‘We are going to buy all of it’: Michael Saylor talks Bitcoin Strategy at Bitcoin MENA Conference

Bitcoin Magazine

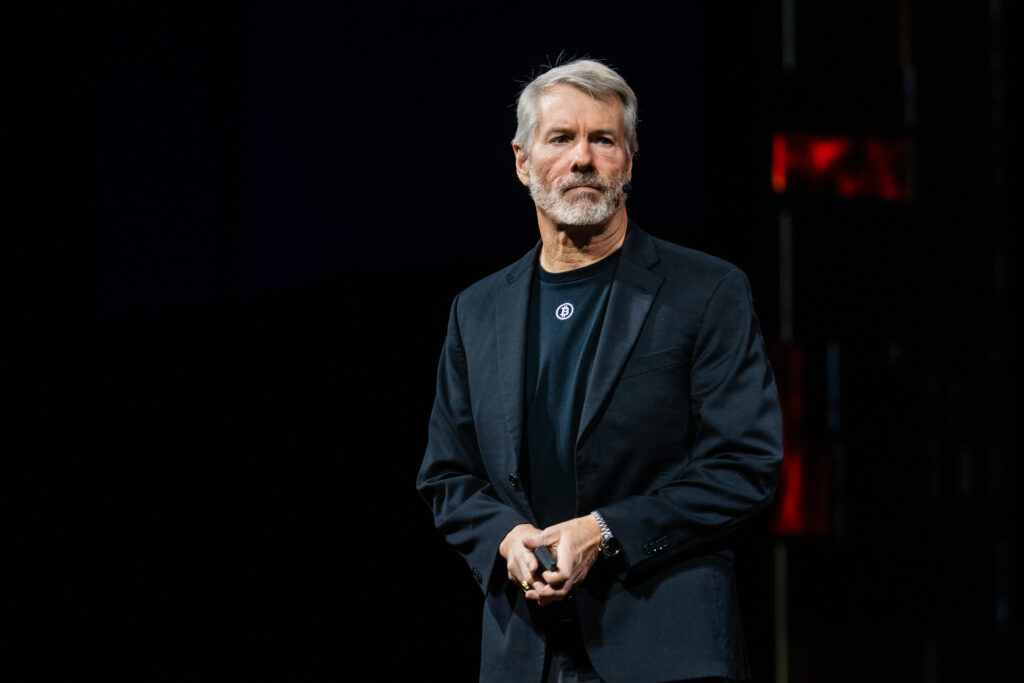

‘We are going to buy all of it’: Michael Saylor talks Bitcoin Strategy at Bitcoin MENA Conference

Michael Saylor, executive chairman of Strategy, delivered a sweeping keynote at the Bitcoin MENA conference earlier today, framing Bitcoin not just as an investable asset, but as the foundation of a new era in digital capital and credit.

Speaking to an audience of sovereign wealth funds, banks, conference attendees, and investors, Saylor outlined how his company is leveraging Bitcoin to create the world’s first digital Treasury and build a global system of Bitcoin-backed credit.

“Bitcoin is digital capital,” Saylor said, opening his talk.

He contrasted Bitcoin with traditional forms of capital such as gold, real estate, and equities, emphasizing its potential as a foundational store of value in the digital economy.

“We are going to buy all of it,” he declared, highlighting Strategy’s ongoing acquisition program, which now totals 660,624 Bitcoin, including 10,600 acquired last week.

The purchases, he explained, range from $500 million to $1 billion weekly, underscoring the company’s aggressive accumulation strategy.

Banks are meeting with Saylor to discuss Bitcoin

Saylor stressed the importance of recent institutional and regulatory shifts. He said that over the past year, major U.S. banks including Bank of America, Wells Fargo, JP Morgan, and Citi have moved from cautious observers to active participants, offering custody solutions and credit facilities tied to Bitcoin.

“All of the large banks in the United States have gone from not banking Bitcoin 12 months ago to issuing credit against Bitcoin or Bitcoin derivatives,” he noted.

JUST IN: Michael Saylor says he got approached by all the major banks recently to launch #Bitcoin products and services.

— Bitcoin Magazine (@BitcoinMagazine) December 9, 2025

Banks are herepic.twitter.com/AcHQRCaP7y

He also highlighted bipartisan U.S. government support for Bitcoin, citing figures from the Treasury, SEC, and CFTC.

Bitcoin as a yield-generating credit

Central to Saylor’s thesis is the conversion of Bitcoin’s volatile digital capital into predictable, yield-generating credit.

Strategy has launched a series of Bitcoin-backed credit instruments designed to provide steady cash flows while preserving exposure to the asset’s long-term appreciation.

“If you have a short time horizon, you buy the credit,” he said. “If you trust Bitcoin and have a long horizon, you buy the equity.”

Saylor described how these instruments work. Using over-collateralization, Strategy transforms Bitcoin holdings into digital credit with lower volatility and reliable yields.

The firm has introduced products like STRK, a preferred stock paying an 8% dividend backed by Bitcoin, and STRF, a perpetual bond yielding 10% that funds long-term investment in digital assets.

“We convert 120 months or 240 months of duration into one month,” Saylor explained, emphasizing the ability to deliver near-immediate cash flows from long-term capital.

He also outlined Strategy’s approach to amplifying equity performance. By issuing credit instruments and reinvesting proceeds in Bitcoin, the company effectively enhances its Bitcoin holdings per share over time.

“Every seven years, we double our Bitcoin per share,” he said.

The result, Saylor claims, is a corporate structure that aligns long-term Bitcoin growth with investor returns while creating unprecedented liquidity in credit markets.

Saylor framed these innovations in historical context. Just as gold served as the foundation for centuries of credit instruments—from mortgages to sovereign debt—Bitcoin, he argued, will form the backbone of a digital credit system.

“If we have digital gold, it’s very logical that the world’s going to run on digital gold-backed credit,” he said, noting the potential for Bitcoin to underpin global financial systems.

Throughout his keynote, Saylor emphasized both scale and vision. He described a tour of the Middle East, meeting investors across Dubai, Bahrain, Kuwait, and Abu Dhabi, presenting a unified vision of digital capital and credit.

“The opportunity for Treasury companies is to accumulate pools of capital and issue credit that meets regulatory requirements, integrates into the banking system, and absorbs currency risk,” he said.

At the time of writing, Bitcoin is ripping past $94,000.

This post ‘We are going to buy all of it’: Michael Saylor talks Bitcoin Strategy at Bitcoin MENA Conference first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

MICHAEL SAYLOR JUST HAD A MEETING WITH CZ AT BITCOIN MENA

MICHAEL SAYLOR JUST HAD A MEETING WITH CZ AT BITCOIN MENA

Minister of State Bilal Bin Saqib says, “

Minister of State Bilal Bin Saqib says, “