Bitcoin’s Net Realized P/L Hits Zero Again — Is a June 2022-Style Capitulation Next?

Bitcoin is again near another critical on-chain inflection point as a key profitability indicator goes back to the levels that last occurred during one of the most painful downtrends in the history of the market.

CryptoQuant analyst Adler AM data shows that the Net Realized Profit and Loss of Bitcoin has dropped by approximately 97% after it achieved its recent high and is now approaching the levels of near-zero territory.

The situation is similar to those observed in June 2022 before BTC plummeted from about 30,000 to almost 16,000.

Net Realized P/L has dropped by 97% and returned to zero. The last time this happened was in June 2022 – right before the drop from $30K to $16K. Whales are still in profit (a 25-80% buffer), so there is no panic yet. But the market is being supported not by buyers – but by the… pic.twitter.com/ooQsnaGTCA

— AxelAdler Jr (@AxelAdlerJr) January 26, 2026

Net Realized P/L tracks the balance between realized profits and losses on the Bitcoin network based on on-chain cost basis. Positive readings signal dominant profit-taking, while negative values reflect loss-driven selling.

Readings near zero suggest trades are occurring close to cost basis, indicating profit exhaustion and a balance between buyers and sellers.

Bitcoin Selling Pressure Fades, but Buyers Stay on the Sidelines

The analyst pointed out that the current setup resembles the period just before Bitcoin’s main capitulation leg in 2022. In late 2024 and early 2025, Net Realized P/L surged above $1.5 billion, reflecting an overheated profit-taking phase.

By January 26, 2026, that figure had collapsed to roughly $60 million, effectively flattening at the zero line. In 2022, a similar return to zero did not mark a bottom.

Instead, the metric continued lower into deeply negative territory, falling to around minus $350 million as the price slid another 50%.

Adler noted that the present zero reading should not be interpreted as a bullish reversal signal. Instead, it represents a pause where selling pressure from profit-takers has largely dried up, but fresh demand has not stepped in.

On-chain data suggests the market is currently being supported more by the absence of sellers than by strong buying interest, a fragile equilibrium that has historically broken lower during risk-off environments.

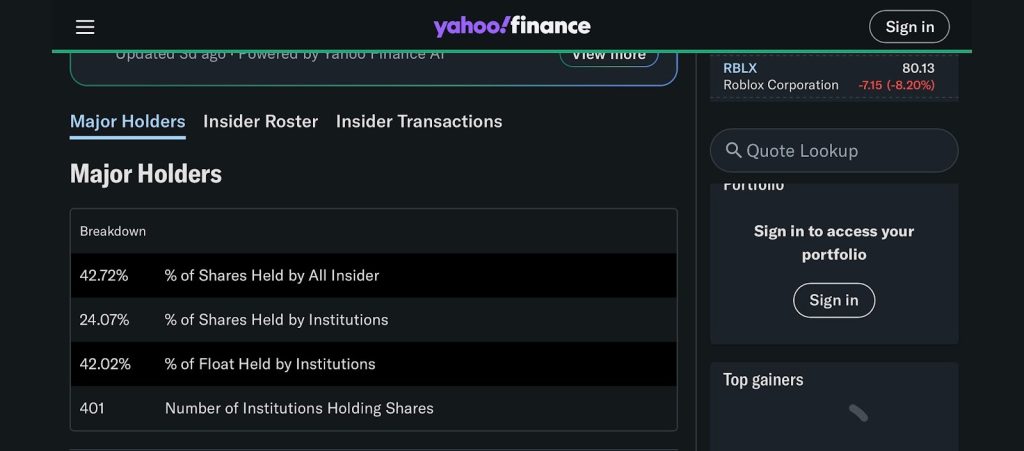

Despite the warning signals, large Bitcoin holders remain in profit, as realized price data segmented by balance size shows that all major whale cohorts are still comfortably above their average acquisition costs.

Holders with balances between 100 and 1,000 BTC have the highest realized price, near $69,900, giving them an estimated profit buffer of about 25% at current prices.

Other large cohorts, including wallets holding 10–100 BTC and those with more than 10,000 BTC, have average entry prices closer to $48,000 and $51,000, translating to unrealized gains of 70% to 80%.

This helps explain the lack of panic selling, even as price has pulled back sharply from recent highs.

Bitcoin Slips Below $88K as Volatility Picks Up

At the time of writing, Bitcoin was priced at approximately $87,756, having fallen by approximately 1.1% in the last 24 hours and 5.7% in the last week.

Trading volume, however, surged more than 160% day over day to $53.1 billion, pointing to heightened activity as traders reposition amid volatility.

Macro pressure has contributed to the discomfort because U.S. President Donald Trump threatened to impose 100% tariffs on any Canadian products in case Ottawa strengthens trade relations with China, and the rumors of a potential American government shutdown resurfaced.

