GameStop transfers Bitcoin to Coinbase, Senate Democrats amend crypto bill, UK finalizes regulation consultation | Weekly Recap

Swiss banking giant UBS, with assets under management (AuM) of up to $7 trillion, is set to launch Bitcoin trading for some of its clients. This comes amid predictions that regulatory clarity and broader adoption could send the BTC price to as high as $200,000.

Bloomberg reported that UBS is planning to launch crypto trading for some of its wealth clients, starting with its private bank clients in Switzerland. The bank will reportedly begin by offering these clients the opportunity to invest in Bitcoin and Ethereum. At the same time, the crypto offering could further expand to clients in the Pacific-Asia region and the U.S.

The banking giant is currently in discussions with potential partners, and there is no clear timeline for when it could launch Bitcoin and Ethereum trading for clients. This move is said to be partly due to increased demand from wealth clients for crypto exposure. UBS also faces increased competition as other Wall Street giants are working to offer crypto trading.

Morgan Stanley, in partnership with Zerohash, announced plans to launch crypto trading in the first half of this year, starting with Bitcoin, Ethereum, and Solana. The banking giant may soon also be able to offer its crypto products, as it has filed with the SEC to launch spot BTC, ETH, and SOL ETFs.

Furthermore, JPMorgan, another of UBS’ competitors, is considering offering crypto trading to institutional clients, although this plan is still in the early stages. The bank already accepts Bitcoin and Ethereum as collateral from its clients. Last year, it also filed to offer BTC structured notes that will track the performance of the BlackRock Bitcoin ETF.

Kevin O’Leary predicted that Bitcoin could rally to between $150,000 and $200,000 this year, driven by the passage of the CLARITY Act. His prediction came just as White House Crypto Czar David Sacks said banks would fully enter crypto once the bill passes. As such, there is a possibility that BTC could reach this $200,000 psychological level in anticipation of the amount of new capital that could flow into BTC from these banks once the bill passes.

BitMine’s Chairman, Tom Lee, also predicted during a CNBC interview that Bitcoin could reach between $200,000 and $250,000 this year, partly due to growing institutional adoption by Wall Street giants. Meanwhile, Binance founder Changpeng “CZ” Zhao said that a BTC rally to $200,000 is the “most obvious thing in the world” to him.

At the time of writing, the Bitcoin price is trading at around $89,600, up in the last 24 hours, according to data from CoinMarketCap.

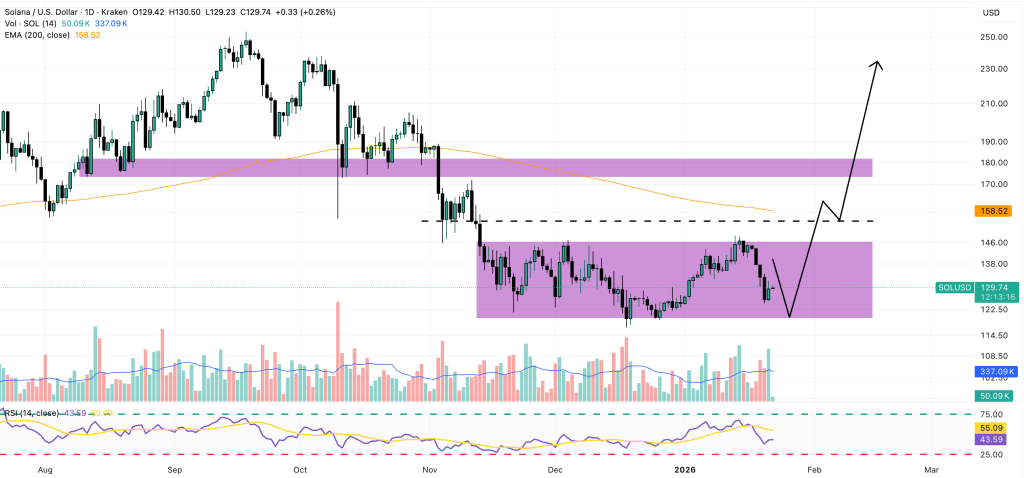

Solana is trading near $126, slipping modestly over the past 24 hours but holding a price zone that traders are watching closely. While short-term price action reflects broader market caution, Solana’s underlying activity tells a very different story. Network usage, institutional interest, and upcoming protocol upgrades are all accelerating, creating a widening gap between price and fundamentals as the market heads deeper into 2026.

This divergence is shaping Solana’s near-term outlook and its longer-term investment narrative.

Solana ended the session near $126.72, with daily trading volume around $2.74 bn and a market capitalization just under $72 bn, ranking the token #7 globally. The recent pullback follows a rejection near $147.50, with price now consolidating inside a defined support band between $124 and $127.

On the technical side, SOL remains below its 50-EMA near $134 and 200-EMA around $136, confirming that short-term momentum has cooled. However, candlestick behavior has shifted.

Recent sessions show smaller bodies and reduced downside follow-through, suggesting selling pressure is fading rather than accelerating. As long as $125 holds, the move looks corrective, not structural.

While price has softened, Solana’s network activity continues to expand at record speed.

Key on-chain metrics stand out:

These figures point to real demand rather than short-term trading flows, reinforcing Solana’s role as a high-throughput settlement layer.

Institutional adoption is quietly reshaping Solana’s positioning. Enterprise blockchain firm R3 is building Solana-native infrastructure focused on private credit and trade finance, while Coinbase completed full Solana chain integration, expanding liquidity access across major regions.

At the same time, Solana has crossed $1 bn in tokenized real-world assets, supported by flows tied to BlackRock’s BUIDL initiative and rising USDC velocity. This shift is reframing Solana from a speculative trading chain into an institutional-grade platform for tokenized finance.

From a price perspective, Solana price prediction seems bearish as SOL is testing a rising trendline that originates from December lows. RSI remains subdued near 38–40, reflecting caution but not exhaustion. A clean break below $124 would expose $120.90, while a reclaim above $131.50 would signal renewed upside toward $136 and $141.60.

