Crypto ally Rick Rieder emerges front‑runner for Fed Chair on Polymarket

The Supreme Court appears poised to deliver a contradictory message to the American people: Some independent agencies deserve protection from presidential whim, while others do not. The logic is troubling, the implications profound and the damage to our civil service system could be irreparable.

In December, during oral arguments in Trump v. Slaughter, the court’s conservative majority signaled it would likely overturn or severely weaken Humphrey’s Executor v. United States, the 90-year-old precedent protecting independent agencies like the Federal Trade Commission from at-will presidential removal. Chief Justice John Roberts dismissed Humphrey’s Executor as “just a dried husk,” suggesting the FTC’s powers justify unlimited presidential control. Yet just weeks later, during arguments in Trump v. Cook, those same justices expressed grave concerns about protecting the “independence” of the Federal Reserve, calling it “a uniquely structured, quasi-private entity” deserving special constitutional consideration.

The message is clear: Wall Street’s interests warrant protection, but the rights of federal workers do not.

The MSPB: Guardian of civil service protections

This double standard becomes even more glaring when we consider Harris v. Bessent, where the D.C. Circuit Court of Appeals ruled in December 2025 that President Donald Trump could lawfully remove Merit Systems Protection Board Chairwoman Cathy Harris without cause. The MSPB is not some obscure bureaucratic backwater — it is the cornerstone of our merit-based civil service system, the institution that stands between federal workers and a return to the spoils system that once plagued American government with cronyism, inefficiency and partisan pay-to-play services.

The MSPB hears appeals from federal employees facing adverse actions including terminations, demotions and suspensions. It adjudicates claims of whistleblower retaliation, prohibited personnel practices and discrimination. In my and Harris’ tenure alone, the MSPB resolved thousands of cases protecting federal workers from arbitrary and unlawful treatment. In fact, we eliminated the nearly 4,000 backlogged appeals from the prior Trump administration due to a five-year lack of quorum. These are not abstract policy debates — these are cases about whether career professionals can be fired for refusing to break the law, for reporting waste and fraud or simply for holding the “wrong” political views.

The MSPB’s quasi-judicial function is precisely what Humphrey’s Executor was designed to protect. This is what Congress intended to follow in 1978 when it created the MSPB in order to strengthen the civil service workforce from the government weaponization under the Nixon administration. The 1935 Supreme Court recognized that certain agencies must be insulated from political pressure to function properly — agencies that adjudicate disputes, that apply law to fact, that require expertise and impartiality rather than ideological alignment with whoever currently occupies the White House. Why would today’s Supreme Court throw out that noble and constitutionally oriented mandate?

A specious distinction

The Supreme Court’s apparent willingness to treat the Federal Reserve as “special” while abandoning agencies like the MSPB rests on a distinction without a meaningful constitutional difference. Yes, the Federal Reserve sets monetary policy with profound economic consequences. But the MSPB’s work is no less vital to the functioning of our democracy.

Consider what happens when the MSPB loses its independence. Federal employees adjudicating veterans’ benefits claims, processing Social Security applications, inspecting food safety or enforcing environmental protections suddenly serve at the pleasure of the president. Career experts can be replaced by political loyalists. Decisions that should be based on law and evidence become subject to political calculation. The entire civil service — the apparatus that delivers services to millions of Americans — becomes a partisan weapon to be wielded by whichever party controls the White House.

This is not hypothetical. We have seen this movie before. The spoils system of the 19th century produced rampant corruption, incompetence and the wholesale replacement of experienced government workers after each election. The Pendleton Act of 1883 and subsequent civil service reforms were not partisan projects — they were recognition that effective governance requires a professional, merit-based workforce insulated from political pressure.

The real stakes

The Supreme Court’s willingness to carve out special protection for the Federal Reserve while abandoning the MSPB reveals a troubling hierarchy of values. Financial markets deserve stability and independence, but should the American public tolerate receiving partisan-based government services and protections?

Protecting the civil service is not some narrow special interest. It affects every American who depends on government services. It determines whether the Occupational Safety and Health Administration (OSHA) inspectors can enforce workplace safety rules without fear of being fired for citing politically connected companies. Whether Environmental Protection Agency scientists can publish findings inconvenient to the administration. Whether veterans’ benefits claims are decided on merit rather than political favor. Whether independent and oversight federal organizations can investigate law enforcement shootings in Minnesota without political interference.

Justice Brett Kavanaugh, during the Cook arguments, warned that allowing presidents to easily fire Federal Reserve governors based on “trivial or inconsequential or old allegations difficult to disprove” would “weaken if not shatter” the Fed’s independence. He’s right. But that logic applies with equal force to the MSPB. If presidents can fire MSPB members at will, they can install loyalists who will rubber-stamp politically motivated personnel actions, creating a chilling effect throughout the civil service.

What’s next

The Supreme Court has an opportunity to apply its principles consistently. If the Federal Reserve deserves independence to insulate monetary policy from short-term political pressure, then the MSPB deserves independence to insulate personnel decisions from political retaliation. If “for cause” removal protections serve an important constitutional function for financial regulators, they serve an equally important function for the guardians of civil service protections.

The court should reject the false distinction between agencies that protect Wall Street and agencies that protect workers. Both serve vital public functions. Both require independence to function properly. Both should be subject to the same constitutional analysis.

More fundamentally, the court must recognize that its removal cases are not merely abstract exercises in constitutional theory. They determine whether we will have a professional civil service or return to a patronage system. Whether government will be staffed by experts or political operatives. Whether the rule of law or the whim of the president will govern federal employment decisions.

A strong civil service is just as important to American democracy as an independent Federal Reserve. Both protect against the concentration of power. Both ensure that critical governmental functions are performed with expertise and integrity rather than political calculation. The Supreme Court’s jurisprudence should reflect that basic truth, not create an arbitrary hierarchy that privileges financial interests over the rights of workers and the integrity of government.

The court will issue its decisions over the next several months and when it does, it should remember that protecting democratic institutions is not a selective enterprise. The rule of law requires principles, not preferences. Because in the end, a government run on political loyalty instead of merit is far more dangerous than a fluctuating interest rate.

Raymond Limon retired after more than 30 years of federal service in 2025. He served in leadership roles at the Office of Personnel Management and the State Department and was the vice chairman of the Merit Systems Protections Board. He is now founder of Merit Services Advocates.

The post The Supreme Court’s dangerous double standard on independent agencies first appeared on Federal News Network.

© AP Photo/Julia Demaree Nikhinson

On Thursday, Senator Craig Bowser introduced a new piece of legislation aimed at creating a Strategic Bitcoin and cryptocurrency reserve for Kansas state.

The proposal, filed as Bill 352, would permit the Kansas Public Employees Retirement System (KPERS) to allocate up to 10% of its total funds into Bitcoin exchange-traded funds (ETFs).

Under the bill’s framework, KPERS would not be obligated to sell its Bitcoin ETF holdings if their value grows beyond the 10% allocation threshold, unless the board determines that doing so would better serve the interests of beneficiaries.

If enacted, the legislation would also require the KPERS board to conduct an annual review of the investment program, with the results formally submitted to the governor for oversight and evaluation.

Kansas’ move follows a growing trend among US states exploring BTC as a strategic asset as the regulatory environment surrounding crypto has significantly shifted under President Donald Trump’s administration.

Texas set an early benchmark last November when it became the first state to formally incorporate cryptocurrency into its treasury strategy by purchasing $10 million worth of Bitcoin.

In North Dakota, lawmakers are considering BTC investments as a potential hedge against inflation. Oklahoma has also entered the conversation, with Senator Dusty Deevers introducing the Bitcoin Freedom Act.