The move triggered more than $320 million in liquidations of leveraged long positions in a matter of hours.

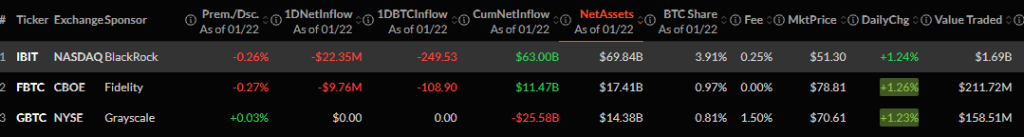

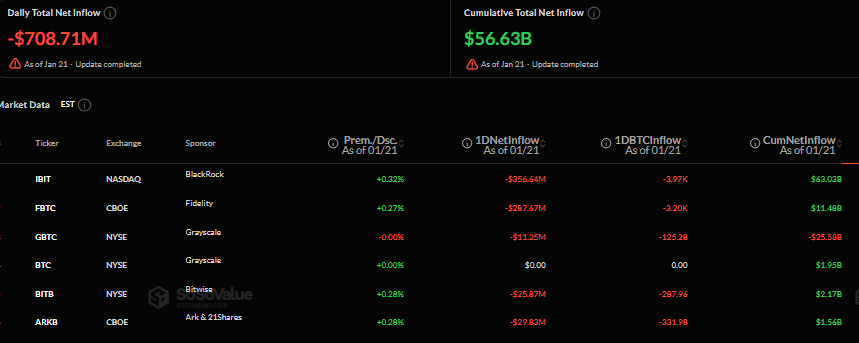

Also, CoinShares reported $1.73 billion in outflows from digital asset investment products last week.

— Cryptonews.com (@cryptonews) January 26, 2026

Digital asset investment products saw sharp outflows last week, with investors pulling $1.73B — the largest weekly decline since mid-November 2025, according to CoinShares.#BTC #ETPs https://t.co/2ni4w83evG

Bitcoin-linked products accounted for $1.09 billion of those outflows, with the bulk coming from U.S.-based funds.

Exchange order book data shows sell-offs were absorbed with modest volume delta, indicating controlled selling.

Analysts say liquidity remains stable, with no signs yet of cascading capitulation.

The post Bitcoin’s Net Realized P/L Hits Zero Again — Is a June 2022-Style Capitulation Next? appeared first on Cryptonews.

(@matchametaxyz)

(@matchametaxyz)

Vitalik Buterin: Verkle Trees Implementation to Benefit Ethereum Stakers and Network Nodes

Vitalik Buterin: Verkle Trees Implementation to Benefit Ethereum Stakers and Network Nodes Ethereum community member Eugenio Reggianini has proposed a technical framework to align Ethereum with EU GDPR rules.

Ethereum community member Eugenio Reggianini has proposed a technical framework to align Ethereum with EU GDPR rules.