Looking further ahead, the upcoming Alpenglow upgrade, targeting faster finality and expanded block capacity, reinforces Solana’s long-term thesis. If fundamentals continue to outpace price, the current range may prove to be a positioning phase rather than a peak.

Solana Trade idea: Buy near $124–$125, target $136, stop below $120.90.

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.9 million, with tokens priced at just $0.013625 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the PresaleThe post Solana Price Prediction: Why $126 Could Be the Calm Before SOL’s Next Surge appeared first on Cryptonews.

China’s ChatGPT-grade LLM, DeepSeek AI, has released striking price forecasts for XRP, Cardano, and Solana as the crypto market looks ahead to 2026.

According to the model, a prolonged bull market, backed by clearer, more supportive regulation in the United States, could propel top altcoins to new all-time highs in the next phase of the cycle.

Here’s DeepSeek AI’s projected outlook for three of the most closely watched cryptocurrencies over the coming year.

Ripple’s XRP ($XRP) entered 2026 with solid momentum, gaining 19% in the first week of the year. From its current price of $1.89, DeepSeek AI believes a fully developed bull market could lift XRP to $10 by the end of 2026, implying upside of roughly 430%, or more than 5x returns.

XRP ranked among the strongest-performing large-cap cryptocurrencies last year. In July, it posted its first fresh all-time high (ATH) in seven years, climbing to $3.65 after Ripple secured a pivotal legal victory against the U.S. Securities and Exchange Commission.

That ruling significantly reduced regulatory uncertainty surrounding XRP and helped calm concerns that the SEC might intensify enforcement actions across the broader altcoin market. Sentiment was further boosted by the return of pro-crypto Donald Trump to the White House, injecting renewed optimism into the sector.

Technically, XRP’s Relative Strength Index is sitting near 43. Since early January, price action has been shaping a partial bullish flag formation. If that pattern completes amid favorable macro conditions and regulatory clarity, it could light a fuse that would easily send XRP to DeepSeek AI’s upper $10 projection.

Strengthening the bullish narrative, newly approved spot XRP ETFs in the U.S. are beginning to draw capital from traditional finance, echoing the sustained institutional inflows seen following the launch of Bitcoin and Ethereum ETFs.

Cardano ($ADA) is one of the most academically rigorous blockchain projects in crypto. Founded by Ethereum co-creator Charles Hoskinson, the platform emphasizes peer-reviewed research, robust security, scalability, and long-term viability.

With a market capitalization above $13.3 billion and more than $164 million in TVL across its ecosystem, Cardano remains a notable competitor to Ethereum. Consistent developer engagement and a steadily expanding decentralized application ecosystem continue to support its long-term adoption outlook.

DeepSeek AI forecasts that ADA could climb to $12 by early 2026. From its current level near $0.36, that move would represent gains of approximately 3,233%, decisively quadrupling its previous ATH of $3.09 set during the 2021 bull market.

That said, ADA is currently trading at its lowest price since October 2024. If macroeconomic conditions worsen and the crypto sector lacks positive catalysts, additional downside may occur over the year.

However, such a scenario appears less likely, as digital asset regulation remains a priority topic for U.S. lawmakers.

Solana ($SOL) continues to rank among the fastest-growing smart contract platforms in the crypto industry. The network supports roughly $8.2 billion in total value locked and carries a market capitalization exceeding $72.5 billion, alongside rapidly rising developer and user activity.

Interest in SOL has accelerated following the rollout of Solana-focused ETFs from asset managers including Bitwise and Grayscale.

After a sharp correction late in 2025, SOL has been consolidating within a key support zone and is currently trading near $128. A sustained breakout may depend on Bitcoin reclaiming the $100,000 level, a milestone many analysts expect sooner rather than later.

In DeepSeek AI’s most bullish scenario, Solana could surge to $600 by 2027. That would translate to roughly 369% upside from current levels and double SOL’s previous ATH of $293, recorded last January.

Growing institutional adoption also reinforces Solana’s long-term prospects. Increasing use of the network for real-world asset tokenization by firms such as Franklin Templeton and BlackRock highlights Solana’s expanding role within traditional finance.

Beyond DeepSeek AI’s forecasts, the crypto presale market continues to attract traders searching for the next breakout.

Maxi Doge ($MAXI) has quickly become one of January’s most talked-about meme coin presales, raising more than $4.5 million ahead of its anticipated exchange listings.

The project delivers an exaggerated, gym-bro parody of Dogecoin. Bold, unapologetic, and deliberately degenerate, Maxi Doge fully embraces the raw meme energy that originally drove meme coins into the mainstream.

After years of Dogecoin’s dominance, Maxi Doge is cultivating its own Maxi Doge Army, united by meme culture, high-risk trading strategies, and a shared appetite for extreme volatility.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, giving it a lower environmental footprint than Dogecoin’s proof-of-work design.

Presale buyers can stake their tokens for yields of up to 69% APY, although returns decline as more users enter the pool. MAXI is currently selling for $0.0002795 in the latest presale round, with automatic price increases scheduled at each new funding stage. Interested investors can purchase using MetaMask or Best Wallet.

Say goodbye to Dogecoin. Maxi Doge is the new dog in town!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post China’s DeepSeek AI Predicts the Price of XRP, Cardano and Solana By the End of 2026 appeared first on Cryptonews.

Crypto researcher Axel has provided insights into why the Bitcoin, Ethereum, and Solana prices are still crashing. This comes as BTC continues to see a supply overhang, which threatens to put more downward pressure on crypto prices.

In a research report, Axel noted that anomalous exchange inflows accompanied the BTC breakdown below the $90,000 zone as sellers prepared in advance. The market is also still at risk of further selling pressure as the 1.0 level of the short-term holders’ SOPR is now acting as a resistance rather than support. As such, there is a possibility that Bitcoin, Ethereum, and Solana prices will decline further.

Further commenting on Bitcoin netflows into exchanges, Axel noted that between January 20 and 21, almost 17,000 BTC flowed into exchanges, coinciding with BTC dropping to as low as $87,000, while Ethereum and Solana prices also dropped. The crypto researcher explained that these anomalously high values followed a period of predominantly negative netflow in the first half of this month.