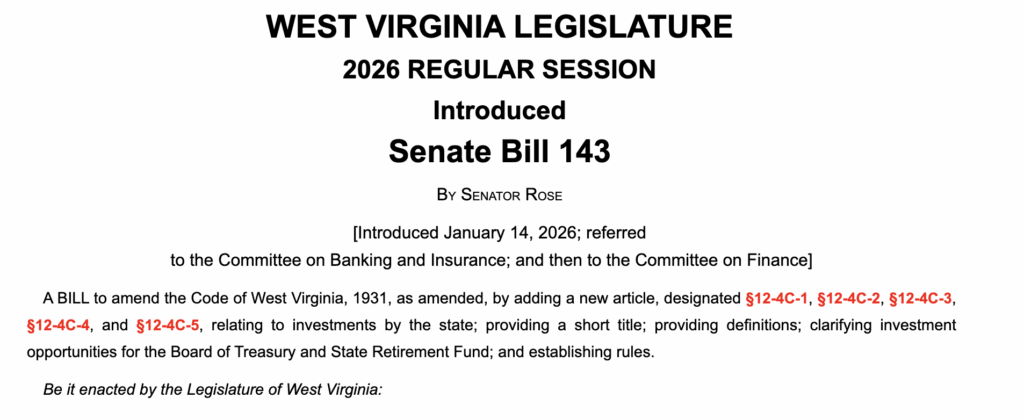

Meanwhile, Tennessee introduced a new bill last week—HB1695—designed to establish its own Strategic Bitcoin Reserve. West Virginia has put forward Senate Bill 143, which proposes allocating 10% of certain state funds toward a cryptocurrency reserve.

Missouri has made notable progress as well, advancing House Bill 2080 to create a Strategic Bitcoin Reserve Fund. That measure has already passed its second reading and is now moving forward for further consideration in the state House.

Featured image from DALL-E, chart from TradingView.com

Bitcoin Magazine

Kansas Introduce Bill to Establish Strategic Bitcoin Reserve

Kansas has become the latest U.S. state to explore a formal role for Bitcoin and digital assets in public finance, with lawmakers introducing legislation that would create a state-managed Bitcoin and Digital Assets Reserve Fund.

The bill, introduced by State Senator Craig Bowser, proposes amending Kansas’ unclaimed property laws to explicitly recognize digital assets, including cryptocurrencies and virtual currencies, and to establish a framework for their custody, management, and potential sale.

If passed, the legislation would place oversight of the reserve with the Kansas State Treasurer.

Under the proposal, unclaimed digital assets, like Bitcoin, would be transferred to the state after three years of inactivity following undeliverable written or electronic communication to the owner.

There is some ambiguity around what an ‘unclaimed digital asset’ is but the bill appears to apply only to custodial digital assets held by a legally defined “holder,” such as exchanges, banks, trust companies, or other licensed custodians, not to self-custodied wallets.

Per the bill, the three-year abandonment clock begins only after written or electronic communication to the owner is returned as undeliverable, and it stops immediately if the owner shows any sign of activity, including logging in or accessing another account with the same custodian.

Unlike many traditional forms of unclaimed property, the bill allows these assets to be delivered and held in their native digital form, rather than being immediately liquidated.

The legislation also permits the state’s designated qualified custodian to stake digital assets and receive airdrops, subject to direction from the treasurer.

Any staking rewards or airdropped assets generated after three years would be transferred into the BTC and Digital Assets Reserve Fund, creating a mechanism for the state to accumulate digital assets over time.

In a notable provision, the bill prohibits BTC from being deposited into the state’s general fund.

Instead, Kansas would retain Bitcoin as part of its reserve, while directing 10% of deposits of non-bitcoin digital assets into the general fund, contingent on legislative appropriations. Supporters argue this structure treats BTC as a long-term reserve asset rather than a short-term revenue source.

BREAKING: Kansas Senator Craig Bowser introduces bill to create a Strategic Bitcoin Reserve

— Bitcoin Magazine (@BitcoinMagazine) January 22, 2026pic.twitter.com/WeQjtrc3Vi

The bill also lays out how the state would handle the sale of digital assets. Cryptocurrencies that trade on established exchanges would have to be sold at market prices, while assets without active exchange listings could be sold using other commercially reasonable methods.

The goal of all this is to minimize market disruption while adding clearer guardrails around how state-held digital assets are managed.

If passed, the legislation would put Kansas alongside a growing number of U.S. states exploring how Bitcoin and other digital assets might fit into long-term financial and custodial strategies.

In recent years, state lawmakers across the country have debated whether Bitcoin could serve as a hedge against inflation, a diversification tool, or a way to modernize public finance infrastructure.

This post Kansas Introduce Bill to Establish Strategic Bitcoin Reserve first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Pierre Rochard, CEO of The Bitcoin Bond Company, has formally requested that the Federal Reserve include Bitcoin as an explicit variable in its 2026 supervisory stress tests, arguing the asset’s extreme volatility and growing institutional adoption warrant standalone treatment in banking risk assessments.

The letter, submitted January 20 to the Federal Reserve Board, challenges the practice of grouping Bitcoin with other cryptocurrencies and proposes quantitative calibration based on the asset’s historical behavior dating back to 2015.

Rochard’s submission arrives as the US government navigates conflicting policies on Bitcoin holdings, amid recent confusion over whether forfeited assets from the Samourai Wallet case violated Executive Order 14233, which requires seized Bitcoin to be transferred to the Strategic Bitcoin Reserve rather than liquidated.

However, the Department of Justice later confirmed, through White House crypto advisor Patrick Witt, that the 57.5 BTC had “not been liquidated and will not be liquidated,” resolving speculation after blockchain analysts flagged a November transfer to a Coinbase Prime address.

It is in the United States national interest to become the Bitcoin Superpower.

— Pierre Rochard (@BitcoinPierre) January 20, 2026

To that end, the Federal Reserve should begin integrating bitcoin into its stress tests and scenarios.

I've sent in a comment letter explaining what I believe to be reasonable path forward. (1/3) pic.twitter.com/rDILZMpFv5

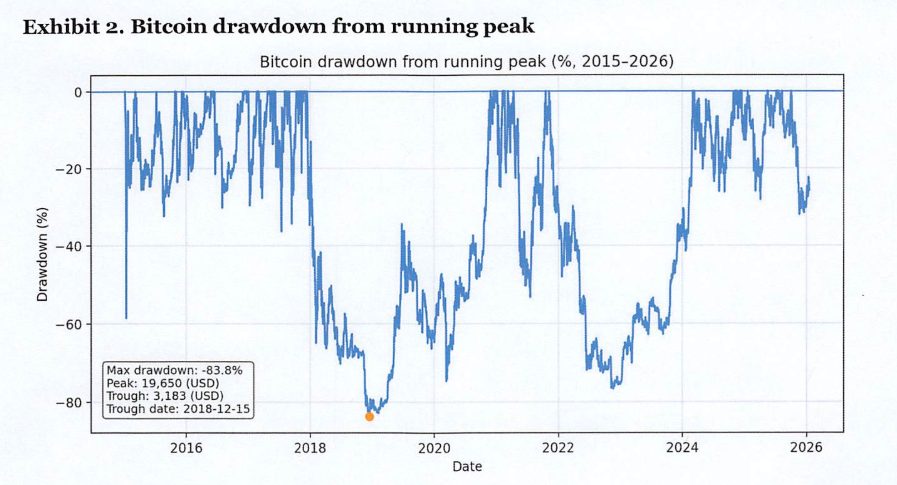

Rochard’s letter presents a detailed analysis showing Bitcoin’s 73.3% annualized realized volatility over the 2015-2026 sample period, compared to just 18.1% for the S&P 500 over the same timeframe.

The analysis documents a maximum drawdown of 83.8% from peak to trough, with daily return tails ranging from -10.0% at the 1st percentile to 10.7% at the 99th percentile, far exceeding typical asset behavior.

“Bitcoin’s risk profile is unusually idiosyncratic and materially non-linear: it has experienced repeated, deep peak-to-trough drawdowns and sustained periods of very high realized volatility,” Rochard wrote.