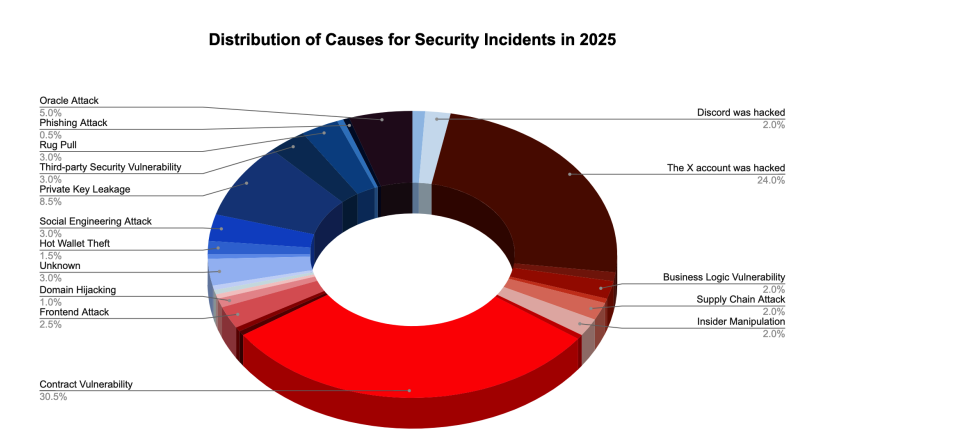

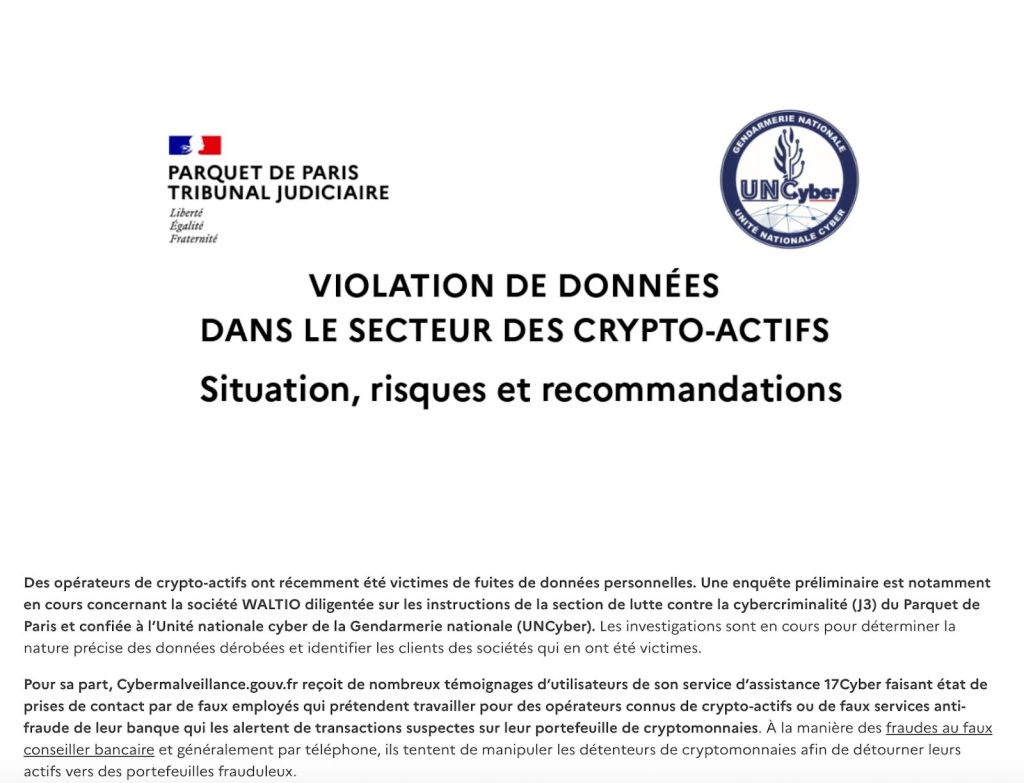

Masked gunmen steal crypto USB in France as prosecutors reveal tax official sold government database access identifying crypto investors to criminal gangs for 800 euros per operation.

Masked gunmen steal crypto USB in France as prosecutors reveal tax official sold government database access identifying crypto investors to criminal gangs for 800 euros per operation.

@RevolutApp may buy a US bank with a national charter to fast-track its American expansion and bypass the lengthy process of obtaining its own licence.

@RevolutApp may buy a US bank with a national charter to fast-track its American expansion and bypass the lengthy process of obtaining its own licence. The OCC has conditionally approved five crypto firms, including

The OCC has conditionally approved five crypto firms, including  Revolut launches zero-fee stablecoin swaps for its 65 million users as crypto trading drives 298% revenue growth in its wealth division.

Revolut launches zero-fee stablecoin swaps for its 65 million users as crypto trading drives 298% revenue growth in its wealth division.

Telegram CEO Pavel

Telegram CEO Pavel  Governments are expected to start treating AI data centers and energy-backed computing power as strategic infrastructure in 2026, similar to how oil reserves are managed.

Governments are expected to start treating AI data centers and energy-backed computing power as strategic infrastructure in 2026, similar to how oil reserves are managed.

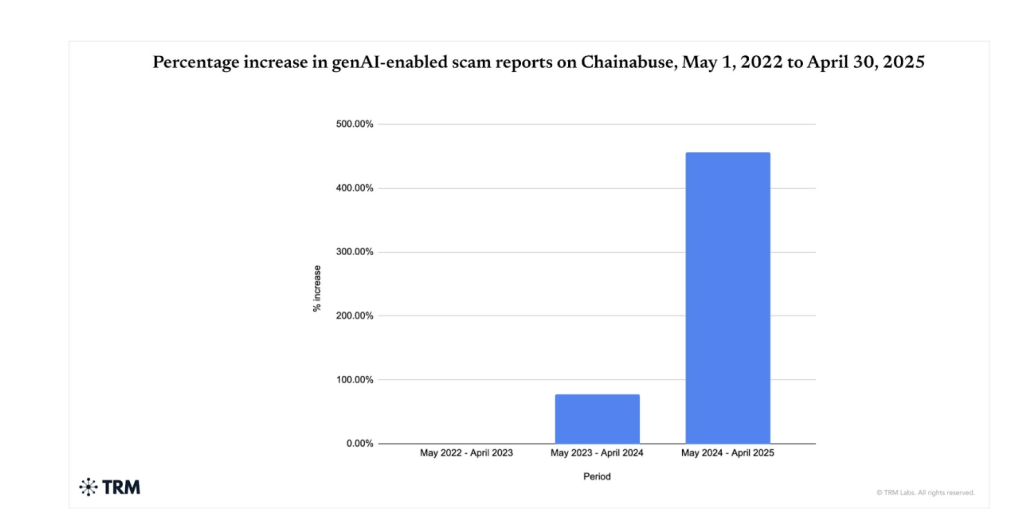

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.