In the context of the falling Bitcoin price, Axel stated that such a spike is more likely to reflect supply preparation than neutral transfers. In other words, the breakdown below $90,000 appears to be structural rather than emotional. Meanwhile, Bitcoin netflow returned to neutral levels yesterday, but the accumulated inflow still creates a supply overhang, which could lead to further declines in the prices of Bitcoin, Ethereum, and Solana.

Axel noted that a signal of improvement would be if netflow turns negative again amid rising prices, which could indicate that the overhang has cleared. However, with the short-term holders’ 7-day SMA SOPR below 0.996, the crypto researcher suggested that BTC faces increased selling pressure on every recovery as these holders look to sell at breakeven. He added that a reversal trigger could be confirmed if the SOPR breaks above 1.0 from below, with the 7-day SMA holding unity for three to five days to filter out false spikes after the selloff.

In its latest research report, on-chain analytics platform Glassnode explained that a Bitcoin rally above $100,000 looks unlikely for now as the supply overhang persists. They noted how this overhang supply above $98,000 remains the dominant sell-side force capping short to mid-term rebounds.

Alluding to the Unspent Realized Price Distribution metric, Glassnode noted that the recent BTC rally has partially filled the prior air gap between $93,000 and $98,000, driven by redistribution from top buyers into newer market participants.

However, the unresolved supply overhang is expected to likely cap attempts above the $98,400 short-term holders’ cost basis and the $100,000 level. A meaningful and sustained acceleration in demand momentum is said to be required for a clean breakout above $100,000 to occur.

Defi Development Corporation has pushed the boundaries of crypto culture and corporate experimentation after launching what it describes as the world’s first memecoin created by a publicly traded company.

The company’s move has already ignited controversy across the Solana ecosystem.

1/

— DeFi Dev Corp. (DFDV) (@defidevcorp) January 22, 2026ANNOUNCING $DONT

Today, we announce @disclaimercoin, the first-ever publicly traded company-created memecoin launched via @bonkfun.

No roadmap, no utility, no cabal, & no promises.

Just a disclaimer: DONT buy it.

30% will sit on $DFDV's balance sheet FOREVER.pic.twitter.com/epOPX3NPUk

The token, called DisclaimerCoin and trading under the ticker $DONT, briefly surged to a market capitalization of more than $26 million within hours of launch.

The launch comes at a time when Solana’s memecoin market remains hyperactive, driven by speculation, rapid liquidity rotation, and a growing overlap between on-chain culture and institutional capital.

Against that backdrop, DFDV’s decision to issue a memecoin has raised questions not only about market behavior but also about how far publicly listed companies can go in embracing crypto-native norms without crossing regulatory or ethical lines.

DeFi Development Corporation said that $DONT was intentionally released without a utility, roadmap, or promises.

The company framed the token as a live experiment rather than a product, stating that it exists purely to test what happens when a real corporation engages directly with internet-native markets.

In a post confirming the launch, DFDV executive Dan Kang said the token was legitimate and reiterated a simple message to traders: “Don’t buy it.”

Yes, it’s real. No, we were not hacked.

— DK (@CryptoIRGuy) January 22, 2026

Don’t buy it. https://t.co/u1a9anbBD7

Despite this, on-chain activity of the token has seen massive activity.

Within two hours of launch on the Bonk.fun platform and Raydium liquidity pools, $DONT climbed rapidly, with early wallets recording outsized gains.

On-chain data shows that some addresses were able to trade the token profitably before or immediately after the public announcement, fueling speculation about insider access or privileged information.

One wallet reportedly sold billions of $DONT tokens for hundreds of thousands of dollars in profit without purchasing them on the open market.

Meanwhile, other wallets linked by analysts to validator infrastructure associated with DFDV also posted gains.

The suspicious activity has added to skepticism, particularly given Solana’s history of high-profile memecoin launches tied to compromised social media accounts.

However, Defi Development Corporation has repeatedly affirmed the authenticity of the token that $DONT was officially issued by DFDV.

Tokenomics published by the company outline a fixed supply of 420 billion $DONT, with no inflation mechanism.

Thirty percent of the supply is held permanently on DFDV’s balance sheet, forty percent was allocated to public liquidity, and twenty percent was reserved for ecosystem and community purposes.

Additionally, ten percent is assigned to early contributors, including employees subject to predefined sales rules.

As a result of the price surge, the balance sheet allocation alone briefly translated into an estimated $8 million increase in the company’s reported on-chain assets.

The move fits into a broader pattern of experimentation by DeFi Development Corporation, which has positioned itself as an unconventional digital asset treasury firm.

— Cryptonews.com (@cryptonews) September 24, 2025

DeFi Development (@defidevcorp) expanded its stock buyback program to $100M, holding over 2M $SOL tokens.#DeFi #Solana https://t.co/G6CGnoAK7p

Since adopting its non-Bitcoin DAT strategy in 2025, the company has tokenized its stock on-chain, operated validators as a treasury function, and deployed capital into Solana DeFi protocols to generate yield.

The firm ended 2025 as one of the top-performing crypto-linked Nasdaq stocks, even as the broader Solana market faced declining prices.

That context is important, as Solana-focused treasuries have been under pressure in recent months. With SOL down sharply from late 2025 highs, many DATs have seen treasury values fall, and net asset values compress.

DFDV’s treasury, currently valued at roughly $283 million and centered around nearly 2.2 million SOL, has declined by more than 30% over the past three months, underscoring the financial strain across the sector.

The post Solana DAT’s $DONT Memecoin Hits $26M – But Degens Are Warned: “Don’t Buy It” appeared first on Cryptonews.

If you compare Bitcoin to gold, the underperformance is clear. Altcoins like XRP, Solana, and SUI have followed the same pattern and are still sitting deep below their all-time highs.

Bitcoin has recently tried to regain strength, but each rally keeps getting rejected at key resistance levels as market uncertainty persists.