He argued these properties affect valuations, margin requirements, counterparty exposures, and liquidity demands “in ways that cannot be reliably inferred from other scenario variables.“

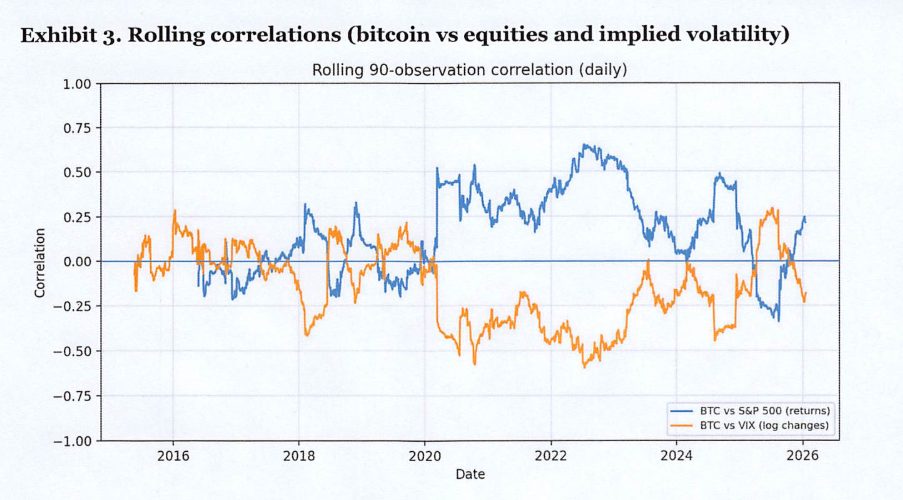

The submission includes rolling correlation analysis demonstrating Bitcoin’s unstable dependence structure with macro-financial variables, with correlation between Bitcoin and S&P 500 returns ranging from negative to strongly positive across 90-observation windows.

Rochard warned that “a fixed ‘beta’ mapping from equities (or risk sentiment) to bitcoin will understate risk in some regimes and overstate it in others,” making explicit scenario variables essential for consistent stress testing across banks.

Rochard recommends that the Federal Reserve provide quarterly Bitcoin price paths for baseline, adverse, and severely adverse scenarios, with optional daily paths for global-market-shock datasets.

He suggests three calibration methods:

“The calibration goal is not to forecast bitcoin, but to supply a consistent and severe, but plausible, path that stress tests can translate into market and counterparty outcomes,” Rochard explained.

He emphasized that firms without Bitcoin exposure could simply ignore the variable, while those with direct or indirect exposure would gain “transparency, reproducibility, and consistent scenario translation” rather than relying on inconsistent proxy assumptions.

The timing coincides with broader market stress, as Bitcoin plunged to $88,000 amid $1.07 billion in liquidations over 24 hours while gold surged past $4,800 per ounce.

The divergence has renewed debate over Bitcoin’s role as either a risk asset or a strategic reserve, particularly after President Trump’s threats to impose tariffs on Greenland triggered a flight from US assets.

CEO of Galaxy, Mike Novogratz, noted “the gold price is telling us we are losing reserve currency status at an accelerating rate,” adding that Bitcoin “is disappointing as it is still being met with selling.”

The gold price is telling us we are losing reserve currency status at an accelerating rate. The long bond selling off is not a good sign either. $BTC is disappointing as it is still being met with selling. I will reiterate it has to take out 100-103k to regain its upward…

— Mike Novogratz (@novogratz) January 20, 2026

The Federal Reserve’s comment period for the 2026 stress test scenarios closes February 21.

Senator Cynthia Lummis, who previously criticized potential government Bitcoin sales as squandering “strategic assets while other nations are accumulating bitcoin,” has proposed legislation to acquire up to 1 million Bitcoin over five years through budget-neutral methods, including tariff revenue and revalued gold reserves.

The post Bitcoin Advocate Urges Federal Reserve to Add BTC to Stress Tests appeared first on Cryptonews.

On Tuesday, US Treasury Secretary Scott Bessent confirmed plans for the country’s Strategic Bitcoin Reserve (SBR), coinciding with a sharp decline in BTC and the overall cryptocurrency market.

In a discussion about the government’s approach to BTC and the recent seizures of the cryptocurrency, Bessent reassured the public that the administration would cease all sales of seized Bitcoin.

Instead of auctioning off these assets, the government plans to add the seized Bitcoin to the Strategic Bitcoin Reserve, which was set up in March last year by President Donald Trump’s administration.

This decision, however, did little to mitigate BTC’s plummet on Tuesday, as the lack of any plans to purchase additional coins from the market contributed to continued downward pressure on prices.

Bessent elaborated that the initiative is part of a broader strategy aimed at fostering digital asset innovation within the United States while maintaining federal oversight of confiscated cryptocurrencies.

“This administration’s policy is to add seized Bitcoin to our digital asset reserve,” Bessent stated, marking a decisive shift in the government’s handling of Bitcoin assets.

Bitcoin has experienced a decline of nearly $5,800—coinciding with political tensions after President Trump hinted at a 10% tariff on the European Union (EU) in an attempt to compel Denmark to sell Greenland.

This geopolitical maneuver has not only affected Bitcoin but has also resulted in a staggering loss of approximately $215 billion in total market capitalization across the crypto sector.

Market analyst Ted Pillows warned that BTC must maintain its position above the $89,000 mark. He expressed that failing to hold this level would signal the end of the short-term upward trend, further complicating an already tumultuous condition for the cryptocurrency.

When writing, BTC still holds above the key level outlined by Pillows at $89,497, but has declined by 3.7% in the last 24 hours.

Featured image from OpenArt, chart from TradingView.com

Bitcoin Magazine

U.S. Treasury Confirms That All Seized Bitcoin Will Join the Strategic Bitcoin Reserve

When asked about the U.S. government’s approach to Bitcoin and recent BTC seizures, U.S. Treasury Secretary Scott Bessent re-affirmed that the administration will halt all sales of seized BTC and instead add it to the Strategic Bitcoin Reserve (SBR).

At the World Economic Forum in Davos, Bessent told journalist Christine Lee that the initiative is part of a larger effort to bring digital-asset innovation onto U.S. soil while keeping federal oversight of seized cryptocurrency

This sentiment comes from questions about the government’s handling of BTC seized from developers linked to Tornado Cash in the Southern District of New York as well as the handling of bitcoin from Samourai Wallet developers.

While Bessent declined to comment on ongoing litigation, he emphasized that any seized BTC would be retained by the federal government after legal damages are resolved, rather than being sold at auction as in prior years.

“This administration’s policy is to add seized Bitcoin to our digital asset reserve,” Bessent said, highlighting the first step in implementing the SBR: stopping all sales.

JUST IN:

— Bitcoin Magazine (@BitcoinMagazine) January 20, 2026Treasury Sec. Scott Bessent says, “The policy of this government is to add seized #Bitcoin to our digital asset reserve.”

pic.twitter.com/e6X2D4peSv

The reserve, established under a March 2025 executive order, treats Bitcoin as a long-term strategic asset, akin to gold or petroleum stockpiles.

Bessent also seemed to frame the broader strategy of this current innovation as a pro-innovation, pro-onshore.

The Treasury wants to make the U.S. the “best regulatory regime for digital assets,” citing bipartisan legislation such as the Genius Act, which codifies stablecoin rules at the federal level.

Last week, U.S. officials denied reports that BTC forfeited by Samourai Wallet developers had been sold, confirming the assets will remain part of the Strategic Bitcoin Reserve (SBR) under Executive Order 14233.

Patrick Witt of the President’s Council of Advisors for Digital Assets stated that the Department of Justice confirmed the 57.55 BTC, worth roughly $6.3 million, has not and will not be liquidated.

The clarification came after earlier reports suggested the U.S. Marshals Service may have transferred the BTC to Coinbase Prime, fueling speculation of a sale that would have violated the executive order.

Journalist Frank Corva reported that the U.S. Marshals Service appears to have sent the 57.55 BTC forfeited by Samourai Wallet developers directly to a Coinbase Prime address, which showed a zero balance, suggesting the BTC may have already been sold.

If true, this selling would contradict Executive Order 14233, which requires forfeited bitcoin to be held in the U.S. Strategic Bitcoin Reserve rather than liquidated.

This post U.S. Treasury Confirms That All Seized Bitcoin Will Join the Strategic Bitcoin Reserve first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Michael Saylor’s Strategy ($MSTR) Spends $2.13 Billion to Buy 22,305 Bitcoin

Strategy (MSTR), the world’s largest publicly traded corporate holder of bitcoin, has added another major tranche of BTC to its balance sheet, purchasing 22,305 bitcoin for approximately $2.13 billion over the past week.

The acquisition, disclosed today, was made at an average price of roughly $95,284 per bitcoin, roughly 4% more than current prices. As of Jan. 19, 2026, Strategy now holds a total of 709,715 BTC, acquired for approximately $53.92 billion at an average price of $75,979 per coin.

