SEC Drops Enforcement Case Against Winklevoss-Founded Crypto Exchange Gemini

The US Securities and Exchange Commission has agreed to dismiss its enforcement case against Gemini, the cryptocurrency exchange founded by billionaire twins Tyler and Cameron Winklevoss, after investors in its defunct lending program recovered their crypto assets in full.

Key Takeaways:

- The SEC dropped its case after Gemini Earn investors were fully repaid in crypto.

- Repayments came through the Genesis bankruptcy process in mid-2024.

- The decision hinged on a 100% in-kind return of customer assets.

In a joint filing submitted Friday to federal court in Manhattan, the SEC and Gemini Space Station cited the complete repayment of assets to users of the Gemini Earn program through the Genesis Global Capital bankruptcy process.

The repayments were completed between May and June 2024, according to the court document.

SEC Drops Gemini Case After Earn Investors Made Whole

The regulator said the decision followed the “100 percent in-kind return” of crypto assets to affected investors, meaning customers received the same digital assets they had originally deposited rather than cash equivalents.

Based on that outcome, the SEC concluded that dismissing its claims against Gemini was appropriate.

The case stems from charges brought in January 2023, when the SEC accused Gemini Trust Company and Genesis Global Capital of offering unregistered securities through the Gemini Earn program.

Under the arrangement, Gemini users loaned their crypto to Genesis in exchange for yield, with Gemini acting as the platform intermediary.

The SEC has dismissed its lawsuit against the Winklevoss twins–backed Gemini over its earn product pic.twitter.com/aq35vpGxG7

— 0xMarioNawfal (@RoundtableSpace) January 23, 2026

At its peak, the Gemini Earn program held approximately $940 million in customer assets.

That balance was frozen in November 2022 when Genesis halted withdrawals amid broader market turmoil following the collapse of several major crypto firms.

Genesis later filed for bankruptcy, triggering months of negotiations among creditors, regulators, and counterparties.

Unlike many firms that failed during the 2022 crypto downturn, Genesis ultimately returned customer assets rather than liquidating holdings and distributing cash proceeds.

That outcome played a central role in the SEC’s decision to unwind its case against Gemini.

SEC Drops Gemini Case as Crypto Policy Softens and Exchange Grows

The dismissal comes amid a broader shift in the SEC’s approach to digital asset regulation under US President Donald Trump.

The administration has signaled a more accommodating stance toward the crypto sector, with Trump publicly pledging to support mainstream adoption of digital assets and ease regulatory pressure on the industry.

In its filing, the SEC stressed that the dismissal does not reflect its position on other crypto-related enforcement actions, underscoring that the decision was specific to the facts of the Gemini case.

The exchange has continued to expand its institutional footprint following the resolution of the Earn dispute.

Gemini made a high-profile debut on Nasdaq last year, reflecting renewed investor interest in regulated crypto platforms as the market rebounds. According to LSEG data, the company is currently valued at approximately $1.14 billion.

The post SEC Drops Enforcement Case Against Winklevoss-Founded Crypto Exchange Gemini appeared first on Cryptonews.