Fundamentally, nothing has gone wrong. XRP, SOL, and SUI continue to improve over time. Technically, though, these coins are still in a weak phase. Below is how things could play out for the three as we head into 2026.

Ripple price is currently down 60% from its highs and has been in a downtrend for eight days in a row. Momentum has faded, but RSI at 43 has not yet signaled oversold conditions.

XRP is trading inside a clear descending channel. This explains why every bounce lately has been corrective rather than trend-changing.

Price recently pushed off the lower boundary near the $1.80 area, which is acting as a short-term demand zone and a key bullish invalidation level. As long as XRP holds above $1.80, this bounce remains technically valid, but the structure is still fragile.

The first real test for buyers sits around the $2.40–$2.50 zone. It lines up with prior resistance and the upper part of recent consolidation. A clean break and hold above that area would be the first signal that momentum is shifting. Also, it will open the door for a move toward the $3.00 level next.

Solana is still stuck inside a clear descending channel, which is why every bounce lately has been corrective instead of a real trend change.

Price recently bounced off the lower boundary around the $118 area, which is acting as short-term demand and a key support to watch. As long as SOL stays above that zone, the bounce remains technically valid, but the structure is still weak.

The level bulls need to reclaim is $144, since it lines up with channel resistance and prior supply. A clean break and hold above $144 would be the first real sign of strength and could open the door toward $200, with a bigger resistance waiting near $250.

RSI is sitting around 42, showing momentum is still weak; it would need to push back above 50 to support a stronger move higher.

SUI is trying to find its bottom after a huge selloff, with price now narrowing up between rising support around $1.40 and a descending resistance from the prior downtrend.

So far, that $1.40 area has held well and is acting as a key demand zone, keeping the short-term bullish setup alive.

If buyers can push price above the downtrend trendline and reclaim the $1.90–$2.00 area, that would be the first real sign of momentum turning and could open the door for a bigger bounce toward the $3.50–$4.00 resistance zone.

Holding above $1.40 is crucial. A clean break above $2.00 would add potential to the bullish scenario, while losing support would likely put SUI back under downside risk.

While XRP, Solana, and SUI are all trapped in downtrends and waiting on clean technical breaks, some traders are skipping the patience game and looking for where momentum does not need perfect charts to work. That is where Maxi Doge comes in.

Maxi Doge is built for exactly this kind of market. When majors underperform, confidence is low, and rallies keep failing at resistance, capital often rotates into high-beta memecoins with simple narratives and asymmetric upside. That rotation usually starts quietly, long before charts flip bullish.

The project has already pulled in strong early funding, even as broader altcoin sentiment stays weak. On top of that, Maxi Doge offers aggressive staking rewards, with APY hovering around 70%, giving holders a reason to sit tight while the rest of the market chops sideways.

Historically, some of the biggest memecoin runs have kicked off when Bitcoin and large caps looked stuck and boring. Maxi Doge is positioning itself for that exact window. If volatility picks up heading into 2026, the tokens accumulated during periods of frustration are often the ones that move first and hardest.

For traders tired of waiting on XRP, SOL, and SUI to break their downtrends, Maxi Doge stands out as a high-risk, high-reward play worth keeping on the radar.

Visit the Official Maxi Doge Website HereThe post Crypto Price Prediction Today 22 January – XRP, Solana, Sui appeared first on Cryptonews.

Those expecting early 2026 to be a milestone on the road to crypto adoption will have to wait just a little longer.

Coinbase recently withdrew its support for the CLARITY Act, a key piece of legislation that will enable U.S. regulators to oversee the industry, causing the U.S. Senate Banking Committeee to postpone the bill for at least a few weeks.

Still, comprehensive U.S. crypto regulation this year is inevitable. Meanwhile, Bitcoin dominance has been slipping since summer, a sign that the smart money is rotating into altcoins like XRP, Solana, and Cardano ahead of the next bull run.

Ripple’s $119 million market cap XRP ($XRP) is a cornerstone of blockchain-based cross-border payments, offering fast settlement times and minimal transaction costs.

The XRP Ledger (XRPL) was purpose-built for banks and financial institutions, aiming to overhaul slower, more expensive legacy systems like SWIFT.

Ripple’s expanding profile has earned recognition from prominent organizations, including the UN Capital Development Fund and the White House, underscoring XRP’s global and potentially game changing reputation.

Following the resolution of Ripple’s lengthy legal battle with the SEC, XRP surged to an all-time high (ATH) of $3.65 in mid-2025. Since then, broader market weakness has driven a pullback of roughly 46%, with the token now trading near $1.95.

Despite the downturn, XRP may not remain below the $2 mark for long. A key catalyst has been the launch of spot XRP exchange-traded funds in the U.S., providing regulated access for both institutional and retail investors.

Additional ETF approvals, combined with clearer regulatory frameworks, could propel XRP toward the $5 by Q2, while a 2026 bull target of $10 remains plausible.

Solana ($SOL) is one of the best smart contract platforms out there. Known for high throughput and low transaction costs, the Solana network supports more than $8.5 billion in total value locked (TVL) and SOL maintains a market cap around $74 billion.

The rollout of Solana spot ETFs by asset managers such as Grayscale and Bitwise has also been instrumental in introducing the asset to TradFi institutional investors.

Trading around $130, SOL currently sits slightly below its 30-day moving average, a technical signal that often precedes a rebound toward trend alignment. A bullish flag pattern that formed in late 2026 could resolve into a strong upward move.

A clear break above resistance near $200 and $275 would open the door for Solana to exceed its ATH of $293.31 and potentially climb past $300 before the end of the quarter.

Solana is also emerging as a key platform for real-world asset tokenization, widely regarded as one of blockchain’s most compelling use cases for institutions. Major players such as BlackRock and Franklin Templeton have used Solana to issue tokenized investment products.

Cardano ($ADA) was established in 2015 by Charles Hoskinson, a co-founder of Ethereum, and officially launched in 2017.

The ongoing development of this Proof-of-Stake blockchain is grounded in peer-reviewed academic research, an approach that continues to set Cardano apart from many competitors in the sector.