The latest purchase marks Strategy’s largest weekly bitcoin acquisition since November 2024 and its fifth-largest bitcoin purchase announcement to date.

Led by executive chairman Michael Saylor, the company has continued its aggressive, near-weekly accumulation strategy, using capital markets activity to convert traditional financial assets into bitcoin exposure.

The latest purchase was funded through a combination of common stock issuance and sales of the company’s perpetual preferred equity, Stretch (STRC).

According to regulatory filings, the company raised about $2.125 billion in net proceeds between Jan. 12 and Jan. 19 through its at-the-market (ATM) programs. The bulk of the funds came from the sale of 10.4 million shares of MSTR Class A common stock, generating approximately $1.83 billion.

An additional $294.3 million was raised through the issuance of roughly 2.95 million STRC preferred shares. Smaller amounts were generated via STRK preferred stock, while no shares were issued under the STRF or STRD programs during the period.

Despite the continued accumulation, Strategy shares were under pressure in early trading, falling about 5% as bitcoin prices slid below $91,000. The pullback follows a broader crypto market sell-off after BTC traded above $94,000 late last week.

With more than 709,000 bitcoin now held, Strategy controls over 3% of bitcoin’s total circulating supply.

Several weeks ago, the company also announced they are increasing their U.S. dollar reserve to $2.25 billion, up from $1.44 billion in December, intended to support dividend payments on preferred shares and interest obligations on outstanding debt.

BREAKING:

— Bitcoin Magazine (@BitcoinMagazine) January 20, 2026STRATEGY BUYS ANOTHER 22,305 #BITCOIN FOR $2.1B pic.twitter.com/Rt9XSMP7QK

Earlier this month, the company was relieved of some selling pressure when MSCI concluded its review of digital asset treasury companies and decided not to exclude them from its major global equity indexes.

The index provider said bitcoin-heavy firms will remain eligible under existing rules while it conducts further research on how to distinguish operating companies from investment-like entities.

The decision eased months of market anxiety after MSCI had proposed reclassifying companies with more than 50% of assets in digital assets as fund-like and therefore ineligible for inclusion.

Companies like Strategy, along with industry groups, pushed back strongly, warning that exclusions could trigger billions of dollars in forced passive selling.

This post Michael Saylor’s Strategy ($MSTR) Spends $2.13 Billion to Buy 22,305 Bitcoin first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

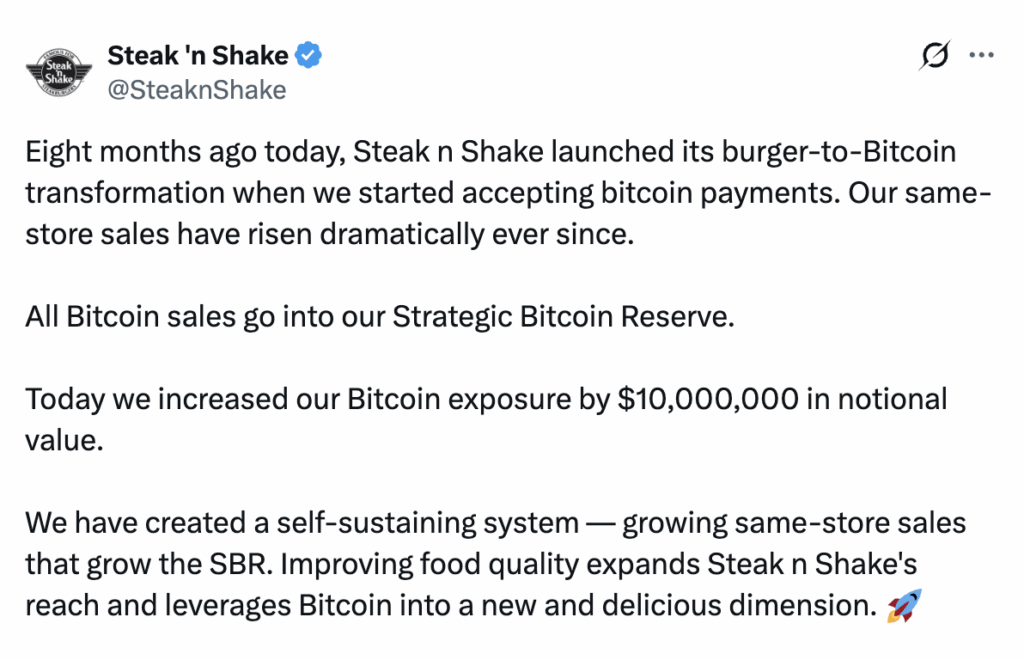

Steak ’n Shake Adds $10 Million in Bitcoin to Corporate Treasury

Popular fast-food chain Steak ’n Shake added $10 million worth of bitcoin to its corporate treasury, deepening its commitment to bitcoin eight months after rolling out BTC payments across all U.S. locations.

The company said on social media that the move follows a “self-reinforcing cycle” driven by bitcoin adoption, where customers paying in BTC help generate incremental revenue that is then recycled into business improvements.

According to Steak ’n Shake, all bitcoin-denominated revenue flows directly into what it calls its strategic bitcoin reserve, which is used to fund restaurant upgrades, ingredient improvements, and remodeling initiatives—without raising menu prices.

“Eight months ago today, Steak ’n Shake launched its burger-to-bitcoin transformation when we started accepting bitcoin payments,” the company wrote on social media. “Our same-store sales have risen dramatically ever since.”

Steak ’n Shake began accepting bitcoin payments in May 2025 using the Lightning Network, positioning the rollout as a way to cut card processing fees while attracting a younger, crypto-native customer base. The strategy is working.

Same-store sales rose more than 10% in the second quarter of 2025, according to the company.

Chief Operating Officer Dan Edwards previously said Steak ’n Shake saves roughly 50% in processing fees when customers choose to pay with bitcoin rather than traditional card networks.

NEW: Fast food giant Steak 'n Shake announces it acquired $10 million #Bitcoin for its Strategic Bitcoin Reserve

— Bitcoin Magazine (@BitcoinMagazine) January 17, 2026

"All Bitcoin sales go into our Strategic Bitcoin Reserve."pic.twitter.com/tRlYaOzbtQ

The chain has leaned into its bitcoin branding over the past year, introducing a Bitcoin-themed burger in October and pledging to donate a small portion of revenue from its “Bitcoin Meal” to support open-source Bitcoin development.

The recent $10 million purchase—roughly 105 BTC at current prices—marks Steak ’n Shake’s most direct treasury allocation to bitcoin to date.

While the position is modest compared with major corporate holders such as Strategy, which holds more than 687,000 BTC worth over $65 billion, it underscores a broader trend of corporate bitcoin accumulation.

According to data from Bitcointreasuries, total bitcoin held in treasuries—including public companies, private firms, governments, and exchange-traded funds—has now surpassed 4 million BTC.

Last fall, the company ran a poll on X over the weekend asking its 468,800 followers whether it should expand its crypto options to include Ethereum.

Nearly 49,000 votes were cast, with 53% in favor.

However, just four hours later, the company suspended the poll, declaring its allegiance to Bitcoiners. “Poll suspended. Our allegiance is with Bitcoiners. You have spoken,” Steak ‘n Shake posted.

This post Steak ’n Shake Adds $10 Million in Bitcoin to Corporate Treasury first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Recent allegations regarding the Bitcoin (BTC) sale by the US Marshal Service (USMS) — operating under the Department of Justice (DOJ) — have been addressed by White House crypto advisor Patrick Witt, who confirmed that the digital assets forfeited by Samourai Wallet and its founders have not been liquidated.

In a post on social media platform X (formerly Twitter), Witt clarified that the DOJ has verified that the digital assets taken from the Samourai Wallet will not be sold, in accordance with Executive Order 14233. He emphasized that these assets will remain on the government’s balance sheet as part of the Strategic Bitcoin Reserve.

Earlier in the month, speculations suggested that the USMS, following directives from the DOJ, had sold approximately 57.55 Bitcoin forfeited in the Samourai Wallet case through Coinbase Prime on November 3, 2025.

