Polymarket’s U.S. Comeback Positions Prediction Markets as a Coinbase Retention Play: Analyst

Polymarket has re-entered the U.S. market following regulatory approval from the Commodity Futures Trading Commission (CFTC), a move that could position prediction markets as a new engagement tool for major crypto platforms such as Coinbase, according to a report by Clear Street analyst Owen Lau.

The prediction market operator which was restricted from serving U.S. customers in 2022, has returned after receiving a CFTC approval of an Amended Order of Designation.

Polymarket has now launched a U.S.-based application initially offering a limited set of sports-related event contracts, with additional verticals such as politics and crypto expected over time.

Lau describes the development as a meaningful reversal allowing Polymarket to onboard brokerages and customers directly while facilitating trading on regulated U.S. venues.

— Cryptonews.com (@cryptonews) December 30, 2025

In 2026, prediction models will be used to collectively decide what is true and what is not [true] and as a guide for fact-checking, analysts say. #Polymarket #Kalshi #PredictionMarkets #BTChttps://t.co/fkQeRz28Qs

Ultra-Low Fees Show Growing Competition

Polymarket’s comeback is accompanied by a notably aggressive pricing structure. The platform is offering 10 basis point taker fees and zero maker fees which Lau believes is the lowest among major prediction market and sports betting platforms.

For comparison, DraftKings and FanDuel reported net revenue margins of 6.7% and 10.1%, respectively. Lau said Polymarket’s pricing makes it a credible alternative to incumbent sports betting operators and signals increasing fee compression across event-based trading markets.

State-Level Regulatory Risk Remains Fragmented

While the CFTC approval may suggest improved federal-level clarity for certain event contracts, Lau cautioned that regulatory risk remains uneven at the state level.

On Jan. 20, 2026, a Massachusetts judge granted an injunction preventing rival platform Kalshi from offering sports-related event contracts in the state.

More broadly, at least three states — Massachusetts, Nevada, and Maryland — have issued unfavorable rulings against prediction market platforms, highlighting continued fragmentation across U.S. jurisdictions. This patchwork environment could complicate the sector’s expansion even as federal oversight becomes clearer.

Coinbase Seen as Key Distribution Partner

Lau argues that these developments represent an opportunity for Coinbase and indirectly Circle to partner with Polymarket or other prediction market platforms.

Coinbase’s scale — more than 100 million verified users and 9.3 million monthly transacting users — provides a sizable and relevant distribution base for event contracts. In his note, Lau suggests that prediction markets could benefit from being embedded into larger platforms with existing user engagement.

However, he notes that prediction markets may not become major standalone profit centers in the near term. Instead, Lau expects them to serve primarily as engagement and retention tools within Coinbase and other integrated platforms, helping drive activity and user stickiness amid rising competition.

As prediction markets expand beyond sports into politics and crypto, Polymarket’s U.S. return could mark a new phase for event-based trading — even as regulatory uncertainty continues to shape the sector’s trajectory.

The post Polymarket’s U.S. Comeback Positions Prediction Markets as a Coinbase Retention Play: Analyst appeared first on Cryptonews.

Senate Judiciary leaders oppose blockchain developer protections in crypto bill, warning exemptions modeled on Lummis-Wyden BRCA could block money laundering prosecutions.

Senate Judiciary leaders oppose blockchain developer protections in crypto bill, warning exemptions modeled on Lummis-Wyden BRCA could block money laundering prosecutions. Crypto market structure bill – Clarity Act – has been further delayed by the US Senate Banking Committee until late February or March.

Crypto market structure bill – Clarity Act – has been further delayed by the US Senate Banking Committee until late February or March. Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.

Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes. The SEC opened just 13 crypto enforcement cases in 2025, down 60% from 2024, with most new actions under Chair Paul Atkins focused on fraud.

The SEC opened just 13 crypto enforcement cases in 2025, down 60% from 2024, with most new actions under Chair Paul Atkins focused on fraud.

