Senate Postpones Vital Crypto Market Structure Markup Due to Snow – New Date Confirmed

A winter storm in Washington, D.C., has compelled the senators to delay the first markup vote on comprehensive digital asset market structure legislation.

The Senate Agriculture Committee confirmed on Monday that it had postponed its scheduled Tuesday markup of the Digital Commodity Intermediaries Act because of dangerous weather conditions across the capital.

— Eleanor Terrett (@EleanorTerrett) January 26, 2026

JUST IN: The @SenateAg Committee has rescheduled its crypto market structure markup for 10:30 a.m. Thursday. pic.twitter.com/xjBLGqGVfM

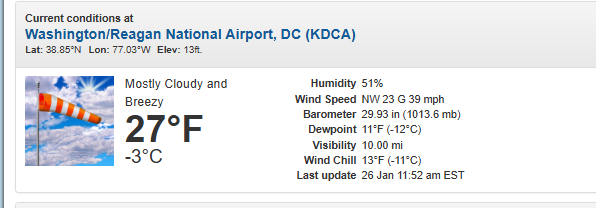

The committee staff cited unsafe travel conditions, noting that much of Washington is covered by snow and ice amid dangerously low temperatures caused by a major winter storm.

Flights Canceled, Roads Icy as Senate Crypto Markup Slips

The weekend was topped off by an arctic cold snap and heavy snowfall, with wind chills dropping down to below zero and daytime temperatures struggling to reach the mid-20s Fahrenheit.

The snowy sidewalks and the icy roads, along with the high winds, led to the closure of federal offices on Monday, with a snow emergency being declared in the city, which limited the movement of vehicles on major routes.

People were also greatly affected in air travel, with thousands of flights being cancelled across the country and major delays at Reagan National Airport as airlines and airports cleared backlogs.

Schools and universities in the area of Washington, Maryland, and Virginia went to closures or remote education, and legislators had restricted mobility as crews proceeded with snow removal.

The weather scramble created a new obstacle of a long legislative procedure that has already experienced a series of postponements.

The Agriculture Committee markup is paid close attention to, as it is the first occasion that the Senate formally votes on and amends a crypto market structure bill.

The panel oversees the Commodity Futures Trading Commission, and the legislation would expand the agency’s authority over digital commodities such as Bitcoin.

The bill is the product of months of negotiations led by Committee Chair John Boozman, with contributions from Senator Cory Booker, though bipartisan agreement has proven difficult.

Agriculture Committee Emerges as Key Path for Crypto Legislation

The way ahead was unclear even before the weather delay, as the Senate Banking Committee, which has jurisdiction over the Securities and Exchange Commission, has consistently put off its parallel bill, the CLARITY Act.

That effort was derailed earlier this month after Coinbase withdrew its support, citing concerns over restrictions on tokenized equities, stablecoin rewards, and the balance of power between regulators.

— Cryptonews.com (@cryptonews) January 15, 2026

Coinbase CEO @brian_armstrong said the exchange cannot support the Senate’s crypto bill as written, warning it would hurt tokenized equities, DeFi and privacy while weakening the CFTC.#Coinbase #CryptoPolicy https://t.co/kMbxepaWYk

Banking Committee leaders have since pivoted to housing legislation following President Donald Trump’s push to prioritize affordability, pushing crypto legislation into late February or March.

The delay in the Banking Committee has increased pressure on the Agriculture Committee’s bill, which now represents the most immediate legislative vehicle for crypto market structure reform.

However, last week, the Senate Agriculture Committee, led by Republicans, released its bill text, but it seemingly lacked Democratic support.

— Cryptonews.com (@cryptonews) January 22, 2026

Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.#ClarityAct #Stablecoinhttps://t.co/Wjz1vpYh5d

The Agriculture Committee’s bill differs from the Banking Committee’s approach on several key issues, including stablecoins and token classification.

While the CLARITY Act explicitly restricts interest-like rewards for holding payment stablecoins, the Agriculture Committee’s proposal largely sidesteps yield rules by excluding permitted payment stablecoins from CFTC oversight, deferring those questions to other frameworks such as the GENIUS Act.

The bill also explicitly places meme coins under CFTC jurisdiction, a move not mirrored in the Banking Committee’s draft.

The legislation has drawn increasing political attention as President Trump said last week that he expects to sign a crypto market structure bill “very soon,” framing digital assets as a strategic priority for maintaining U.S. competitiveness.

