US Spot Bitcoin ETFs See Worst Week in One Year After $1.33B Outflows

US spot Bitcoin exchange-traded funds recorded their weakest performance in nearly a year, shedding $1.33 billion in net outflows during a shortened four-day trading week, according to data from SoSoValue.

Key Takeaways:

- US spot Bitcoin ETFs logged their weakest week in nearly a year, with $1.33 billion in outflows.

- Selling peaked midweek, led by heavy redemptions from BlackRock’s IBIT.

- Ether ETFs also turned negative, shedding $611 million over the same period.

The pullback marks the worst weekly showing since February 2025 and reflects a sharp reversal in investor sentiment after strong inflows the previous week.

The outflows follow a period of optimism, when spot Bitcoin ETFs pulled in $1.42 billion in net inflows.

Midweek Bitcoin ETF Outflows Surge as $709M Exits in Single Day

Selling pressure peaked midweek. Wednesday alone saw $709 million exit Bitcoin ETFs, making it the heaviest outflow day of the week.

Tuesday followed closely behind with $483 million in redemptions. Outflows eased toward the end of the week, with $32 million leaving on Thursday and $104 million on Friday.

The magnitude of the withdrawals echoes the turbulence seen in late February 2025, when Bitcoin ETFs lost $2.61 billion in a single week during a sharp market downturn.

That episode, often referred to by analysts as the “February Freeze,” coincided with Bitcoin’s drop from above $109,000 to below $80,000 and included a record $1.14 billion single-day outflow on Feb. 25.

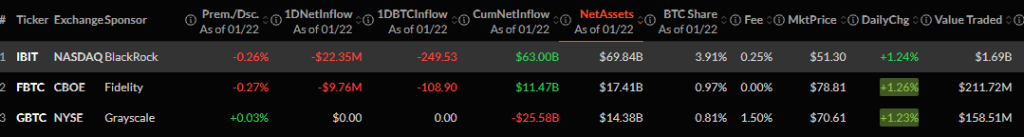

BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot Bitcoin ETF by assets under management, posted outflows on all four trading days last week.

Data from SoSoValue shows the fund experienced its heaviest redemptions on Tuesday and Wednesday, accounting for a significant share of the overall decline.

1/ US Spot Crypto ETF Weekly Flows (Jan 12-16, ET)

— SoSoValue (@SoSoValueCrypto) January 19, 2026

• BTC ETFs: +$1.42B

• ETH ETFs: +$479M

• SOL ETFs: +$46.88M

• XRP ETFs: +$56.83M

Source: SoSoValue#CryptoETF #SoSoValue pic.twitter.com/Wi35m9jMLu

IBIT currently holds about $69.75 billion in net assets, representing roughly 3.9% of Bitcoin’s total circulating supply.

Despite the recent pullback, the broader picture for spot Bitcoin ETFs remains positive.

Since their launch in January 2024, cumulative net inflows stand at $56.5 billion, with total net assets across all US spot Bitcoin ETFs reaching approximately $115.9 billion.

Ethereum ETFs were not spared from the broader risk-off move. Spot Ether ETFs posted $611 million in net outflows for the week, reversing the prior week’s $479 million inflow streak.

Wednesday was again the worst day, with $298 million redeemed, followed by $230 million on Tuesday.

Total net assets for Ether ETFs now sit around $17.7 billion, with cumulative inflows of $12.3 billion since their July 2024 debut.

Solana ETFs Defy Broader Sell-Off as Bitcoin, XRP Funds See Outflows

Not all crypto-linked funds followed the same pattern. Spot Solana ETFs continued to attract capital, recording $9.6 million in net inflows over the week, extending a multi-week positive trend.

Bitwise’s BSOL remained the category leader by assets. Spot XRP ETFs, meanwhile, saw mixed flows, ending the week with $40.6 million in net outflows after a sharp $53 million exit on Tuesday.

The ETF drawdowns come amid signs of shifting market dynamics on-chain. According to a CryptoQuant report, Bitcoin holders have begun realizing net losses for the first time since October 2023.

The firm noted the market has moved from a profit-taking phase into a loss-realization phase, with roughly 69,000 BTC in realized losses since Dec. 23, a pattern reminiscent of past transitions from bull to bear markets.

The post US Spot Bitcoin ETFs See Worst Week in One Year After $1.33B Outflows appeared first on Cryptonews.

Thailand chooses KuCoin as lead partner for historic $153M tokenized government securities with $3 minimum investment.

Thailand chooses KuCoin as lead partner for historic $153M tokenized government securities with $3 minimum investment.