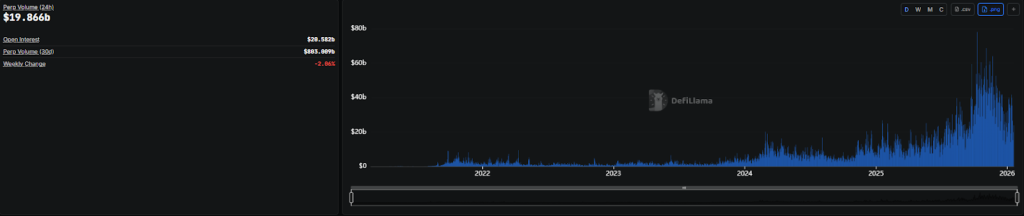

Data from DefiLlama shows that the overall activity in the sector continues to explode, with cumulative perp volume exceeding $803 billion over 30 days.

Total perp trading volume over the past 24 hours stood near $19.9 billion, while open interest reached about $20.6 billion.

Market data shows Hyperliquid pulling further ahead in both trading volume and open interest, two metrics that traders tend to treat differently.

Over the past seven days, Hyperliquid processed about $40.7 billion in perpetual futures volume, according to figures compiled from CryptoRank and DefiLlama.

That compared with roughly $31.7 billion on Aster and $25.3 billion on Lighter over the same period.

Hyperliquid reclaims the perps throne

— CryptoRank.io (@CryptoRank_io) January 18, 2026

As Lighter’s airdrop is distributed, the platform’s volumes have started to fade – weekly volume has decreased nearly 3x from its peak.@HyperliquidX has captured the lead and is now ranked 1st by volume and open interest.@variational_io… pic.twitter.com/LChbSdaU8a

The divergence becomes more pronounced when looking at open interest, which reflects where traders are willing to keep leveraged positions open rather than simply rotate trades.

Hyperliquid recorded about $9.57 billion in open interest over the past 24 hours, exceeding the combined $7.34 billion held across rival platforms, including Aster, Lighter, Variational, edgeX, and Paradex.

The widening gap suggests traders are increasingly using Hyperliquid as a primary venue to hold leveraged positions, rather than simply rotating capital in search of short-term incentives.

The shift has become more apparent as reward-driven activity cools across the sector.

Buybacks Roll Out as Unlocks Cloud Perp DEX Outlook

Lighter, which saw a surge in trading ahead of its airdrop late last year, has experienced a sharp slowdown since the distribution, with weekly volumes falling significantly from their December highs.

Also, the LIT token has dropped to new lows, losing more than a third of its value over the past month as a significant share of airdropped tokens moved into the market.

In an effort to support its token, Aster recently activated what it calls a Strategic Buyback Reserve.

We're now actively deploying our Strategic Buyback Reserve for $ASTER token repurchases automatically.

— Aster (@Aster_DEX) January 19, 2026

Building on our Stage 5 Buyback Program announced last month, this activation allocates 20-40% of daily platform fees into targeted buybacks, responding dynamically to market… https://t.co/cIbles9eHM

The program builds on a broader buyback framework announced in December, under which up to 80% of daily fees can be directed to automatic and discretionary buybacks, all executed on-chain.

However, the scale of upcoming token unlocks remains a central concern for the market.

Aster has significant token unlocks scheduled through 2026, including quarterly releases of roughly 183 million ASTER in January and April, followed by additional large releases mid-year and ongoing monthly emissions.

Although the team previously delayed unlocks to build utility and reduce near-term pressure, the scale of upcoming supply has become a focal point for traders assessing downside risk.

While incentive-driven activity has cooled across the sector, Hyperliquid has continued to attract capital even as its token, HYPE, has weakened alongside the broader market.

The post ASTER Slumps 75% to New Lows as Hyperliquid Pulls Ahead — Is the Perp DEX Race Already Over? appeared first on Cryptonews.