The lack of confirmation until now had led experts to assert that such actions would violate EO 14233, signed by President Donald Trump. This order mandates that Bitcoin obtained through criminal or civil forfeiture be retained and added to the US Strategic Bitcoin Reserve, rather than being sold off.

The Bitcoin in question is valued at almost $6.4 million and was seized from the creators of Samourai Wallet. According to US authorities, the cryptocurrency mixer facilitated over $237 million worth of illicit transactions.

The DOJ had announced in November the sentencing of Keonne Rodriguez and William Lonergan Hill, the co-founders of Samourai Wallet.

Rodriguez, the company’s CEO, and Hill, its Chief Technology Officer, were implicated in a conspiracy involving the operation of a money transmitting business that “knowingly” transmitted proceeds from criminal activities.

The criminal proceeds laundered through their platform originated from various illegal activities, including drug trafficking, darknet marketplace operations, cyber intrusions, fraud, murder-for-hire schemes, and even a child pornography website. Rodriguez received a five-year prison sentence, while Hill was sentenced to four years.

At the time of writing, Bitcoin is trading at $95,300, marking an almost 6% increase over the past seven days. However, it is still unable to regain the key $100,000 level, which has eluded the cryptocurrency since November last year.

Featured image from DALL-E, chart from TradingView.com

Bitcoin Magazine

U.S. Government Denies Sale of Forfeited Samourai Wallet Bitcoin, Says BTC Will Remain in Strategic Bitcoin Reserve

Members of the U.S. government have denied reports that bitcoin forfeited by Samourai Wallet developers was liquidated in violation of President Trump’s executive order mandating the retention of government-held bitcoin.

In a brief statement on X on January 16, Patrick Witt, Executive Director of the President’s Council of Advisors for Digital Assets and Deputy Director at the Department of War’s Office of Strategic Capital, said the Department of Justice (DOJ) has confirmed that the forfeited digital assets “have not been liquidated and will not be liquidated” pursuant to Executive Order 14233.

According to Witt, the bitcoin will remain on the U.S. government’s balance sheet as part of the Strategic Bitcoin Reserve (SBR).

“We have received confirmation from DOJ that the digital assets forfeited by Samourai Wallet have not been liquidated and will not be liquidated,” Witt said. “They will remain on the USG balance sheet as part of the SBR.”

The clarification follows reporting by Bitcoin Magazine earlier this month that raised questions about whether the U.S. Marshals Service (USMS), acting under DOJ direction, had sold approximately 57.55 bitcoin — worth roughly $6.3 million at the time — using Coinbase Prime in November 2025.

That reporting cited an “Asset Liquidation Agreement” and on-chain data suggesting the forfeited bitcoin may have been transferred directly to a Coinbase Prime address that later showed a zero balance, fueling speculation that the assets had already been sold.

BREAKING:

— Bitcoin Magazine (@BitcoinMagazine) January 16, 2026President Trump Executive Director says the government has not sold any bitcoin forfeited by Samourai Wallet and the bitcoin will NOT be sold.

The bitcoin will be added to the US strategic reserve. pic.twitter.com/80vZymPmqK

If true, such a sale would have potentially violated EO 14233, which explicitly states that bitcoin acquired by the U.S. government through criminal or civil forfeiture “shall not be sold” and must instead be retained as part of the Strategic Bitcoin Reserve.

The executive order was designed to reverse the long-standing practice of liquidating seized bitcoin and to formally recognize bitcoin as a strategic reserve asset of the United States.

The Samourai Wallet case has been closely watched within Bitcoin and crypto policy circles, not only because of the forfeiture issue but also due to broader concerns about continued prosecutions of developers of noncustodial software.

Samourai developers Keonne Rodriguez and William Lonergan Hill pleaded guilty and were charged in 2025 to conspiracy to operate an unlicensed money transmitting business, a charge critics argue is incompatible with the noncustodial nature of the software.

Those concerns have been heightened by what many view as inconsistencies between DOJ actions and guidance issued under the Trump administration, including Deputy Attorney General Todd Blanche’s April 2025 memo calling for an end to “regulation by prosecution” of noncustodial crypto tools, according to Bitcoin journalist Frank Corva.

If true, the administration’s confirmation that the Samourai bitcoin remains intact and earmarked for the Strategic Bitcoin Reserve will likely be seen as a win for proponents of the bitcoin industry.

This post U.S. Government Denies Sale of Forfeited Samourai Wallet Bitcoin, Says BTC Will Remain in Strategic Bitcoin Reserve first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

West Virginia Lawmakers Propose Bitcoin Investments With State Funds

West Virginia lawmakers introduced legislation this week that would authorize the state treasurer to invest a portion of public funds in bitcoin, precious metals, and regulated stablecoins, marking a significant step toward integrating digital assets into state-level finance.

West Virginia Senate Bill 143, introduced by Sen. Chris Rose during the 2026 regular legislative session, would create a new section of state law titled the “Inflation Protection Act of 2026.” The measure permits the Board of Treasury Investments to allocate up to 10% of funds it oversees into gold, silver, platinum, and certain digital assets, subject to existing investment rules.

Under the bill, the West Virginia could invest in digital assets that maintained an average market capitalization above $750 billion over the prior calendar year. That threshold currently limits eligibility to only bitcoin, without naming the asset directly in statute.

At the end of the digital bill, there is text that says “The purpose of this bill is to empower the Treasurer to invest in gold, silver, and bitcoin.”

The bill also allows investments in stablecoins that have received regulatory approval at either the federal or state level.

The proposed 10% cap would apply at the time an investment is made. If asset prices rise and push the allocation above that threshold, the board would not be required to sell holdings, though it would be barred from making additional purchases until the allocation falls back below the limit.

The legislation includes detailed custody requirements for digital assets. Holdings would need to be secured either directly by the West Virginia treasurer through a defined secure custody system, by a qualified third-party custodian, or through a registered exchange-traded product.

The bill outlines standards for key control, geographic redundancy, access controls, audits, and disaster recovery.

In addition to holding digital assets, the bill would allow the treasurer to pursue yield-generating activities. Digital assets could be staked using third-party providers if legal ownership remains with West Virginia. The treasurer could also loan digital assets under rules designed to avoid added financial risk.

JUST IN:

— Bitcoin Magazine (@BitcoinMagazine) January 16, 2026West Virginia introduces a bill to allow allocating 10% of state funds to #Bitcoin

BULLISHpic.twitter.com/KE9i4fpY9i

Precious metals investments could be held through exchange-traded products, by qualified custodians, or directly by West Virginia in physical form. The bill allows for cooperative custody arrangements with other states, subject to rules established by the treasurer.

West Virginia retirement funds would face tighter limits. Under the proposal, retirement systems could invest only in exchange-traded products registered with federal or state regulators, rather than holding digital assets directly.

The bill grants the treasurer authority to propose implementing rules, which would require legislative approval.

The proposal reflects a growing interest among U.S. states in using bitcoin and hard assets as long-term stores of value for public funds.

Several states have explored or enacted similar measures allowing limited exposure to digital assets, though most have relied on exchange-traded products rather than direct custody.

Most recently, Rhode Island lawmakers reintroduced Senate Bill S2021, which would temporarily exempt small Bitcoin transactions from state income and capital gains taxes, allowing up to $5,000 per month and $20,000 annually to be tax-free.

Introduced January 9 by Senator Peter A. Appollonio, the bill was referred to the Senate Finance Committee and is framed as a pilot program to reduce tax friction for everyday Bitcoin use.

This marks the second consecutive year Rhode Island legislators have proposed a targeted Bitcoin tax exemption.

West Virginia Senate Bill 143 has been referred to the Senate Committee on Banking and Insurance, with a subsequent referral to the Committee on Finance.

At the time of writing, Bitcoin is trading at $95,494 with a 24-hour volume of $52 billion, down 1% on the day and roughly 1% below its seven-day high of $96,933. The asset’s market cap stands at $1.91 trillion, supported by a circulating supply of 19.98 million BTC out of a maximum 21 million.

This post West Virginia Lawmakers Propose Bitcoin Investments With State Funds first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

The White House is still treating a US Strategic Bitcoin Reserve as an active priority, even as officials work through what executive director of the White House Crypto Council Patrick Witt described as the legal and bureaucratic questions that sit beneath an idea that, on paper, sounds simple.