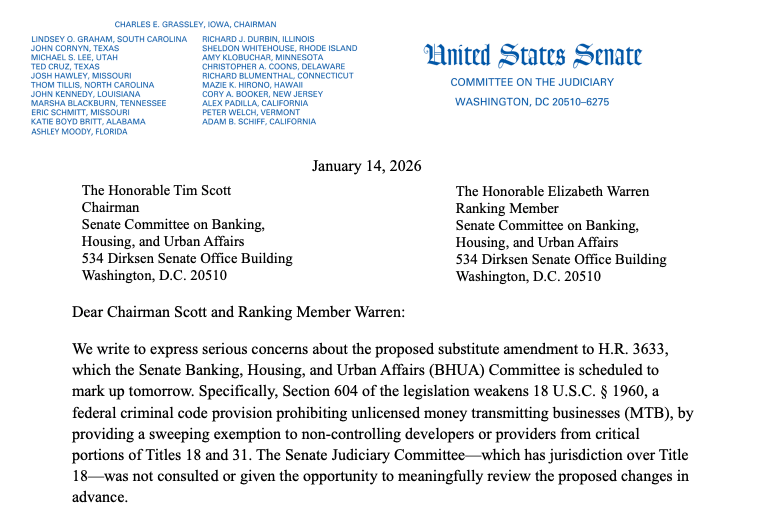

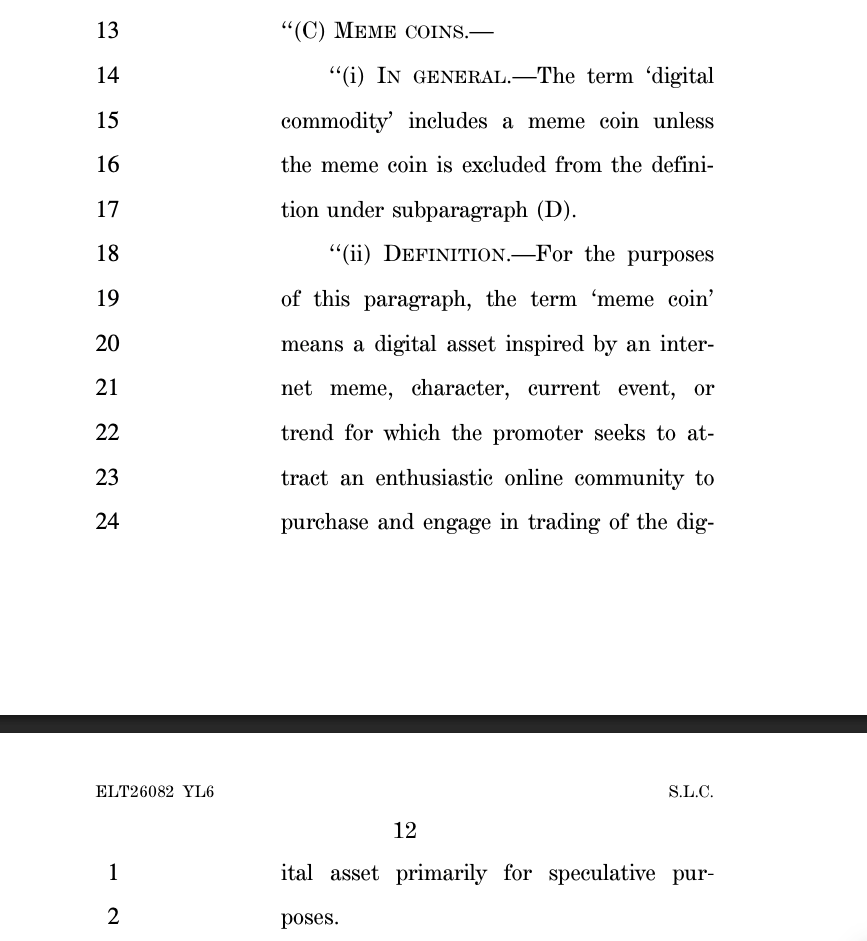

Senate Judiciary leaders oppose blockchain developer protections in crypto bill, warning exemptions modeled on Lummis-Wyden BRCA could block money laundering prosecutions.

Senate Judiciary leaders oppose blockchain developer protections in crypto bill, warning exemptions modeled on Lummis-Wyden BRCA could block money laundering prosecutions. Crypto market structure bill – Clarity Act – has been further delayed by the US Senate Banking Committee until late February or March.

Crypto market structure bill – Clarity Act – has been further delayed by the US Senate Banking Committee until late February or March. Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.

Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.

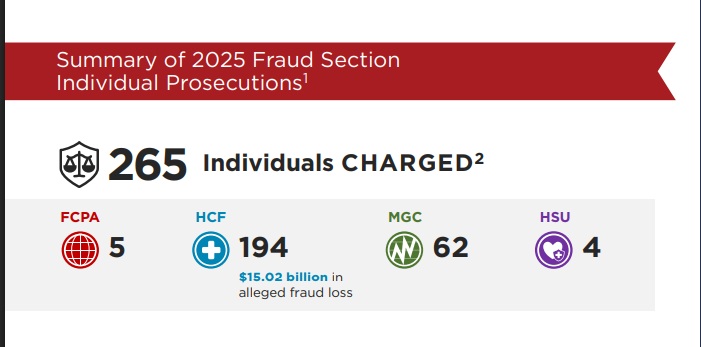

The SEC opened just 13 crypto enforcement cases in 2025, down 60% from 2024, with most new actions under Chair Paul Atkins focused on fraud.