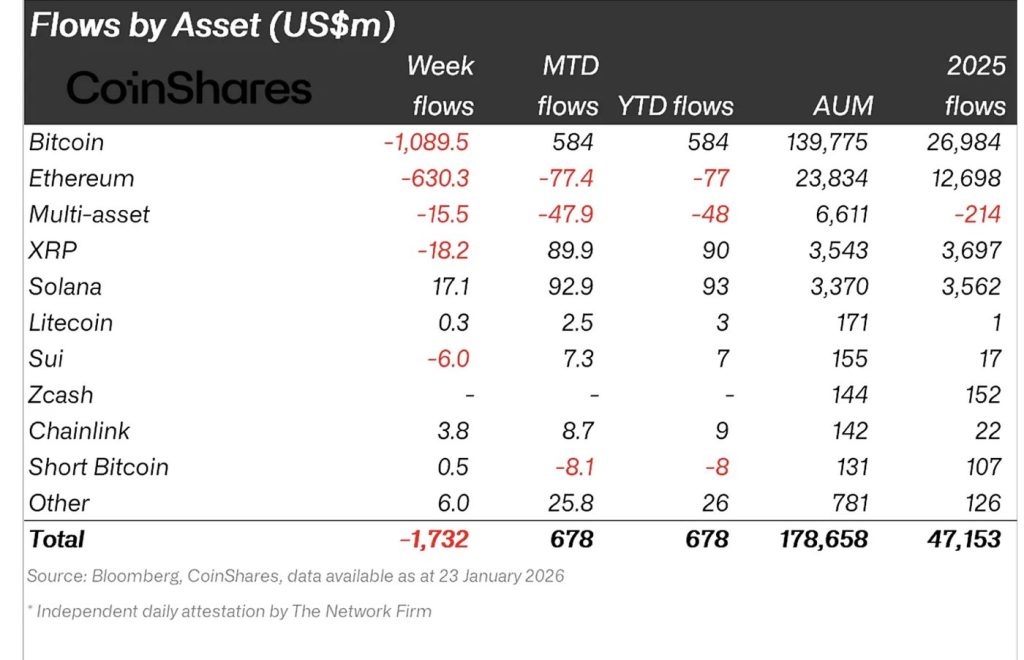

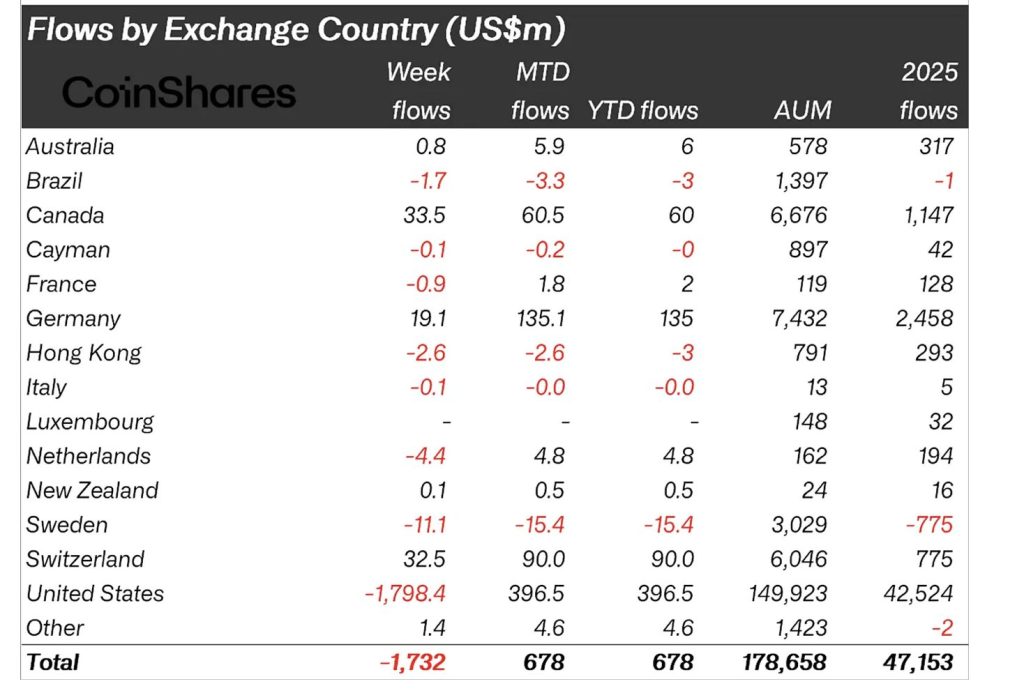

Digital asset investment products saw $2.17bn in weekly inflows, the strongest since Oct 2025, according to CoinShares.

Digital asset investment products saw $2.17bn in weekly inflows, the strongest since Oct 2025, according to CoinShares.

France conducts AML inspections on Binance and Coinhouse among 100+ entities for MiCA licenses with only 4 firms approved before June 2026 deadline.

France conducts AML inspections on Binance and Coinhouse among 100+ entities for MiCA licenses with only 4 firms approved before June 2026 deadline.

Nomura’s Swiss-based unit Laser Digital is seeking a license in Japan to offer institutional crypto trading, signaling confidence in the country’s digital asset market.

Nomura’s Swiss-based unit Laser Digital is seeking a license in Japan to offer institutional crypto trading, signaling confidence in the country’s digital asset market.

BitGo has expanded its institutional OTC trading platform to support derivatives, strengthening its push to offer regulated infrastructure for digital asset strategies.

BitGo has expanded its institutional OTC trading platform to support derivatives, strengthening its push to offer regulated infrastructure for digital asset strategies.

(@nansen_ai)

(@nansen_ai)