In an interview recorded at the White House for the Jan. 13 episode of Crypto In America, Witt told host Eleanor Terrett that interagency talks on implementing President Donald Trump’s executive order are ongoing and that the effort remains on the administration’s “priority list,” as Congress simultaneously moves toward its next steps on crypto market structure legislation later this week.

Asked how the White House is thinking about the reserve “these days,” Witt pointed to a process being driven not only by crypto policy staff, but by the operations machinery tasked with pushing executive orders through the federal government.

“We’ve had good engagement from the Deputy Chief of Staff for Policy team, which is Steven Miller’s team […] [to] make sure that all of the executive orders that have been signed by the president — that the agencies are moving out on them,” Witt said. “The treasury team, commerce team is involved. […] It seems straightforward, but then you get into some […] obscure legal provisions and why this agency can’t do it, but actually this agency could.”

Witt framed the current phase as less about whether the administration wants the reserve, and more about ensuring it can move in a way that will withstand scrutiny. “We’re continuing to push on that. It is certainly still on the priority list right now,” he said, adding that “Department of Justice, Office of Legal Counsel […] has provided some good guidance on where we can […] move out on this executive order […] and do so in a legally sound way.”

The remarks come against the backdrop of Trump’s March 2025 executive order establishing a Strategic Bitcoin Reserve and a broader “digital asset stockpile,” which directed the government to treat existing federally held bitcoin as a long-term reserve asset while agencies were tasked to research ways for budget-neutral acquisition.

Witt also addressed a separate flashpoint that has circulated in Bitcoin circles in recent days: speculation that the Department of Justice had sold bitcoin linked to the Samourai Wallet case, potentially conflicting with the administration’s reserve posture.

“I think it was somewhat misreported,” Witt said, referencing the settlement language and what he characterized as standard legal drafting. “If you look at the settlement agreement, the legal documents, it sounds like […] the agency is going to take a certain action. […] In talking with DOJ, it was basically written in such a way where they preserve all of their options and their rights in those agreements, but those bitcoins have not been liquidated. Those digital assets have not been sold.”

Witt’s bottom line for viewers was that the headline allegation, that DOJ had “outright violated” the executive order, “is not a concern,” though he stressed that he could not say more beyond that.

At press time, BTC traded at $95,078.

The broader crypto market is seeing an unexpected uptick, with the Bitcoin, Ethereum, and Dogecoin prices among the top coins recording gains. This sharp increase in value follows the release of US economic data, which indicates positive trends in unemployment and consumer spending. Additionally, potential regulatory changes stemming from a proposed bill are also fueling market momentum and boosting investor confidence across the sector.

After consolidating for days following their last rebounds, Bitcoin, Ethereum, and Dogecoin are surging again amid a series of recent US data reports. The US Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI) for all urban consumers earlier on Tuesday, January 13, covering December 2025.

The CPI report revealed that prices rose 0.3% on a seasonally adjusted basis last month, with the year-over-year all items index up 2.7% unadjustment. The shelter index increased 0.4% in December, making it the largest contributor to the overall rise. Meanwhile, food prices rose 0.7% both at home and away, and energy rose 0.3%. This increase in CPI data tends to affect cryptocurrency price movements, as moderate inflation often reduces fears of aggressive rate hikes by the US Federal Reserve (FED), encouraging investors to allocate funds to alternative stores of value like BTC and higher risk assets like ETH and DOGE.

In addition to the CPI data, the US jobs report, released on January 9, showed that 50,000 jobs were added in December 2025. Although this was below the revised 56,000 in November and lower than the initial forecast of 60,000, it was still a significant and positive result for investors. While changes in job reports do not directly affect cryptocurrency price action, they can influence investor sentiment by increasing the likelihood of an interest rate cut.

The crypto market has also been bullish ahead of the US Senate Banking Committee’s vote on the CLARITY Act on January 15, 2026. If passed, the bill is expected to provide clearer legal frameworks for digital assets in the US. Subsequently, the regulatory progress will reduce uncertainty and encourage more institutional participation in the crypto market.

Overall, the combination of the US CPI release, jobs report, and potential regulatory clarity is what’s driving the market. Traders are responding favorably to these developments, reflecting renewed optimism.

Fueled by positive economic data, Bitcoin’s price has increased by over 3% so far today, rising from around $91,000 to over $94,000 at the time of writing. CoinMarketCap data also shows that Ethereum has seen even stronger gains, surging more than 6% to trade above $3,300. Meanwhile, Dogecoin has risen by over 6%, reaching $0.148.

The Defense Department has long tried to simplify and reform the reserve duty status system, which has expanded to more than 30 separate statutes scattered across about 20 different titles of federal law.

This complex system has created pay and benefits inequities and frequent administrative delays when National Guard members and reservists shift between duty statuses.

A new bipartisan bill now seeks to consolidate dozens of duty statuses under which National Guard members and reservists are called to service to just four.

If passed, the Duty Status Reform Act would ensure service members performing assignments in the same category receive the same pay and benefits.

Rep. Gil Cisneros (D-Calif.), the bill’s sponsor, said the effort is his “number one priority returning to Congress.”

“With the current duty status system, service members doing similar jobs often receive significantly less benefits due to them being under different duty statuses. Currently, at any point during activation, a Guardsman can go between up to 10 different duty statuses, resulting in lapses of pay and administrative hurdles. This bipartisan bill fixes existing problems like this and puts active duty under our one category,” Cisneros, a Navy veteran who returned to the House in 2025 after serving from 2019 to 2021, said at a Jan. 8 press conference.

The current system is a product of decades of patch fixes done by Congress spanning from World War II to the Global War on Terror. And while the Defense Department has attempted to overhaul the system over the last two decades, most efforts have failed to gain traction.

“It’s been a very gradual build up process, and so over time, there have been these gaps that have been developed where a reserve component member may be doing duty of one sort right next to reserve component duty person doing that kind of duty right next to them and they’re receiving potentially different pay and benefits. Or it could be the case where they’re on one sort of duty, they come to do their next day of duty, and they’re on a different status, and their underlying pay and benefits may change,” Lisa Harrington, senior operations researcher at RAND, told Federal News Network in August.

The bill builds on a Defense Department–commissioned RAND report that recommended consolidating the reserve duty status system into four categories, including contingency duty, training and support, reserve component duty and remote assignments.

Contingency duty covers deployments and mobilizations where reservists and National Guard members are called to serve, usually involuntarily, for combat operations, national emergencies, disaster response or other missions requiring additional manpower.

Training and support assignments include required training, administrative assignments or support to other units.

Reserve component duty, which is most commonly associated with traditional reserve service, includes training periods, administrative assignments and support activities.

Remote assignments are designed to account for duty that can be completed virtually, such as online courses.

“Let me be clear about what this bill does and what this bill does not do. It does not create new entitlements, new pay or new benefits. It does align existing benefits so service members performing the same mission alongside their active duty counterparts receive the same rights, protections and predictability. This is about parity and fairness, not expansion,” retired Maj. Gen. Francis M. McGinn, president of the National Guard Association of the United States, said at the press conference.

It is unclear what strategy the lawmakers plan to pursue to pass the measure, but Cisneros said he has spoken with Rep. Adam Smith (D-Wash.), ranking member on the House Armed Services Committee, and plans to meet with HASC Chair Mike Rogers (R-Ala.).

“I think now is the time to move it forward, and we’re going to keep working to make sure that it does get over across the finish line,” Cisneros said.

Rep. Jack Bergman (R-Mich.), the bill’s cosponsor, said he is “more than cautiously optimistic on the timing that we have here.”

“When you think of a defense dollar, we don’t talk about the totals, but how do we spend a defense dollar in the right way without overspending? But also the very subtle part of this — in the end, if we do it right, it’s about our readiness, but it’s also about the recruiting and retention of those men and women who have not even yet thought about serving,” Bergman said.

Harrington said the potential cost of the reform might be one of the concerns since accurately predicting how much the reform would ultimately cost is difficult.

“The costs we think are not something that would stop the reform from happening when people understand exactly how the costs play out,” she said.

If you would like to contact this reporter about recent changes in the federal government, please email anastasia.obis@federalnewsnetwork.com or reach out on Signal at (301) 830-2747.