The SEC opened just 13 crypto enforcement cases in 2025, down 60% from 2024, with most new actions under Chair Paul Atkins focused on fraud.

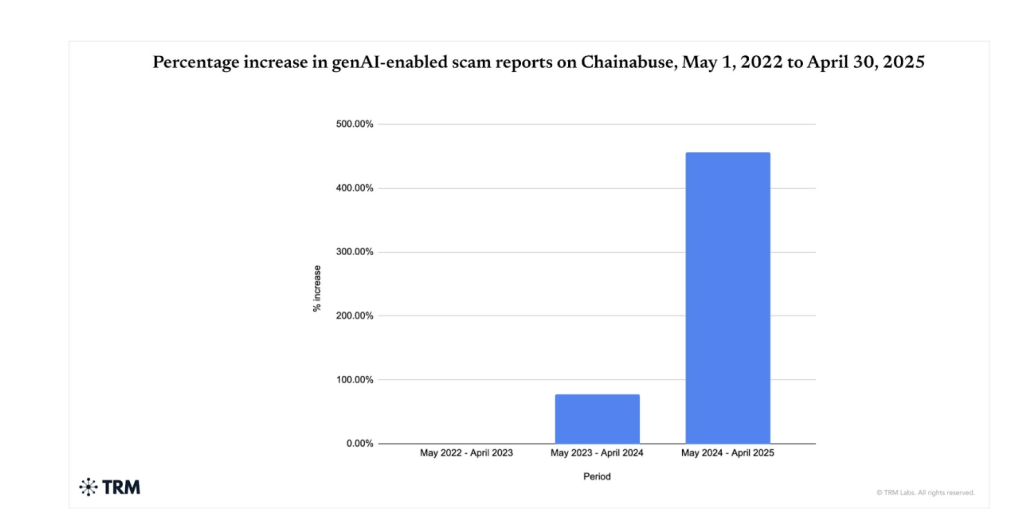

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

France conducts AML inspections on Binance and Coinhouse among 100+ entities for MiCA licenses with only 4 firms approved before June 2026 deadline.

France conducts AML inspections on Binance and Coinhouse among 100+ entities for MiCA licenses with only 4 firms approved before June 2026 deadline.

NEW: Where do we stand on crypto market structure legislation right now? The

NEW: Where do we stand on crypto market structure legislation right now? The

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.

Coinbase CEO

Coinbase CEO

Thailand chooses KuCoin as lead partner for historic $153M tokenized government securities with $3 minimum investment.

Thailand chooses KuCoin as lead partner for historic $153M tokenized government securities with $3 minimum investment.

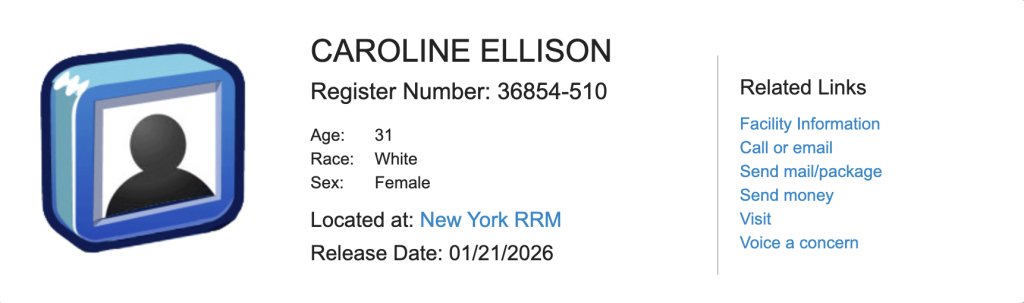

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.

The

The  Coinbase says crypto market structure bill more complex than stablecoin framework but global competition will force congressional action this year.