With a market value of approximately $13.4 billion and a TVL of $168 million, ADA still has plenty of headroom to grow before competing directly with Solana as the leading alternative to Ethereum.

From a technical perspective, ADA’s Relative Strength Index is hovering near 43. Over the past 24 hours, the token has gained 2%, bringing its price to around $0.365.

The appearance of a bullish falling wedge pattern in late 2026 indicate the possibility of an imminent rally that could, under favorable conditions, help ADA push through local resistance zone to hit $1.20 by the end of Q1.

Additionally, if the CLARITY act is resolved, Cardano could easily revisit its $3.09 ATH before year-end.

Bitcoin Hyper ($HYPER) is an emerging Bitcoin Layer-2 network focused on accelerating transactions, lowering fees, and enabling advanced smart contract functionality.

Powered by the Solana Virtual Machine, Bitcoin Hyper incorporates decentralized governance and a Canonical Bridge to facilitate seamless cross-chain Bitcoin transfers.

The project’s presale has already raised over $30.8 million, with some market commentators projecting potential returns ranging from 10x to 100x once the token becomes available on exchanges. A recent audit conducted by Coinsult reported no critical vulnerabilities in the smart contract.

The HYPER token underpins the ecosystem, serving as the medium for transaction fees, governance participation, and staking incentives.

Participants can stake tokens during the token sale to earn yields of up to 38% APY, though returns gradually decrease as overall participation increases.

With exchange listings anticipated later this year, Bitcoin Hyper’s presale offers early supporters exposure to the next evolution of the Bitcoin network.

Visit the official website or follow Bitcoin Hyper on X and Telegram for more information.

Visit the Official Website HereThe post Best Crypto to Buy Now January 22 – XRP, Solana, Cardano appeared first on Cryptonews.

While SOL has pulled back slightly in recent days, on-chain activity is heating up as a new wave of AI-focused tokens drives fresh interest across the Solana ecosystem.

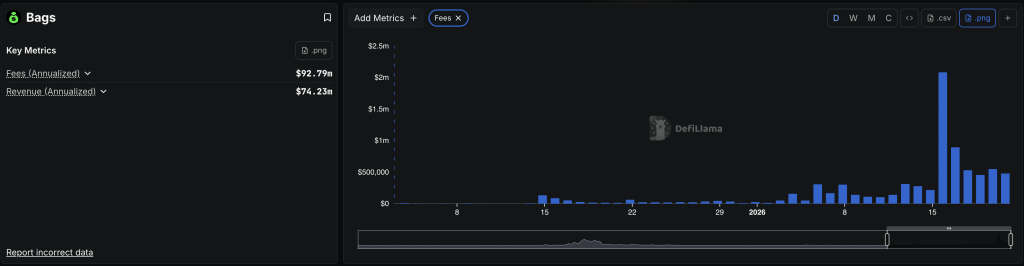

Leading the charge is Bags, a viral new launchpad built on Solana that has quickly become a favorite among users of the generative AI platform Claude.

Similar to Pump.fun, Bags lets users launch tokens with ease, but its growing focus on AI-themed coins has sparked a surge in demand.

This rise in activity and niche specialization could support a bullish Solana price prediction, especially as AI and crypto continue to converge.

Data from DeFi Llama shows that Bags fees spiked to their highest level on record at $2 million just 6 days ago, and have stood above $400,000 every day since then.

Meanwhile, Jupiter data indicates that the protocol has captured a 23.2% market share in the launchpad market in the past 7 days, surpassing well-established rivals like Meteora and LetsBonk.fun.

Solana (SOL) benefits directly from Bags’ popularity as it results in higher transaction volumes for the network and a direct increase in fees.

SOL has been consolidating for months now, moving between $120 and $146 as the crypto market has struggled to find direction lately.

This top altcoin has dropped in 4 out of the last 6 trading sessions, and could be eyeing the $120 support once again as market sentiment remains depressed.

Nonetheless, a spike in network transaction volumes due to the growing popularity of protocols like Bags and Pump.fun could drive up SOL’s demand in the near term.

To confirm a bullish outlook, the price has to break out of its consolidation pattern and preferably move above $160 to reverse its downtrend.

In that case, SOL could rise to $200 shortly if bullish momentum gains enough traction.

Other Solana-based solutions like Bitcoin Hyper ($HYPER) could soon jump into the spotlight in the same way as Bags. This crypto presale aims to launch the first real Bitcoin L2 and has raised more than $30 million to get it done.

Bitcoin Hyper ($HYPER) is a high-potential presale that brings Solana’s speed and low fees to Bitcoin, making it faster, cheaper, and far more usable.

Built as a next-gen Layer 2, Bitcoin Hyper unlocks real DeFi and payments for BTC, giving developers the tools to launch efficient, scalable apps directly in the Bitcoin ecosystem.

For the first time, BTC holders can stake, lend, earn yield, and trade their assets without needing to bridge out or leave the security of the Bitcoin blockchain.

Bitcoin Hyper solves the key limitations of Bitcoin, bringing smart contract support and high-speed transactions to the world’s most recognized crypto network.

The presale has already raised over $30 million, and early $HYPER buyers are currently earning up to 38% APY through staking.

To buy $HYPER at its discounted presale price, head to the official Bitcoin Hyper website and connect any compatible wallet (e.g. Best Wallet).

You can buy using USDT, USDC, ETH, or simply use a bank card for a quick and easy purchase.

Visit the Official Bitcoin Hyper Website HereThe post Solana Price Prediction: Solana Activity Explodes as AI Tokens Go Viral – Is This the New Trend? appeared first on Cryptonews.

Solana failed to settle above $140 and nosedived. SOL price is now consolidating losses below $135 and might struggle to start a recovery wave.

Solana price failed to remain stable above $140 and started a fresh decline, like Bitcoin and Ethereum. SOL declined below the $138 and $135 support levels.

The price gained bearish momentum below $132. A low was formed at $124, and the price is now consolidating losses. The price recovered a few points and climbed above the 23.6% Fib retracement level of the downward move from the $143 swing high to the $124 low.