The post Lawmakers push to overhaul complex reserve duty status system first appeared on Federal News Network.

© Getty Images/iStockphoto/horkins

Bitcoin Magazine

Florida Revives Bitcoin Reserve Push With New 2026 Bill

Florida lawmakers have revived a push to put bitcoin on the state’s balance sheet, filing new legislation for the 2026 session that would create a state-run cryptocurrency reserve after a similar effort stalled last year.

House Bill 1039, filed Jan. 7 by Republican Rep. John Snyder, would establish a Strategic Cryptocurrency Reserve Fund that sits outside Florida’s main treasury.

The proposal authorizes the state’s chief financial officer to invest public funds in digital assets under a set of guardrails that include audits, reporting requirements, and advisory oversight.

The bill marks a reset rather than a clean break. Florida lawmakers floated broader crypto investment proposals in 2025, but those measures were withdrawn after facing resistance over scope and risk.

The new framework narrows the focus and reflects a growing preference among Republican lawmakers for treating bitcoin as a reserve-style asset rather than a speculative trade.

Under HB 1039, the CFO would have discretion over whether and when to invest. The bill does not mandate a minimum allocation.

Earlier versions of Florida legislation proposed allowing up to 10% of certain state-managed funds to be invested in bitcoin. While the new bill revives that concept, it leaves deployment decisions to the CFO and places the reserve outside pension and retirement accounts.

The legislation includes requirements for independent audits and the creation of an advisory committee to guide investment strategy and risk management. Supporters say those provisions are meant to address concerns about volatility while still giving the state flexibility to act.

The renewed effort is closely tied to parallel legislation in the Senate. Republican Sen. Joe Gruters, a longtime bitcoin supporter and ally of President Donald Trump, has filed companion bills that lay out the trust structure and funding mechanics for the reserve.

Together, the House and Senate measures would govern how Florida acquires, holds, and manages any digital assets.

While the bills do not explicitly name bitcoin, they effectively limit eligibility to it. Only digital assets that maintained an average market capitalization of at least $500 billion over the past 24 months would qualify.

At present, bitcoin is the sole asset that meets that threshold, with a market cap above $1 trillion. Ethereum and other crypto fall well short.

Backers frame the proposal as a hedge rather than a bet. Florida Chief Financial Officer Jimmy Patronis has publicly described bitcoin as “digital gold” and said limited exposure could help diversify state-managed funds over long time horizons. The bill states that the reserve is intended to help protect public assets against inflation and currency debasement.

Florida’s approach mirrors moves in other states that have narrowed their focus to bitcoin after initial attempts to authorize broader crypto exposure.

New Hampshire became the first state to explicitly allow public funds to be invested in crypto, granting its treasurer authority to allocate up to 5% of certain portfolios.

Texas approved a small bitcoin ETF purchase in late 2025 as part of its own reserve strategy.

Wyoming, meanwhile, has passed a slate of laws clarifying the legal status of digital assets without committing public funds.

The proposal also fits within Florida’s broader stance on digital money. In 2023, Gov. Ron DeSantis signed legislation blocking central bank digital currencies from recognition under the state’s commercial code.

The move positioned Florida as skeptical of federally issued digital money while remaining open to decentralized alternatives like bitcoin.

If passed, Florida would become one of the largest U.S. states to formally experiment with crypto as a reserve-class asset. Supporters argue that a tightly governed reserve could allow the state to gain exposure without putting core public funds at risk. Critics, however, point to bitcoin’s history of sharp price swings and question whether public money should be exposed at all.

HB 1039 and its Senate companions must clear committee hearings and floor votes during the 2026 legislative session.

The bills include a conditional effective date of July 1, 2026, meaning implementation would only begin if the full legislative package is approved and signed into law.

This post Florida Revives Bitcoin Reserve Push With New 2026 Bill first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Taiwan Reveals It Holds 210 Bitcoin Seized in Criminal Cases, Valued at $18 Million

Taiwan’s Ministry of Justice has disclosed that the government holds more than 210 bitcoin seized through criminal investigations, placing the island among the world’s top government holders of the asset by volume.

The disclosure, confirmed by legislator Ko Ju-chun, shows that judicial authorities held 210.45 BTC as of Oct. 31. At current market prices, their BTC is worth about $18 million. According to data from Bitcoin Treasuries, this would put Taiwan as the 10th-largest government holder of BTC globally.

Ko said the information was released in response to a legislative inquiry and shared an image documenting the total amount held under state custody. The ministry said the bitcoin was confiscated in cases tied to financial crime and illegal digital asset activity.

Back in November, Taiwan’s Premier and Central Bank reportedly agreed to study Bitcoin as a strategic reserve, draft pro-Bitcoin regulations, and pilot BTC treasury holdings, starting with seized BTC that is ‘awaiting auction.’

While many countries have accumulated BTC through enforcement actions, few have provided clear guidance on custody standards or long-term policy.

Taiwan’s Ministry of Justice did not outline any plans to liquidate, auction, or convert the seized BTC into fiat currency. Officials also did not disclose where or how the BTC is custodied, or whether it is held through self-custody or third-party services.

BREAKING:

— Bitcoin Magazine (@BitcoinMagazine) December 18, 2025The Ministry of Justice has just revealed that Taiwan now holds 210.45 Bitcoin in seized assets.

Another nation-state holding Bitcoin pic.twitter.com/bp6VJ90rDM

The United States, which leads global government BTC holdings with more than 328,000 BTC, has seized crypto linked to cybercrime and fraud cases. China and the United Kingdom rank next after the U.S.

Collectively, governments worldwide hold more than 640,000 BTC, or about 3% of bitcoin’s total supply, according to public data. Most of these holdings stem from law enforcement seizures rather than formal reserve strategies.

Taiwan has not announced any intention to adopt BTC as part of its national reserves.

Still, the disclosure lands amid broader debates in the country over digital asset regulation and the treatment of confiscated crypto. Lawmakers have pressed agencies to clarify whether seized assets should be sold, retained, or managed under a standardized framework.

The Ministry of Justice said the BTC was obtained as part of its broader effort to track and process virtual assets tied to criminal proceedings.

At the time of writing, the price of Bitcoin is near $88,000.

This post Taiwan Reveals It Holds 210 Bitcoin Seized in Criminal Cases, Valued at $18 Million first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Spot Bitcoin exchange-traded funds listed in the US recorded a sharp revival in inflows on Wednesday, signalling renewed institutional engagement after weeks of uneven activity.

The move marked the strongest single-day intake in more than a month and coincided with shifting expectations around US monetary policy.

While Bitcoin’s price action remains constrained by heavy supply levels, ETF flows suggest investors are reassessing exposure through regulated products as macro conditions evolve.

US spot Bitcoin ETFs recorded $457 million in net inflows on Wednesday, their highest daily total since mid-November.

Fidelity’s Wise Origin Bitcoin Fund led the session, attracting roughly $391 million and accounting for the bulk of the inflows.

BlackRock’s iShares Bitcoin Trust followed with around $111 million, according to data from Farside Investors.

The latest intake pushed cumulative net inflows for US spot Bitcoin ETFs above $57 billion.

Total net assets climbed past $112 billion, equivalent to about 6.5% of Bitcoin’s total market capitalisation.

The figures underline the growing role ETFs play in shaping institutional access to Bitcoin exposure.

The inflow revival comes after a choppy period through November and early December, when ETF activity swung between modest inflows and sharp outflows.

That instability reflected cautious positioning amid uncertain price direction and tightening liquidity conditions.

The last time spot Bitcoin ETFs recorded inflows above $450 million was on November 11, when funds drew roughly $524 million in a single day.

The renewed activity suggests investors may be positioning earlier in anticipation of changing macro conditions, rather than responding to short-term price momentum.

ETF flows have increasingly become a barometer for how institutions interpret broader financial signals.

Macro expectations shifted further on Wednesday after US President Donald Trump said he plans to appoint a new Federal Reserve chair who strongly supports cutting interest rates.

Speaking during a national address marking the first year of his second term, Trump said he would announce a successor to current Fed Chair Jerome Powell early next year.

He added that all known finalists favour lower rates than current levels.