The post Senate Postpones Vital Crypto Market Structure Markup Due to Snow – New Date Confirmed appeared first on Cryptonews.

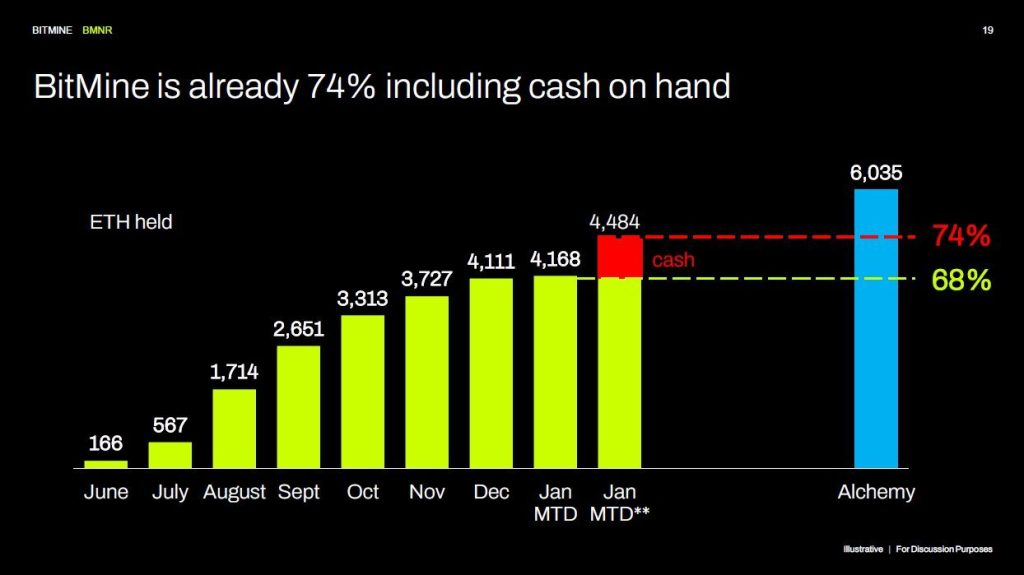

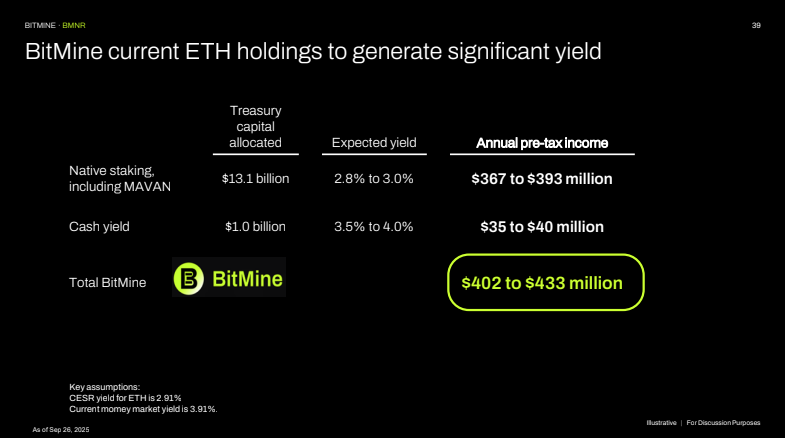

BitMine

BitMine

BitMine

BitMine

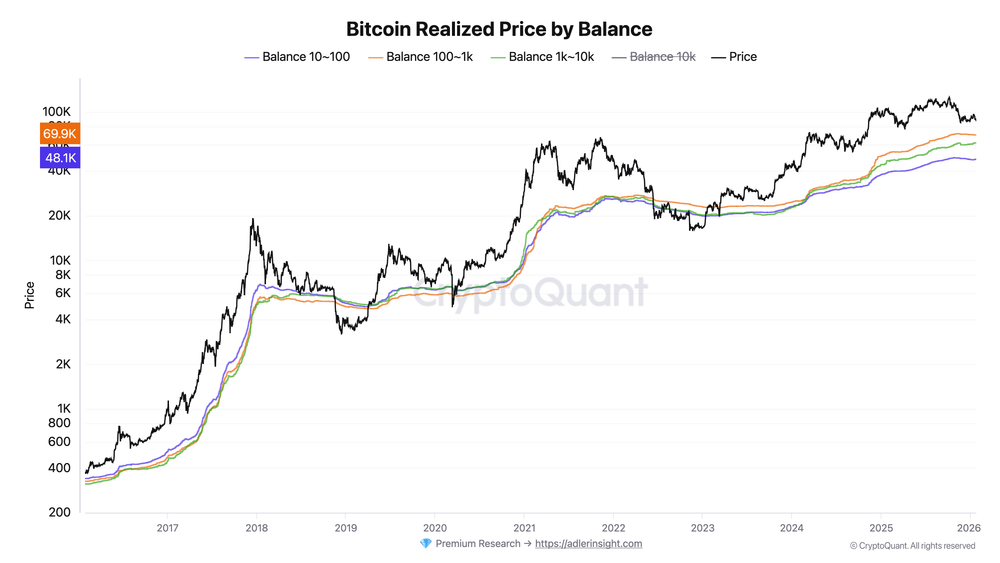

Adler Jr (@AxelAdlerJr)

Adler Jr (@AxelAdlerJr)

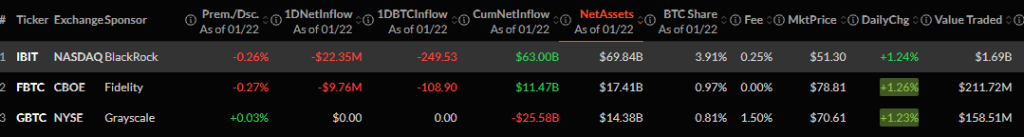

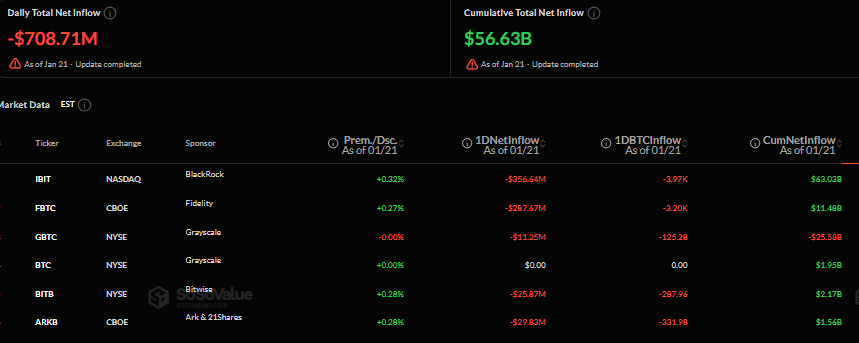

Digital asset investment products saw sharp outflows last week, with investors pulling $1.73B — the largest weekly decline since mid-November 2025, according to CoinShares.

Digital asset investment products saw sharp outflows last week, with investors pulling $1.73B — the largest weekly decline since mid-November 2025, according to CoinShares.

(@matchametaxyz)

(@matchametaxyz)

