Years Later, Bitcoin Open Interest In BTC Still Fails To Break Past Previous Peaks

Bitcoin’s price is fluctuating below the $90,000 mark as volatility increases across the entire cryptocurrency market. During the bearish price action, attention is now being shifted to the cautious signal from the Bitcoin Open Interest in BTC terms, which has remained below past all-time high in years.

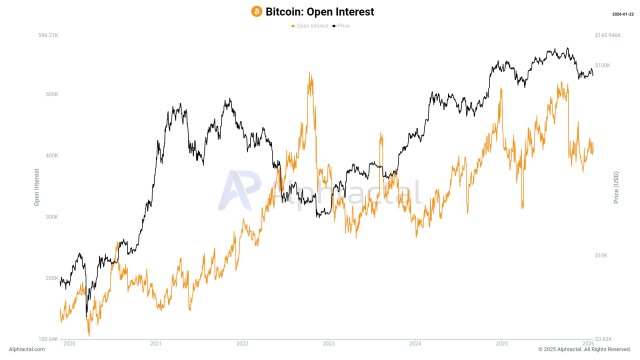

Open Interest Tells A Different Story When Measured In BTC

Amid the ongoing volatile action of the crypto market, the derivatives market for Bitcoin is providing a more subdued message. This message is unfolding on the Bitcoin Open Interest (OI) in BTC terms as outlined in a recent research by Joao Wedson, a market expert and founder of the Alphractal analytics platform.

In the report shared on the X platform, the market expert highlighted that the open interest measured in BTC terms has failed to reach new all-time highs since 2022. The BTC-based perspective shows a more restricted usage of leverage over cycles, whereas dollar-denominated measures frequently climb in tandem with price.

On Thursday, the metric experienced a bounce, but Wedson stated that the upward move was mainly in USD-dominated open interest. This pattern suggests that traders are becoming more cautious in the market by allocating capital more carefully as opposed to putting it all into risky positions.

According to the expert, the trend simply suggests that speculation is present in the market and it’s currently expanding. However, the chart shows that the broader market is still far from any form of extreme or irrational euphoria.

Not Enough Profit To Trigger A Bullish Recovery

BTC’s inability to produce another major rally is linked to the level of investors in profit. Darkfost stated that there are still not enough investors in profit to hope for a sustainable bullish recovery. Thus, it is crucial to understand that latent profits are not harmful to a market; it is quite the opposite.

When investors are most in profit, the situation is much more comfortable, which motivates them to hold. However, this only holds up to a certain point. Also, when the supply in profit surpasses 95% or even 100%, latest profits begin to impact the market and may trigger essential corrective phases.

The ongoing correction remained moderate with a drawdown to around 31%, but it was able to sharply reduce the percentage of supply in profit, suggesting very late entry by many investors. Currently, over 71% of BTC is in profit after dropping as low as 64%, a very concerning level that has typically been observed only when Bitcoin was entering a bear market.

However, in Darkfost’s view, the market must reclaim above 75% supply in profit to regain a more stable structure. As long as it stays above this level, the supply in profit has historically been associated with positive periods, as shown in the chart.

With the recent price rebound, the supply in profit saw a brief climb back to 75% before getting rejected. Meanwhile, many BTC investors possibly used this opportunity to exit at break-even or to cut their losses.