Coinbase says crypto market structure bill more complex than stablecoin framework but global competition will force congressional action this year.

The CFTC granted narrow no-action relief to four prediction markets, reducing immediate enforcement risk.

The CFTC granted narrow no-action relief to four prediction markets, reducing immediate enforcement risk.

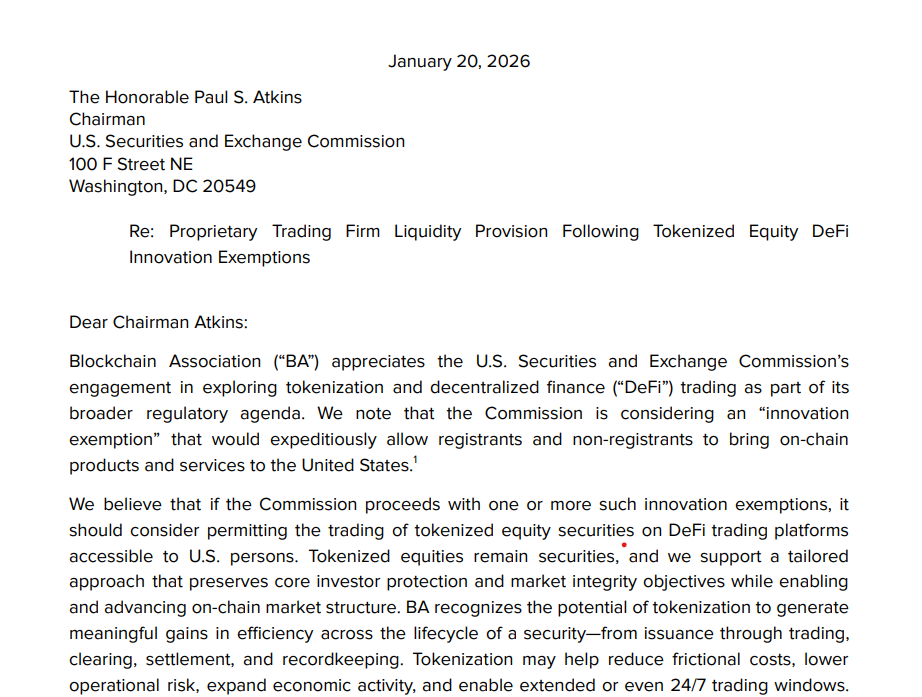

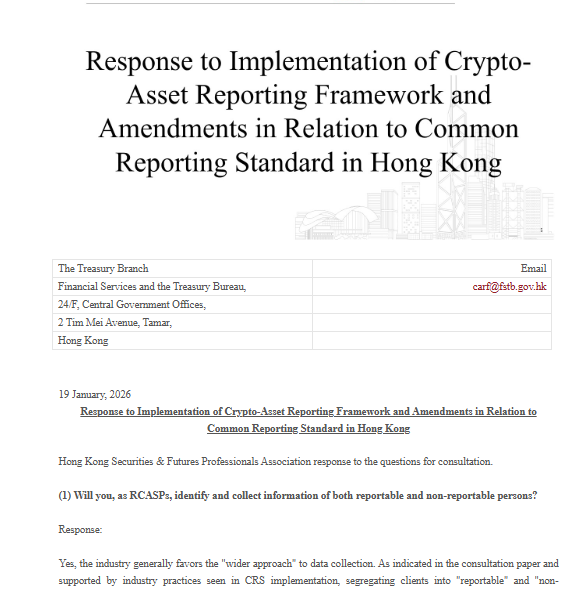

Hong Kong is set to implement the Crypto Asset Reporting Framework by 2026, enhancing tax transparency and tackling cross-border tax evasion in the crypto space!

Hong Kong is set to implement the Crypto Asset Reporting Framework by 2026, enhancing tax transparency and tackling cross-border tax evasion in the crypto space!

Kazakhstan establishes a digital asset regulatory framework, licensing crypto exchanges and giving the central bank authority to approve tradable coins.

Kazakhstan establishes a digital asset regulatory framework, licensing crypto exchanges and giving the central bank authority to approve tradable coins.