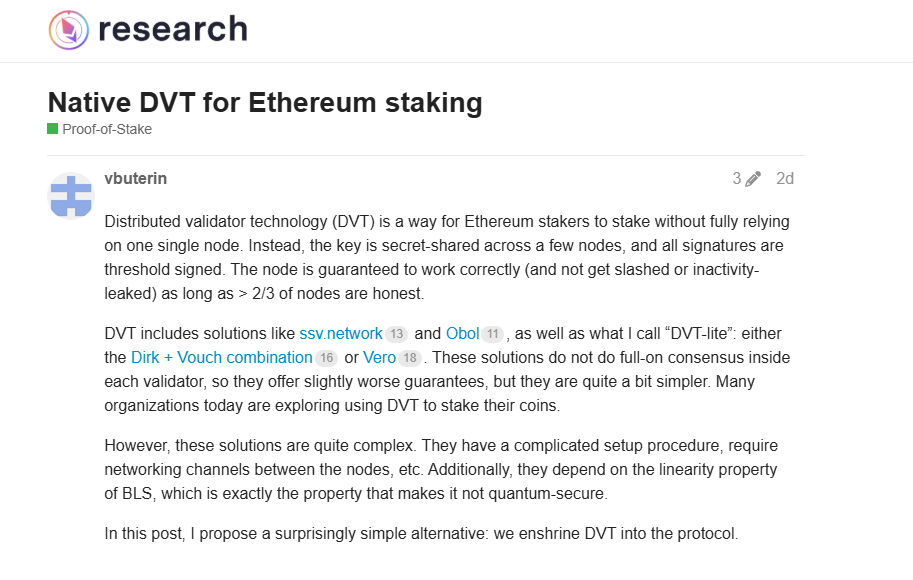

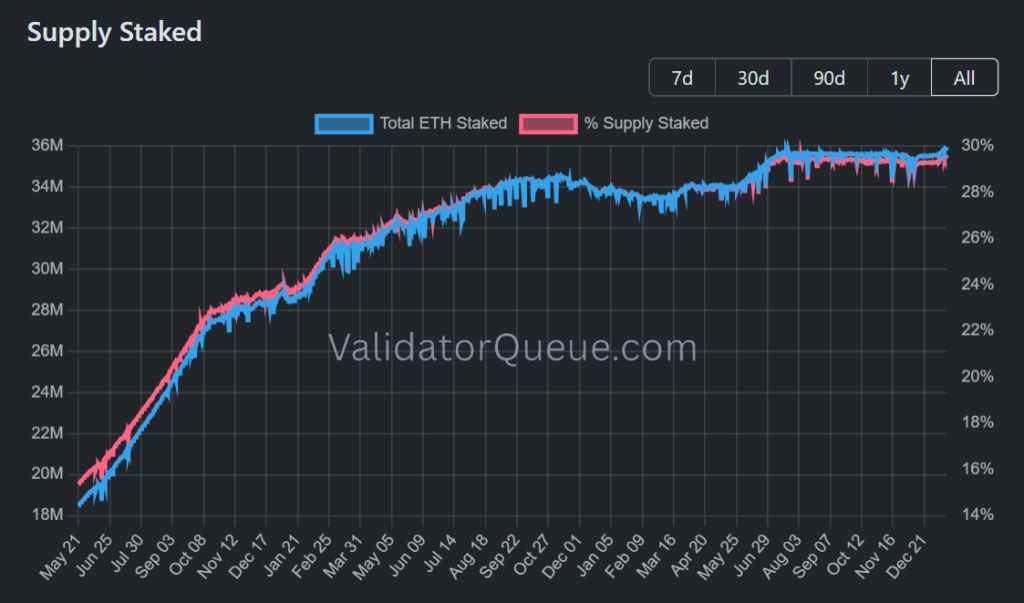

Vitalik Buterin: Verkle Trees Implementation to Benefit Ethereum Stakers and Network Nodes

Vitalik Buterin: Verkle Trees Implementation to Benefit Ethereum Stakers and Network Nodes Ethereum community member Eugenio Reggianini has proposed a technical framework to align Ethereum with EU GDPR rules.

Ethereum community member Eugenio Reggianini has proposed a technical framework to align Ethereum with EU GDPR rules.

