Does Capital Really Rotate From Gold To Bitcoin? On-Chain Data Offers Insight

“Bitcoin is the digital gold” is one of the most popular narratives in the cryptocurrency industry, reiterating BTC’s growing status as a formidable store of value. However, while the premier cryptocurrency has floundered over the past months, gold and the metals market have largely witnessed explosive growth.

These contrasting performances have led to conversations about capital rotation between Bitcoin and gold, as the crowd expects one to always outperform the other at any given time. Recent data, however, suggests that the relationship between the BTC and gold price action is overrated.

Capital Flow Link Between BTC And Gold Overestimated

In a January 24 post on the X platform, on-chain analyst with the pseudonym Darkfost weighed in on the discourse surrounding capital rotation between gold and Bitcoin. According to the market pundit, the idea that investor funds flow from gold to Bitcoin is somewhat overblown.

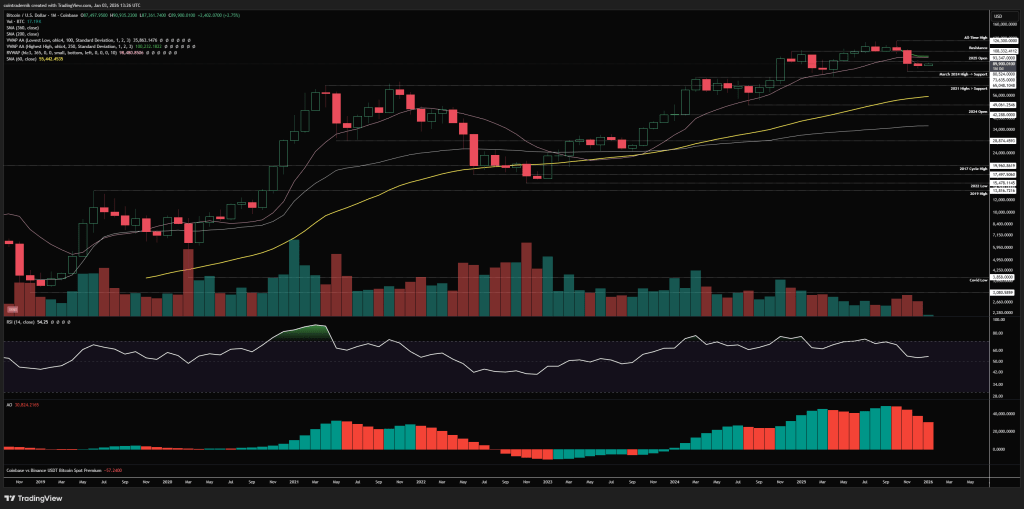

To highlight this overestimation, Darkfost shared a chart showing periods where BTC outperforms or underperforms depending on gold’s trend. This chart typically provides two signals: positive (BTC above the 180-day moving average [MA] and gold below the 180-day MA) and negative (BTC below the 180-day moving average and gold below the 180-day MA).

As observed in the chart above and stated by Darkfost, the relationship between Bitcoin and gold does not appear to be fully substantiated. The on-chain analyst revealed that there have been as many positive periods as the negative ones, suggesting that the flagship cryptocurrency moves independently of gold.

Darkfost wrote:

This suggests that BTC continues to evolve independently, without clear evidence of a sustained capital rotation from gold.

Furthermore, Darkfost noted that a positive signal does not necessarily mean that capital is flowing out of gold into Bitcoin. According to the on-chain analyst, it is simply not possible to determine whether there is a capital flow relationship between the world’s largest cryptocurrency and gold.

Bitcoin & Gold Price Overview

While Bitcoin started the new year on a pretty strong note, the bullish momentum has pretty much waned over the past two weeks. Meanwhile, the gold price has continued to flourish this year, recently reaching a new all-time high above $4,900 per ounce.

As of this writing, the price of BTC stands at around $89,230, reflecting no significant movement in the past 24 hours. According to data from CoinGecko, the flagship cryptocurrency is nearly 30% adrift its all-time high above the $126,000 level.