Binance launches USD1 rewards programme with WLFI token airdrops

- Binance launched a USD1 rewards campaign, distributing $40m in WLFI tokens through weekly airdrops.

- WLFI payouts are based on users’ net USD1 balances, with higher rewards for USD1 used as collateral.

- USD1’s market cap has surpassed $3 billion, while WLFI activity has increased across DeFi and payroll uses.

Binance has rolled out a new rewards campaign for users holding USD1, offering weekly WLFI token airdrops with a total of $40 million in WLFI earmarked for distribution.

The exchange said eligible accounts that maintain a USD1 balance between Jan. 23 and Feb. 20 will receive rewards throughout the programme.

The initiative ties WLFI payouts directly to net USD1 balances on Binance, using a snapshot-based system to calculate qualifying amounts.

Binance is positioning the campaign as an incentive for users who hold or deploy USD1 across supported products, while both USD1 and WLFI continue to see growing activity across the wider crypto ecosystem.

How Binance will distribute WLFI rewards

Binance said WLFI rewards will be paid once a week, starting Feb. 2.

Each weekly distribution will cover activity from the previous seven days.

The campaign is structured to release roughly $10 million worth of WLFI tokens per week, spread across four consecutive weeks, which brings the total allocation to $40 million in WLFI.

The exchange said the rewards are designed to reflect users’ qualifying USD1 balances over time, rather than a single moment in the campaign window.

Which USD1 balances count for eligibility

Eligibility is based on users’ net USD1 balances held on Binance, with multiple account types included in the calculation.

Binance confirmed that USD1 stored in Spot, Funding, Margin, and USDⓈ-M Futures accounts will all count toward the campaign’s rewards calculation.

However, borrowed funds are excluded. Binance said reward calculations are based on net USD1 balances, meaning any USD1 that has been borrowed does not qualify for WLFI rewards.

The exchange also said that USD1 used as collateral in margin or futures accounts earns a higher reward rate.

This introduces an added incentive for users who allocate USD1 into collateral-based trading products, rather than keeping it entirely idle in standard wallets.

Snapshot and rate system used for payouts

Binance said it will take hourly snapshots of user balances throughout the campaign period. However, the rewards calculation does not rely on an hourly average.

Instead, Binance will use the lowest USD1 balance recorded each day to determine a user’s qualifying amount for that day.

For each weekly payout, Binance will then calculate rewards using a seven-day average balance.

This ties distributions to consistency because a single daily dip in holdings could reduce the qualifying amount for that day and then affect the overall weekly average.

Binance also said payouts will use an effective annualised rate, which will be set at the time of each distribution.

As a result, the rate applied could vary between weekly drops depending on the conditions Binance sets when rewards are released.

USD1 growth and WLFI activity in early 2026

USD1, launched in April 2025, is described as a multichain stablecoin that is fully backed one-to-one by US dollars and money market funds.

Since its launch, it has recorded sharp growth. According to data from DeFiLlama, USD1’s market capitalisation now exceeds $3 billion.

The stablecoin is available across several blockchains, including Monad, Ethereum, Solana, and Aptos.

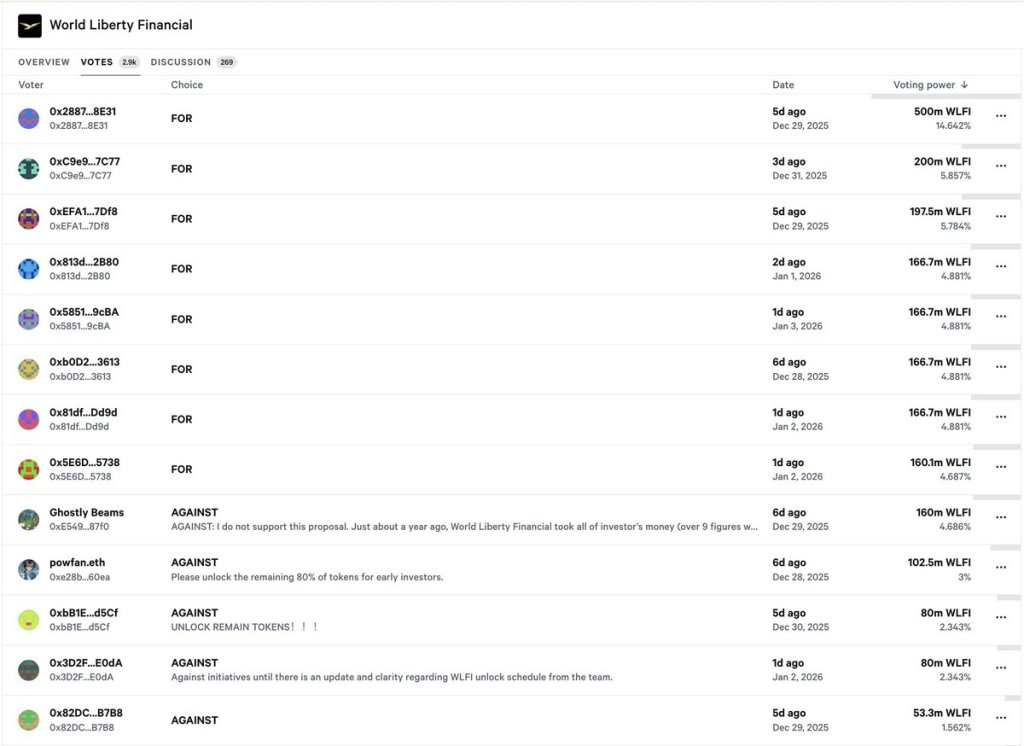

WLFI, the main token of the World Liberty Financial ecosystem, has also seen increased activity in early 2026.

It has recently been added to payroll services, decentralised finance lending platforms, and on-chain liquidity venues.

The token has drawn new interest and partnerships in recent weeks, though its connection to US President Donald Trump has also faced criticism, with some pointing to concerns around a potential conflict of interest.

Binance said users must complete identity verification and live in eligible jurisdictions to take part in the programme.

The exchange added that broker accounts are excluded and noted that reward timing may vary due to operational conditions.

The post Binance launches USD1 rewards programme with WLFI token airdrops appeared first on CoinJournal.