South Korea's Supreme Court rules Bitcoin on exchanges can be legally seized under Criminal Procedure Act, establishing precedent as regulators expand asset freeze powers and AML enforcement.

ANNOUNCING

ANNOUNCING

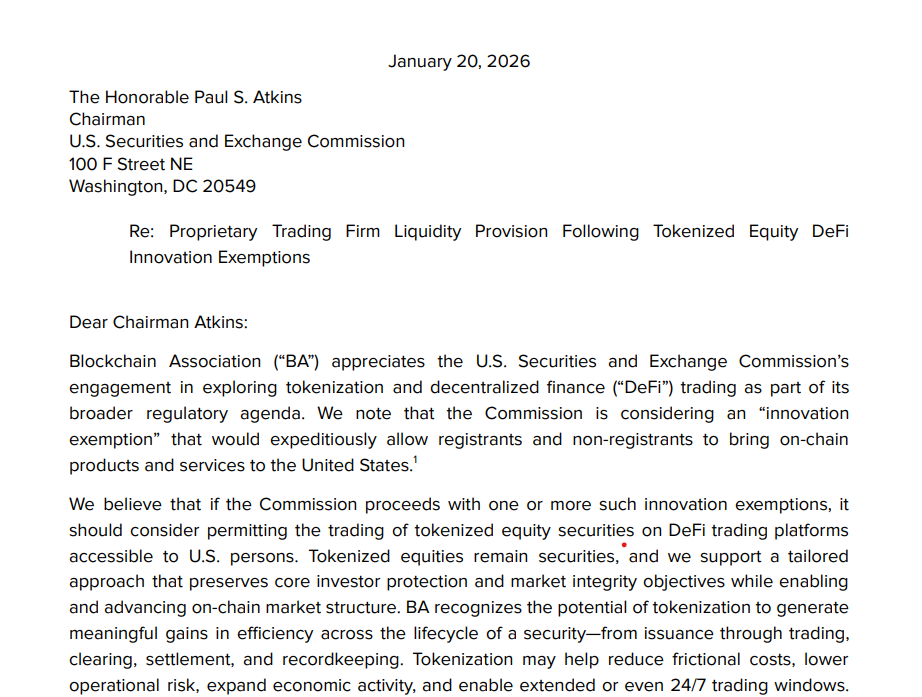

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure.

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure. BNB (@cz_binance)

BNB (@cz_binance)  The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.

The SEC has given a key green light to the Depository Trust and Clearing Corporation’s (DTCC) push into blockchain-based markets.

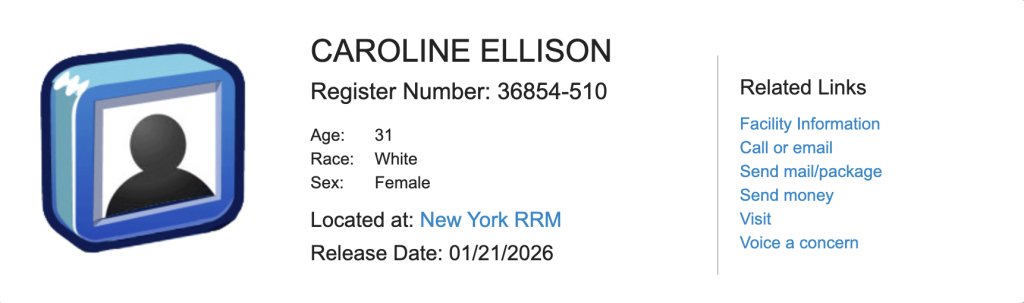

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.

OneCoin’s legal chief pleaded guilty to money laundering and wire fraud charges, according to a statement released today from the U.S. Attorney’s Office for the Southern District of New York.

OneCoin’s legal chief pleaded guilty to money laundering and wire fraud charges, according to a statement released today from the U.S. Attorney’s Office for the Southern District of New York.

Coinbase says crypto market structure bill more complex than stablecoin framework but global competition will force congressional action this year.

Coinbase says crypto market structure bill more complex than stablecoin framework but global competition will force congressional action this year.

(@suji_yan)

(@suji_yan)

Tom Lee

Tom Lee

The Senate finally confirms

The Senate finally confirms  Michael Selig becomes CFTC chairman as Caroline Pham exits agency after implementing major crypto regulatory reforms including spot trading approval and prediction market relief.

Michael Selig becomes CFTC chairman as Caroline Pham exits agency after implementing major crypto regulatory reforms including spot trading approval and prediction market relief.