Solana is now trading below $135 and the 100-hourly simple moving average. On the upside, immediate resistance is near the $134 level or the 50% Fib retracement level of the downward move from the $143 swing high to the $124 low.

The next major resistance is near the $136 level. The main resistance could be $138. There is also a key bearish trend line forming with resistance at $138 on the hourly chart of the SOL/USD pair. A successful close above the $138 resistance zone could set the pace for another steady increase. The next key resistance is $144. Any more gains might send the price toward the $150 level.

If SOL fails to rise above the $133 resistance, it could continue to move down. Initial support on the downside is near the $129 zone. The first major support is near the $125 level.

A break below the $125 level might send the price toward the $120 support zone. If there is a close below the $120 support, the price could decline toward the $112 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is losing pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $129 and $125.

Major Resistance Levels – $133 and $138.

Solana Mobile has rolled out its long-awaited SKR token airdrop for Seeker smartphone users and select developers, adding a fresh ecosystem catalyst as SOL trades near a critical technical support zone.

Related Reading: What the Triple-Tap At $1.80 Means For The XRP Price

The launch comes at a time when Solana’s price is hovering around $120–$130, an area analysts see as decisive for the token’s medium-term direction. SKR debuted at around $0.006 and climbed above $0.01 within hours of launch, pushing its market capitalization past $70 million.

More than 100,000 users are eligible to claim the airdrop through the Seeker phone’s built-in wallet over a 90-day window. Any unclaimed tokens will be returned to the general distribution pool.

Solana Mobile allocated 30% of SKR’s fixed 10 billion token supply to airdrops and early unlocks. Nearly 2 billion SKR are being distributed to Seeker phone owners and developers who deployed “quality apps” in the Solana dApp Store during Season 1.

The company said the token underpins governance, incentives, and economic activity within the Solana Mobile ecosystem. SKR can be staked directly from the Seed Vault wallet, with inflation events occurring every 48 hours. The annual inflation rate starts at 10% and declines by 25% each year until it stabilizes at 2%.

The airdrop coincides with the start of Seeker’s Season 2 campaign, which introduces a refreshed app catalog, rewards programs, and a focus on sectors such as DeFi, gaming, payments, trading, and decentralized physical infrastructure (DePIN).

Community reaction has been mixed. Some users reported receiving several thousand dollars’ worth of SKR, while others reported allocations closer to $50–$100. Some users expressed disappointment, citing delays in phone delivery and additional shipping costs.

SOL Price Near Key SupportWhile SKR draws attention to Solana’s mobile strategy, the SOL token itself is facing a technical test. After breaking below $136, SOL has slipped into the $120–$127 zone, where an ascending trendline from the 2023 lows meets historical horizontal support.

This area has previously acted as both resistance and support, making it a closely watched “flip zone” for traders. A sustained hold above $120 could open the door to a recovery toward the $135–$150 range. A breakdown, however, may expose downside targets near $110 or even $100.

Related Reading: Trove’s New Token Craters 95%, Sparking Investor Revolt

Short-term indicators show some stabilization. SOL recently bounced from around $124 to near $128, supported by renewed ETF inflows of roughly $3.08 million and spot market accumulation of about $9.31 million. These flows suggest buyers are stepping in at current levels.

Cover image from ChatGPT, SOLUSD chart on Tradingview

Elon Musk’s ChatGPT rival, Grok AI, has released explosive 2026 price forecasts for XRP, Solana, and Pepe.

According to the AI model, a prolonged bull market, backed by clearer and more supportive U.S. regulation, could propel major cryptocurrencies to new all-time highs in the next market cycle.

Here’s how Grok AI expects three of the crypto market’s most prominent assets to perform over the coming year.

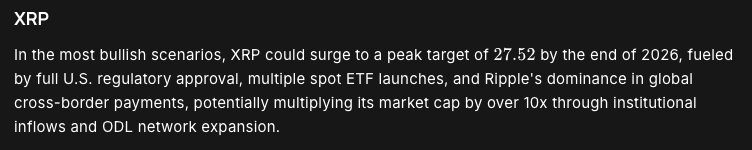

Ripple’s XRP ($XRP) entered 2026 with notable strength, gaining 19% in the opening week of the year. Currently trading around $1.90, the token could post gains of up to 1,350% in a full bull market, with Grok AI modeling a move toward $27.52 by the end of the year in a 2026 bull market.

XRP ranked among the best-performing large-cap cryptocurrencies last year. In July, it notched its first new all-time high (ATH) in seven years, reaching $3.65 after Ripple secured a decisive legal victory against the U.S. Securities and Exchange Commission.

That ruling sharply reduced regulatory uncertainty surrounding XRP and helped ease fears that the SEC would pursue similar actions against other major altcoins. The return of pro-crypto Donald Trump to the White House further boosted the industry’s hopes for a fair and clear playing field.

From a technical standpoint, XRP’s Relative Strength Index (RSI) sits near 50, while the price remains slightly below its 30-day moving average. From the end of the first week of January to today, XRP’s price forms a partial bullish flag. If this formation fully resolves and favourable macroeconomic and industry conditions emerge, then a run to $27.52 is conceivable.

The recent approval of spot XRP exchange-traded funds (ETFs) in the U.S is beginning to funnel traditional capital into the asset, echoing the sustained, multi-billion-dollar inflows seen after Bitcoin and Ethereum ETFs launched.

Solana ($SOL) is one of the fastest-growing smart contract platforms in the crypto sector. The network currently hosts $8.4 billion in total value locked (TVL) and commands a market capitalization above $75.6 billion, alongside surging developer activity and user adoption.

Interest in SOL has intensified following the launch of Solana-focused ETFs by asset managers such as Bitwise and Grayscale.

After a steep pullback toward the end of 2025, SOL has been consolidating within a critical support range and now trades near $130. A decisive move higher may hinge on Bitcoin reclaiming the $100,000 level, a milestone many analysts expect to see this year.

In Grok AI’s most optimistic outlook, Solana could rally to $1,200 by 2027. That scenario implies roughly 823% upside from current prices and would place SOL 4x above its prior all-time high of $293, set last January.