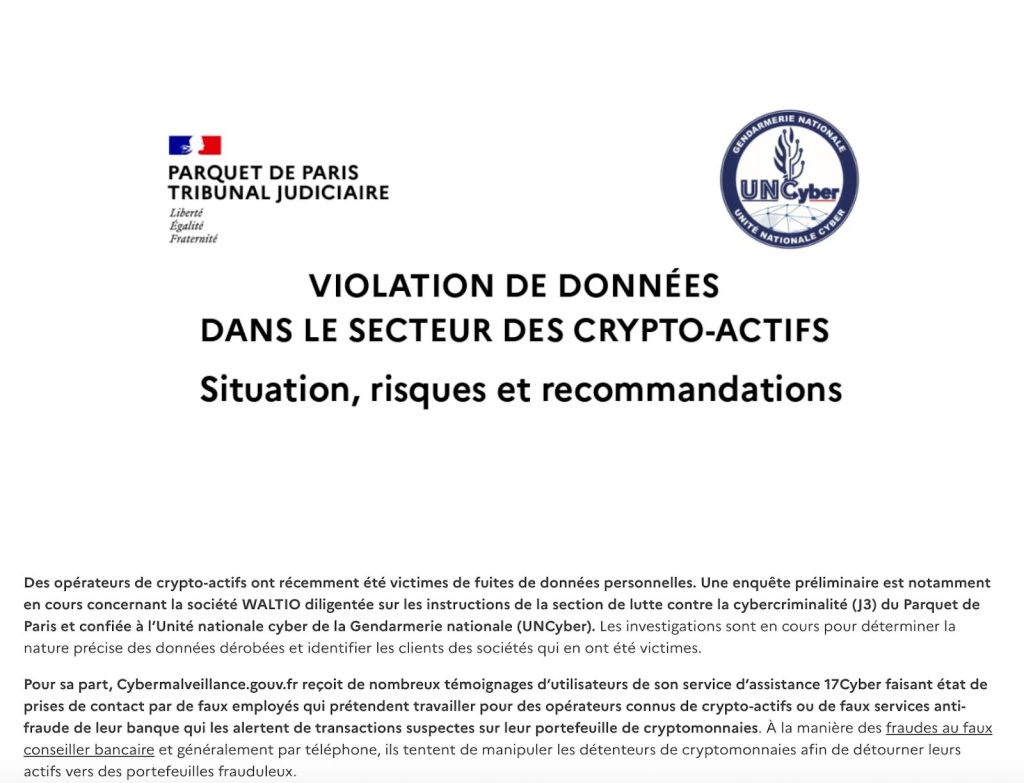

Masked gunmen steal crypto USB in France as prosecutors reveal tax official sold government database access identifying crypto investors to criminal gangs for 800 euros per operation.

Masked gunmen steal crypto USB in France as prosecutors reveal tax official sold government database access identifying crypto investors to criminal gangs for 800 euros per operation.

@RevolutApp may buy a US bank with a national charter to fast-track its American expansion and bypass the lengthy process of obtaining its own licence.

@RevolutApp may buy a US bank with a national charter to fast-track its American expansion and bypass the lengthy process of obtaining its own licence. The OCC has conditionally approved five crypto firms, including

The OCC has conditionally approved five crypto firms, including

Telegram CEO Pavel

Telegram CEO Pavel  Governments are expected to start treating AI data centers and energy-backed computing power as strategic infrastructure in 2026, similar to how oil reserves are managed.

Governments are expected to start treating AI data centers and energy-backed computing power as strategic infrastructure in 2026, similar to how oil reserves are managed.

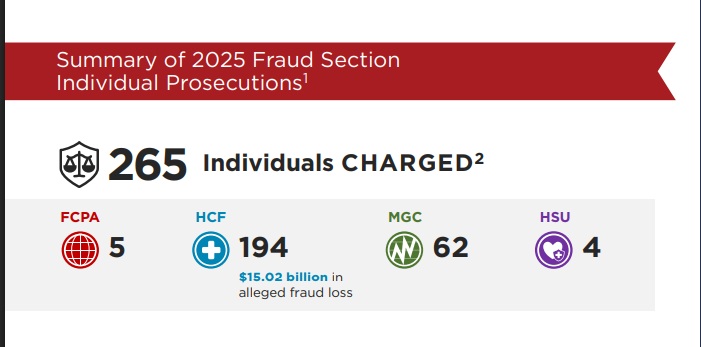

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.

ANNOUNCING

ANNOUNCING

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure.

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure. BNB (@cz_binance)

BNB (@cz_binance)  The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.

The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.

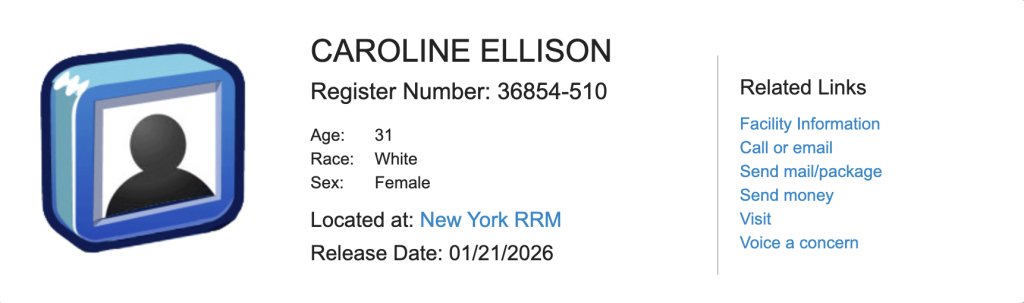

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.

OneCoin’s legal chief pleaded guilty to money laundering and wire fraud charges, according to a statement released today from the U.S. Attorney’s Office for the Southern District of New York.

OneCoin’s legal chief pleaded guilty to money laundering and wire fraud charges, according to a statement released today from the U.S. Attorney’s Office for the Southern District of New York.

Coinbase says crypto market structure bill more complex than stablecoin framework but global competition will force congressional action this year.

Coinbase says crypto market structure bill more complex than stablecoin framework but global competition will force congressional action this year.

(@suji_yan)

(@suji_yan)

Tom Lee

Tom Lee