Lower interest rates are generally viewed as supportive for risk assets such as crypto, as they ease financial conditions and improve liquidity.

Against this backdrop, spot Bitcoin ETFs appear to be attracting capital as a relatively direct way to express macro-driven positioning.

Despite stronger ETF inflows, Bitcoin’s market structure remains under pressure.

The asset has returned to price levels last seen nearly a year ago, leaving a dense supply zone between $93,000 and $120,000 that continues to cap recovery attempts.

This has pushed the amount of Bitcoin held at a loss to around 6.7 million BTC, the highest level of the current cycle, according to Glassnode.

Glassnode data also points to fragile demand across both spot and derivatives markets.

Spot buying has been selective and short-lived, corporate treasury flows episodic, and futures positioning continues to de-risk rather than rebuild conviction.

Until sellers are absorbed above $95,000 or fresh liquidity enters the market, Bitcoin is likely to remain range-bound, with structural support forming near $81,000.

The post Spot Bitcoin ETF sees sharp inflow revival amid shifting US rate signals appeared first on CoinJournal.

Bitcoin Magazine

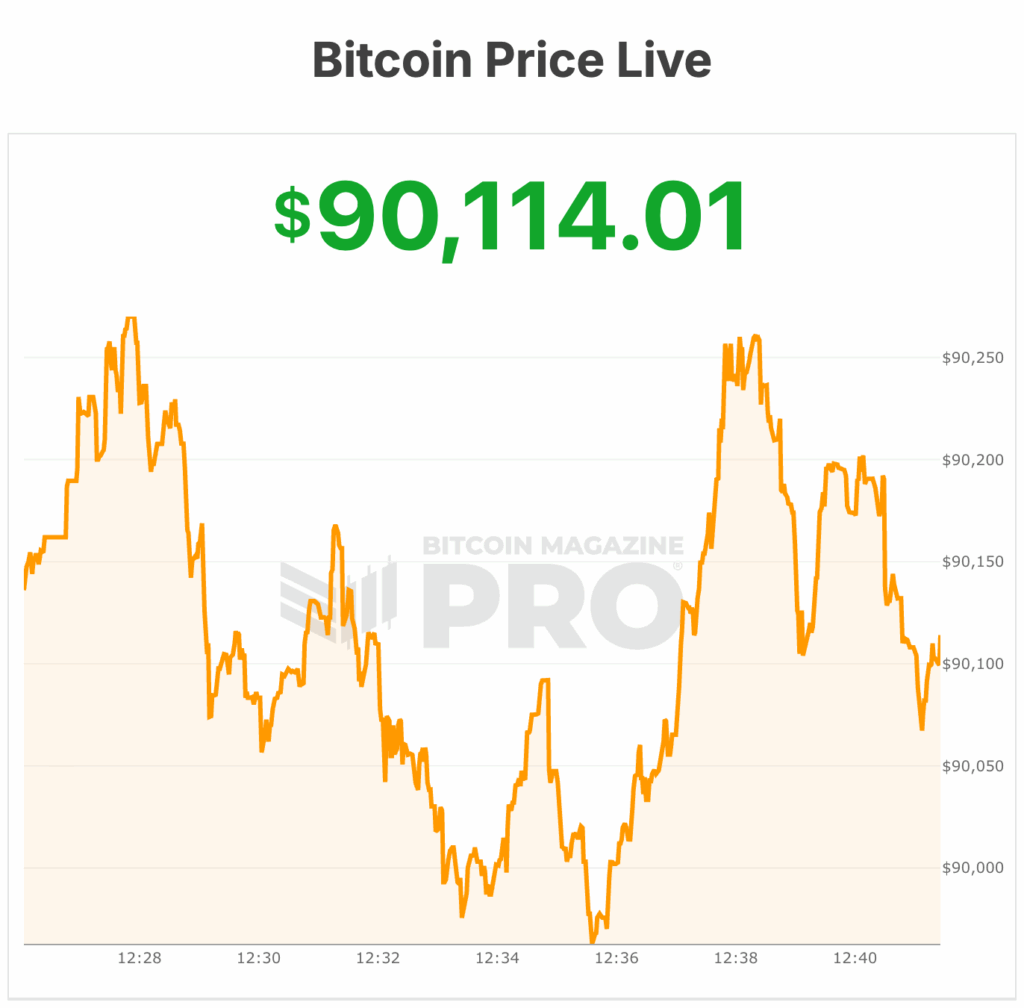

Bitcoin Price Fights For $90,000 Despite Fed Rate Cuts

The bitcoin price fell on Wednesday night into Thursday, even after the U.S. Federal Reserve lowered interest rates, as Fed Chair Jerome Powell signaled a cautious approach heading into 2026.

On Wednesday, the Fed cut its benchmark rate by 25 basis points to 3.50%–3.75%, a move widely expected by markets. However, the 9–3 split among Federal Open Market Committee (FOMC) members and Powell’s hawkish remarks during the press conference tempered investor enthusiasm for risk assets, including cryptocurrencies.

One official favored a deeper 50-basis-point cut, while two voted against any reduction.

The Bitcoin price briefly jumped over $94,000 but then dropped below $90,000 and stabilized around $89,730 at the time of writing.

Bitfinex analysts shared with Bitcoin Magazine that the Fed’s unexpectedly hawkish tone surprised markets, causing a price reversal and kept risk appetites in check.

The Fed’s updated “dot plot” shows little consensus for more than a single 25-basis-point cut in 2026, with stronger growth forecasts and shifting tax policy limiting near-term easing.

Timot Lamarre, director of market research at Unchained, wrote to Bitcoin Magazine that “

There is so much to be bullish about in the bitcoin space – from Square facilitating bitcoin payments to large institutions like Vanguard now allowing their clients access to bitcoin ETFs to quantitative tightening coming to an end.”

Lamarre said that bitcoin’s recent price movements show a gap between growing adoption and the price increase that usually comes with higher demand.

Bitcoin price’s recent pullback also reflects broader market concerns. Technology stocks, including Oracle, suffered after disappointing earnings and warnings about slower-than-expected AI-related profits.

Oracle shares fell 11% in after-hours trading following revenue and profit forecasts below analysts’ expectations.

The Fed’s outlook for 2026 suggests only one additional rate cut, fewer than markets had anticipated. Asian stock markets declined, and U.S. equity futures pointed lower, while European trading remained subdued.

Standard Chartered recently revised its year-end Bitcoin forecast, lowering its target from $200,000 to $100,000, citing a slowdown in corporate treasury buying and reliance on ETF inflows to support future price gains.

Bernstein analysts recently said that they see a structural shift in Bitcoin’s market cycle, meaning that the traditional four-year pattern has broken. They forecast an elongated bull cycle driven by steady institutional buying, which offsets retail selling, and minimal ETF outflows.

The bank raised its 2026 price target to $150,000 and expects the cycle to peak near $200,000 in 2027, maintaining a long-term 2033 target of roughly $1 million per BTC.

Meanwhile, JPMorgan remains bullish over the next year, projecting a gold-linked, volatility-adjusted Bitcoin target of $170,000 within six to twelve months, factoring in market fluctuations and mining costs.

Analysts say Bitcoin’s decline after the Fed announcement reflects a “sell the fact” dynamic. “The market had fully priced in the cut ahead of time,” said Tim Sun, senior researcher at HashKey Group. “Concerns over political and economic developments in 2026, combined with potential inflation from AI-driven capital expenditure, are weighing on risk sentiment.”

Last week, Bitcoin price saw a volatile ride, dipping to $84,000 before bulls pushed it up to $94,000, then dropping slightly below $88,000, and closing the week at $90,429.

The market now faces key support at $87,200 and $84,000, with deeper support zones around $72,000–$68,000 and $57,700.

Resistance levels stand at $94,000, $101,000, $104,000, and a thick zone between $107,000–$110,000, with momentum likely slowing above $96,000.

Typically, rate cuts lead to bullish momentum, but the market may have already priced in this month’s rate cut. The bitcoin price has fallen roughly 28% since its October all-time high.

At the time of publishing, the bitcoin price is at $90,114.

This post Bitcoin Price Fights For $90,000 Despite Fed Rate Cuts first appeared on Bitcoin Magazine and is written by Micah Zimmerman.