Solana also benefits from a strong long-term narrative. Increasing institutional use of the network for real-world asset tokenization, led by firms such as Franklin Templeton and BlackRock, highlights Solana’s growing role in traditional finance.

Pepe ($PEPE), launched in April 2023, has grown into the largest non-doge-themed meme coin, with a market capitalization of approximately $2.2 billion.

Drawing inspiration from Matt Furie’s “Boy’s Club” comics, PEPE’s instantly recognizable branding and cultural staying power have helped it maintain a strong presence across crypto-focused social media.

Despite fierce competition in the meme coin arena, PEPE’s dedicated community has kept it near the top of the sector. Occasional cryptic posts from Elon Musk on X have further fueled speculation that PEPE could be sitting alongside DOGE and BTC in his portfolio.

PEPE currently trades around $0.0000051, roughly 82% below its December 2024 all-time high of $0.00002803.

Under Grok’s most bullish assumptions, PEPE could surge by as much as 390%, climbing to approximately $0.000025, just short of ATH.

Finally, outside of Grok’s projections, the crypto presale space continues to attract investors hunting for high-risk, high-reward opportunities.

Maxi Doge ($MAXI) has quickly become one of January’s most talked-about presales, raising over $4.5 million ahead of its anticipated exchange debut.

The project positions introduce an exaggerated, gym-bro reinterpretation of Dogecoin. Loud, irreverent, and deliberately outrageous, Maxi Doge embraces the raw meme energy that originally defined meme coin culture.

After years of DOGE dominating the meme spotlight, Maxi Doge is assembling its own Maxi Doge Army, united by meme loyalty, degen trading tactics, and a taste for extreme volatility.

MAXI is issued as an ERC-20 token on Ethereum’s proof-of-stake network, giving it a smaller environmental footprint than Dogecoin’s proof-of-work design.

The current presale round offers staking rewards of up to 69% APY, though yields decline as more tokens are staked. MAXI is priced at $0.0002795 in the latest phase, with automatic price increases scheduled for each subsequent funding stage. Tokens can be purchased using MetaMask or Best Wallet.

Say goodbye to Dogecoin. Maxi Doge is the new dog in town!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post Elon’s Grok AI Predicts the Price of XRP, Solana and PEPE By the End of 2026 appeared first on Cryptonews.

Delphi Digital is betting that Solana’s next major upgrade cycle will reposition the network as an “exchange grade” environment capable of supporting onchain order books that can realistically contend with centralized venues on latency, liquidity depth, and market structure. In a Jan. 20 post on X titled “2026 is the Year of Solana”, the research firm argued Solana’s 2026 roadmap is its “most aggressive upgrade cycle” yet, one that “overhaul[s] everything from consensus to infrastructure to become the decentralized Nasdaq.”

Delphi framed the roadmap less as a grab bag of performance enhancements and more as a capital-markets push: “Solana’s roadmap is about transforming it into an exchange grade environment where a native onchain CLOB can viably compete with CEX latency, liquidity depth, and fairness. Here are all the upgrades making this possible.” In that view, shaving milliseconds matters only insofar as it produces predictable, enforceable execution outcomes for applications like high-frequency trading and central limit order books.

The centerpiece, Delphi wrote, is Alpenglow, a consensus redesign it called “the most significant protocol level change in Solana’s history.” The firm said Alpenglow introduces a new architecture built around Votor and Rotor, with Votor changing how validators reach agreement. Rather than “chaining multiple voting rounds together,” validators would aggregate votes offchain and “commit to finality in one or two rounds,” producing “theoretical finality in the 100-150 millisecond range, down from the original 12.8 seconds.”

Delphi emphasized Votor’s parallel finalization paths as a resilience feature, not just a speed play. If a block gets “overwhelming support (80%+ stake)” it finalizes immediately; if support is between 60% and 80%, a second round triggers, and finality follows if that also clears 60%. The goal, Delphi argued, is to preserve finality even with unresponsive segments of the network.

Alpenglow also introduces what Delphi called a “20+20” resilience model: safety holds as long as no more than 20% of stake is malicious, while liveness persists even if another 20% is offline, “tolerat[ing] up to 40% of the network being either malicious or inactive while still maintaining finality.” Under this design, Proof of History is “effectively deprecated,” replaced by deterministic slot scheduling and local timers. Delphi said the upgrade is expected to roll out in early to mid 2026.

Delphi also pointed to Firedancer, Jump’s C++ validator client, as a structural upgrade aimed at reducing a long-standing operational risk. Solana has historically relied on a single client, now known as Agave, and Delphi described that “monoculture” as a central weakness because client-level faults can cascade into broader network halts.

Firedancer’s objective, Delphi said, is a deterministic, high-throughput engine that can process “millions of TPS with minimal latency variance.” Ahead of full readiness, Delphi highlighted “Frankendancer,” a transitional build that combines Firedancer’s networking and block production modules with Agave’s runtime and consensus components, as a bridge to “substantially” increased client diversity.

On infrastructure, Delphi spotlighted DoubleZero as a private fiber overlay for validators, likening its transmission profile to traditional exchange connectivity: “the same infrastructure traditional exchanges like Nasdaq and CME rely on for microsecond level transmission.” The argument is that as validator sets expand, propagation variance becomes the enemy of tight finality windows. By routing messages along “optimal paths” and supporting multicast delivery, Delphi said DoubleZero can narrow latency gaps across validators—an enabler for both Votor’s quorum formation and Rotor’s propagation design.

Delphi also framed Solana’s block-building roadmap as a market-structure project. It described Jito’s BAM (Block Assembly Marketplace) as separating ordering from execution via a marketplace and privacy layer, with transactions ingested into TEEs so “neither validators nor builders can see raw transaction content before ordering takes effect,” reducing pre-execution behavior like frontrunning.

Harmonic, meanwhile, targets builder competition by introducing an open aggregation layer so validators can accept proposals from “multiple competing builders in real time,” with Delphi summarizing: “Think of Harmonic as a meta-market and BAM as a micro-market.”

