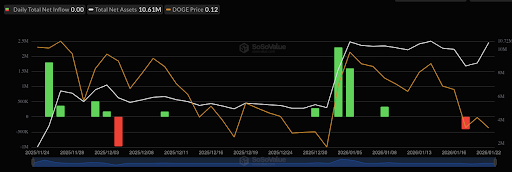

Bitcoin Spot ETFs Record $1.33 Billion Outflow In 2026 See-Saw Performance

The Bitcoin Spot ETFs continue to witness a volatile start to 2026, with back-to-back weeks showing sharply contrasting performance. After netting a staggering $1.42 billion in weekly netflows on January 16, market momentum soon swung the opposite way in line with a Bitcoin decline, forcing a net outflow of $1.33 billion over the last week. A similar phenomenon was seen in the first two weeks of the year, after an initial net deposit of $458.77 million by January 2 was followed by a net outflow of $681.01 million by January 9. This investor behavior suggests a highly reactive market with little long-term confidence.

No Positive Performance In Bitcoin Spot ETF Market Onslaught

In analyzing the most recent wave of withdrawals in the Bitcoin Spot ETF market, data from SoSoValue shows that the fourth trading week of January recorded no single day with a positive netflow. The heaviest outflows totaled $708.71 million on January 21, followed by the smallest daily outflow of $32.11 million on January 22.

Looking at individual funds, BlackRock’s IBIT, the market leader, suffered the largest net outflows valued at $537.49 million. As usual, Fidelity’s FBTC ranks a close second with redemptions surpassing deposits by $451.50 million. Other Bitcoin Spot ETFs with heavy net outflows also included Grayscale’s GBTC, Bitwise’s BITB, and Ark Invest’s ARKB, which suffered losses estimated at $172.09 million, $66.25 million, and $76.19 million, respectively.

Meanwhile, VanEck’s HODL, Valkyrie’s BRRR, and Franklin Templeton’s EZBC also experienced net outflows between $6 million and $11 million. Notably, Grayscale’s BTC, Invesco’s BTCO, WisdomTree’s BTCW, and Hashdex’s DEFI recorded the least activity with zero netflows. At press time, total net assets for the Bitcoin Spot ETFs stand at $115.88 billion, with BlackRock’s IBIT accounting for over 54% of these holdings, as the undisputed market leader. Meanwhile, total cumulative net inflow is presently valued at $56.49 billion.

Related Reading: Monero, Zcash, And Dash Prohibited In India Amid Money-Laundering Crackdown

Ethereum Spot ETFs Register $611M Outflows In Market Bloodbath

According to more data from SoSoValue, the Ethereum Spot ETFs also witnessed massive levels of redemptions in the last trading week, resulting in a net outflow of $611.17 million. Similar to its Bitcoin counterpart, the BlackRock ETHA also produced the largest net withdrawals valued at $431.50 million. Presently, the total net assets for the Ethereum Spot ETFs are valued at $17.70 billion, representing 4.99% of Ethereum’s market cap. Meanwhile, the cumulative total net inflow is valued at $12.30 billion.