Raiku rounds out the thesis by adding deterministic latency and programmable execution guarantees adjacent to Solana’s validator set, using Ahead-of-Time (AOT) transactions for pre-committed workflows and Just-in-Time (JIT) transactions for real-time needs—without modifying L1 consensus.

Delphi ultimately tied the technical roadmap to market demand: Solana’s spot trading gravity, the consolidation of onchain perps toward a handful of venues, and the need to reach performance parity with centralized platforms. It cited expectations for “new Solana native perps like Bulk Trade coming early next year,” and pointed to products like xStocks bringing “onchain equities directly to Solana,” arguing that liquidity and attention are consolidating toward a chain with faster settlement, better UX, and denser capital.

At press time, SOL traded at $127.

Solana Mobile has launched an airdrop of its native token, SKR, opening claims to users of its Seeker smartphone and select developers active in its decentralized app ecosystem.

Key Takeaways:

In a statement released Tuesday, Solana Mobile said the airdrop reflects its broader vision of user ownership in mobile platforms.

“Seeker and SKR are a bet that there’s another way for mobile: that the people who use the network should own the network,” the company said, adding that more than 100,000 users are eligible to claim tokens.

Owners of the Seeker phone can claim their allocation directly through the device’s built-in wallet.

The claim window is set at 90 days, after which any unclaimed tokens will be returned to the airdrop pool, according to the announcement.

Eligibility also extends beyond hardware users. Developers who launched what Solana Mobile described as “quality apps” on the Solana dApp Store during Season 1 are included in the distribution, underscoring the company’s push to reward early ecosystem contributors.

SKR is positioned as the core asset underpinning governance, incentives, and economic activity across the Solana Mobile ecosystem.

Got your SKR? Put it to work.

— Seeker | Solana Mobile (@solanamobile) January 21, 2026

Stake on Seeker:

1. Open Seed Vault Wallet

2. Go to SKR Staking

3. Choose your amount

4. Stake to earn SKR rewards

Inflation events every 48 hrs.

Stake on web: https://t.co/We5Qoveogu

Program ID: SKRskrmtL83pcL4YqLWt6iPefDqwXQWHSw9S9vz94BZ pic.twitter.com/OZFUqbOVnp

The token has a fixed supply of 10 billion units, with 30% allocated to airdrops and unlocks at launch.

Solana Mobile said this structure is intended to prioritize early participation while maintaining long-term issuance controls.

Airdrop recipients are being encouraged to stake their SKR tokens. According to the project’s documentation, inflation events occur every 48 hours under a linear schedule that starts with 10% annual inflation.

That rate is designed to decline by 25% each year until it reaches 2%, at which point inflation will remain constant.

The token launch coincides with the rollout of Seeker’s Season 2 campaign, which introduces new apps, rewards, and early-access programs.

Focus areas include decentralized finance, gaming, payments, trading, and decentralized physical infrastructure networks (DePIN).

Seeker is an Android-based smartphone and the successor to Solana Mobile’s first device, Saga.

It comes preloaded with blockchain-focused features, including Seed Vault hardware-backed key storage and a native Solana dApp Store.

In August, Solana Mobile said it had received roughly 150,000 preorders for Seeker, with shipments planned across more than 50 countries.

The Solana Seeker includes a Genesis NFT providing owners access to future airdrops, exclusive content, and reward programs, with particular focus on the planned native ecosystem token, SKR.

SKR represents the native ecosystem token for Solana mobile devices, operating on Solana’s layer-1 blockchain and expected to be “airdropped directly to builders and users for ecosystem participation.”

According to CoinGecko data, SKR was trading at $0.01062 at the time of publication, up 54% over the past 24 hours.

The post Solana Mobile Launches SKR Token Airdrop for Seeker Phone Users appeared first on Cryptonews.

Trove Markets’ new token collapsed almost immediately after trading began, wiping out the vast majority of early gains and leaving many backers angry and confused. The drop was brutal. Traders who bought early watched their holdings shrink by about 95% in a matter of hours.

Initial prices implied a market value near $20 million. Based on reports, the token fell to roughly $0.0008 per unit, trimming the market cap to below $1–2 million.

Some wallets unloaded huge chunks of coins right after the token generation event. That selling pressure coincided with a flood of posts on social platforms calling the launch a rug pull.

According to reports, the project raised roughly $11.5 million in its public sale. The Trove team announced it would keep about $9.4 million to fund further work and pay for a switch of blockchains.

Refunds totaling about $2.44 million were returned to some investors, and another $100,000 was earmarked for additional reimbursements. The numbers left many buyers feeling shortchanged and asking why a large share of the money stayed with the team.

Team Keeps Majority Of FundsOn-chain analysts and tracing tools flagged unusual transfers tied to a handful of new accounts. Reports note that a meaningful slice of the token supply moved into one cluster of wallets, and some transfers were routed through services like ChangeHero.

That activity raised questions about whether all token allocations were handled openly. Legal calls and demands for public audits followed soon after.

Investors reacted quickly. Some demanded full refunds. Others threatened legal steps. Community moderators and influencers amplified complaints and demanded clear timelines for fixes.

We’re pivoting Trove to Solana.

After recent sentiment around Trove, the liquidity partner that had been supporting our Hyperliquid path chose to unwind their 500k $HYPE position. That was their decision and we fully respect it.

This changes our constraints: we’re no longer…

— unwise (@unwisecap) January 18, 2026

Trove posted updates, saying a partner had pulled out and that the pivot to Solana was necessary to keep the project alive.

The team promised to continue building and to be more open about their choices, while pledging to deliver a working platform that might justify holding the funds.

Trust Hinges On Delivery And Transparency— TROVE (@TroveMarkets) January 19, 2026

What happens next will matter more than the words now being exchanged. If the team can show tangible progress on the exchange and create real trading depth, some anger may fade.

If not, the episode could be used as a warning: token sales that change terms late in the process can trigger swift market punishment and reputational damage. Regulatory scrutiny could also increase if large sums are held after a collapse like this.

Featured image from Unsplash, chart from TradingView